As Pakistan strives to attract more FDI, the Board of Investment must continue to learn from the examples of international best practices for FDI policy making and implementation. Dr Ahmad Ghouri examines Pakistan’s 2013-17 FDI Strategy and analyses where the BOI needs improvement.

As Pakistan strives to attract more FDI, the Board of Investment must continue to learn from the examples of international best practices for FDI policy making and implementation. Dr Ahmad Ghouri examines Pakistan’s 2013-17 FDI Strategy and analyses where the BOI needs improvement.

Last year marked the closing of the 2013-17 FDI Strategy, formulated and implemented by the Board of Investment (BOI), Pakistan’s premier investment promotion agency. With a new chairman in place, and at the end of the five-year plan set out in 2013, the BOI will soon be making its next action plan and it is now time to review the Strategy and assess if it was implemented successfully and if the action plans came through.

The BOI not only brings foreign investment but is also a “gatekeeper” for investments made under the all-important China-Pakistan Economic Corridor (CPEC) as no foreign investor can participate in CPEC projects without BOI’s permission. As a “focal point” for CPEC related investments, BOI is also responsible to provide information and assistance through “Investment Facilitation Centres” for speedy materialisation of investment projects. Additionally, as Secretariat for the Approval Board of Special Economic Zones (SEZs), the BOI is responsible to facilitate interdepartmental coordination for SEZs’ approval and to provide necessary policy and research support.

The Last Five Years

The 2013-17 FDI Strategy is undoubtedly a nifty document. It set out a “Two Wing” structure for FDI policy formulation and implementation. The first wing was tasked with carrying out consultation for future investment projects through public-private sector dialogue (PPD), and included sector advisory boards, academic advisory council, and ad hoc advisory boards. The second wing, on the other hand, was required to develop real-time investment projects based on the outcomes of first wing’s consultations, and was supposed to include sector specific experts to support project development.

While, the formulation of Two Winged PPD was quite visionary, it was not implemented properly in the past five years. There is no publicly available information on the members of the academic and ad hoc advisory boards on the first wing of PPD. Also, BOI has not publicly disclosed if any investment projects have ever been procured through the Two-Winged PPD process. If any such PPD boards and projects exist, the BOI should publicise them so that the implementation and effectiveness of the Two-Winged PPD structure can be analysed and appraised. Such public disclosures will also fortify the BOI’s image as a transparent and efficient public sector organisation.

The 2013-17 FDI Strategy also provided a well-defined action plan for all three phases of FDI cycle, i.e., investment promotion, facilitation, and protection. All three phases of FDI policy were bolstered by overarching plans for policy advocacy for regulatory reforms aimed at improving conditions for doing business in Pakistan.

Foreign investment lawyers and policy makers widely agree that the two existing laws that regulate FDI in Pakistan — Foreign Private Investment (Promotion and Protection) Act (1976) and the Furtherance and Protection of Economic Reforms Act (1992) — have outlived their usefulness and need reform to meet the current FDI regulatory needs. However, BOI has not made any serious efforts in past five years to reform these outdated laws.

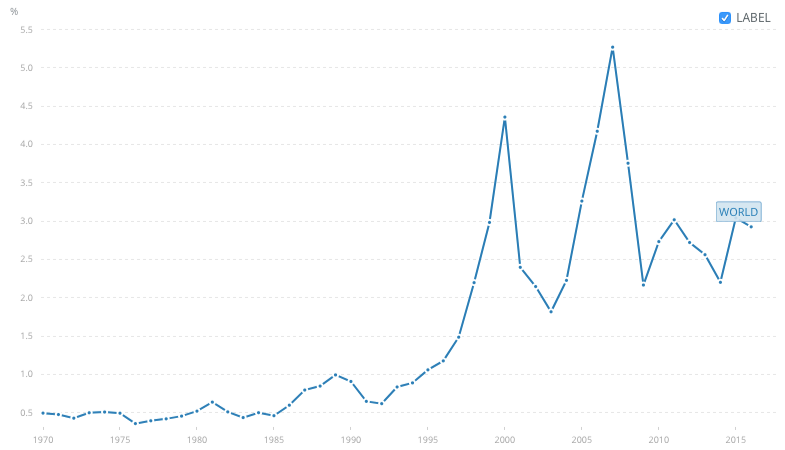

The focus of investment promotion policy was on enhancing the image of Pakistan as an investment location and marketing of investment opportunities to attract FDI projects. The BOI’s performance in this area is not virtuous either. After the FDI boom in 2007, the size of total FDI in Pakistan has been registering a continuous decline. While 2014-15 statistics have shown some positive development in FDI inflows, more recent data reveals that the BOI generally continues to underperform in key areas that could have increased the inward FDI.

Instead of using a research-based FDI strategy for exploiting new markets and avenues, Pakistan continues to rely on traditional and long-standing trading partners such as China and Malaysia.

The BOI’s performance in the other two areas of investment protection and facilitation is also unsatisfactory. In the 2013-17 FDI Strategy, investment protection was primarily intended to be achieved through international investment agreements or bilateral investment treaties (BITs). However, BOI has not made significant progress in the conclusion of new or renegotiation of existing BITs. Only one treaty with Bahrain was concluded during 2013-17. Most of the 48 existing treaties have outlived their expressly stated meaningful life of 10-15 years and need revision. Likewise, Pakistan’s bilateral treaties are of an older generation and do not cater to contemporary FDI policy needs. Yet, the BOI has not taken any serious steps to renegotiate the existing outdated BITs or revise its model BIT.

The new action plan must revise the outdated FDI regulatory framework and provide a defined policy on renegotiation of existing BITs. It must also include a defined manifesto for Model BIT, which ensures an appropriate balance between investor protection and ability of the Pakistani government to protect public interests.

With regards to investment facilitation, the 2013-17 FDI Strategy adopted a narrow view limiting the BOI’s role to assisting foreign investors in setting up businesses in Pakistan. Assistance to foreign investors, which is provided by the “One-Window” services at the BOI’s regional offices, is limited to obtaining visas, licenses, permits, and utility connections. The worldwide practice for investment facilitation goes far beyond mere assistance in setting up of a business. The investment facilitation policies in many countries include procedures to ensure greater transparency and efficiency in administrative procedures and regular consultation with investors throughout the life of a project. Most importantly, investment facilitation practices now include measures ensuring accountability and effectiveness of government officials and mitigation of investment disputes. The transparency of administrative procedures is emphasised in modern investment facilitation policy because it curbs the possibility of corruption by both foreign investors and government officials. In the recent Karkey Karadeniz dispute, for example, the main allegation was that of corruption on both sides. This could have possibly been avoided with increased transparency in the administrative procedure. Contrary to international best practices, the 2013-17 FDI Strategy’s investment facilitation framework did not include any investment dispute prevention policy or system for early detection of disputes.

What next?

The new action plan must revise the outdated FDI regulatory framework and provide a defined policy on renegotiation of existing BITs. It must also include a defined manifesto for Model BIT, which ensures an appropriate balance between investor protection and ability of the Pakistani government to protect public interests. While the Two-Wing PPD structure is a good practice and should be continued in the next action plan, however it needs to be properly implemented in order for it to produce the desired results of FDI generation. Additionally, as a public organisation, BOI must develop internal procedures and rules to audit its own policy implementation and should also publish reports outlining reasons for failures to implement its action plans. It is also equally important that the BOI makes all FDI related data publicly available in the interest of transparency and appraisal.

As Pakistan is destined to leapfrog the present development cycle, the BOI must continue to learn from the examples of international best practices for FDI policy making and implementation. It is refreshing that the new BOI chairman has emphasised on sustainable economic development and achieving non-economic contributions along with economic development through FDI. It would be interesting to see how these objectives are incorporated in the future FDI strategy and, most importantly, what steps are taken to ensure its proper implementation.

Cover Image: Pixabay/CCO Creative Commons

This article gives the views of the author, and not the position of the South Asia @ LSE blog, nor of the London School of Economics. Please read our comments policy before posting.

About The Author

Dr Ahmad Ghouri is a Senior Lecturer in Commercial Law, University of Sussex (UK). He can be reached at a.a.ghouri@sussex.ac.uk. He tweets @ahmadalighouri

Dr Ahmad Ghouri is a Senior Lecturer in Commercial Law, University of Sussex (UK). He can be reached at a.a.ghouri@sussex.ac.uk. He tweets @ahmadalighouri