Unlike the federal government, US local governments must have balanced budgets. When local governments face fiscal crisis, many states have the power to take over a local government and appoint an emergency financial manager to get the local government back to financial stability. In new research which examines eight recent state takeovers of US municipalities, Akheil Singla, Thomas Luke Spreen, and Jason Shumberger assess the effectiveness of state-appointed emergency financial managers. They find that these managers perform no better than the local officials they replace; they simply manage the situation differently, often by selling or privatizing public assets to generate cash.

Unlike the federal government, US local governments must have balanced budgets. When local governments face fiscal crisis, many states have the power to take over a local government and appoint an emergency financial manager to get the local government back to financial stability. In new research which examines eight recent state takeovers of US municipalities, Akheil Singla, Thomas Luke Spreen, and Jason Shumberger assess the effectiveness of state-appointed emergency financial managers. They find that these managers perform no better than the local officials they replace; they simply manage the situation differently, often by selling or privatizing public assets to generate cash.

Local governments provide most of the day-to-day public services—police and fire protection, schools, trash collection, utilities, sewers—that Americans rely upon. US local governments also operate under strict balanced budget requirements, which means that they must raise sufficient revenue each year to meet their expenses. These governments usually walk this fiscal tightrope successfully, but, sometimes, they slip. Worse, in rare cases they fall off the rope entirely. When that happens, state governments may intervene to mitigate the resulting damage from a local financial crisis. The most extreme state intervention is an outright takeover of a distressed local government, such as what occurred in Flint, Michigan from 2011 to 2015. When this occurs, the decision-making authority over a locality is surrendered by local officials to state-appointed emergency financial managers (EFMs). In new research, we find that EFMs are no better at resolving fiscal crises than the local elected officials they replace.

Can State Takeovers Solve Fiscal Crises?

Periodically, local governments fail to raise sufficient revenue to meet their financial obligations. Governments typically weather these periods of fiscal stress by tapping into accrued reserves, increasing taxes or fees, or cutting expenses. Local officials have incentive to delay the actions as they are usually unpopular with voters. In some rare cases, failure to act can cause ongoing budgetary challenges to metastasize into a full-blown crisis.

States regularly intervene in such local fiscal crises. While the specific provisions vary across states, the most severe of these interventions is a state takeover. Takeover laws enable a state’s government to remove decision-making authority from local elected officials and transfer it to state-appointed emergency financial managers. Twenty US states possess the legal authority to engage in a takeover of a financially distressed local government. The logic behind a state takeover is simple: if local officials cannot resolve a financial crisis, new management is needed.

The central appeal of emergency financial managers (EFMs) is that they can enact the necessary but politically unpopular reforms to resolve a financial crisis. After all, EFMs need not fear electoral consequences for their decisions. But critics argue that the unilateral authority and unelected nature of EFMs violate the central tenets of American democracy. They also question whether EFMs possess sufficient local knowledge and expertise to resolve the complex challenges facing distressed local governments.

The water contamination crisis in Flint, Michigan is one notable example of EFM decision-making that resulted in real harm to thousands of people. This raises the important and previously unanswered question: are EFMs better at resolving local financial crises compared to the local officials they replace?

Do Takeovers Actually Improve Local Financial Outcomes?

The major challenge of assessing the performance of EFMs is that we cannot know what would have happened in the absence of state intervention. This problem is compounded by the fact that few states that possess the legal authority to engage in a state takeover have acted on it. Further, most local governments are financially sound and are therefore at no real risk of a state takeover.

“20161005-FNS-LSC-0788” (Public Domain) by USDAgov

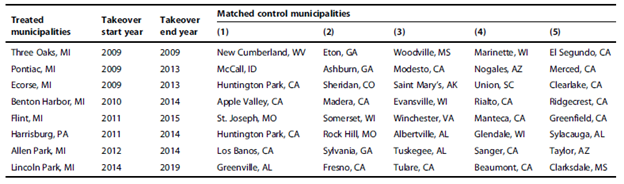

We resolved these challenges using statistical matching techniques. First, we identified eight state takeovers that occurred in Michigan and Pennsylvania between 2009 and 2014. Then we identified a set of 40 municipalities that 1) were in states without takeover laws, and 2) experienced financial crises at the same time with the eight municipalities that received a state appointed EFM (Table 1). We then evaluated the performance of both sets of municipalities along several financial health indicators prepared from audited financial reports spanning 10 years.

Table 1 – Takeover and Counterfactual Municipalities

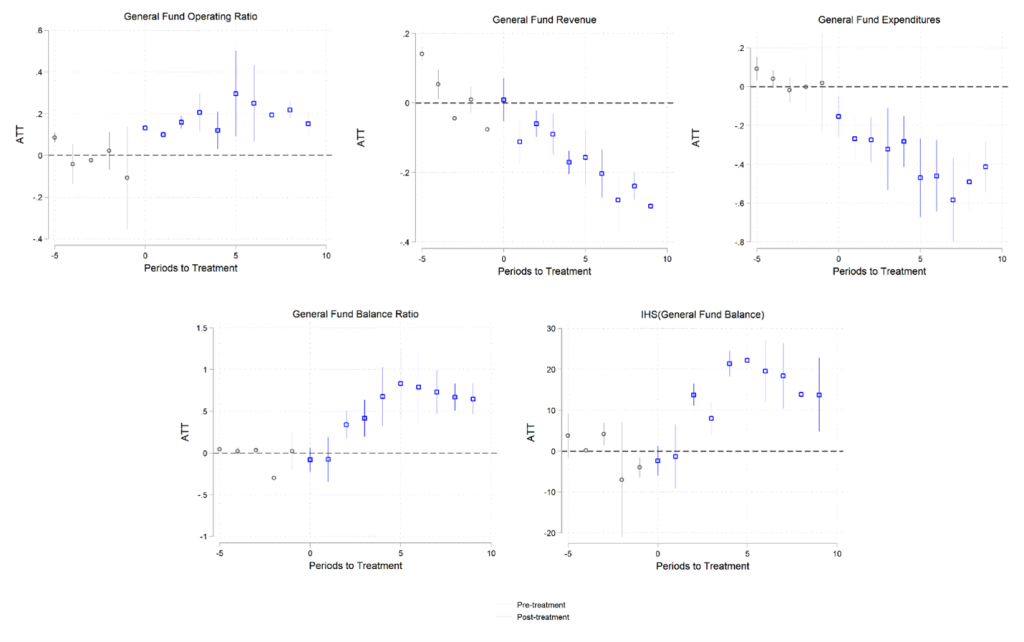

Our analysis shows that EFMs improve budgetary balance through austerity-oriented approaches, like expenditure cuts (Figure 1). This yields meaningful improvement in local financial health. But it also implies a reduction in the volume or quality of local public services. Our analysis also shows that several long-term financial health indicators materially declined following state intervention, driven principally by monetization of public assets. This suggests that EFMs favor the sale or privatization of public assets to generate cash.

Figure 1 – Financial performance after state intervention relative to matched counterfactual

State-appointed emergency financial managers do no better than local officials

While our assessment is not comprehensive—we do not, for instance, consider the composition of local public spending or broader economic indicators—it does provide an overall picture of the effect of state takeover on local government financial performance. The results suggest that EFMs charged with resolving a local financial crisis perform no better or worse than the local officials they replace. They simply manage the situation differently. Local financial distress is typically the result of economic headwinds that EFMs are no better equipped to address.

Our findings add to a growing body of research that shows state monitoring and intervention into local governments typically fail to address the root economic problems of troubled municipalities. We argue that states should instead address local fiscal emergencies by loosening local budget constraints by directing state aid to troubled local governments, providing a means to reduce or remove existing debts, or allowing local governments more flexibility to borrow to support operations.

- This article is based on the paper, ‘Decree or democracy? State takeovers and local government financial outcomes’, in Public Administration Review.

- Please read our comments policy before commenting.

- Note: This article gives the views of the author, and not the position of USAPP – American Politics and Policy, nor the London School of Economics.

- Shortened URL for this post: https://bit.ly/43vMus8