Over the past three decades, monetary policy has become the tool of choice for policymakers who wish to influence the economy. But does pulling the lever of monetary policy actually give the intended result, or are policy changes simply responses to economic developments? Using Latin American countries that use the dollar as a natural experiment, Tim Willems finds that when the U.S. Federal Reserve contracts the money supply, this leads to a fall in prices, and little initial movement of output.

Over the past three decades, monetary policy has become the tool of choice for policymakers who wish to influence the economy. But does pulling the lever of monetary policy actually give the intended result, or are policy changes simply responses to economic developments? Using Latin American countries that use the dollar as a natural experiment, Tim Willems finds that when the U.S. Federal Reserve contracts the money supply, this leads to a fall in prices, and little initial movement of output.

Although countries all around the world see monetary policy as an important stabilization tool, there is no broad consensus on its effects. While some notable scholars argue that its effects on output are large, others find them to be small. Similarly, when it comes to the impact of monetary policy on the price level (inflation), reported results vary wildly: most theoretical models predict that an interest rate increase should lower prices, but many empirical studies actually find the opposite (i.e.: the price level goes up following an interest rate increase – an observation that has been dubbed “the price puzzle”).

The reason for this lack of agreement in empirical studies is that monetary authorities (such as the US Federal Reserve) typically respond to economic developments. Consequently, it is difficult to identify the causal effect of monetary policy on economic variables: when one sees inflation and the nominal interest rate rise hand-in-hand in the data, is that because the interest rate increase produces inflation, or because inflation triggers an increase in the interest rate?

The standard way of getting around such an identification problem would be to run an experiment: rather than letting monetary authorities respond to economic developments, let’s implement monetary policy in a way that is fully random (that is: unrelated to economic conditions). Since this kills any impact of economic variables on monetary policy (as the latter is now completely random), such a strategy solves the reverse causality problem and would enable us to identify the causal effect of monetary policy on the economic variables of interest.

The problem with this experimental approach is that its implementation is costly in a macro setup: a randomized monetary strategy might destabilize the economy, the costs of which could be huge. Consequently, policy makers understandably refrain from such a radical form of policy experimentation in practice – the downside being that there continues to be uncertainty on the exact impact of changes in monetary policy.

In recent research I suggest a way of decreasing this uncertainty. I start from the observation that although the US Federal Reserve does not experiment on the US economy (for the objections mentioned above), there are certain countries that voluntarily inflict such experimentation upon themselves. For differing reasons (often having to do with weak local institutions), several countries have chosen to do away with their domestic currencies, and use the US dollar instead. The absence of a local currency implies that these countries are no longer able to implement their own independent monetary policy. Instead, they import monetary policy from the Fed. Examples of such “dollarized countries” include Ecuador, El Salvador, and Panama.

Interestingly, economic conditions in these dollarized countries are not very synchronized with those in the US. As a result, movements in the stance of US monetary policy are only weakly correlated with economic circumstances in the dollarized economies. This obviously implies that US monetary policy is not particularly well-suited to the dollarized economies at hand, but simultaneously enables us to uncover the causal effect somewhat more easily. The reason is that we no longer have to worry about the complicating impact of local economic developments on monetary policy (“the reverse causality”): the Fed simply does not care about (say) inflation in Ecuador, because it is not part of its mandate, so it wouldn’t respond to movements in such variables either.

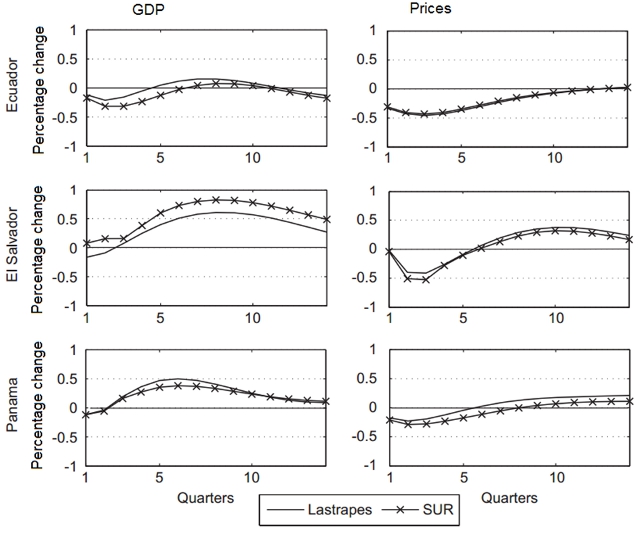

Exploiting this natural setup, I find that consistently across Ecuador, El Salvador, and Panama, in response to a monetary contraction, the price level falls quickly and significantly, and that output (as measured by real GDP) does not show a significant immediate response to changes in monetary policy. These findings are illustrated in Figure 1, below.

Figure 1 – GDP and Price responses to monetary contraction

Note: GDP and price estimations are based on two regressions, see: Lastrapes (2005)

The lack of a significant output response is in line with the first finding since the latter suggests that prices adjust rather quickly – pushing the economy towards to a situation of monetary neutrality (in which changes in monetary policy are not able to affect real variables, as all adjustment takes place through prices).

The fact that the price level falls after a monetary contraction, suggests that the aforementioned “price puzzle” is due to the econometric problems bothering the standard approach – in particular the fact that price increases soon tend to be followed by interest rate increases (which may give researchers the false impression that it are the interest rate increases that cause the price level increases).

The obvious drawback to the approach taken here is that inference is solely based on the responses of variables in dollarized countries. This leaves one wondering how US variables itself are affected by changes in US monetary policy.

Answering this question is the challenge taken up in related work by Gobbi and Willems (2014). They explicitly aim to map the findings for the dollarized countries back to US variables. Doing so, their analysis suggests that a monetary contraction decreases the price level in the US itself too, while clear output effects are also absent in their study. This suggests that the effects of monetary policy are not very different across the various countries considered, while it also implies that monetary policy is not too powerful when it comes to affecting output.

This article is based on the paper “‘Analyzing the effects of US monetary policy shocks in dollarized countries’” in the European Economic Review. The working paper version of the paper is available at here.

Featured image credit: photosteve101 (Creative Commons BY)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/W3VhQo

_________________________________

Tim Willems – Nuffield College, University of Oxford

Tim Willems – Nuffield College, University of Oxford

Tim Willems is a post-doctoral research fellow at Nuffield College, University of Oxford, and a member of the Centre for Macroeconomics. He holds degrees from Tilburg University and University College London and obtained his PhD in Economics from the Tinbergen Institute at the University of Amsterdam.