Wealth inequality in the United States increased over the last several decades and worsened as a result of the Great Recession, which reduced the average wealth of families by nearly 30 percent. In new research, Signe-Mary McKernan and Caroline Ratcliffe, with Gene Steuerle and Sisi Zhang, measure disparities in wealth accumulation and loss. They argue that social welfare and tax policies pay too little attention to wealth building and mobility relative to consumption and income. Reforming America’s regressive asset-building policies would help.

Wealth inequality in the United States increased over the last several decades and worsened as a result of the Great Recession, which reduced the average wealth of families by nearly 30 percent. In new research, Signe-Mary McKernan and Caroline Ratcliffe, with Gene Steuerle and Sisi Zhang, measure disparities in wealth accumulation and loss. They argue that social welfare and tax policies pay too little attention to wealth building and mobility relative to consumption and income. Reforming America’s regressive asset-building policies would help.

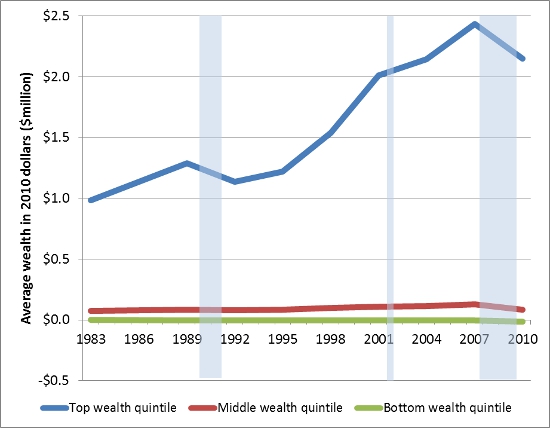

The average wealth of US families doubled over the 30 year period from 1983 to 2010, with the increase driven by high-wealth families (Figure 1). This has worsened wealth disparities over time. The average wealth of high-wealth families (the top 20 percent by wealth) increased by 120 percent between 1983 and 2010, while the average wealth of middle-wealth families (middle 20 percent) increased only 13 percent and the average wealth fell for the lowest wealth families (bottom 20 percent).

Figure 1: Wealth Inequality is increasing

Source: Tabulations of the 1983, 1989, 1992, 1995, 1998, 2001, 2004, 2007, and 2010 Survey of Consumer Finances. Note: Shaded areas indicate recessions.

Wealth matters. It is insurance against tough times, pays for tuition to get a better education and a better job, provides capital to build a small business, savings to retire on, and can be a springboard into the middle class. Wealth translates into opportunity (see our video).

Who’s falling behind in the United States? The young and families of color.

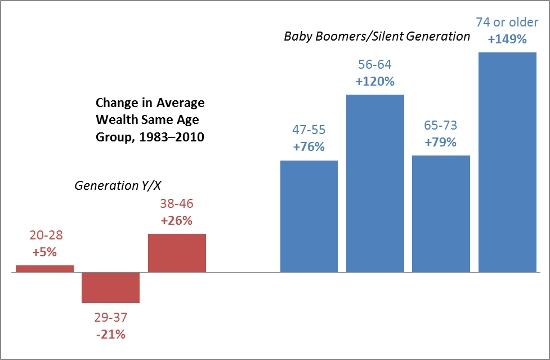

A lost generation? As a society becomes wealthier, succeeding cohorts typically acquire more wealth than their predecessors. We don’t see this pattern in recent decades. In 2010, people in their late-20s to mid-30s had less wealth than people the same age over a quarter century earlier (in 1983), while people age 50 and older had nearly twice as much wealth as people the same age in 1983 (Figure 2; Steuerle et al. 2013).

Figure 2: Older Generations Accumulate, Younger Generations Stagnate

Source: Tabulations of the 1983 and 2010 Survey of Consumer Finances.

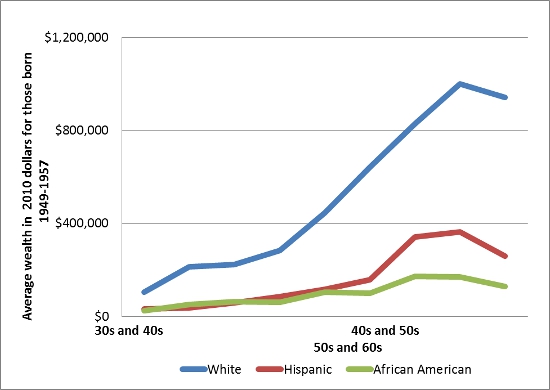

The racial wealth gap grows sharply with age:It’s not just today’s young who are not on a firm wealth building path. African Americans and Hispanics are not on the same wealth building trajectory as whites. They are less likely to own homes and retirement accounts, so miss out on these traditionally powerful wealth building tools.

The wealth trajectory for white families increases steadily as families move from their 30s to their 60s (figure 3). The trajectory for African Americans and Hispanics, on the other hand, is much flatter.

Figure 3: Some Not on Wealth Building Path

Source: Tabulations of the 1983, 1989, 1992, 1995, 1998, 2001, 2004, 2007, and 2010 Survey of Consumer Finances.

The Great Recession, which ran from December 2007 to June 2009, exacerbated wealth disparities and resulted in large wealth losses. Using over two decades of US Survey of Consumer Finances (SCF) triennial data, we measure the impact of the Great Recession on wealth relative to the counterfactual of what wealth would have been given wealth accumulation trajectories. We look at overall declines, as well as declines by age and race/ethnicity.

The Great Recession lives up to its name. We find that the Great Recession reduced the average wealth of American families by 28.5 percent—double the magnitude of other recessions since the 1980s. All major wealth components fell as a result of the Great Recession. Home equity (primary residence) and business equity fell over one-third and retirement and non-retirement financial assets fell about one-fifth.

Young families and families of color lost the largest percentage of their wealth as a result of the Great Recession.

The wealth of the youngest cohort examined—people in generation X and ages 35-43 in 2010—fell by 47.0 percent. This decline was driven in large part by declines in housing wealth. The wealth of older cohorts (people ages 44-79 in 2010 who are primarily in the baby boom and silent generations) fell by a substantially and statistically significantly smaller 20-28 percent (depending on the specific cohort groups). African American and Hispanic families experienced wealth declines of 47.6 percent and 44.3 percent (respectively) as a result of the Great Recession. The wealth of white families fell by 26.2 percent.

America’s skewed federal subsidies exacerbate the disparity in wealth holdings.When it comes to asset building subsidies, the cards are stacked against low-income, low-wealth Americans. The Federal government spends billions of dollars annually ($384 billion in 2013) to support long-term asset-building. These subsidies go through the tax code, so primarily benefit high-income Americans, leaving out African Americans, Hispanics, and younger Americans who often have lower income. For example, about 70 percent of the mortgage interest deduction and employer-sponsored retirement plan subsidies go to the top 20 percent of tax payers, while the bottom 20 percent receive less than one percent.

Wealth inequality has been increasing, and the Great Recession disproportionately harmed groups already falling behind. Policies that focus directly on building wealth are critical to reduce wealth inequality.Possible interventions include well-designed children’s savings accounts, expanded access to automatic savings products, homeownership incentives that work, and encouraging rather than penalizing low-income families that build emergency savings.

This article is based on the paper ‘Disparities in Wealth Accumulation and Loss from the Great Recession and Beyond’, in the American Economic Review.

Featured image cCredit: Toban Black (CC-BY-NC-2.0)

Please read our comments policy before commenting

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1rd1yAx

______________________

Signe-Mary McKernan – The Urban Institute

Signe-Mary McKernan – The Urban Institute

Signe-Mary McKernan is a senior fellow and economist at the Urban Institute, where she co-directs the Opportunity and Ownership Initiative. Her research focuses on access to assets and credit and the impact of safety net programs. She published the book Asset Building and Low-Income Families with Michael Sherraden.

_

Caroline Ratcliffe – The Urban Institute

Caroline Ratcliffe – The Urban Institute

Caroline Ratcliffe is an economist and expert in the asset building and poverty fields. Her research focuses on low-income families and underserved consumers, and she has published extensively on the role of emergency savings, homeownership, poverty dynamics, and welfare receipt.