CASE OF INDIAN CENTRAL BANK – RESERVE BANK OF INDIA (RBI)

Inflation Forecast Targeting Mechanism – Based on Eurocentric Ideals

Over some decades, many central banks all over the world have resorted to the monetary policy of inflation targeting, in which they set an explicit target rate for inflation. For the U.S., the European Union, the United Kingdom and Japan, this target inflation rate is at or near 2%. But is the same inflation target optimal for all economies? Is inflation targeting even the right tool for them? Inflation forecast targeting mechanism is particularly “eurocentric” and have requirements that developing economies do not fully meet. It can maybe be argued that advanced countries also face some of these problems but still are applying and benefiting largely from this mechanism. However, it’s important to highlight that they are “not immune” to problems with their fiscal, financial, and monetary institutions, but historically, they have performed phenomenally well and when compared there has been a major difference in the degree of the problems in developing countries.

One may also argue at this juncture that nobody is “forcing” or “coercing” the developing countries to follow suit by any international commitments or laws as in the case of explicit eurocentrism manifested in pre 1945 era. However, this is a more subtle and insidious form of eurocentrism also called as subliminal eurocentrism, wherein the ideals of the West are presumed to be right and to be followed in order to gain “modernity” and “growth”.

RBI and Inflation Targeting

The Flexible Inflation Targeting Framework (FITF) was launched in India post the amendment of the Reserve Bank of India (RBI) Act, 1934 in 2016. In accordance with the Act, the Government of India affixes the inflation target every 5 years post consultation with the RBI.

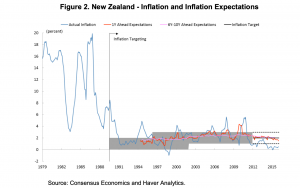

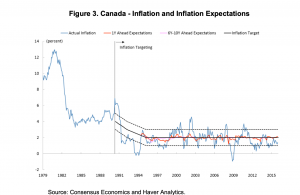

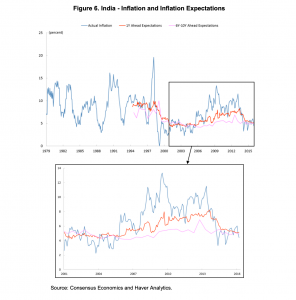

Other Countries Experience with Inflation-Forecast Targeting (IFT) International experiences with IFT in countries that in the past had staggeringly weak price stability history suggest that it may in fact help in minimising the magnitude of shocks. The experiences of New Zealand and Canada decidedly manifest that they turned to inflation targeting to deal with an ingrained problem of high and variable inflation. After doing a comparative analysis, the inflation in India showed similar pattern as that in the FIT countries. There are evident similarities with the nature of problems that countries like New Zealand and Canada experienced at the time they adopted inflation targeting with that faced by India during the years preceding the FIT. Yet, there are several challenges that remain peculiar to the case of India that suggest it’s not the right monetary decision for it.

India’s Experience with IFT and reasons why is it not suitable for India – Major Challenges

1. No track record—the challenge of building credibility: CPI is a measure of calculation to estimate the change in prices of a basket of goods and services consumed by a defined population group in a defined area with respect to the base year. It is calculated by taking price changes of a predefined basket of goods and services and averaging them. There’s a major flaw in this measurement: CPI is dependent on consumption weights that are procured via household surveys. The last published household survey was done in 2011-12 and this is outdated. The recent 2017-18 survey (not released but leaked) captured only 33% national income.

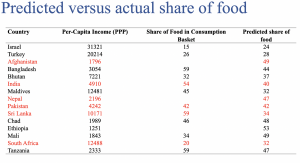

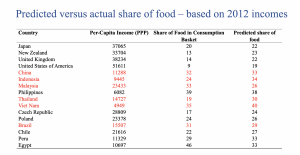

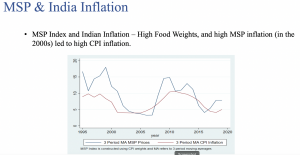

2. Importance of food prices to changes in the CPI: India’s food share in CPI surveys is much higher than predicted by Engle curves (relationship between food shares and per capita income). India’s economic indicators resemble that of low middle income emerging economies – food share reflects consumption as observed in very poor economies. Incidentally, India has a 14 per cent difference between the predicted share of food and the actual share of food in India. It is also important to highlight that food prices are highly susceptible to supply shocks, which often manifest in India in the form of vagaries of rainfall and its impact on agricultural output.

3. Empirical Evidence of RBI’s failure in prediction: RBI’s one quarter ahead forecasts have been way off the mark since introduction of IT. It failed miserably, RBI overestimated inflation till 2019 and have underestimated inflation since then.

4. IT did not help with improved monetary policy: When inflation is below the target or GDP growth below potential, real rates should be lower than the neutral real rate. When growth or inflation is higher, then real rates should be higher than the neutral real rates. Inflation targeting led to opposite results in India.

So, to conclude, the moderation in inflation happens to coincide with the adoption of inflation target. It is important to recognise the costs associated with inflation targeting–measurement errors in CPI estimation, forecast errors and extremely high real rates having potentially adverse impact on growth.

Suggested Solution – Decolonising

IT demands several pre-conditions for its successful implementation such as independence of central banks, well developed financial markets, flexible exchange rate, etc. Most emerging economies, including India, lack these conditions. Besides, RBI has objectives to take care of other parameters like economic growth, stable exchange rate and financial stability, and cannot restrict itself to the single objective of inflation.

Since the turn of events after the 2007 crisis, a dual policy of price stability coupled with growth is a sensible approach for an emerging economy. EMEs are, in general, subject to economic shocks of higher magnitude during financial crises, and financial stability becomes the sole objective under such circumstances. Therefore, RBI should continue its Multiple Indicator Approach where price stability, financial stability and economic growth are considered for decision-making.

In fact, other developing countries can implement the multi-indicator approach, with some weightage given to inflation. Like India, these EMEs also do not have an effective transmission mechanism, flexible exchange rate and several other pre-requisites for IT implementation. Several EMEs that have been following IT have been restraining growth and are subject to financial shocks. Adopting the multi-indicator approach would not be grueling for these countries, given that price stability and economic growth is already a concern they have been implicitly battling.

IT: Not a panacea

In 2000, Frederic S. Mishkin concluded that “although inflation targeting is not a panacea and may not be appropriate for many emerging market countries, it can be a highly useful monetary policy strategy in a number of them”. Inflation targeting has been effectively practiced in a growing number of countries over the past some decades, and many more countries are striding towards this framework. Overall, inflation targeting has been a flexible framework that has been resilient in changing circumstances; however, not all countries have the same circumstances, and a one-size-fits-all approach, no matter how flexible, is not the right way forward. Individual countries must assess their economies to determine whether inflation targeting is appropriate for them or if it can be tailored to suit their needs.

Photo by Markus Spiske on Unsplash