The following is a book review of ‘Financial Cold War: A View of Sino-US Relations from the Financial Markets’ by James A. Fok (Wiley, 2022). If you are interested in finding out more about Financial Cold War, join China Foresight’s webinar with James A. Fok on 10 March 2022 by clicking here.

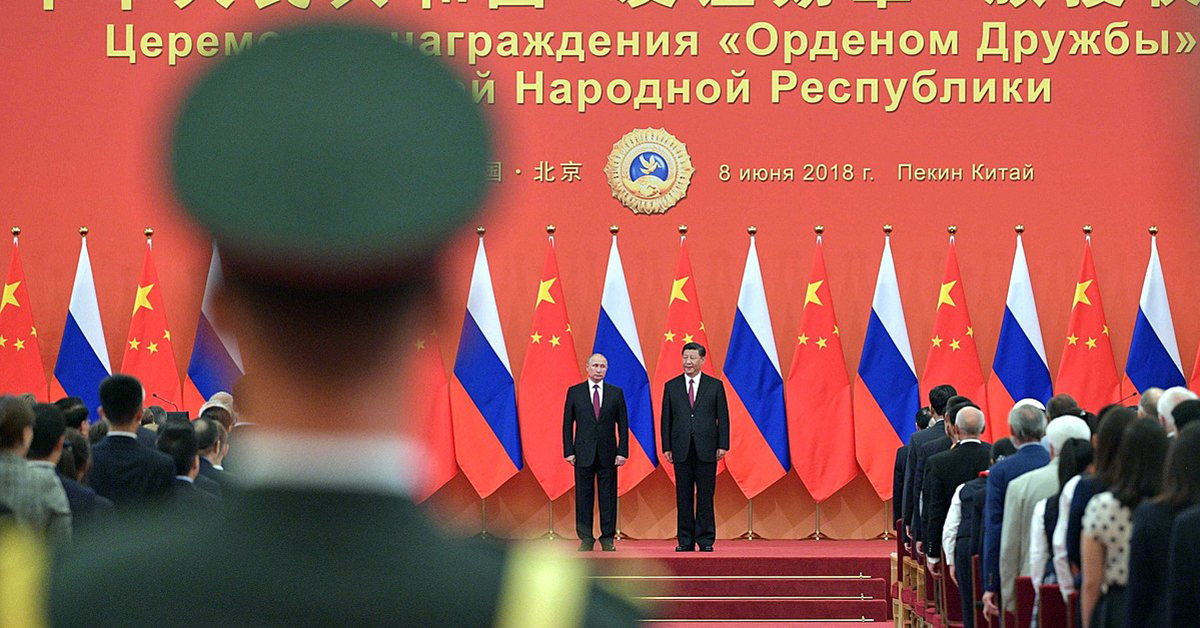

The Russian invasion of Ukraine and the ensuing sanctions and boycotts by a host of governments, companies and institutions has powerfully highlighted the intersection of geopolitics and financial markets. It is this connection that James A. Fok explores in his recent book, Financial Cold War: A View of Sino-US Relations from the Financial Markets, by explaining in particular how the structure of international finance has contributed to and shaped tensions in the US-China relationship.

The book accomplishes this task by putting forth four interconnected arguments. Tracing the establishment of the USD as the global reserve currency with the establishment of the Bretton Woods system after the Second World War, Fok firstly explains how the centrality of the dollar has benefitted international trade and investment as well as become a source of US power. However, it has also produced financial imbalances and in turn contributed to domestic instability.

Secondly, charting China’s rise in the US-centric global monetary system, Fok asserts that China’s rapid economic growth has further exacerbated these dollar-induced imbalances and, in the context of restricting financial liberalisation domestically, also resulted in structural imbalances in China’s own economy. This unsustainable Chinese growth model is now reaching its limits.

Thirdly, far from being an accidental process, Chinese and US policies have contributed to the current status quo. By favouring corporations and wealthy elites, fiscal, industrial and monetary policies have failed to curb excessive income and wealth inequality, thereby contributing to a populist and nationalist backlash. Political polarisation, as seen under the Trump presidency’s ‘trade war’, then feeds into geopolitical tensions between the two major powers.

Lastly, Fok emphasises that geoeconomic warfare – or a worsening ‘Financial Cold War’ – would be costly for both sides. Due to their economic interdependence, both the US and China have a strong interest in addressing those areas of the global financial and monetary system that are in need of reform. Yet, paradoxically, it is exactly this interdependence that has contributed to the deteriorating US-China relationship in the first place.

Throughout the analysis, Fok delicately avoids structural determinism while explaining the constraints and opportunities that financial markets create for US and Chinese foreign and economic policy. Fok therefore rightly calls for action on part of policy makers in both Washington and Beijing. The book outlines three possible paths of reform, including the establishment of a new global reserve currency; the rebalancing of reserve holdings to reduce the role of the USD; and the gradual containment of US fiscal deficits.

Although it is the expressed aim of the book to remain analytical rather than prescriptive, the book could offer more details on how to put these proposals into action. Appealing for far-sighted leadership is surely important, but political leaders are often themselves embedded in ideological environments while facing powerful interest groups that benefit from the entrenched status quo. A further elaboration on the role of third parties – especially the agency of actors across the Global South as well as the European Union – in pushing for concrete policy changes in bilateral and multilateral settings would have been insightful in this regard, giving the book even more practical relevance for a diverse global audience.

Overall, Financial Cold War is a well-argued, reflective and refreshing contribution to ongoing discussion about China’s rise and, in particular, the US-China relationship. Fok should be on the reading list of everyone trying to understand the most consequential major power relationship of the 21st century.

This article gives the views of the author, and not the position of the China Foresight Forum, LSE IDEAS, nor The London School of Economics and Political Science.

Zhōngguó Shíkè 中国时刻 (China Moments) are short comments which respond to current affairs reporting on China’s domestic and foreign policy.