Africa’s central banks are uniquely positioned to support their countries’ transitions to a green economy, but there is no one-size-fits-all approach, write Reuben Wambui, Joseph Feyertag and Pierre Monnin.

Climate change and the net zero transition pose serious challenges to African economies; they also bring unique development opportunities for them. Mobilising the investments needed to address these challenges and seize these opportunities requires no less than a transformation of the financial system. Central banks, which sit at the heart of this system, can play a crucial role in this process.

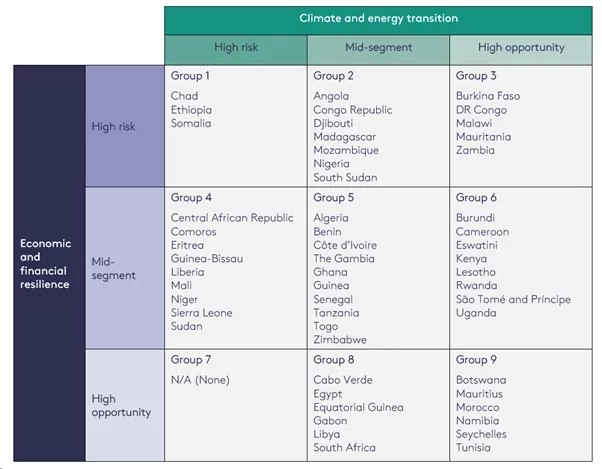

There is no one-size-fits-all solution. Across the African continent, central banks face different economic conditions, financial infrastructures, and monetary policy frameworks. Each must develop a regionally tailored and nuanced policy response to support a green transformation that does not jeopardise the development of African economies and instead promotes economic growth and social wellbeing.

Challenges and opportunities

Many African economies are highly vulnerable to physical climate risks, such as floods, droughts, and storms. The Intergovernmental Panel on Climate Change (IPCC) has warned of significant negative effects on Africa’s economic output and growth due to increased temperatures and reduced rainfall. One estimate shows that Africa’s GDP per capita is 13.6 per cent lower than it would have been without human-induced global warming.

Some African economies, particularly those relying on fossil fuel revenues, are also exposed to transition risks. These vulnerabilities are disproportionately high among the poorest households in Africa, while the continent’s contribution to global greenhouse gas emissions is minimal.

On the other hand, the continent is ripe for investment in low-carbon technologies and has rich resources to help with meeting global net zero goals. Africa is home to 60 per cent of the world’s solar resources, 30 per cent of the world’s mineral resources, and has the potential to capture carbon through some of the world’s largest and most pristine tropical forests and natural landscapes.

African economies struggle to harness their resources in these opportunities. For example, they are utilising only 6 per cent of their exploitable hydropower capacity and exporting mineral resources without processing them. Further, last year, the region recorded record deforestation, which threatens future carbon capture potential, as well as posing threats to natural ecosystems and biodiversity.

Tailoring policy responses

African central banks can be instrumental in both mitigating risks and capitalising on transition opportunities through tailored policy responses. Their comprehensive knowledge of the economy and financial markets uniquely positions them to inform other policymakers of the broad economic consequences of climate change. They are also equipped to ensure financial stability during the transition and to develop sustainable financial markets. Finally, they can support sustainable funding through their monetary policy operations and contribute to regional and international initiatives for the net zero transition.

However, not all central banks on the continent face the same conditions. They operate under different mandates. Sustainability objectives are explicitly included in the mandate of some central banks. For others, they are implicitly relevant through their impacts on other mandates like the stability of the financial system, the exchange rate, and prices.

The monetary policy framework in which a central bank operates also shapes its potential response to climate challenges and transition opportunities. Climate change is likely to have a significant impact on economic factors such as exchange rate stability, sovereign debt management and price and economic stability. However the impact of climate change on capital flows and exchange rates is likely to be more relevant for central banks implementing a fixed or anchored exchange rate policy, while the impacts of climate change on inflation and interest rates are of greater significance to central banks implementing an interest rate policy.

Currently, central banks in the region are at different stages of integrating climate considerations into their policies. Some have already issued regulatory guidance, reporting requirements, and have supported sustainable finance initiatives, while others have joined peer networks. By October 2023, 16 African central banks and supervisors had joined the Network for Greening the Financial System, a group whose members share best practices on climate risk management and other tools to mobilise finance for the net zero transition. This is an indication of the growing appetite by African central banks to integrate climate considerations into their operations.

Africa’s diverse landscape demands nuanced climate policy responses. Countries like Chad, Ethiopia and Somalia face high risk both in their vulnerability to climate change and their economic and financial resilience. On the other hand, countries such as Botswana, Mauritius, Morocco, Namibia, the Seychelles, and Tunisia have enormous opportunities across both fronts.

Most of the 54 economies face intersecting risks and opportunities. While a country might face high transition risks due to climate change vulnerability, high reliance on fossil fuel rents or high low-carbon investment needs, it might face high opportunity thanks to large forest or mineral rents, high GDP per capita, or renewable energy potential.

Policy options

There are different policy options available to central banks to help address climate change. Where a country sits on the risk versus opportunity spectrum is crucial in shaping a central bank’s response. But its position in terms of economic and financial resilience is equally important.

In countries with high economic risks, especially those with higher climate risk exposure, it is crucial that central banks assess and communicate the social, economic, and financial consequences of climate change, but also of the economic opportunities of the net zero transition. Ensuring the resilience of the financial system to climate shocks is also key for domestic and international financial institutions’ investments in adaptation and transition measures.

In countries with untapped transition opportunities, central banks can help reap the benefits of a global transition by developing the market infrastructure and contributing the financial professional expertise needed to mobilise sustainable finance. Their initial experience with using financial instruments to fund the transition can serve as a starting point for others to extend such tools. With their regional and international outreach in diverse policymaking forums, central banks can share lessons from their experience implementing such instruments. Central banks can also amplify the development of sustainable finance markets through monetary policy operations.

None of these options is a single silver bullet. Central banks must take a holistic approach with measures ranging from assessing and mitigating risks to supporting local and international financial markets in funding the transition.

This blog is based on the report “Net Zero Central Banking in Africa’s Diverse Economies: Challenges, Opportunities and Policy Options,” published by the LSE Grantham Research Institute.

Photo credit: