In 2008, the U.S. Treasury took over the running of the Government-Sponsored Enterprises, Fannie Mae and Freddie Mac, following massive losses after the collapse of the housing market. Dirk Krueger and Kurt Mitman argue that the government’s implicit bailout guarantee to organizations such as these effectively constituted a mortgage interest rate subsidy to homeowners prior to 2008, and even after the crisis. Modeling the effects of the subsidy, they find that without it there would be fewer mortgages and foreclosures, and households would be leveraged less. They make the case for a much reduced role for the government in the residential mortgage market.

In 2008, the U.S. Treasury took over the running of the Government-Sponsored Enterprises, Fannie Mae and Freddie Mac, following massive losses after the collapse of the housing market. Dirk Krueger and Kurt Mitman argue that the government’s implicit bailout guarantee to organizations such as these effectively constituted a mortgage interest rate subsidy to homeowners prior to 2008, and even after the crisis. Modeling the effects of the subsidy, they find that without it there would be fewer mortgages and foreclosures, and households would be leveraged less. They make the case for a much reduced role for the government in the residential mortgage market.

The United States enjoys one of the highest home ownership rates in the world, at 70 percent, and owner-occupied housing represents the single most important asset for most U.S. households. Part of the attractiveness of owner-occupied housing stems from a variety of subsidies the government provides to homeowners. In addition to tax-deductible mortgage interest payments, another subsidy arises from government intervention in the mortgage market. In the US close to half of residential mortgages are held by so-called Government-Sponsored Enterprises (GSE’s), e.g. Fannie Mae and Freddie Mac, totaling more than $5 trillion in value.

In the event of a downturn in the housing market and the economy as a whole, many of these mortgages might not be serviced in full, and thus the GSE’s faced substantial aggregate risk on their mortgage portfolio. Given this risk, one should expect the GSE’s would have to pay a substantial risk premium on the debt they issue. On the contrary, prior to the crisis of 2008, the GSE’s could borrow at a rate very close to that of the U.S. treasury. Market participants expected that the GSE’s would be bailed out by the government in the event of a crisis — an implicit bailout guarantee. To the extent that this interest rate advantage is passed on to households financing homes with a mortgage eventually held by the GSE’s, the bailout guarantee is essentially a mortgage interest rate subsidy to homeowners, paid for by the U.S. tax payer in case of GSE default.

As history showed, the GSEs did go under. In September 2008, the US Treasury took conservatorship of Fannie Mae and Freddie Mac after huge losses following the collapse of house prices, effectively nationalizing the GSE’s. Since then, the US government has provided in excess of $180 billion to help GSE’s remain solvent. The future of the GSE’s and the role of the government in mortgage market remains a key question facing policy makers.

In recent research, we have modeled the effects of U.S. government bailout guarantees for Government Sponsored Enterprises, and investigated the optimal degree of such bailout guarantees. We evaluated the aggregate and redistributive consequences of this subsidy by constructing a model where households can borrow against their real estate wealth positions through mortgages collateralized by their homes, and can default on their mortgages, with the consequence of losing their homes. We model the guarantee as a tax-financed mortgage interest rate subsidy, reflecting the fact that prior to the crisis the implicit bailout guarantee reduced borrowing costs for the GSE’s, and the assumption that at least part of this interest rate advantage is passed on to mortgage holders. The literature has argued that at least part of the funding advantage the GSE’s have enjoyed went into pockets of the GSE’s shareholders, rather than subsidized the mortgages of home owners.

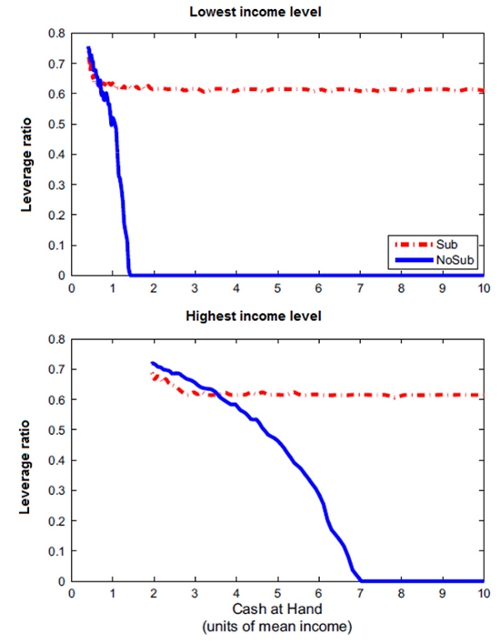

We find that this mortgage subsidy does not significantly change the fraction of homeowners, because on one hand the subsidy makes real estate ownership more attractive, but on the other hand the higher taxes required to finance the subsidy, lower after-tax income and thus discourage home ownership for low-income and low-asset households. However, compared to a world without such a policy, the guarantee does lead to excessive mortgage origination, higher leverage (as shown in Figure 1) across most levels of household wealth, and larger foreclosure rates. Our findings suggests that the government subsidy of the GSE’s may have contributed to the increase in mortgage debt and household leverage prior to the housing bust, which in turn may have exacerbated the economic impact of the recent decline in house prices.

Figure 1 – Effects of GSE mortgage interest subsidy on household leverage

Note: This figure compares the optimal leverage choice for a household in the baseline economy and the economy without the subsidy for different levels of cash at hand for the highest and lowest persistent income states.

The aggregate welfare gains from abolishing the bailout guarantee and implied interest rate subsidy are significantly positive, and poor households would strongly benefit from such a reform. If we were to ask people if they would prefer to live in a world with or without the government subsidy there would be substantial disagreement among households. Low-wealth households prefer to live in a world without the subsidy since they hold little housing and mortgages, and thus do not benefit from the interest rate subsidy, but bear part of the tax bill required to finance it. In contrast, wealthy households have larger homes and mortgages, and thus the benefits accruing to them outweigh the fiscal burden of the policy.

We also looked at what the optimal level of government subsidy (via the GSEs) should be, and found that a small positive interest rate subsidy is called for. Under the current policy, high wealth households take on large mortgages, subsidized by the government. However, with a lower subsidy the attractiveness of such borrowing diminishes and wealthier households reduce their leverage and mortgage debt. Lower wealth households still benefit from the subsidized mortgages and the tax burden on them is greatly reduced because of the much smaller amount of mortgage origination. The poorest households still lose from such a subsidy, however, since they don’t own homes and thus can’t take advantage of subsidized mortgages at all.

While our results do suggest that the government should significantly reduce its role in the residential mortgage market, it does not imply that a complete withdrawal is optimal. Our analysis proceeds by comparing stationary equilibria with and without the bailout guarantee and thus aim at studying the long-run consequences of the guarantee in normal, economically tranquil times. It begs the question; to what extent did the policy contribute to the emergence of the 2008 housing crisis, by encouraging a run-up in mortgage leverage and house prices prior to the crash? It also leaves open for future research the conjecture that the bailout guarantee contributed to the persistent slump in the housing market the U.S. economy still finds itself embattled in. The purpose of our ongoing research is to exactly tackle these questions.

This article is a version of the paper, “Housing, Mortgage Bailout Guarantees and the Macro Economy” in the Journal of Monetary Economics.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1ag8apl

_________________________________

About the authors

Dirk Krueger – University of Pennsylvania

Dirk Krueger – University of Pennsylvania

Professor Krueger is a Professor of Economics at the University of Pennsylvania. He served as a co-editor of the American Economic Review from 2009-2011, is a Research Associate at the National Bureau of Economic Research and Penn’s Population Studies Center, a Research Fellow at the Centre for Economic Policy Research, a Research Fellow at Netspar, a Research Professor at Mannheim Research Institute for the Economics of Aging, and an Adjunct Professor and Research Fellow at Goethe University Frankfurt. His research has focused on whether, how and to what extent risk, a central concern in macroeconomics, is shared across households or groups of households.

Kurt Mitman – University of Pennsylvania

Kurt Mitman – University of Pennsylvania

Kurt Mitman is a PhD Candidate in the Department of Economics at the University of Pennsylvania. He is a research assistant at the National Bureau of Economic Research and New York University. His research focuses broadly on macroeconomics, including household finance, default and labor markets.