Stock market and consumer sentiment indices used to be co-occurrent indicators, but since the outbreak of COVID-19 we have witnessed a disconnect between these two indices in many countries of the world, including India. Nufazil Altaf and Farooq Shah examine the reasons for the emergence of this disconnect between stock market and consumer sentiment indices in India.

Consumer sentiment indices are widely recognised indicators that spell out the overall perception and expectations of consumers towards the economy. These indicators tend to rise during periods of boom when consumers are financially more confident, and fall during periods of recession as consumers tend to reduce their discretionary spending. Additionally, these indicators help business communities to gauge the mood of the consumer to anticipate strategies for the same. Finally, it is known that the overall economic health of a country is likely to affect the movements of the stock markets.

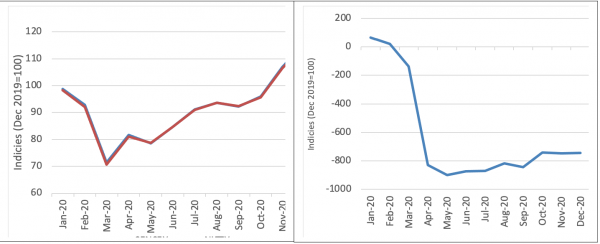

Historically, we have seen that consumer sentiment tend to move in tandem with stock market indices. However, since the outbreak of COVID-19, we have witnessed a shift as consumers and stock markets tend to move in opposite direction in many countries of the world like the US and the Europe. Such a disconnect has been witnessed in India as well. After a sharp drop in major Indian stock indices like SENSEX and NIFTY 50 during February–March 2020, we witnessed a rebound in them after April 2020. However, this rebound stood in strident contrast to consumer sentiments that continue to witness a sharp fall since February 2020 (Figure 1).

Figure 1: Disconnect between Stock Markets & Consumer Sentiment

Source: Bombay Stock Exchange; National Stock Exchange; CMIE Economic Outlook

Before we explain the reasons for the emergence of this disconnect, we need to understand how these two indices are formulated in India. Consumer sentiment index is derived from the Economic Outlook of the Centre for Monitoring Indian Economy (CMIE) database. The survey consists of five questions posed to a sample of 158,624 households. These questions are (posted per se):

- Compared to a year ago, how is your family faring financially these days — Better, Same, Worse

- Do you think that a year from now your family would be faring financially — Better, Same, Worse

- How would you describe the next 12 months’ financial and business conditions in our country — Good times, Uncertain times, Bad times

- What do you think would the next 5 years’ financial and business conditions in our country be — Continuously good times, Uncertain with ups and downs, Continuously bad times

- Do you think that this is generally a good or bad time to buy things like furniture, refrigerator, television, two-wheeler, car — Good time, Same as other times, Bad time

BSE SENSEX and NIFTY 50

The BSE SENSEX and NIFTY 50 is a float-adjusted market capitalisation index of the largest and most liquid Indian securities. BSE SENSEX includes 30 publicly traded Indian companies, whilst NIFTY 50 includes 50 such Indian companies. A company’s market capitalisation is calculated as its current stock price multiplied by its total number of outstanding shares. It is worth noting that market capitalisation changes with daily price fluctuations.

Reasons for Disconnect

As mentioned above, the companies’ weight in BSE SENSEX is determined by float-adjusted market capitalisation; accordingly, it is obvious that some sectors form a larger proportion of the index. Table 1 (below) presents the float-adjusted Market Capitalisation of each sector on BSE SENSEX.

| Table 1: Float-adjusted Market Capitalisation on BSE SENSEX | ||

| No. | SENSEX/Sectors | Float adjusted Market Capitalisation % |

| 1 | Finance | 41.41 |

| 2 | Information Technology | 18.70 |

| 3 | Oil & Gas | 12.38 |

| 4 | FMCG | 8.66 |

| 5 | Transport Equipments | 4.32 |

| 6 | Capital Goods | 3.05 |

| 7 | Telecom | 2.70 |

| 8 | Healthcare | 2.40 |

| 9 | Chemical & Petrochemical | 2.18 |

| 10 | Power | 1.88 |

| 11 | Housing Related | 1.17 |

| 12 | Consumer Durables | 1.15 |

Source: Bombay Stock Exchange

Based on this breakdown, we can see that the Finance and Information Technology sector accounts for over 60 per cent of the total market capitalisation on BSE SENSEX. It is worth noting that these two sectors have performed strongly relative to the other sectors during the COVID-19 pandemic. This might be due to the fact that the finance sector received a boost from India’s federal bank (Reserve Bank of India (RBI)) in areas of liquidity, regulation and supervision. Specifically, to infuse back the wiped out liquidity in the financial sector, the RBI reduced the Cash Reserve Ratio (CRR) requirements of all banks. In addition to the above, under the Marginal Standing Facility (MSF), banks in India have been allowed by RBI to borrow overnight at their discretion by dipping up to 2% into the Statutory Liquidity Ratio (SLR).

Keeping in view the unpredictable impact of Covid-19, new regulation and supervision with regard to material uncertainties has been brought up for the Banking, Financial Services and Insurance (BFSI) sector. It is believed that if the entity prepares the financial statements under the going-concern assumption, it will be required to disclose material uncertainties such as bankruptcies of the borrowers, and business issues that affect lending in sectors like real-estate, and Small and Micro Enterprises (SMEs). Further, with regard to Information Technology sector, a survey by McKinsey and Company reveals that most Indian consumers have tried new shopping behaviours and digital habits during the Covid-19 pandemic, and as many as 25 % of the respondents reported a high intent to continue doing so. These events have effected growth in these sectors as they continue to perform well during the pandemic.

Corporate sector reforms were also spurred by the pandemic in March 2020; among them, the major one that intensified the rebound in the stock markets was the introduction of direct listing regime for the first time. This direct listing regime permits Indian companies to directly list their equity on foreign stock exchanges and, equally, allows foreign companies to list their equity on the Indian stock exchange. These developments have together played a major role in instilling an upward rebound in stock market indices. However, the consumers are yet to get their treat.

Will there be a reconnection anytime soon?

As of now this question is quite difficult to answer. In fact, the government and the RBI are committed to spur growth in the corporate sector during the pandemic. Policies are intended towards buoying the stock markets and thereby speeding up the economic recovery. However, consumer sentiment is yet to get a boost. The recent announcement by the government regarding Leave Travel Concession (LTC) cash voucher scheme and the advancement of interest free festival loan of INR 10,000 to its employees may provide some relief to consumers.

© Banner image: Markus Winkler, ‘Technology Share Chart’, Unsplash.

This post gives the views of the authors and not of the ‘South Asia @ LSE’ blog, the LSE South Asia Centre or the London School of Economics & Political Science.

It impacts alot