What do we know about how a market economy operates in the immediate aftermath of a major natural disaster such as an earthquake? Well, actually less than you might think. Specialists in disaster studies have understandably focussed on resilience, relief and reconstruction. The economics of disasters has offered limited frameworks for such addressing this kind of question, although major natural disasters have usefully served in analysis as exogenous shocks or natural experiments. Yet rebuilding economic activity following a major natural disaster must be helped by improving our understanding of the mechanisms whereby the disaster impacts on market activity, and the response of economic actors, both individual and collective. Our work builds on the idea that the analysis of markets in the short-term recuperation phase is best undertaken using the laws of supply and demand, an argument put forward in one of the classic works of the economics of disasters back in 1969.[1]

The Great Kantō Earthquake

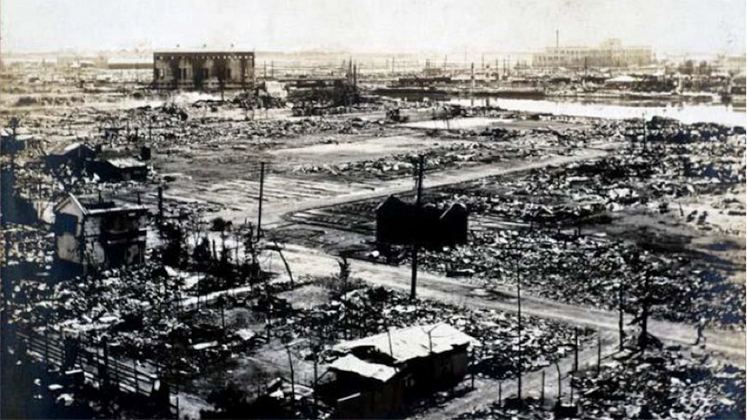

The so-called Great Kantō Earthquake of September 1923 in Japan devastated the cities of Tokyo and Yokohama and much of the surrounding area. The location of the disaster is shown on the map.

While significant damage was caused by the seismic shocks and subsequent tsunami, much of the destruction and casualties (well over 100,000 died) was inflicted by the fires that broke out following the earthquake. The physical destruction was immense, and affected not only the country’s political capital, but its largest urban conglomeration and its major export port. The Kantō plain was also in many respects the hub of an increasingly integrated national economy.

Our concern in this article has been to analyse the shifts in the availability of, and demand for, different commodities following the 1923 disaster, with a view to identifying the magnitude and duration of such shifts. We have done this through an analysis of price changes for different products over the period before and after the disaster, something that allows us to explore what economists have termed the ‘ripple effects’ of natural disasters.

Our data confirmed that the economic impact of the disaster was far from being confined to the area of destruction. Price changes were experienced across the Japanese archipelago. We did find, though, that the extent of any change tended to diminish the greater the distance from the capital area.

It was also clear that the impact on prices was somewhat stronger in the north and northeastern half of Japan, a region that had traditionally been more closely integrated with Tokyo, than was the case in the southwest, which had long been more closely integrated with the urban area around the city of Osaka. The variation and pattern of the price changes we identified conformed with what we know about patterns of market integration in Japan in the early 20th century. At the same time, the ripples were in many cases less than might have been expected, and certainly less than cotemporary reports suggested. Nor were they in most cases of a significant duration. While there were some initially significant price rises associated with a sudden demand for reconstruction goods, for example, price levels tended to fall again within a few months, suggesting a move back towards some kind of market equilibrium. The pattern of change varied according to the product; a diversity of factors affected supply and demand for different products, and understanding these factors, as well as the pattern of government and institutional intervention in some markets, requires further analysis. It is also the case that analysis of retail prices, for which data are much more difficult to obtain, might well show a somewhat different story from the wholesale price data set that we have been able to compile. Retail prices are, of course, much more difficult to control and a better reflection of what the consumer actually had to cope with.

Overall, though, our analysis confirms that at this time Japan was a relatively well integrated economy. Our findings that prices reverted relatively rapidly toward equilibrium are in line with most other economic indicators showing that there was a relatively rapid reversion to former trends. The disaster, in short, was a short-term exogenous shock from which Japan soon recovered. That does not mean that it did not matter. We still have insufficient knowledge of the factors accelerating or limiting the spread and duration of any price changes following a natural disaster of this kind, and, crucially, of any implications for the longer term consequences of such a shock for the economy as a whole. For contemporary disaster studies, understanding these factors is one of the keys to recovery and the building of resilience.

[1] D.Dacy & H.Kunreuther, Economics of Natural Disasters (New York, 1969).

This post was originally published on the EHS’s The Long Run blog, on May 28, 2019. You can find the original article here.