While the retaliatory tariffs of the China – US trade war are hurting both producers and consumers in China and the US, Aakanksha Shrawan explores whether it is possible for India to benefit, and how it might achieve this.

While the retaliatory tariffs of the China – US trade war are hurting both producers and consumers in China and the US, Aakanksha Shrawan explores whether it is possible for India to benefit, and how it might achieve this.

A lot has been written about the China – US trade war that has been going on for the better part of this year. US President Donald Trump announced in his campaign that he would return prosperity to the US Rust Belt that has been “stolen” by China. As a first measure, on January 22, the US levied safeguard tariffs on residential washing machines, solar cells and modules. Although these tariffs were levied on imported items from all over the world, China was the major target. This led to a spiralling rise in the tariffs imposed by both China and the US which has steadily escalated into a trade war. While the the US initially imposed tariffs on $50 billion worth of Chinese imports, it has further increased tariffs which now target around $450 billion of Chinese exports to US. Although China doesn’t import such a vast universe of goods from the US, it still imposed tariffs on US imports, mainly the agricultural products of the US, and these constituents had voted predominantly for Mr. Trump during the past election.

While these retaliatory tariffs are going to hurt both producers and consumers in China and the US, this tit-for-tat rise in tariffs is bound to have a ripple effect on other nations’ economies, especially emerging and export dependent ones. In particular, there is one line of thought that believes that India can seize this opportunity and enter segments such as textiles and garments along with gems and jewellery. For example, Laminates-manufacturer Greenlam Industries is aiming to increase its sales to US on the back of these developments despite US having imposed tariffs on these products. However, almost 42 per cent of Indian GDP is constituted of exports and imports which shows that this trade war might have an adverse impact on India. The below section will therefore examine the information to see if India could actually benefit from the ongoing tariff retaliations.

Men at work in a foundry, Hyderabad. Photo credit: Ajesh Pamnani, Flickr, CC BY-NC-ND 2.0.

What can be gained for India?

India might potentially gain from the fact that China is looking to reduce its dependence on the monopoly of US technology companies. India might be a contender as its technology industry is graduating to a higher level. According to Euromonitor (2017) hourly manufacturing wages in China are around 5 times greater than those paid in India. This increase in wages is pushing companies to shift assembly lines to countries such as India and Sri Lanka. If this trade war intensifies, multinationals and suppliers in China and US will start relocating their production lines to nations such as India, at least for certain sectors, where costs of production will be lesser as standard trade theory predicts.

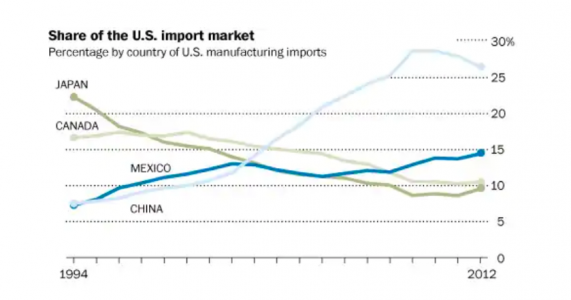

However, rising labour costs are only one of the many factors in determining supply chains. Despite Mexico having labour costs on average around 20% lower than China, it remains the third largest trade partner and behind China. China still holds the top spot. Factors such as effective court systems, improved capital markets and capital account convertibility, also play a critical role in the offshoring of production in developing countries apart from wage rates.

Figure 1. Share of the US import market. Source: WITS

One key ingredient that we seem to miss while thinking India has something to gain from this trade war is that price alone is not as important it is thought to be. Although labour costs in India will be lower than China, the uncertainty of laws and resource restraints make shifting production activities to India uneconomic. Multinationals often shift production to a developing country owing to cheaper local cost structures and resource availability. However, they are reluctant to change production processes as they fear that they will not be able to exercise control over the quality of the products when the production process is changed. This is due to the unfamiliarity and unpredictability of the new process and hence, its impact on quality. Since a lot is riding on the quality of products, they prefer keeping processes the same and choose not to relocate. Therefore, the claim that manufacturing might move to India and other developing countries in the wake of the trade war is not plausible at least in the short run.

Courting international business

In the last 4-5 years, however, India has seen the launch of a slew of development programmes. Some of these include Make in India, Skill India and Startup India. In addition, India launched a number of business-friendly reforms which enabled it to jump 30 spots from 130 to 100 out of about 190 countries in the World Bank’s ease of doing business ranking for 2018. Four factors – enforcing contracts, getting electricity, protecting minority investors and paying taxes– have contributed the most to this improvement.

The Government of India has also liberalised the FDI policies in 21 sectors and 87 sub-sectors in the last three years. This has led to a healthy growth rate of FDI inflows in the manufacturing sector of 23 per cent in two years, rising from USD 16.5 billion in 2014-15 to USD 20.3 billion in 2016-17. The recent decision by the government to treat all NRI investments as domestic investments has made India an attractive destination for businesses. Labour is in the Concurrent list in India, which leads to regulatory heterogeneity. Thus, the government is working on a uniform Labour Code that rationalises all the existing laws under one Code Certain states such as Maharashtra and Rajasthan have gone ahead and done their fair share for easier functioning of manufacturing units.

Room for improvement: further reforms?

While these reforms have started yielding incremental results, these are not enough as foreign companies are also looking for reliability and quality along with ease of doing business. Since India is starting from a low base as India’s share in exports of goods and services is around 20%, it needs reforms of a much greater magnitude if wants to compete with the likes of China. China, which has a share of nearly 37% of international trade in goods, has successfully integrated its manufacturing ability to cater to the global value chains by building necessary infrastructure and skilled labour force. These two are the major areas where India seems to be lacking greatly. Thus, India needs more deep-seated reforms in infrastructure and skill formation to establish itself as an attractive destination for production activities. These reforms will be beneficial for India not only during the US-China trade wars, for instance, but also in the longer term.

This article gives the views of the author, and not the position of the South Asia @ LSE blog, nor of the London School of Economics. Please read our comments policy before posting.

About the Author

Aakanksha Shrawan holds a Masters in Development Economics from South Asian University, New Delhi. She is currently working with Pahle India Foundation, New Delhi as a Research Assistant. She also writes articles for newspapers. Her research interests include international trade, macroeconomics and financial economics.

Aakanksha Shrawan holds a Masters in Development Economics from South Asian University, New Delhi. She is currently working with Pahle India Foundation, New Delhi as a Research Assistant. She also writes articles for newspapers. Her research interests include international trade, macroeconomics and financial economics.