With disputes between the US federal and state governments as to how best to respond to the Covid-19 pandemic ongoing, many local governments have had to respond to the crisis on their own. Bruce D. McDonald, III and Sarah E. Larson write that for many of these local governments, Covid-19 is a double crisis. Not only is it a public health emergency, it is also a financial crisis as sales tax revenues plummet because of stay at home policies at the same time as health expenditures are on the rise.

With disputes between the US federal and state governments as to how best to respond to the Covid-19 pandemic ongoing, many local governments have had to respond to the crisis on their own. Bruce D. McDonald, III and Sarah E. Larson write that for many of these local governments, Covid-19 is a double crisis. Not only is it a public health emergency, it is also a financial crisis as sales tax revenues plummet because of stay at home policies at the same time as health expenditures are on the rise.

The Covid-19 pandemic has created a global public health emergency as governments race to respond. In the United States, this response has been challenged by a federal government that has provided little cohesive guidance and often misleading information. When combined with a lack of coordination by states, many local governments have been left to respond to the crisis on their own. Local governments, however, have begun to face a second health crisis, this one related to their financial health.

Anecdotally, many local governments are expecting a drop in sales and use tax revenue due to the virus of between a best-case scenario of 20 percent and a worse-case of 50 percent. While many local governments were fiscally stressed prior to the outbreak, now they are also faced with an increase in demand for public services while stay-at-home orders and fears of an economic recession threaten their ability to rely on a steady stream of sales tax revenue to fund services.

Economic instability caused by the Covid-19 pandemic has affected sales tax revenues of local governments in several ways. Social distancing and stay-at-home policies installed by many governments have restricted access to businesses that are viewed as non-essential. With fewer open businesses, there are fewer opportunities for the public to purchase goods or services and revenue to be collected. This problem is made worse in that the majority of purchases currently taking place are centered on groceries and medical supplies, both of which are often either exempt from sales taxes or have a lower rate of taxation imposed. This suggests that what business is being conducted does so at the lowest sales tax rates possible. Finally, in times of economic uncertainty individuals respond cautiously, leading them to forgo purchases of large, big-ticket purchases and other non-essential items. Ultimately, with fewer purchases being made, less revenue is being collected by local governments.

Photo by LOGAN WEAVER on Unsplash

For local governments, the availability of sales tax revenue is essential to their continued operation and any reduction in that revenue can place the government into a position of fiscal stress. Sales tax revenue is the second-largest stream of revenue available to local governments, accounting for around 10 percent of their annual revenue on average. This dependence can vary with governments like the City of Phoenix, AZ relying on sales tax for about 45 percent of its revenue and Durham County, NC relying on the tax for approximately 29 percent of its revenue. The more dependent a government is on a specific stream of revenue, the more susceptible it is to its corresponding economic cycles and other shocks, such as the Covid-19 pandemic. The capacity to provide services and programs and to meet other obligations is in part a function of the revenue available to the government. As available revenue shrinks, the capacity of a local government to meet its financial obligations likewise goes down and the government becomes fiscally stressed.

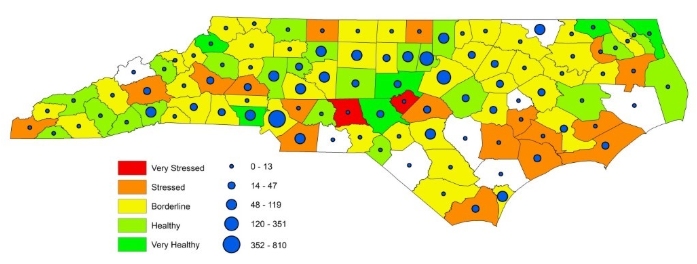

In our study, we explore the impact of Covid-19 on the fiscal health of local governments by looking at 92 counties in North Carolina. We take a novel approach to understanding the outbreak’s impact, studying how potential declines in sales tax revenue resulting from the outbreak have influenced fiscal health. We used county financial data from the North Carolina Department of State Treasurer for fiscal years 2008 through 2019. We then matched the data with population and economic growth data to forecast the fiscal health for the financial years (FYs) 2020 and 2021. Then, we conducted a series of simulations to estimate the fiscal health for the counties given a loss of sales and tax revenue of up to 50 percent for the remainder of FY 2020. We ran a second series of simulations to estimate the impact on FY 2021 with the outbreak lasting progressively longer, starting with the first quarter of the year and lasting through the entire year.

Although many counties were fiscally stressed before the outbreak, the results of our analysis showed that even a modest reduction of 25 percent in sales tax revenue in the final months of FY 2020 shifted many of the counties into financially unstable positions. Overall, the results showed an increase in the number of counties experiencing fiscal stress by almost 43 percent. The number of counties that are either borderline healthy or stressed likewise increased 16 percent. The results were somewhat bleaker if counties experience the worst-case scenario of a 50 percent decline in sales tax revenues. Under this simulation, the number of fiscally stressed counties in the state is expected to increase by 107.1 percent. The impact of the virus continues to grow the longer we practice social distancing or impose stay-at-home policies. For example, if the outbreak were to last until December, we would expect to see an increase of fiscally stressed or very stressed counties by 78.6 percent.

Figure 1 – Estimated fiscal health of North Carolina counties for FY2020 and Spread of Covid-19 as of April 8, 2020

The concern regarding fiscal health of counties during the Covid-19 epidemic is evolving. Local governments are the front line of the outbreak, with counties being the local governments as primary provers of direct services to their citizens through health departments. As Figure 1 shows, many of the counties that will begin to experience fiscal stress due to the outbreak are also the counties most severely struck by the virus. This suggests that these counties may experience a more difficult time fighting the outbreak as they are both facing a citizenry with increased rates of infection and are fiscally strained by both potential increased expenditures and loss of sales and use tax revenues.

- This article is based on the paper “Implications of the Coronavirus on Sales Tax Revenue and Local Government Fiscal Health.”

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: https://bit.ly/3beogru

About the authors

Bruce D. McDonald, III – North Carolina State University

Bruce D. McDonald, III – North Carolina State University

Bruce D. McDonald III is associate professor of public budgeting and finance and director of the Municipal Research Lab at North Carolina State University. Currently, he serves as co‐editor‐in‐chief of the Journal of Public Affairs Education, general editor for the Routledge Public Affairs Education book series, and co-host of the Academics of PA podcast. His research focuses on issues of fiscal health and local governance.

Sarah E. Larson – University of Central Florida

Sarah E. Larson – University of Central Florida

Sarah E. Larson is an assistant professor of public budgeting and finance in the School of Public Administration at the University of Central Florida. Currently, she serves as the social media editor for the Journal of Public and Nonprofit Affairs, sponsorship chair for the Association of Budgeting and Financial Management, and co-coordinator for the public finance and budgeting section of Western Social Science Association. Her research focuses on issues in taxation policy; specifically focused on sales, use, and property taxation.