How much is a bitcoin worth? This question is difficult to answer because bitcoin, and cryptocurrencies in general, are notoriously volatile. Users face significant market risk because of the fluctuation in the exchange rate between bitcoin and other currencies. For all the hypes about how cryptocurrency is shaping the future of fintech, it is crucial to understand the factors behind its price swing. Policy makers need to unpack the forces behind bitcoin to devise regulations and curb financial stability risks. Businesses need to understand the price movement patterns before adopting bitcoin or even launching their own digital currency — what is known as an initial coin offering. Our research studies whether and to what extent social media can explain bitcoin’s value.

Although bitcoin was intended to be used as a currency, most bitcoin owners treat it as a financial investment. Indeed, researchers find that the price movement of bitcoin resembles that of stocks rather than currency. Literature has shown that sentiment extracted from social media platforms, such as investor forums, blogs, and Twitter, can be used to predict trends in the financial market. Yet previous studies typically consider sentiment from social media as a whole, disregarding the mixed signals from various users and channels. Our study compares the effects of sentiment generated by users with different levels of activity: the active users who contribute most content (the vocal minority), and the relatively inactive users who contribute less often (the silent majority).

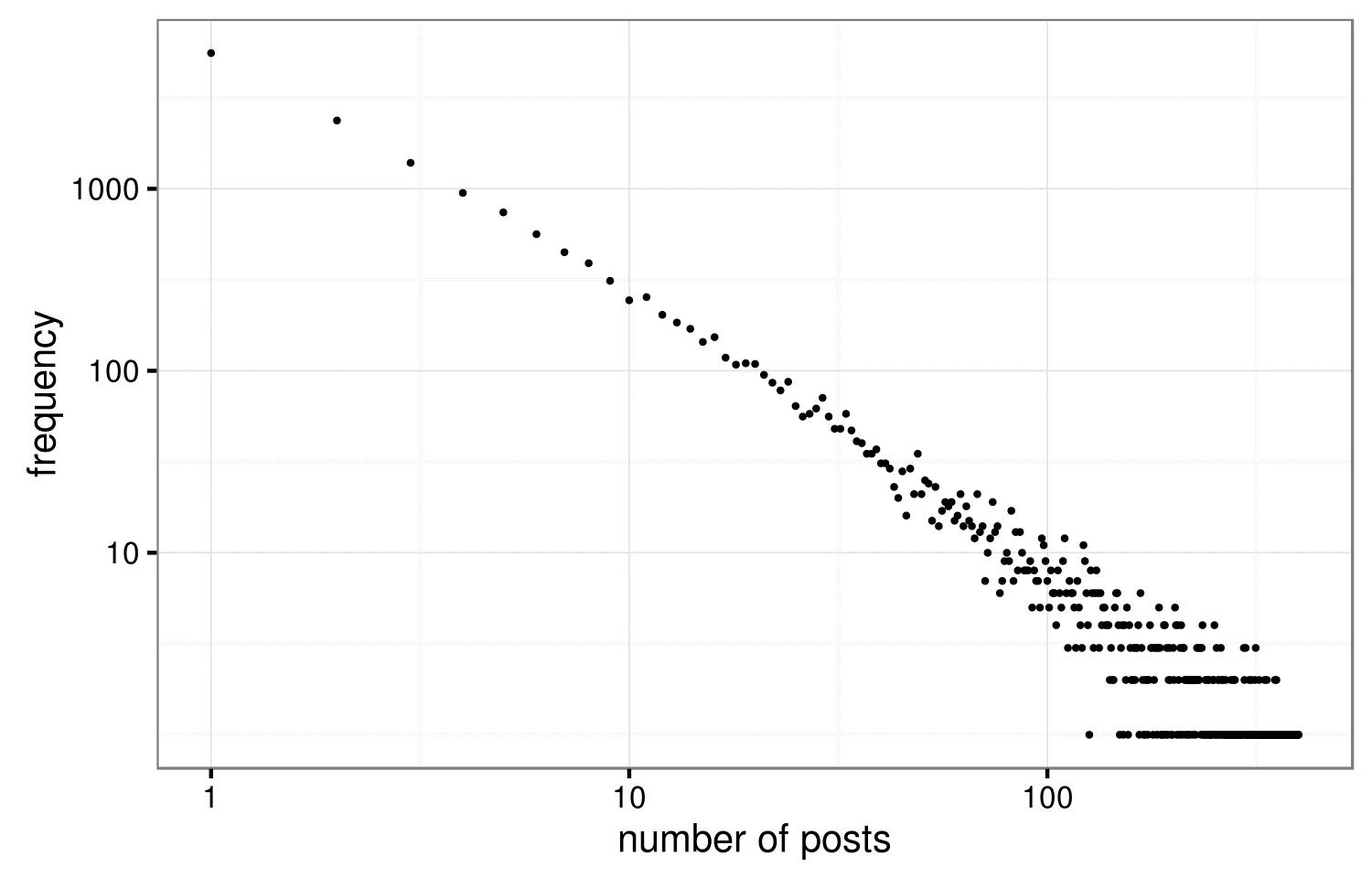

An interesting phenomenon that motivated our research is that many statistics on the internet follow a power law distribution. The probability distribution gets its name because the frequency of an event is a constant power of a numerical attribute of the event (e.g. size). You may also have heard of the Pareto principle, or 80/20 rule, which can be used to describe the same phenomenon. Examples of the distribution include the number of friends a person has on social networks, the number of incoming links to a website, and the readership of blogs. Do social media messages about bitcoin have the same characteristic?

We collect over 343,000 forum posts from bitcointalk.org, the most popular bitcoin community, according to a survey. Our finding confirms that social media messages about bitcoin indeed follow a power-law distribution. The following figure shows a log-log plot of the number of posts by users and user counts. (The X-axis is the log number of posts written by a user, and the Y-axis is the log frequency.) A straight line serves as a simple visual diagnostic for power-law. The statistics are even more extreme than the 80/20 rule suggests — the top 20 per cent of the users generates more than 87 per cent of the posts, and the top 5 per cent percent of the users generates 63 per cent of the posts. In other words, the vast majority of the social media messages about bitcoin are generated by a small handful of active users.

Figure 1. A log-log plot of the number of posts by users and user counts

We then build a vector error correction model to study the exchange rate of bitcoin. The model includes various variables as predictors, including bitcoin’s price, volatility, trading volume, transaction volume, and other internet variables, such as the web traffic to bitcoin’s website and Google search volume. Our main variable of interest is the sentiment of the forum messages, captured by counting the occurrences of positive and negative words defined in a widely adopted finance sentiment dictionary.

Our empirical model suggests that about 4.5 per cent of the variance of bitcoin value can be explained by variability of the sentiment from silent majority users, but only 0.45 per cent of the variance can be explained by the vocal minority. In other words, the sentiment from the silent majority users is a much stronger predictor of future bitcoin’s price swing. Its effect is about 10 times stronger despite the vocal minority generating way more buzz. Our results are robust to different cutoff values for defining the vocal minority and different time period.

Our findings have several relevant implications. First, we provide evidence that social media offer substantial novel information about bitcoin’s daily fluctuations. These signals seem to be factored into the price-formation process and can influence future returns.

Second, companies should strategically evaluate their decision to adopt bitcoin or another cryptocurrency as a payment system. Adoption decisions can induce positive public relations through social media, which will, in turn, affect the value of the cryptocurrency. The dynamic relationship between social media content and cryptocurrency means there is a chance to create a self-fulfilling feedback loop for new fintech start-ups.

Third and most important, when incorporating social media data into financial models, the silent majority users’ opinions cannot be overlooked. More analytic efforts should seek to identify the opinions from the long tail of the online community. This is especially true for cryptocurrencies — the most zealous users are often behaving irrationally and in denial of downside risks.

Overall, we conclude that social media sentiment is an important leading indicator of future bitcoin value. Yet the relationship is complex, because the voice of the silent majority exerts a more significant effect than the volume of their posts would suggest. Our study offers new insights into the cryptocurrency market and the economic impact of social media.

♣♣♣

Notes:

- This blog post is based on the author’s paper How Does Social Media Impact Bitcoin Value? A Test of the Silent Majority Hypothesis, co-authored with Zhe Shan, Qing Bai, Xin (Shane) Wang and Roger H.L. Chiang, Journal of Management Information Systems, 2018.

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Photo via Max Pixel, under a CC0 1.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy

Feng Mai is an assistant professor of information systems at the School of Business, Stevens Institute of Technology. He is also a fellow of the Risk Institute at the Fisher College of Business, Ohio State University. He received his Ph.D. from the University of Cincinnati. Feng’s research interests are social media, fintech and machine learning. His work has appeared in leading academic journals.

Feng Mai is an assistant professor of information systems at the School of Business, Stevens Institute of Technology. He is also a fellow of the Risk Institute at the Fisher College of Business, Ohio State University. He received his Ph.D. from the University of Cincinnati. Feng’s research interests are social media, fintech and machine learning. His work has appeared in leading academic journals.

Zhe Shan is an assistant professor in the Department of Operations, Business Analytics, and Information Systems in the Lindner College of Business at the University of Cincinnati. He earned his Ph.D. in business administration and operations research from Penn State University’s Smeal College of Business. His research interests include fintech innovation, information security, patient-centred healthcare and business process analytics.

Zhe Shan is an assistant professor in the Department of Operations, Business Analytics, and Information Systems in the Lindner College of Business at the University of Cincinnati. He earned his Ph.D. in business administration and operations research from Penn State University’s Smeal College of Business. His research interests include fintech innovation, information security, patient-centred healthcare and business process analytics.

Xin (Shane) Wang is an assistant professor in marketing and statistics, and the MBA ’80 Faculty Fellow at the Ivey Business School of Western University. He received his Ph.D. in marketing from the University of Cincinnati. His research focuses on machine learning with applications in marketing, social media analytics, the marketing-IS interface and Bayesian statistics.

Xin (Shane) Wang is an assistant professor in marketing and statistics, and the MBA ’80 Faculty Fellow at the Ivey Business School of Western University. He received his Ph.D. in marketing from the University of Cincinnati. His research focuses on machine learning with applications in marketing, social media analytics, the marketing-IS interface and Bayesian statistics.