The debate about the desirability of international financial flows is at the centre of the discussion of researchers and policy makers. This article focuses on one key aspect of capital controls: their impact on firms’ access to capital markets and their consequences for competition and aggregate productivity growth. Indeed, cross-country studies report that the deregulation of international capital flows correlates with productivity growth. This finding is important because productivity differences across countries are main factors explaining differences in income per capita. Yet there is little information about the forces driving the increase in aggregate productivity.

In this article, I argue both theoretically and empirically that financial openness removes distortions in the access to capital markets across firms and promotes productivity growth through two forces. First, it improves credit conditions for firms that were shut out from international borrowing. Second, it turns on pro-competitive forces that lead unconstrained firms to invest more in technology as well. This results in a broad-based increase in aggregate productivity.

To illustrate this mechanism, think of an economy where capital controls make international borrowing too costly for most of the firms, but there are some firms that are able to circumvent these controls and obtain foreign funds at lower financing rates. For example, while most firms in the economy are shut out from international financial markets, foreign affiliates operating in this economy may still have access to deep, within-firm, internal capital markets, thus generating heterogeneous access to credit markets. In a context like this, capital markets are distorted and – I argue – this distortion undermines competition and all firms’ investments in technology.

To see the intuition behind this, think of a sector where there are these two types of firms that compete with one another. In this setting, firms that are shut out from international capital markets face higher financing costs that undermine their innovation incentives. Firms that get access to foreign funds enjoy a cost advantage over their competitor thats allows them to obtain higher markups. Since these market leaders face weak competition, they have little incentive to engage in costly and uncertain innovation activities.

What happens if we reduce capital controls and allow all firms to gain access to foreign funds?

I argue that productivity grows through two forces. The first force is quite intuitive. The deregulation removes barriers to international borrowing and allows firms that were shut out from international capital markets to obtain cheaper credit. Lower financing costs promote their innovation activities. But there is second pro-competitive force. The reduction in capital controls removes the cost advantage of previous market leaders, which deepens competition. Tighter competition implies that these firms are now more likely to be displaced by new innovators if they do not innovate. Therefore, procompetitive forces encourage stagnant market leaders to innovate more as well in order to preserve their market share. Thus, the deregulation of capital controls can lead to a broad-based acceleration of aggregate productivity through competitive forces.

In this article, I exploit rich firm-level data around the deregulation of capital controls in Hungary in 2001 to argue empirically the mechanism described above. This reform revoked capital controls that had imposed asymmetric access to international borrowing across firms. In particular, capital controls restricted domestic firms to borrow locally in a tight credit market, while allowing foreign firms to raise funds abroad and, thus, circumvent the low credit in the Hungarian financial system. In 2001, all capital controls were lifted and, with them, the ban on domestic firms’ international borrowing.

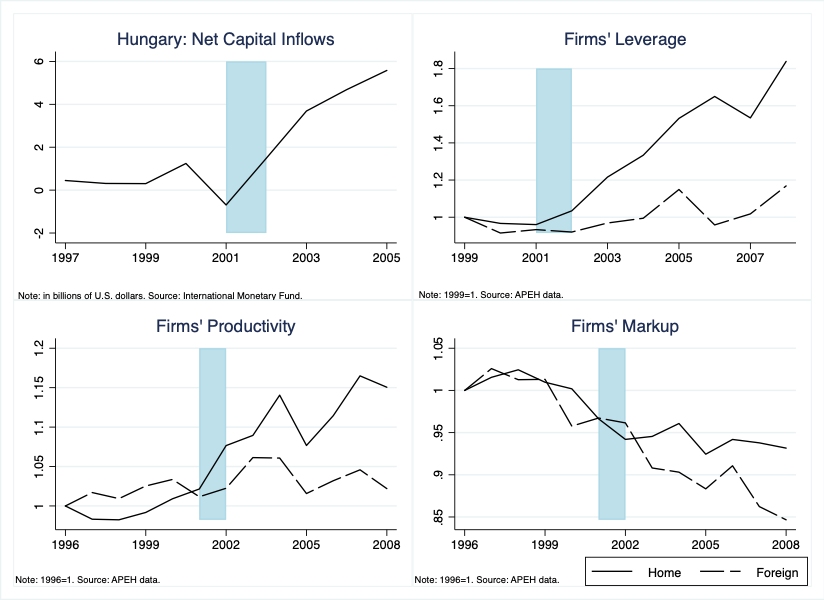

Figure 1. The deregulation of capital controls in Hungary in 2001

Credit: Varela, L. in Review of Economic Studies, Volume 85, Issue 2, April 2018, Pages 1279–1313

Capital controls in Hungary were associated with a low level of credit and worse financing conditions and lower leverage for domestic firms. The liberalisation of capital controls led to large capital inflows, particularly towards banks whose net capital inflows rose from 0.6 to 3.3 billion U.S. dollars per year, as shown in Figure 1. The expansion in banks’ liquidity associated with an increase in the local credit supply that substantially improved financing terms for domestic firms. By 2004, the difference in the interest rate paid by domestic and foreign firms had fallen five-fold, and the difference in the required collateral had dropped four-fold. This improvement in financing terms associated with a reallocation of credit towards domestic firms, whose share of aggregate credit increased by 17 percentage points.

I then provide evidence for the two channels mentioned above. I first demonstrate that, while prior to the deregulation, domestic and foreign firms’ growth rates were similar, following it, domestic firms started growing much faster. In particular, domestic firms increased relatively more their productivity, R&D and innovation activities and leverage (as illustrated in Figure 1). Importantly, I also show that the expansion of domestic firms was larger in sectors where firms were more credit constrained.

Additionally, my results point to the second, pro-competitive, channel. Foreign firms’ markups decrease. Indeed, foreign firms’ markups dropped by more and their productivity increased faster in sectors where competition intensified the most following the expansion of domestic firms. These findings suggest that foreign firms responded to the deeper competition by innovating more. Altogether, I show that the expansion in firms’ productivity resulted in a large expansion in aggregate productivity growth, which increased by 3 percentage points per year within the five years following the deregulation of capital controls.

My article sheds light on the current debate on capital controls in developing economies. It is often argued that countries might consider it beneficial to encourage foreign direct investment and discourage financial flows. The evidence presented in this paper warns about possible distortions created by this policy. By restricting financial flows, capital controls can reduce local credit and tighten financing terms for domestic firms. This creates asymmetric access to external funds between domestic and foreign firms, which reduces the competitive pressure of the former and allows foreign companies to obtain higher markups, resulting in lower investment and economic growth. Viewed through the lens of the paper, non-FDI flows might benefit the economy by reducing asymmetric access to capital markets across firms and unleashing pro-competitive forces.

♣♣♣

Notes:

- This blog post is based on Reallocation, Competition, and Productivity: Evidence from a Financial Liberalization Episode, The Review of Economic Studies, Volume 85, Issue 2, April 2018, Pages 1279–1313

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by pashminu, under a Pixabay licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Liliana Varela is an assistant professor of the department of finance of LSE and a research affiliate of the CEPR. Her research focuses on international economics and macroeconomics and, particularly, on the impact of capital flows on economic growth.

Liliana Varela is an assistant professor of the department of finance of LSE and a research affiliate of the CEPR. Her research focuses on international economics and macroeconomics and, particularly, on the impact of capital flows on economic growth.