MSc student Erica Belcher provides an overview of the LSE Mexico Week 2017 launch event on ‘Inequality in Mexico and How to Address It’, which took place on Monday 6 March. Listen to the podcast recording.

Income inequality is no new news for Mexico. In fact, the words of Alexander von Humboldt (1811) ring as true today as they did over 200 years ago:

“Mexico is a country of inequality. Nowhere does there exist such a fearful difference in the distribution of fortune.”

The 17th annual LSE Mexico Week brought together the LSE Latin American and Caribbean Centre, the LSE Department of Government and the LSE Student Union Mexican Society, in a three-day series of conferences and roundtable discussions to address the problems facing the South American country. The theme of Monday 6th March’s opening event – Inequality in Mexico and how to address it – struck a chord with the largely Spanish-speaking audience who had come to hear Paul Segal, Gerardo Esquivel Hernandez and Salomon Chertorivski address a topic that often falls on deaf ears within the Mexican government.

The problem?

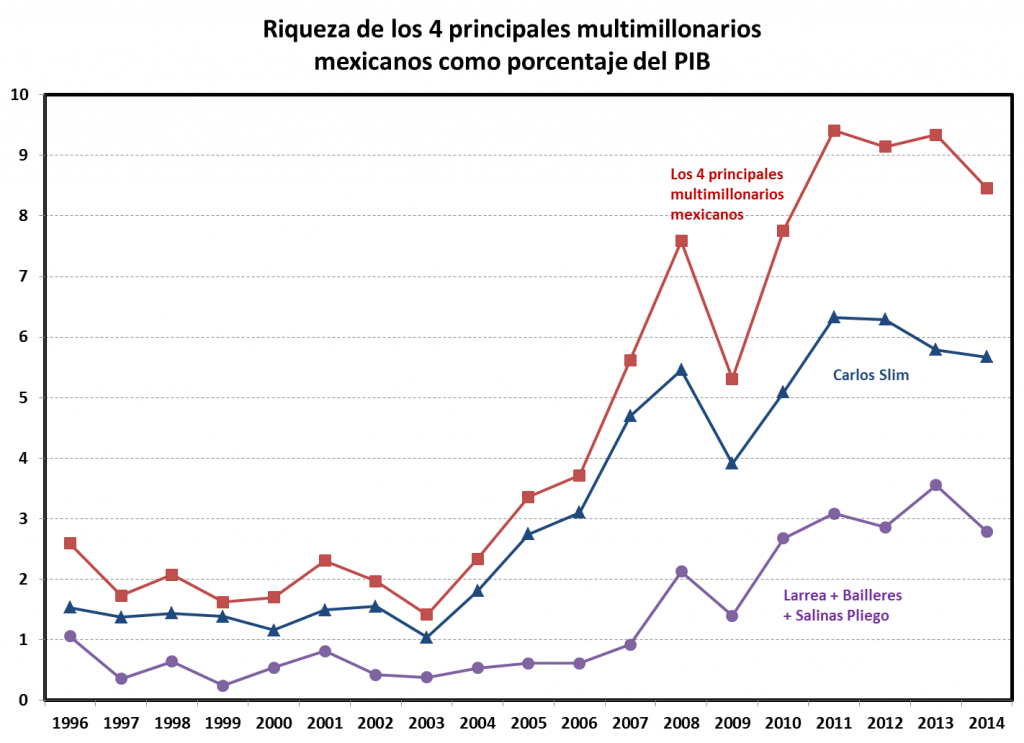

Mexico’s approach to poverty and inequality is emblematic of the radical neo-liberal reforms put in place since the mid 1980’s, to reduce state intervention in the economy and open domestic markets to foreign competition. The approach was supposed to lead to systematic and major reductions in poverty and inequality. Yet income inequality in Mexico remains staggeringly high. Whilst the four richest men have increased their share of GDP from 2% to 9% in less than ten years, 53% of the country live below the poverty line. In 2014, these four billionaires could have hired up to 3 million workers paying a minimum wage with no effect felt on their purse strings; in other words, more than enough to employ all the 2.3 unemployed people in Mexico. Only until recently Mexico had no taxes on capital gains in the stock market. For Paul Segal, not only does this show the structural flaws with the neoliberal model but also highlights that levels of inequality are more a matter of political choice than economic destiny.

Figure 1: Wealth of the Four Main Mexican Multimillionaires as a Percentage of GDP

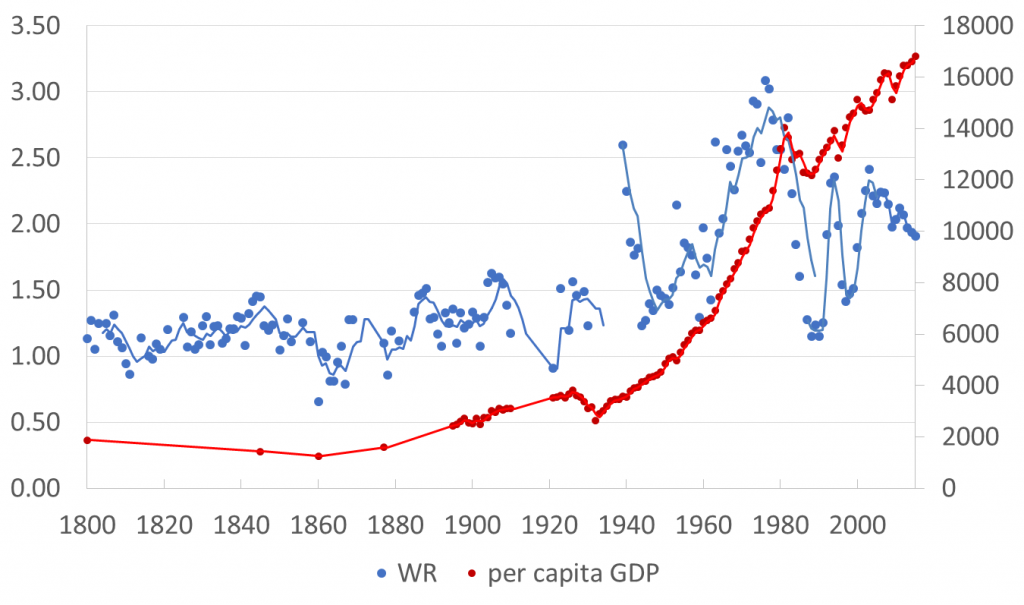

Using a measure of nearly two centuries of construction worker’s wages, Segal and his team were able to discover how inequality affects the average Mexican household. Export-led growth combined with the stagnation of real wages caused inequality to rise substantially in the late 19th century. From the 1920’s, state-led development ushered in an era of rapid industrialisation – the ‘Mexican Miracle’. With the help of powerful social actors including unions and agrarian organisations, rural productivity increased and political pressure supported a high minimum and real wage. For the first and only time, workers were able to share the benefits of capitalist growth. However, contrary to Kuznets, capitalist growth eventually led a rising inequality; real GDP per capita has grown 9 times since the 19th century, while low skilled workers near the middle of the distribution had a wage growth of only 80%. Why? According to Segal, an exceptionally high population growth in much of the 20th century afforded Mexico a ‘reserve army of labour’ which provided surplus human capital for big business (Lewis, 1954). As the graph below demonstrates, the demand for capital failed to catch up with the supply of workers in Mexico, which served to keep wages at their subsistence level and 53% below the poverty line.

Figure 2: Real Wages (WR) and per capita GDP, 1800 – 2015

Paul Segal and his team’s recently published report marks a trend away from relying on synthetic inequality indices such as the Gini coefficient. Though popular, the Gini coefficient doesn’t tell the whole story. The compression of large measures into a single indicator means there are lots of different distributions that will achieve the same Gini coefficient. Yet, inequality in different points of the income distribution represent vastly different political and welfare implications.

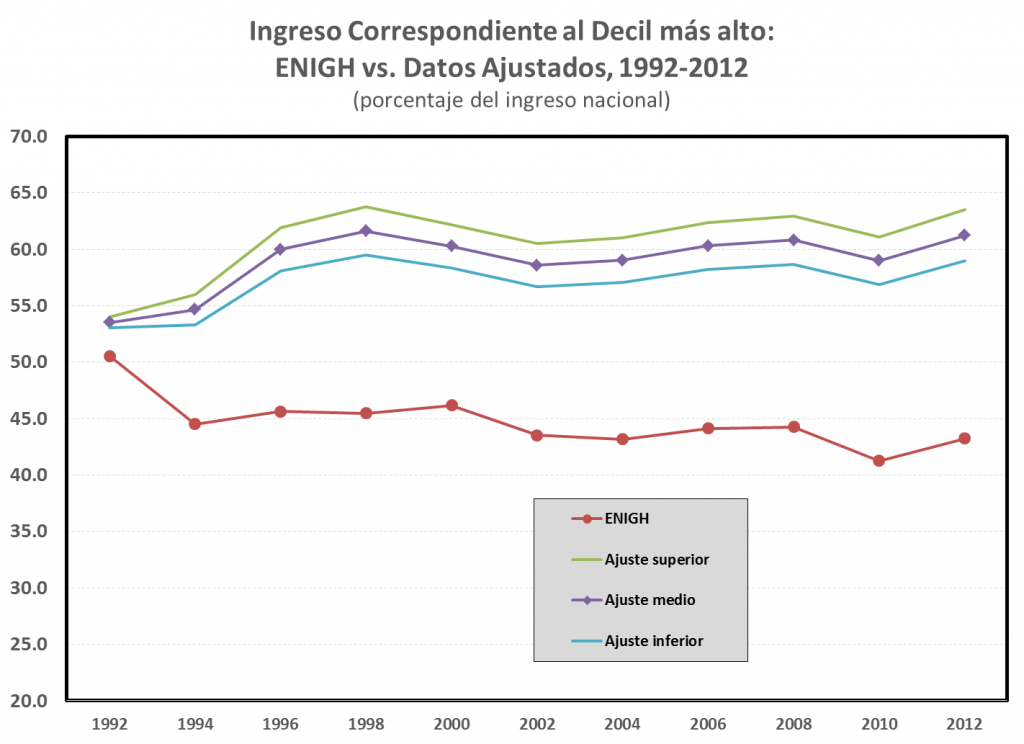

In turn, the three panellists proposed new, more accurate, measures of income inequality. Gerardo Esquivel Hernandez, Professor of Economics at El Colegio de Mexico and Author of Oxfam’s ‘Extreme Inequality in Mexico’ report, combined tax data with household data from neighbouring countries such as Chile, Colombia and Uruguay (unsurprisingly Mexico holds no official record of tax data) to generate a more accurate estimate of the share of national income of the top decile.

Figure 3: Income Corresponding to the Highest Decile: ENIGH vs. Adjusted Data, 1992-2012 (Percentage of national income)

The data reveals that the top 1% of Mexico’s high earners enjoy a whopping 21% of the national income in 2012. That’s compared with an average that fluctuates at 10% for other countries in the sample. In 2012, there were 145,000 individuals in Mexico with more than a million dollars net worth. Together, their wealth amounted to a total of $736 billion dollars. The number of millionaires in Mexico grew by 32% between 2007 and 2012, where globally this was reduced by 0.3% (WealthInsight, 2013). The lack of economic competition in the private sector and a weak regulatory environment created the ideal conditions for abuse, highlighting Mexico’s institutional misgivings and exacerbating income inequality.

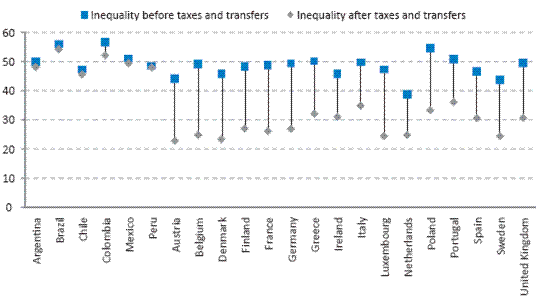

Figure 4: Role of fiscal policy

The solution?

Salomon Chertorivski, Mexico City Secretary of Economic Development, addressed the need to reform the shortcomings of Mexico’s regressive tax system (figure 4). Mexico currently receives a disproportionate 5.4% of all tax revenues from taxes on services, a figure barely comparable to the OECD average of 32.5%, and only implemented capital gains tax recently. There is still no inheritance or estate tax. If Mexico is to balance its developmental disparities, improved redistribution would be a good place to start. After a long and exhaustive debate, Secretary Chertorivski believes Mexico is ready to put together a national wage recovery policy. This includes raising the minimum wage from its current meagre 70.10 pesos to a liveable standard, lifting its recipients out of poverty and into a Mexico of inclusive growth.

Yet, with the outspoken hostility of neighbouring USA, things may get worse before they get better. Mexico needs to ensure its population, both existing and those set to return in the coming years, enjoy a fairer distribution of wealth. Through tax restructuring, increased transparency and heightened welfare provisions, Mexico’s rampant inequality could become a thing of the past.

Erica Belcher is an MSc Comparative Politics Student in the LSE Department of Government. Erica is interested in political psychology and will be writing her dissertation on class and inequality in Britain.

Erica Belcher is an MSc Comparative Politics Student in the LSE Department of Government. Erica is interested in political psychology and will be writing her dissertation on class and inequality in Britain.

Note: this article gives the views of the author, and not the position of the LSE Department of Government, nor of the London School of Economics.

Great article – very insightful.

Fantastic article – now we just need to make it happen!