Managerial biases have been researched at length throughout the years, but not their quantitative effects amid unexpected negative shocks. Using a quarterly survey on a panel of small businesses in China, Ye Zhou, Difang Huang, Muzi Chen, Yunlong Wang and Xiaoguang Yang document the evolution of managerial biases, explore potential mechanisms driving observed changes and evaluate the impact of these biases on firm decision-making.

Research has shown that managerial biases have impacts on corporate investment, capital structure and firm value, even highlighting the relationship between managerial forecasting errors and firm decision-making (Bloom, 2009). However, the quantitative effects of managerial beliefs during unexpected negative shocks have been insufficiently explored. We seek to contribute to the broader academic and policy discourse by examining the joint dynamics of managerial beliefs and decision-making during the COVID-19 pandemic, focusing on a critical yet understudied group: small businesses in one of the world’s largest developing economies, China.

Jointly with the Shanghai Head Office of the People’s Bank of China (PBC), we field a quarterly survey on a panel of representative managers from small businesses, gathering subjective responses and actual information about current and future business conditions. The survey encompasses inquiries about managers’ decision-making and feedback on government support. Leveraging the COVID-19 outbreak and management as a natural experiment, we use data from six waves of surveys – from the second quarter of 2019 to the fourth quarter of 2020 – and divide the data sample into four periods: pre-outbreak, during the outbreak, weaker, and under-control periods. We measure managerial beliefs using subjective survey questions and calculate managerial biases as the difference between objective firm conditions and subjective managerial responses.

In this article, we concisely summarise our primary findings by addressing three questions: 1) are biases present during the COVID-19 pandemic? 2) what factors influence or mitigate these shifts? and 3) do such biases result in changes in decision-making?

1. Are biases present during the COVID-19 pandemic?

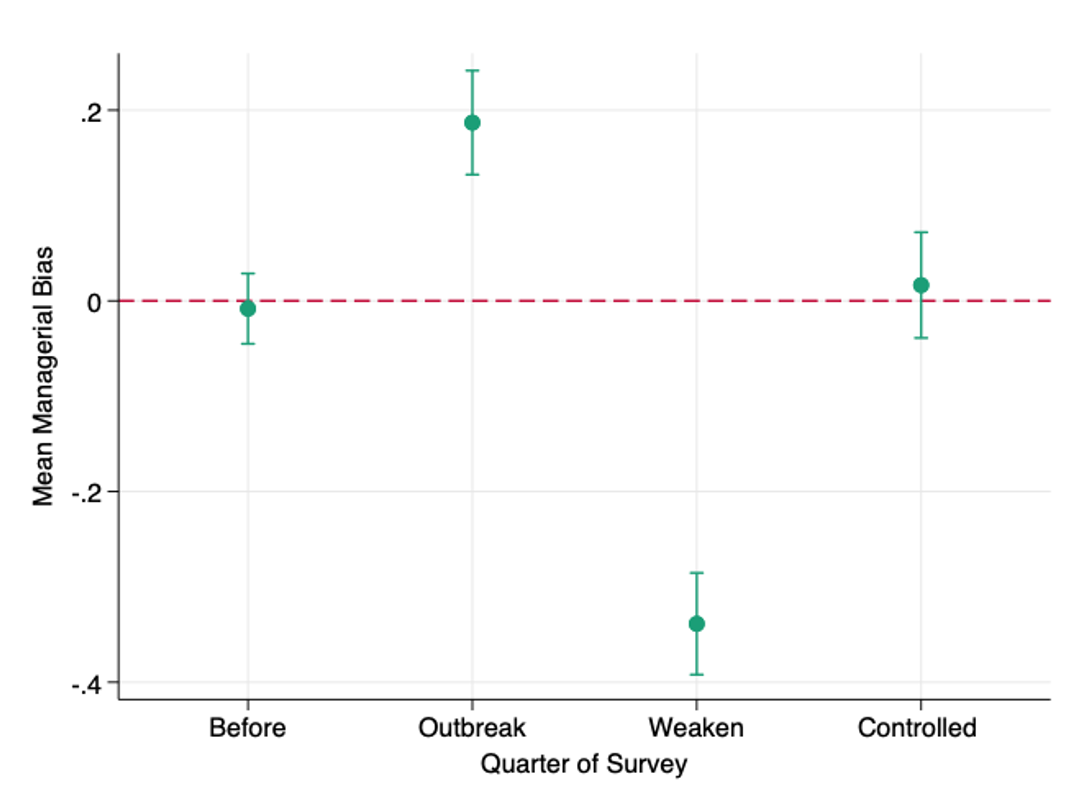

In examining the potential belief shift following the COVID-19 shock, our focus is on documenting the evolution of managerial biases both pre and post the pandemic outbreak. The visual representation in Figure 1 illustrates a close alignment of biases with actual business conditions before the pandemic, a manifestation of over-optimism during the peak, and a subsequent turn to over-pessimism during the pandemic’s weaker period. Notably, this observed shift in biases is temporary; once the pandemic is brought under control, the impact on managerial bias diminishes. Crucially, the robustness of these findings persists even when extending the study period by an additional quarter into the year 2021.

Figure 1. Managerial biases across time

2. What factors influence or mitigate these shifts?

Subsequently, we delve into two potential factors contributing to the shift in managerial biases before and after the pandemic, and investigate the potential mitigating effect of governance policies and bank loans support.

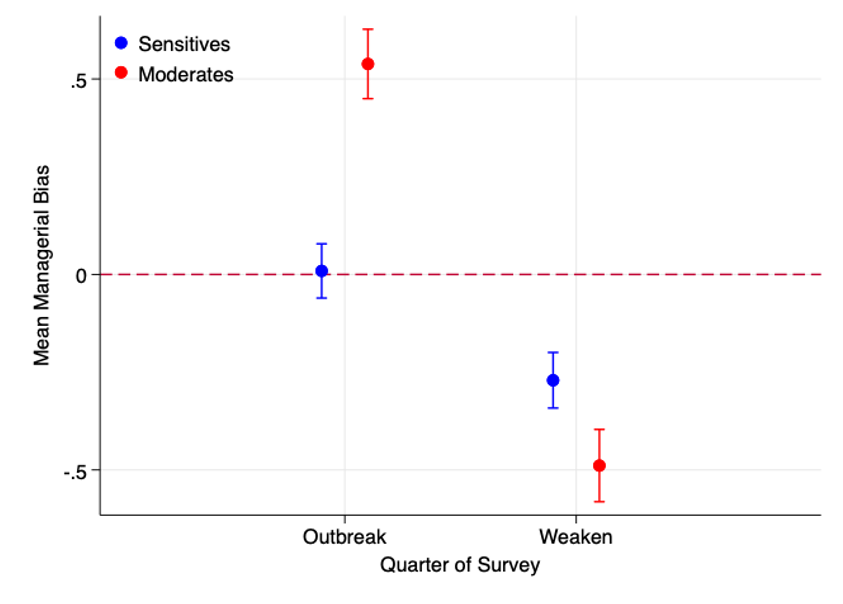

Our investigation reveals that the presence of moderate managers and anchoring effects in an environment of incomplete information may underpin these changes. First, managers may differ in their ability to obtain and learn from new information (Möbius et al., 2022). In our empirical analyses, we categorise managers as moderates or sensitives based on their demonstrated ability to process new data: moderates may disregard changes in actual operating conditions in their survey responses, assuming conditions remain stable, while sensitives are more likely to form managerial opinions using available information. Figure 2 illustrates that moderates may not promptly adjust to the significant fluctuations in actual operating conditions driven by the pandemic, while sensitives may alter their beliefs about firms’ performance based on new information. Importantly, the change in managerial biases is more pronounced for moderates compared to sensitives after the pandemic.

Figure 2. Managerial biases for sensitives and moderates groups

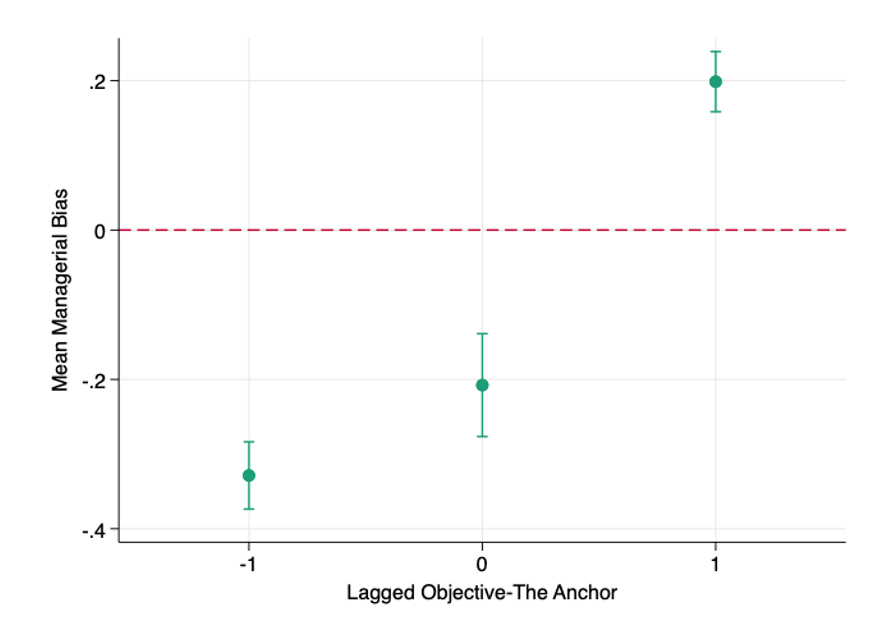

Second, based on current and past information, managers update their beliefs about firm operating conditions and may extrapolate beliefs informed by the past (Bordalo et al., 2019). In other words, managers may also choose an anchor based on their companies’ historical performance and adjust their subjective beliefs accordingly (Tversky and Kahneman, 1974). Before the pandemic, managers possess more accurate information and maintain rational beliefs regarding actual business operations. However, the post-pandemic period introduces uncertainty, resulting in incomplete information, and managers may not fully adapt to the current situation. As depicted in Figure 3, a positive relationship emerges between managerial biases and the anchor, suggesting that favourable conditions in the previous quarter are associated with optimistic managerial beliefs.

Figure 3. Managerial biases and the anchoring effect

Moreover, we demonstrate that government financial support can alleviate negative managerial biases following pandemic shocks. Specifically, among the various policy supports implemented during the pandemic, government financial relief proves effective in reshaping managerial beliefs during the weakened period. Notably, direct fund support from the government shows heightened effectiveness in adjusting managerial beliefs at the onset of the pandemic. Conversely, our findings indicate that bank loan support has an insignificant impact on pessimistic managerial beliefs during the pandemic.

3. Do such biases result in changes in decision-making?

In our comprehensive investigation, we delve deeper to understand the potential impact of documented managerial biases during our study period on the strategic decisions of firms, specifically examining their investment and labour market choices. This exploration aims to shed light on the consequential influence of managerial perceptions on the aggregate efficiency of the macroeconomy. Our empirical observations unveil a notable correlation between optimistic managerial beliefs and a surge in investment, coupled with a reduction in workforce layoffs. Conversely, pessimistic managerial attitudes exhibit an inverse relationship, leading to decreased investment and an uptick in layoffs. These distinctive behavioural patterns, rooted in managerial biases, emerge as crucial factors that may contribute to aggregate inefficiencies within the broader economic landscape, aligning with prior research findings (Gennaioli et al., 2013). We emphasise the resilience and reliability of our results, substantiated through a series of rigorous tests designed to address potential endogeneity bias in firm-level outcomes.

Conclusions

Our research delves into the intricate dynamics of managerial beliefs and decision-making amid unforeseen negative shocks impacting small businesses in China. The findings highlight the pivotal role of managerial beliefs and their profound influence on corporate management and economic fluctuations. Beyond immediate implications, the study suggests that government policy assistance can effectively mitigate adverse effects of managerial biases on firm decision-making during crises. This reveals a symbiotic relationship between managerial practices and governmental interventions, fostering resilience in small businesses facing unprecedented challenges. Contributing substantively to academic and policy discourse, our research broadens understanding of managerial beliefs, providing valuable insights into navigating economic uncertainties and distress. It offers a nuanced perspective on the interplay between management, policy, and economic resilience.

- This blog post is based on How Did Small Business Respond to Unexpected Shocks? Evidence from a Natural Experiment in China, Journal of Corporate Finance (forthcoming)

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics and Political Science.

- Featured image provided by Shutterstock.

- When you leave a comment, you’re agreeing to our Comment Policy.