In recent years, many commentators have expressed growing concerns over levels of public sector pay. While citizens who are unhappy with high pay levels in the public sector could move elsewhere, thus affecting the tax base, in some areas this out-migration is much less likely than others. Jan K. Brueckner and David Neumark write that ‘high amenity’ areas such as California, for its climate, or Manhattan, for its productive density, are more attractive to citizens, which reduces the likelihood that they will vote with their feet over public sector pay, thus leading to better paid government workers in those areas.

In recent years, many commentators have expressed growing concerns over levels of public sector pay. While citizens who are unhappy with high pay levels in the public sector could move elsewhere, thus affecting the tax base, in some areas this out-migration is much less likely than others. Jan K. Brueckner and David Neumark write that ‘high amenity’ areas such as California, for its climate, or Manhattan, for its productive density, are more attractive to citizens, which reduces the likelihood that they will vote with their feet over public sector pay, thus leading to better paid government workers in those areas.

The issue of public-sector pay has become more prominent in the last few years, in part because of state budget woes but also because of high-profile political battles over the collective-bargaining rights of public-sector workers. The media and blogosphere are replete with stories about overpaid public-sector workers, from prison guards in California, to teachers and other public-sector workers in New Jersey, to unionized public-sector workers generally.

Public-sector pay is, of course, not set in competitive markets. Public-sector unionization is high, and public-sector unions are strong and active politically. As a consequence, the pay of public-sector workers is likely to reflect, in part, the extraction of rents from taxpayers. Indeed, the potential for public-sector workers to influence pay (and employment) has long been noted by labor economists. The counterargument, however, is that the ability of public-sector unions to extract high rents may be constrained by mobility, as citizens unhappy with the level or cost public services can move elsewhere, reducing the tax base and hence ability to pay overly high public-sector wages. As Freeman (1986) wrote: “Mobility places great constraints on public-sector union bargaining power.”

While rent extraction by public-sector workers may be limited by the ability of taxpayers to vote with their feet, it may be higher in regions where high amenities diminish the migration response. In recent research, we develop a theoretical model that predicts such a link between public-sector wage differentials and local amenities, which we then test by analyzing variation in these differentials and amenities across states. Public-sector wage differentials are, in fact, larger in the presence of high amenities, with the effect stronger for unionized public-sector workers, whose political power may allow greater scope for rent extraction.

We consider whether mobility actually works in this way. In particular, when residents of high-amenity states are willing to pay for those amenities, public-sector workers may have more leeway for rent extraction. This suggests that, all else the same, public-sector wages should be higher in places with amenities that people value. Our paper demonstrates the existence of this link in a theoretical model, and then tests for it empirically.

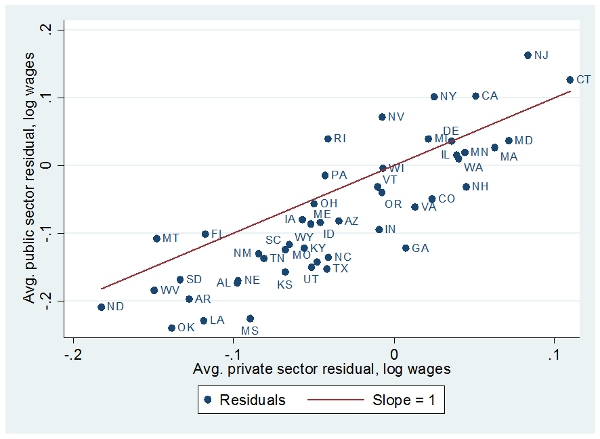

Figure 1: Public Sector vs. Private Sector Wage Differentials by State

Notes: Plotted points are state averages of residuals from separate log wage regressions estimated for state or local public-sector workers and private-sector workers. Estimates are weighted, and include controls for education (16 categories), age and its square, union membership, sex, race, Hispanic ethnicity, marital status (7 categories), residence in a metro area, and year dummy variables. Source: CPS ORG files, 1994-2004.

Initial suggestive evidence for this wage-amenity connection is shown in Figure 1, which plots state-level public-sector wage residuals (representing the wage component not explained by the usual controls) against state-level private-sector wage residuals. The solid line has slope equal to one, so that points on the line represent a state in which the public-sector and private-sector wage premia for the state are equal. While most of points are in fact below the line, note the identities of the states substantially above the line – states where the public-sector premium is larger than the private-sector premium and hence where public-sector workers are “overpaid.” These states have warm weather (California), low rainfall (Nevada), a coastal location (e.g., New York, New Jersey, and Rhode Island), and large, dense urban areas (New York, New Jersey, and California). Thus, Figure 1 suggests that rent extraction may be occurring in places where people like to live.

We test the model’s predictions more formally, by estimating standard log wage regressions that include a public-sector wage differential, a wage differential associated with local amenities, and an interaction between these two differentials. The data bear out this connection between amenities and rent-seeking behavior. We find that public-sector wage differentials are in fact larger in the presence of strong amenities, as are the absolute levels of public-sector wages. The results are the same whether we look at state or local public-sector workers, and they also emerge when we look at important subsets of these workers who receive much attention in the debate over public-sector pay – teachers and prison guards. Furthermore, the relationship between public-sector wage differentials and amenities is stronger for unionized public-sector workers, consistent with their greater ability to extract rents through both organization and influence over the political process. Moreover, among unionized workers, this relationship is stronger in states with extensive collective bargaining. These results suggest that residents who enjoy the beaches and sunshine of southern California, or who benefit from the higher productivity of dense urban areas like Manhattan, are reluctant to leave, giving public-sector workers more leeway to extract rents in such high-amenity places.

Although this phenomenon analyzed is mostly beyond the reach of public policy, one possible policy implication comes from our results on the effect of collective-bargaining laws. Since we showed that a favorable collective-bargaining environment is especially conducive to higher public-sector pay in high-amenity states, stronger collective-bargaining laws might be expected to notably raise cost of operating the public sector in such states, while weaker laws would be especially effective in reducing these costs.

This article is based on paper: Brueckner, Jan K., and David Neumark. 2014. “Beaches, Sunshine, and Public Sector Pay: Theory and Evidence on Amenities and Rent Extraction by Government Workers.” American Economic Journal: Economic Policy, 6(2): 198-230.

Featured image credit: Federico Ricci (Creative Commons BY NC ND)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1mJfZO1

_________________________________________

Jan K. Brueckner – University of California, Irvine

Jan K. Brueckner – University of California, Irvine

Jan K. Brueckner is Professor of Economics at the University of California, Irvine.

_

_

David Neumark – University of California, Irvine

David Neumark – University of California, Irvine

David Neumark is professor of economics and director of the Center for Economics and Public Policy at the University of California, Irvine.

Unfortunately I don’t have access to your paper. I was curious about the public sector advantages myself from reading Biggs and Richwine 2014 paper “Overpaid or Underpaid? A State-by-State Ranking of Public-Employee Compensation.”

Beaches frankly never came to mind, although I did notice the greatest public sector advantages were on the two coasts, and the “coast” of Lake Michigan, Chicago major metropolitan area. My mind went to: extreme population density, high average income overall, high cost of living, etc. I’m sure other minds go to high union presence and Democratic governments. How do you separate the causal relationship of amenities?

Part two, in Biggs paper. He describes seven states (all coastal) as “very large (public-sector) premium”; over 20 percent. His data also indicates that largely those high average premiums are driven by the lowest paid cohort of public workers, almost exclusively due to pensions and health benefits. It appears that many, if not most, public workers are compensated at equal to, or less than, private market rates. The compression factor complicates the averages. Perhaps public sector workers should be separated, for comparison purpose, into two groups; those who are overpaid and those who are not.