The United Kingdom’s Prime Minister, David Cameron has expressed his desire to build a shale gas industry in Britain as a way of lowering cost, seeking to replicate the case of the U.S. where the extraction of shale gas has caused prices to plummet. However, as Anthony McDonnell argues, the UK and U.S. differ in many respects when it comes to shale gas. Importantly, the UK is integrated in the European energy market which would hoover up production in excess of domestic needs, keeping prices high as opposed to in America where an export ban means prices have plummeted due to a glut of supply.

The United Kingdom’s Prime Minister, David Cameron has expressed his desire to build a shale gas industry in Britain as a way of lowering cost, seeking to replicate the case of the U.S. where the extraction of shale gas has caused prices to plummet. However, as Anthony McDonnell argues, the UK and U.S. differ in many respects when it comes to shale gas. Importantly, the UK is integrated in the European energy market which would hoover up production in excess of domestic needs, keeping prices high as opposed to in America where an export ban means prices have plummeted due to a glut of supply.

An increase in global demand for energy together with a reduction in reserves has led energy prices across the world to rise substantially in the last 14 years. A barrel of oil now costs three times more than it did in 2000 in inflation-adjusted prices. Gas prices in most of Europe are indexed to oil prices (gas is too expensive to transport to have its own spot markets), so the rise in oil prices has also led to a substantial rise in European gas prices. This is outside of the British government’s control. Further to this, UK gas production peaked in 2000 and has fallen every year since by an average of 8% a year, so the UK now only produces a fraction of what it did 14 years ago. This has increased UK prices as it now has to pay the transportation costs associated with buying gas abroad; it has also led the UK to become more closely connected to European and world gas markets.

Due mainly to the above factors UK residential gas prices have doubled in the last five years. This, coinciding with the worst financial downturn since the great depression, has put severe financial strain on consumers and has pushed many people into fuel poverty. Understandably, the public is unhappy and demands government action.

Over the last year David Cameron has consistently argued that exploiting Britain’s potentially large shale gas reserves would substantially lower the UK’s gas prices. Writing in the Daily Telegraph last August, the Prime Minister said:

Just look at the United States: they’ve got more than 10,000 fracking wells opening up each year and their gas prices are three-and-a-half times lower than here. Even if we only see a fraction of the impact shale gas has had in America, we can expect to see lower energy prices in this country.

This is misleading as the UK differs from the US for several reasons. The two main factors in determining how much shale gas can be produced are the shale reserve estimates, and the flow rate (how much and how easily gas flows out of the ground per well). We currently do not know how much shale gas there is in the ground in the UK; the British Geological survey and the US Energy Information Agency have changed their estimates several times over the past two years. It will probably be another year before we have precise estimates of the amount of gas in the ground. The second main factor is the flow rate; how much gas comes out of the ground after a well is drilled. Until wells are drilled in the UK we will not know the flow rate. Given how little information we currently have in this area, predictions are extremely unreliable.

(Photo credit: Irekia – Eusko Jaurlaritza)

As well as a lack of information about UK gas reserves there are technical reasons why it and the US differ. The US already has been producing onshore natural gas for a long time (something the UK has never done) which has led to it being able to move quickly from conventional production to unconventional production. It is not clear how long it will take the UK to build a similar service sector, but the lack of one will at the very least lead to production costs being higher here (Bloomberg New Energy Finance estimate that production costs will be 2-3 times higher in the UK than in the US). As well as this, the Boland shale which is most likely to be exploited in the UK is in a dense population area of Northern England. In the US almost all shale gas has come from areas with low population density; more populous areas such as New York and New Jersey have thus far blocked shale gas production. There are many reasons to suspect energy companies will find it more difficult to produce gas in areas with high population.

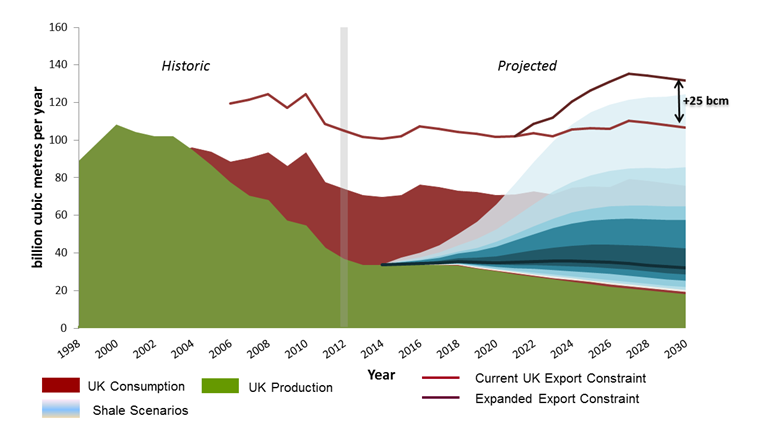

Moreoever, even were there to be a major boom in shale gas exploitation in the UK, gas prices wouldn’t reduce like they have in the US. For one, the UK is well integrated into the European gas market, which will happily buy any excess UK gas production thereby keeping prices high. Presuming the UK retains its free trade status with the rest of Europe (something even the vast majority of Eurosceptics want to do) there is no way for the government to curtail these exports. The only way gas prices will fall in the UK is if the country produces more gas than it is able to export. As part of a research project for the Greater London Authority, I and a team of colleagues analysed how likely the UK was to produce more gas than it would be able export. Our findings are summarised in Figure 1.

Figure 1:

Source: Calculations based on figures from the Department for Energy and Climate Change and the National Grid.

The lighter coloured projections on this fan chart show the more unlikely scenarios. The most optimistic scenario will only take place if there is as much shale gas in the ground as the highest estimates suggest; the flow rates is as good as the Marcellus shale in the US (which is far higher than other US flow rates); and the UK has no difficulty building infrastructure, nor problems with population density or environmentally conscious communities. This is the only scenario where the UK would produce enough gas that it could be difficult to export. However, in reality by retrofitting existing pipelines to run in both directions (as EU legislation would require pipeline operators to do) it would not take very long to accommodate this export demand. In short it is almost inconceivable that UK gas production will become so great that it will have a meaningful effect on UK gas prices.

The Labour party’s flagship energy policy is to break up the six main energy companies in order to increase the number of competitors and to freeze gas and electricity prices for 20 months after the next election. While splitting up the main gas companies might increase competition (though I am sceptical) the latter proposal could cause the UK great problems. Currently about 5% of consumers’ gas bills goes as profit to the energy companies, so even under perfect market conditions the scope for reducing gas prices this way is limited. But what the press and public often ignore about the UK gas market is that it is widely considered successful. Britain has one of the lowest gas prices in Western Europe. By liberalising its market in the late 1990s the country created an effective way of meeting its infrastructural needs without any public investment. This has left the UK in a great position to deal with any future energy uncertainty. In fact many countries in continental Europe look to copy the UK’s liberal energy market. By even suggesting a cap on UK energy prices the Labour party has reduced investment into the energy sector; if this continues, infrastructural problems could end up driving energy prices up rather than down. The Labour party has thus undermined a system that for the most part works very well. While there may be room to improve the gas market instead of opting for well thought out policy, Ed Miliband’s party has done the country a disservice by focusing on headline grabbing policies. This could damage a system that works very well and will at best only keep energy prices low for 20 months (presuming the companies don’t manage to raise the gas prices sufficiently beforehand).

There are however ways by which gas prices could be reduced. Even though I am not in favour of this policy, the Conservative party is right to say that by removing green taxes the energy bills would be lowered. Spending the money these taxes generate on transfers to the most vulnerable so that they can heat their homes sufficiently during the winter would do significantly more to reduce the burden of energy fluctuations on the poor. The government could increase subsidies for retrofitting homes so that people had greater insulation in their houses and would need to buy less gas. There may be room to reduce the impact of changes in gas prices on consumers by improving the existing market. Government could make it easier to compare prices and switch between companies and try to smooth out the energy prices so that gas isn’t cheaper in the summer and more expensive in the winter. There may also be some value in strengthening the regulatory system so that people are protected from possible price fixing. The solutions to this part of the ‘cost of living crisis’ are complicated, and may require the government to spend money. But Cameron and Miliband owe the public a real response to their woes rather than populist sound bites that won’t make gas prices cheaper and may indeed make the whole system worse.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1mPJ0t7

_________________________________________

Anthony McDonnell

Anthony McDonnell is a former Assistant Editor of the LSE Review of Books. He recently finished working on a project for the Greater London Authority assessing the impact that a potential shale gas boom could have on UK energy prices and how this would the authority’s hydrogen strategy, as part of his LSE MPA (Master in Public Administration).