Arvind Kejriwal, the founder of Aam Aadmi Party (AAP) and the current Chief Minister of Delhi, recently announced cash assistance of ₹1000 for every woman above 18 years of age if voted to power in Goa. Goa, a small state in Western India, is due to have state elections next year. The polls are expected to be a tripartite contest, with some even speculating a two-way fight between BJP and AAP. Last month, AAP grabbed eyeballs when Kejriwal made a similar announcement for Punjab, which goes for elections early next year, and is expected to see an intense contest between Congress and AAP.

A mere 10-year old party, AAP has managed to stay in power in Delhi for three consecutive state elections, starting with a minority government in 2013, and then two massive victories in 2015 (67/70 seats) and then again in 2020 (62/70 seats). The party has kept governance and social welfare as its essential electoral narrative, promising key reforms in health, education, water, electricity, and women empowerment.

However, the most exciting aspect of AAP’s governance has been the subsidies or the so-called “freebies” – water, electricity, and public transport for women. In Delhi, 20,000 liters of water for every household, electricity consumption up to 200 units, and travel in all public transport for women is free. While these policies are contested with the argument that it makes people lazier and leads to wastage, they have remained immensely popular with the general public, reflected in the electoral support that the party has garnered over all these years.

As the party looks to expand its base, it went a step further, promising direct cash transfers for women this time. The scheme is expected to cost ₹8000Cr of the exchequer’s money in Punjab (similar calculations for Goa is ongoing), benefitting about 10million women.

Cash transfers are not a novel concept and have, in fact, garnered significant popularity across the world. The idea of UBI has managed to move from being merely a topic of academic debates to being realised on the ground. As the COVID-19 pandemic struck the world, multiple governments resorted to cash transfers, ranging from advanced economies like the US and Japan to emerging countries like Pakistan and Namibia. In India, many state governments, including the Delhi government, provided cash relief to a significant part of its population during the pandemic. Small-scale cash transfer programs have been running across Indian states for years. Old-age and widow pension schemes have proven to be quite effective, albeit small-in-amount. Recently, the central government started providing direct cash transfers of ₹6000 annually to ~110million farmers under the PM-Kisan scheme.

Are cash transfers merely a populist political agenda, or rather have larger economic and social ramifications?

Let us look into how cash transfers fare as a social welfare policy.

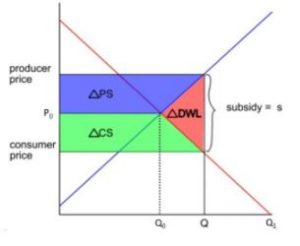

Assume a market with a simple demand and supply graph (see left). In perfect competition, the equilibrium would be at Price P0 and quantity Q0. However, with the introduction of subsidy, the equilibrium effectively shifts to quantity Q.

Now, this has 2-3 implications:

- Subsidy enables consumers with lower willingness to pay (the Q0 to Q crowd) to enter the market. However, consumers with even lower willingness (the poorest of the poor- the Q to Q1 crowd), who are often the main targets of these welfare policies, still miss out. In simple terms, until the cost for every consumer is 0, subsidies do not reach the neediest. But making cost 0 is essentially giving it out for free!

- By introducing a subsidy in the market, the government effectively creates a deadweight loss in society. To think of it in simple terms, the market has been distorted, which creates inefficiency(effectively, you are bringing in consumers whose willingness to pay is less than the equilibrium price and suppliers whose marginal cost is greater than the equilibrium price, which brings in the inefficiency)

- The subsidy doesn’t go only to the consumers- the producers benefit as well (look at the additional producer surplus created). The consumers pay the consumer price, but the suppliers get the producer price. In other words, by the very nature of this graph, a part of the subsidy goes to the producers as well.

So when does the subsidy work? If there are market failures, e.g., information asymmetry (case for MSP), high fixed costs (case for free vaccines), or positive externalities like marginal social benefit (case for subsidizing education), subsidies work better than cash.

But it is not that simple. Even in those cases, giving subsidies requires a lot of information. One needs to understand the consumer’s willingness to pay, the supplier’s marginal costs, their profitability structure, the elasticity of the graphs, and ultimately analyze the equilibrium price.

There are some other qualitative arguments to this debate as well:

- Paternalism: One question even debated amongst economists is- “Do poor know what is right for them?” For instance, we want every child to study and hence have schemes like Mid-day meal, free public education. But what if the poor would instead want to spend that money on purchasing more fertilizers for his/her land? By fixing the potential use of subsidy, are we not restricting the choices for the poor (being paternalistic)?

Cash transfers take a more liberal approach to this problem- give the poor the money and let them choose. No one wants to stay poor at the end of the day. This makes a case for cash against in-kind transfer.

- Exclusion Error: Why not just select the poor and give them the cash? The problem is- targeting is not as simple as it sounds. It is often costly, has high exclusion errors, and suffers from massive corruption. For instance, MGNREGA, which is often credited as self-selecting for the very nature of the scheme, requires extreme manual labor for minimum wage suffers from leakages as high as 50%. While the government has been trying to fix this problem by creating Jan Dhan bank accounts linked with Aadhar cards, there is still a long way.

This makes a case for the universality/unconditionality of cash transfers to lower the leakages while at the same time helping the neediest. And as the government makes targeting more effective through bank accounts and Aadhar, there can be schemes like voluntary give-up of subsidy (as the government did for the Ujjawala scheme)

Some of you may argue the massive economic burden which such policies often entail. While theoretically, that is true, in practice, the governments often gain more because of the leakage fixing in subsidies. When asked how he would fund ₹8000Cr for the cash transfers in Punjab, Kejriwal made a similar argument. “The key for the government is to fix the corruption and leakages. We expect that in itself, could save the government ₹20000-54000Cr”.

To sum up, the poll promises of cash transfers are not mere freebies. They have been economically proven to work, and if executed correctly, can do miracles. Cash transfers, especially to women, will go a long way in bringing financial empowerment to the 50% population, positively impacting women’s health and education and reducing gender violence. It is also expected to play a significant role in curbing the drug menace situation in Punjab, which has destroyed the lives of thousands of young Punjabi men- multiple studies have shown that money in the hands of women is utilized more judiciously and productively. This is also known as the theory of Second Best, when fixing a market failure (poverty) also ends up fixing another market failure (women oppression). The positive contribution of increased consumer expenditure on GDP due to more cash-in-hand can be seen clearly- Delhi has registered an impressive SGDP growth rate of 11.5% over these years.

To be fair, however, sound financial management will be the key to this scheme’s success. Punjab has accumulated massive debt and has a crumbling state economy. This will be an uphill task for AAP, which boasts of doubling the Delhi government’s budget in five years and running one of the few revenue surplus governments in the country. But this is definitely a progressive step in Indian politics- moving away from the politics of religion and focusing on governance and social welfare- with policies verified and stamped by economics as being impactful!

Photo by Ayaneshu Bhardwaj on Unsplash