The pandemic has turned some economic assumptions upside down, says Andrés Velasco.

The pandemic has turned some economic assumptions upside down, says Andrés Velasco.

Economists have never experienced a crisis like this one. Never before have governments told workers not to work and firms not to produce. The global financial crisis and the various debt, unemployment and banking crises of recent decades pale by comparison. So what have we learnt?

Economic crises can always be bigger

When the financial crisis hit 12 years ago, I was finance minister in Chile. I gave many speeches saying that we would never have a crisis bigger than that one–even bigger than the Great Depression. But world GDP was still growing —albeit barely—in 2009, and it fell by over three percentage points in 2020. The sudden and sharp drops in employment and output last year were almost certainly larger than anything humanity has experienced in the past century. The economic crisis prompted by the pandemic is huge, although for a few countries–the United States and China among them—it will be short lived.

Supply shocks can become demand shocks

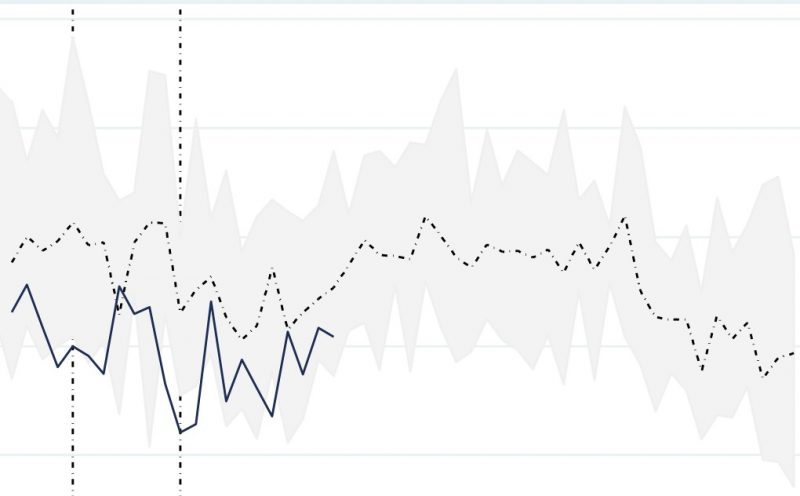

When the government tells firms not to produce, and when it orders workers not to jump on the Tube and go to work, that is what economists call a supply shock. The pandemic constrains the ability of the economy to supply goods. In addition, if you are not someone who can work from home, and as a result your income goes down, you will buy less than you otherwise would. So the supply shock generates demand shock, and the economy gets twice. On top of that, an open economy can be hit by several other shocks. For instance, as world trade collapses the prices of exports are likely to go down. For a poor country with a lot of migrants, remittances will go down. Capital inflows also dried in many countries. What started as one domestic shock became five or six worldwide shocks. That helps explain how sharp and how deep the recession was in 2020.

Rich countries can simply carry on borrowing

Paraphrasing Mario Draghi, the former head of the European Central Bank, rich governments have done “whatever it takes” during the pandemic. They have been spending and borrowing with abandon, writing cheques, handing out subsidies and funding furlough schemes GDP. That is as true of conservative governments as it is of left wing governments. Even fiscally austere Germany has been borrowing like there is no tomorrow.

Had someone had told me the US and the UK would be running fiscal deficits of 15% of GDP and higher, my reaction would have been: ‘What are you smoking?’ Of course this has happened at a very unusual time, when world interest rates remain ultra-low. If interest rates are zero or negative, the carrying cost of public debt is also zero or negative.

The big question, of course, is what will happen if and when interest rates return to normal. If public debt is the same size of GDP—as it is today in the UK and the US—and interest rates suddenly go back to 4 or 5 percent, is that debt sustainable? I hope we will not have to answer that question in the next year or two, but you never know.

The world is very unfair

The other thing economists learned (and only naive economists could learn this, for it has long been obvious to everybody else) is that it is a very unfair world out there. Just as rich countries were doing “whatever it takes” to stay afloat, middle-income and poor countries were doing not ‘whatever it takes’ but “whatever they could afford”. The IMF reports that in response to the pandemic, on average middle income countries spent half as much as rich countries as a share of GDP, and poor countries spent half as much as middle income countries. These huge differences in countries’ ability to respond to the pandemic are based on enormous differences in the ability of governments to mobilise resources, either from domestic or international sources.

International institutions have come up short

Confronted with a crisis of this magnitude, and a gigantic asymmetry in the ability of rich, middle-income and poor countries to borrow, global financial institutions have come up short. They have achieved much less than the G20, led by the UK, did in 2010. A couple of numbers illustrate the point. At the beginning of the crisis the International Monetary Fund said it was in a position to lend $1 trillion. In fact, the IMF has only lent out about $200 billion, and if you narrow the definition it turns out to be more like $85 billion. That may sound like a great deal of money, but in a world financial crisis it is peanuts.

Politicians have been repeating that ‘no one is safe until everyone is safe’, but when it comes to global financial aid few concrete actions have matched those lofty words. In rich countries the crisis will be deep but short-lived. In the rest of the world it will be deep and persistent. We will pay the price both in lives and in livelihoods. It is a very sad conclusion.

____________________

This post was first published on the LSE COVID-19 blog. It is based on Andrés Velasco’s contribution to Lessons Learnt from the Pandemic, an LSE event hosted by the School of Public Policy.

Andrés Velasco is Professor of Public Policy and the Dean of the School of Public Policy at LSE.

Andrés Velasco is Professor of Public Policy and the Dean of the School of Public Policy at LSE.

Photo by Possessed Photography on Unsplash.

1 Comments