While economists and financial analysts have long been interested in the impact of stock market changes on the financial decisions of individuals, especially at times of booms and busts, political scientists have just recently started to analyze how stockholding and market performance affect Americans’ attitudes and political behavior. A recent study by Christine Fauvelle-Aymar and Mary Stegmaier finds that U.S. presidential approval responds to changes in the U.S. stock market in predictable ways.

While economists and financial analysts have long been interested in the impact of stock market changes on the financial decisions of individuals, especially at times of booms and busts, political scientists have just recently started to analyze how stockholding and market performance affect Americans’ attitudes and political behavior. A recent study by Christine Fauvelle-Aymar and Mary Stegmaier finds that U.S. presidential approval responds to changes in the U.S. stock market in predictable ways.

U.S. stocks hit record highs in August in reaction to positive unemployment and manufacturing reports. This sign that the economy is turning around is good news for the American public, stockholders, and for the President. The link between the economy and presidential support has been observed by Presidential candidates and academics for many years. However, only recently has the relationship between the market and presidential approval been demonstrated. As the stock market increases, especially when it is increasing at an accelerating rate, the president’s popularity ratings tend to improve.

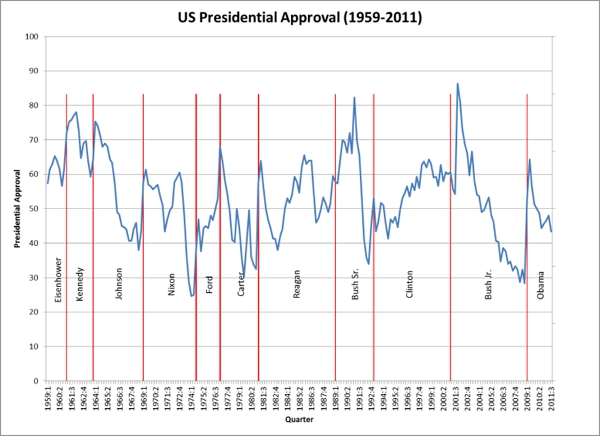

Presidential approval has exhibited dramatic fluctuations over the last half century, as we see in Figure 1. We know, for example, that newly elected presidents enjoy a “honeymoon” period of high popularity during their first few months in office. After that, they begin losing support as they make tough decisions that alienate some supporters. Political scandals, like Watergate or the Iran-Contra Affair, hurt the president’s standing in the polls, while the September 11 Terrorist Attacks rallied the American public around the president.

Figure 1: Quarterly Gallup Presidential Approval

After accounting for the start of a new presidency and critical political events, the dominant factor that explains fluctuations in approval ratings is the state of the economy. In general, we see that the public rewards the president when the economy is improving, and punishes the president during economic decline. Research has tended to emphasize traditional macroeconomic indicators – economic growth, unemployment and inflation – in explaining changes in presidential approval. These same macroeconomic factors also impact government support in other democracies.

Curiously, it is rare for a study of presidential approval to include the impact of the stock market. But, we argue that there are good reasons to consider the market’s influence. First, the market is a leading economic indicator, responding to all types of information and shocks including national economic trends and government policies. As such, stock market figures capture much more about the national economy and business environment than looking at just the unemployment rate or GDP growth. Second, over half of U.S. households own stock directly or indirectly through retirement plans and mutual funds. With so many people holding stock in one form or another, Americans’ personal wealth is directly tied to the fortunes of the market. Third, stock market numbers are reported more frequently in the media than other macroeconomic indicators, and reporters often analyze the daily stock reports in terms of the nation’s economic health and what it means for Americans’ pocketbooks. Even if the public, in general, isn’t attuned to the market, those who pay even cursory attention to the news can have an overall sense of the market’s direction.

Finally, the stock market should be related to Presidential approval because theoretically it is reasonable for Americans to assign at least some responsibility for stock performance to the President. On the surface, the link might not be apparent. But we know that citizens hold the president responsible for the direction of the national economy at election time and in approval ratings. Since the nation’s economic trajectory will have some impact on market performance, and because the public holds the president accountable for national economic performance, the connection exists for stock market conditions to influence presidential approval.

In our research, we examine the impact of stock market changes, using the quarterly All Shares Index, 2005 = 100, for the United States compiled by the OECD, on quarterly Gallup presidential approval ratings from 1960-2011. In doing so, we account for the “honeymoon” effect, political events, and other macroeconomic measures that have been shown to influence presidential popularity. Therefore, the stock market effect is what we find after taking into account these other factors.

Presidential approval is highly sensitive to changes in the share index. A positive change in the index, when controlling for other relevant factors, on average produces an increase in the President’s approval. Interestingly, the effect is even more pronounced when we look at market acceleration or deceleration. When the market is growing at an increasing rate, voters reward the president, but when growth is decelerating, the president is punished. For example, if the share index increases by 5 points between quarters 1 and 2 and then increases by another 15 points between quarters 2 and 3, the market has continued to show growth, and the growth has accelerated, since the increase in the most recent time period is 10 points higher than in the previous period. Controlling for the other factors, this 10 point acceleration would produce a 2.8 percentage point boost in the president’s approval rating. This logic holds true when the market is in decline as well. As the market drops at an increasing pace, the president is punished, but as the market declines at a decreasing rate, the president reaps rewards.

Our findings, combined with the findings of others, show that stockholding and stock market changes affect support for parties and presidents. Since parties and presidents want to win reelection, these findings suggest that governments have political incentives to use their powers to boost stock returns, especially at election time. This is the other side of the economic voting logic – the logic of the political opportunistic and partisan business cycle models. It can now be applied to the stock market, since the market’s impact on presidential support is important at least for citizens in the United States.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/17PagPc

_________________________________

Christine Fauvelle-Aymar – Université de Tours

Christine Fauvelle-Aymar – Université de Tours

Christine Fauvelle-Aymar is an Associate Professor at the Department of Economics, Université de Tours. Her research interests include economic analyses of elections, voter turnout and voting methods.

_

Mary Stegmaier – University of Missouri

Mary Stegmaier – University of Missouri

Mary Stegmaier is a teaching assistant professor in the Truman School of Public Affairs at the University of Missouri. Her research focuses on voting behavior, parties, elections, and political representation in the U.S. and abroad.

1 Comments