Trade flows are complex. Protecting some domestic firms may have inadvertent impacts on others, write Pian Shu and Claudia Steinwender.

Trade flows are complex. Protecting some domestic firms may have inadvertent impacts on others, write Pian Shu and Claudia Steinwender.

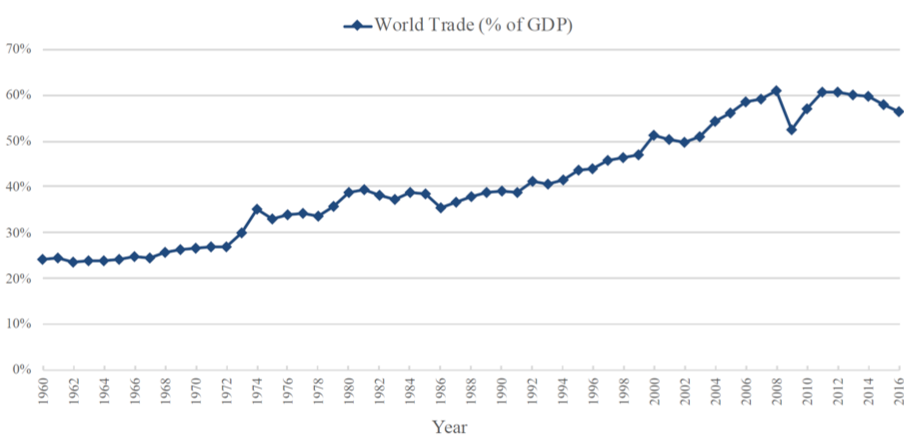

International trade as a percentage of global GDP more than doubled in the 35 years from 1973 to 2008; but trade activity has slowed since the onset of the Great Recession. Although economists have long argued that trade is welfare-enhancing, there is increasing scepticism of trade and globalisation among policymakers and the general public. In a recent paper, we survey the empirical literature on how trade liberalisation impacts domestic firms’ incentives and abilities to innovate; because innovation is a fundamental driver of economic growth, this question is central to trade policy.

Figure 1 – Growth of international trade, 1960-2016

Source: World Development Indicators

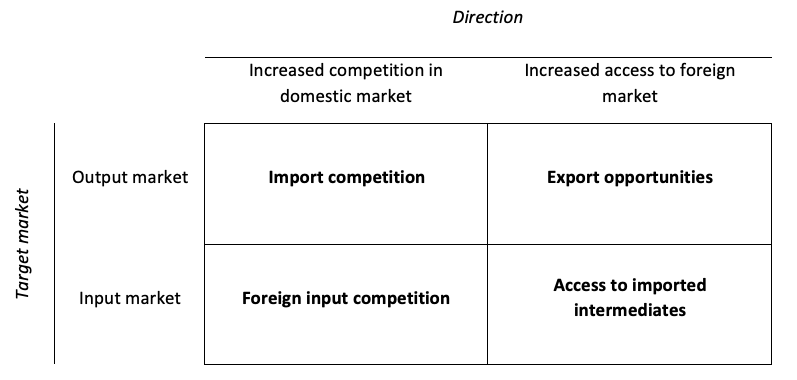

Trade liberalisation can impact a given firm in a range of ways in both the output markets (where the firm sells its products and services) and the input markets (where it buys intermediate goods). From the perspective of Widget Corp., trade liberalisation could bring an influx of foreign competition into domestic markets and/or provide access to foreign markets. We categorise these different types of trade shocks using a 2-by-2 matrix in Table 1.

Table 1 – A categorisation of trade shocks

Impact of import competition on firm innovation

When foreign firms enter Widget Corp.’s domestic output market, they generate import competition, which has an ambiguous impact on innovation in theory. A number of factors—such as the potential profits the firm could capture from additional innovation, managerial efficiency, and firm-specific moving costs—could all be in effect. Empirically, there is strong evidence that import competition spurs productivity and innovation for firms in emerging economies and, to a lesser extent, Europe; but the evidence is more negative for firms in the U.S. and Canada. We propose that these regional differences may be explained by differences in the initial levels of competitiveness as well as the extents of market frictions in domestic markets. Within a country, studies typically show that initially more productive firms tend to be more positively (or less negatively) impacted by import competition.

Impact of export opportunities on firm innovation

Export opportunities provide Widget Corp with access to new foreign output markets. Unlike import competition, export opportunities are generally found to have positive effects on firm productivity and innovation regardless of the country of origin. Export opportunities increase the returns to innovating by expanding the output market to which a firm has access. Furthermore, they could induce learning, especially for exporting firms in developing countries that interact with more technologically advanced foreign counterparts. As with import competition, these productivity benefits tend to accrue disproportionately to firms that were initially more productive.

Impact of access to imported intermediates on firm innovation

When foreign firms enter Widget Corp.’s domestic input market, they provide access to imported intermediate goods for Widget Corp. (and generate import competition for its domestic suppliers). Access to imported intermediates differs from “offshoring” and “outsourcing,” which involve delegating the entire production process to a foreign firm with which Widget Corp. does not trade. Most studies find access to imported intermediates to have a positive and significant impact on firm innovation, and they primarily focus on firms in developing economies. For these firms, access to imported intermediates are likely to lead to an improved production process and learning from more technologically advanced foreign counterparts. In theory, access to imported intermediates could also reduce innovation by acting as a substitute for process-improving technologies; we find no empirical support for this speculation.

Impact of foreign input competition on firm innovation

Foreign input competition is where foreign firms start purchasing from Widget Corp.’s domestic suppliers, generating export opportunities for the suppliers and competition for access to inputs for Widget Corp. Foreign input competition remains understudied in the empirical literature. There is some evidence that increased foreign demand improves the attributes of domestic input, leading to positive spillovers for downstream firms (i.e., Widget Corp.).

Implications

Due to the complexity of trade flows, trade policies have intricate consequences. A policy that aims to protect some domestic firms may have inadvertent impacts on others. For instance, tariffs on imports may increase domestic innovation by insulating firms from import competition; they may also decrease innovation by restricting downstream firms’ access to imported intermediates. Moreover, they may lead to retaliation and reduced access to export markets. The risks of protectionist policies must be carefully evaluated.

- This blog post appeared originally on LSE Business Review and is based on The Impact of Trade Liberalization on Firm Productivity and Innovation, in NBER Book Series Innovation Policy and the Economy, Volume 19, 2019. Editors: Josh Lerner and Scott Stern

- Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics.

- Featured image by Soroush Zargar on Unsplash

Please read our comments policy before commenting

Note: The post gives the views of its authors, not the position USAPP– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/31awFbe

About the author

Pian Shu – Georgia Institute of Technology

Pian Shu – Georgia Institute of Technology

Pian Shu is an assistant professor in strategy & innovation at Scheller College of Business, Georgia Institute of Technology. She studies innovation and entrepreneurship with a focus on science and engineering talent. Dr Shu received a Ph.D. in economics from MIT and a BA in mathematics and mathematical economics from Colgate University. She was an assistant professor at Harvard Business School from 2012 to 2017.

Claudia Steinwender – MIT Sloan School of Management

Claudia Steinwender – MIT Sloan School of Management

Claudia Steinwender is an assistant professor of applied economics at the MIT Sloan School of Management and is affiliated with the National Bureau of Economic Research (NBER), Center for Economic and Policy Research (CEPR), and Centre for Economic Performance at LSE (CEP).