Many businesses across the world have already laid off their workers, furloughed them, or shortened their work hours. Governments have used a variety of job retention programs, most fashioned after the German Kurzarbeit program of the previous Eurozone crisis. These require massive budget allocations and are hardly sustainable over a longer period of time. Differentiated policies to deal with jobs are needed: both for protecting existing jobs and for creating new ones.

Recent research shows that only a handful of countries are considering the second path: Portugal, for example, has established a program that supports startups with less than five years of business activity, through the contracting of incubation services with an incentive of EUR 1,500. The United Kingdom has created the Coronavirus Future Fund for startups – which is available for recently-established companies that have raised at least GBP 250,000 in equity investment in the last 5 years.

One simple way to estimate the size of job losses in the near term is to combine official data on employment structures with surveys of business. For instance, a survey of small businesses in the United States by the Small Business Investor Alliance found that around 20 per cent of the workforce in the wholesale and retail sector lost jobs by mid-March, and 2 in 3 firms anticipated further layoffs.

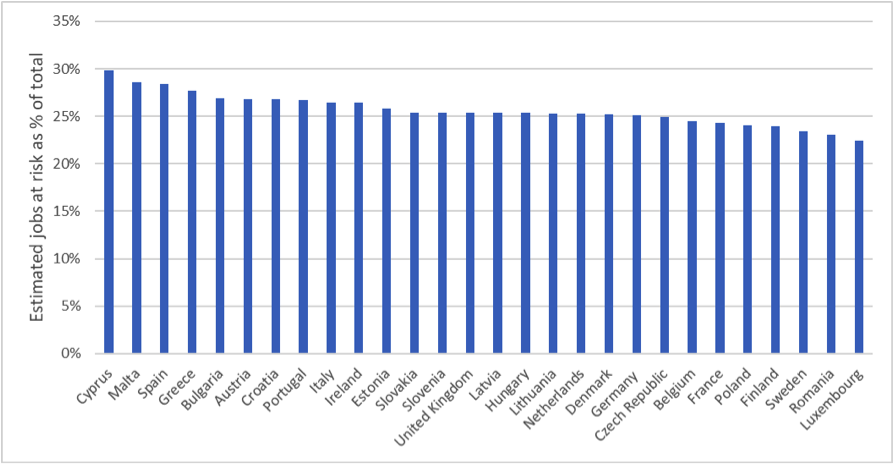

We combine Eurostat end-2019 sector-level employment figures from 28 countries (27 European Union countries plus the United Kingdom) with occupation-level data on industries at risk as a result of physical-distancing policies to calculate the number of jobs at risk as a percentage of total employment. This analysis suggests that the share of workers losing their jobs while social distancing is in place is approximately 26%, with little variation across Europe (Figure 1).

Figure 1. Jobs at risk as percentage of total employment

Source: Eurostat 2020. Notes: Total employment refers to all paid employees and excludes self-employed people.

This analysis shows a troubling trend that mirrors recent findings on firms’ survival times. Using data from 34 middle income and low income countries, we find that under the assumption that firms have no incoming revenues, the median survival time across industries ranges from 6 to 28 weeks. Once collapsed export demand is taken into account, the median survival time falls to between 6 and 18 weeks. Retail is consistently the most cash-constrained sector, while manufacturing is consistently the longest lasting.

To mitigate the devastating consequences of the current crisis on employment numbers, countries are expanding existing job-protection schemes. The United Kingdom has extended its furlough scheme by four months until October 2020, after businesses voiced concerns that otherwise they would not recover in time to re-employ them. As of June 7, 8.9 million workers – over a quarter of the United Kingdom’s entire workforce – had been furloughed. Similarly, France’s temporary unemployment scheme to avert mass bankruptcies and lay-offs as a result of the COVID crisis will be extended, and is now expected to last up to two years. By the end of April, 8.6 million employees were benefitting from the scheme.

While these schemes protect jobs, their cost has been staggering. To date, the United Kingdom’s program has already cost approximately £42 billion, and its total gross cost is estimated to be between £60-£84 billion. Estimates for Germany’s Kurzarbeit’s scheme now surpass €40 billion, and France had already spent more than €26 billion by mid-May.

Few countries, even within Europe, can afford to sustain these programs for long periods of time, so that governments will soon need to start targeting particular sectors or regions. For some countries, tourism will be the obvious sector to target, while others will prioritise manufacturing and construction, given that during the current COVID crisis industrial production in the euro area and the EU has fallen by more than 17%, a level last seen in the mid-1990s. With limited resources, targeting aid to specific sectors or regions is indispensable. The new challenge is choosing which ones.

♣♣♣

Notes:

- This blog post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Ross Sneddon on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Erica Bosio is a researcher at the World Bank Group, where her work focuses on public procurement. Previously, she worked in the arbitration and litigation department of Cleary Gottlieb Steen & Hamilton in Milan. She holds a Master of Laws from Georgetown University and a degree in law from the University of Turin (Italy).

Erica Bosio is a researcher at the World Bank Group, where her work focuses on public procurement. Previously, she worked in the arbitration and litigation department of Cleary Gottlieb Steen & Hamilton in Milan. She holds a Master of Laws from Georgetown University and a degree in law from the University of Turin (Italy).

Maksym Iavorskyi is an operations analyst at the growth analytics unit in the development economics vice presidency of the World Bank. Between 2015 and 2019, he was a member of the Doing Business team and covered the Enforcing Contracts and the Resolving Insolvency Indicators. Prior to joining the World Bank Group, Maksym worked as a lawyer in leading law firms in Ukraine and in the United States. He holds a Master of Laws (LL.M.) from the Geneva Law School and Graduate Institute of International and Development Studies. Maksym speaks Russian and Ukrainian.

Maksym Iavorskyi is an operations analyst at the growth analytics unit in the development economics vice presidency of the World Bank. Between 2015 and 2019, he was a member of the Doing Business team and covered the Enforcing Contracts and the Resolving Insolvency Indicators. Prior to joining the World Bank Group, Maksym worked as a lawyer in leading law firms in Ukraine and in the United States. He holds a Master of Laws (LL.M.) from the Geneva Law School and Graduate Institute of International and Development Studies. Maksym speaks Russian and Ukrainian.

Nathalie Reyes is an analyst in the growth analytics unit at the World Bank. Her work focuses on public procurement, business regulations, and private sector development. Prior to joining the World Bank, Nathalie worked in the Inter-American Development Bank and Universidad Javeriana in Bogota, Colombia. She holds a Master’s degree in development economics and public policy from Université Paris 1 Panthéon-Sorbonne and a degree in economics from the Universidad Militar Nueva Granada.

Nathalie Reyes is an analyst in the growth analytics unit at the World Bank. Her work focuses on public procurement, business regulations, and private sector development. Prior to joining the World Bank, Nathalie worked in the Inter-American Development Bank and Universidad Javeriana in Bogota, Colombia. She holds a Master’s degree in development economics and public policy from Université Paris 1 Panthéon-Sorbonne and a degree in economics from the Universidad Militar Nueva Granada.

A sensible and useful conclusion, but I’m not sure these at risk estimates help us very much. They don’t show much variation by country and yet we know from previous recoveries there is considerable variation in job losses. Countries have also used different policy mixes, have different policies towards the pandemic, and are likely to have different trajectories for their recovery. They will also face different impacts from changes in their primary export markets and restrictions on the movement of migrant workers.

UK has many famous universities which stood for centuries . It’s quality, reputation has world wide accepted .

Hope in the future have a chance to continue study there .