After the Great Recession, not all neighborhoods and regions were equally resilient to booms and busts in the housing market. To explain differences in the resilience of housing markets, Kyungsoon Wang examined home value trajectories before and after the 2007 US housing crisis. She found that while financial mortgage programs helped recovery in the short term, more sustainable urban forms contributed to recovery in the long term. In addition, neighborhoods in strong and boom-bust markets had more factors that contributed to their resilience and bounced back more quickly to their former home values than those in weak markets, highlighting regional housing disparities.

After the Great Recession, not all neighborhoods and regions were equally resilient to booms and busts in the housing market. To explain differences in the resilience of housing markets, Kyungsoon Wang examined home value trajectories before and after the 2007 US housing crisis. She found that while financial mortgage programs helped recovery in the short term, more sustainable urban forms contributed to recovery in the long term. In addition, neighborhoods in strong and boom-bust markets had more factors that contributed to their resilience and bounced back more quickly to their former home values than those in weak markets, highlighting regional housing disparities.

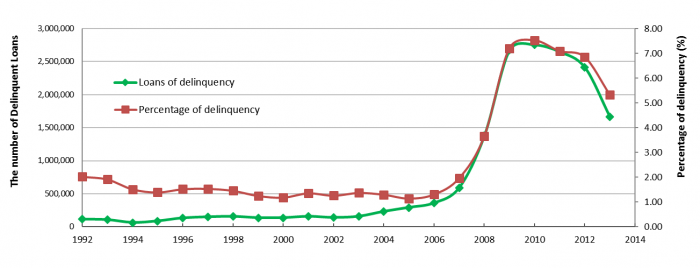

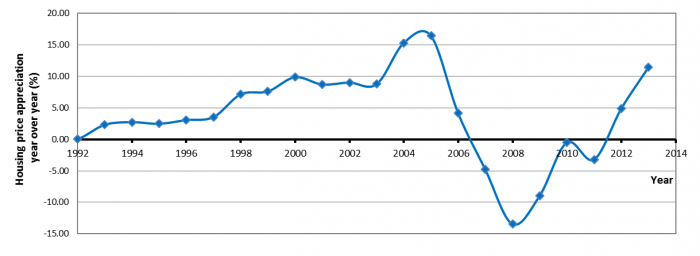

During and after the recent US subprime mortgage crisis, Americans experienced housing price bubbles and collapses followed by a surge in home foreclosures. The soaring home prices of the mid-2000s began to decline in late 2006 and hit their lowest levels in early 2009, when home values began to show an upward trajectory that was interrupted by a slight dip in mid-2011 (as shown in the top of Figure 1). Since late 2011, home values have been on the increase, signaling a housing market recovery. The bottom of Figure 1 shows that the US housing price bust paralleled the foreclosure boom, when the percentage of delinquent loans grew from 1.3 percent in 2006 to about 8 percent in 2010. Consequently, by the end of 2014, there were more than 5.5 million home foreclosures.

Figure 1- Home price appreciation (top) and loans of delinquency (bottom) from August 1992 to August 2014 in the US

Source: CoreLogic Housing Price Index (Top) and Lender Processing Services Inc. (LPS) Applied Analytics (Bottom)

Since the Great Recession, the topic of resilience has attracted the attention of researchers and policy makers. Housing market resilience is the ability of the housing market to bounce back from a shock to the pre-existing system and to maintain a stable condition after a shock. Because of the positive outcomes which follow negative challenges, identifying the factors contributing to resilience helps neighborhoods and regions maintain sustainable communities and prevent future economic downturns. Because US housing markets experienced different paths of recovery after the recent housing boom and bust, the patterns and factors of resilience varied from region to region. While some neighborhoods and regions recovered quickly, others continued to stagnate. Thus, identifying the patterns of housing market boom-bust and recovery could enable policy makers to identify strategies that foster housing market resilience in the face of economic downturns.

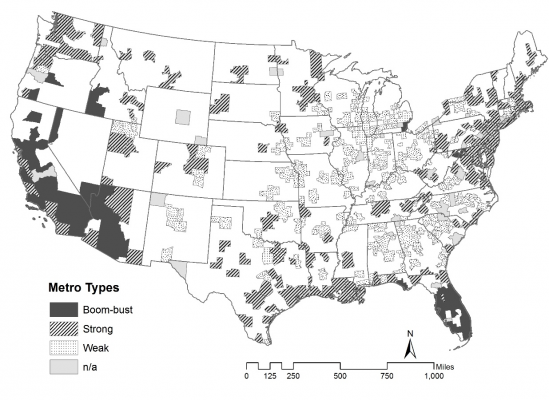

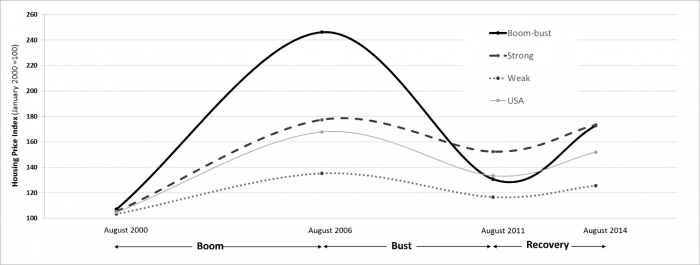

Figure 2 shows the three patterns of metro-level home value trajectories associated with the shock before and after the US housing crisis. The bottom of the figure presents their geographical distributions. Home values in regions that experienced more extreme periods of bust underwent short-term depreciation during the recession but long-term appreciation. Boom-bust markets, whose home values skyrocketed during the boom but then took a dramatic nosedive, were hit the hardest during the bust but bounced back to their prior growth trajectory relatively quickly during the recovery. Geographically, these markets were located in western regions, including California, Nevada, and Arizona, and one southern state, Florida.

Figure 2 – Home value trajectories of three metro types (top) and their geographical distributions (bottom)

Source: CoreLogic HPI

Home value trajectories in strong US markets with moderate or smaller shocks showed relatively steadier growth than the average. The home values of coastal regions of the Pacific Northwest, the Northeast, and the Southwest, including Texas, traditionally the highest cost markets, showed steady growth. Home value trajectories in weak markets with moderate or smaller shocks were lower than the average. They included the Rust Belt, the Midwest, and the Southeast (except for Florida), characterized by declining industries and shrinking populations after the collapse of the urban manufacturing base.

In the aftermath of the Great Recession, the US subprime mortgage crisis meant that home values did not recover equally. While values in boom-bust and strong markets in 2014 returned to their 2004 and 2005 prices, those in weak markets recovered more slowly; returning only to their 2003 and 2004 prices. In geographic terms, the coastal and Sunbelt regions exhibited more resilience, the highest of which occurred in California, Nevada, Arizona, and Florida. By contrast, midwestern and southern regions, except Florida, and the Rust Belt underwent relative stagnation.

To examine the factors associated with housing market resilience, I linked ecological resilience theories – the ability for a system to persist in the face of change or disturbance – to housing markets and identified the factors across the three types of housing markets. I found that if the conditions of neighborhoods and metro areas were stable and/or high in quality prior to the beginning of the housing crisis, home prices in these areas were more resilient during the recovery. Neighborhoods in strong and boom-bust markets had more factors contributing to their resilience, which fostered housing appreciation, compared to those in weak markets, leading to further housing inequality.

Neighborhood and metropolitan factors associated with housing market resilience varied across time and space. When neighborhoods and metropolitan factors were examined in both the short and long terms, mortgage and housing market conditions were significantly associated with short-term resilience. For example, neighborhoods with a large share of low-cost loans were more resilient to the housing crisis, increasing home values. Conversely, most urban form variables contributed to long-term resilience. For instance, neighborhoods with greater auto dependency (i.e., less dense suburban locations) were more vulnerable to housing boom and bust and decreasing home values. Mixed land-use contributed significantly to long-term resilience, that is, the recovery of home values.

“for sale” by nathan esguerra is licensed under CC BY 2.0

From the perspective of the spatial dimension, strong and boom-bust markets had more resilience factors compared to weak ones. The effects of urban form variables, which were particularly evident in strong markets, showed that a higher level of mixed land use and a lower level of auto dependence were strong predictors of housing price recovery. In boom-bust markets, sound housing policies and regulations that establish a 120-day pre-foreclosure period from foreclosure notification to auction contributed to home price resilience. Weak markets had fewer of these resilience factors during the recovery.

When policy makers formulate and establish polices to mitigate disparities in housing recovery, they should consider the factors that impact housing market resilience at both the local and regional levels and in both the short and long terms. During the recent housing crisis, the federal response moved at a slow pace with insufficient funding. Thus, to improve resilience in the short term, they should rapidly and efficiently distribute financial support to the hardest hit stagnant regions and create affordable mortgage programs that promote recovery in a timely manner. To improve resilience over the long run, planners should continue to develop sustainable urban planning strategies that reduce reliance on cars by providing better access to affordable transportation and enhancing compact and mixed-use developments, both of which mitigate sprawl, minimize the effects of economic recession, and foster neighborhood resilience.

- This article is based on the paper ‘Housing market resilience: Neighbourhood and metropolitan factors explaining resilience before and after the US housing crisis’ in Urban Studies

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics.

Shortened URL for this post: http://bit.ly/2MTOyYz

About the author

Kyungsoon Wang – Georgia Institute of Technology

Kyungsoon Wang – Georgia Institute of Technology

Kyungsoon Wang is a researcher interested in housing and real estate market analysis and community and economic development. To explain patterns and factors of U.S. housing market resilience and recovery, she has used other housing performance indicators such as home foreclosures and housing vacancy which have been published in Housing Policy Debate and Journal of Housing and the Built Environment.