With the pandemic raging and a global recession just beginning, unification of the national peso and the convertible peso may alarm Cubans. But once the adjustment filters through the economy, and with the state’s promise that no one will be left behind, it could prove to be a vital step for Cuban development, writes our visiting fellow Helen Yaffe (University of Glasgow).

With the pandemic raging and a global recession just beginning, unification of the national peso and the convertible peso may alarm Cubans. But once the adjustment filters through the economy, and with the state’s promise that no one will be left behind, it could prove to be a vital step for Cuban development, writes our visiting fellow Helen Yaffe (University of Glasgow).

The first of January 2021 was known as “Day Zero” in Cuba. After almost three decades of operating with a dual currency, Cuba’s national peso (CUP) and its convertible peso (CUC) were unified as part of a broader process of “monetary ordering” that also involves major price adjustments, the elimination of “excessive [state] subsidies and undue gratuities”, and significant changes in salaries, pensions, and social assistance benefits. The endeavour is without precedent, both because the US blockade restricts Cuba’s access to external finances and revenues, and because the process is underscored by the state’s commitment to cushion the population from the trauma of restructuring. It is also being carried out in the midst of a global economic recession triggered by COVID-19.

In January 2021, Donald Trump became the twelfth president of the United States to leave office without accomplishing regime change in Cuba, though it was not for want of trying. The Trump administration unleashed over 240 new measures to tighten the world’s longest and most punitive blockade, devised to cause misery and suffering among the Cuban people. Even in the context of the pandemic, the pressure on Cuba intensified; Washington imposed suffocating sanctions while the Miami-based opposition promoted political instability and civil strife. In a final act of spite, on 12 January 2021, the Trump administration restored Cuba to the US list of state sponsors of terrorism, a move designed to obstruct any efforts by the new Biden administration to improve relations with the island.

Incrementally since 2019, Cuba’s access to food and fuel has once again been severely impeded, export earnings slashed, and foreign investors scared off. Measures to tackle the COVID-19 pandemic have demanded additional resources, while the economy was shut down and tourism revenues plummeted as borders were closed. Even while thousands of Cuban medical specialists have treated COVID-19 patients in over 40 countries, goods shortages on the island have made long, exhausting queues part of life’s daily grind, with Cubans rising at 4am to get in line. Poor agricultural production and the pandemic have exacerbated scarcity.

Cuba’s GDP fell by 11% in 2020 – nearly one third of the total drop the island experienced during the “Special Period” between 1990 and 1993, following the collapse of the Soviet bloc. Hard currency receipts were just 55% of planned receipts in 2020, while imports fell 30% compared to 2019. Cuba needs hard currency to purchase on the international market; over half the food, fuel, medicines, and other vital resources consumed on the island are imported, hence the unfilled shelves and long queues. This scenario both complicated and lent urgency to the process of monetary ordering.

Cuba’s dual currency dates back to 1993, the worst year of the Special Period, when the US dollar was reluctantly legalised and allowed to operate alongside the CUP. Possession of the dollar had been prohibited since 1979. Announcing the legislation in a speech on 26 July 1993, President Fidel Castro had made his distaste clear, warning of emerging inequalities as those in receipt of remittances would enjoy “privileges that the rest do not have”, something “we are not used to”. However, “black market” use of US dollars had become so widespread that prohibition was unworkable. Legalisation transferred the benefits of using dollars from individuals to the state, so that everyone could benefit. It was also a necessary component of opening up the tourism industry, which operated in dollars. Furthermore, with so many Cubans having relatives in the United States, the inflow from remittances could bolster the ailing economy. However, remittances also exacerbated historically rooted racial and class inequalities, as most recipients were white and better off; their relatives had often left in earlier, politically motivated waves of emigration and were well-established in the US or Europe, with adequate resources to send money back to Cuba.

US dollar transactions were permitted in the domestic economy and for personal use. Most basic necessities continued to be purchased in CUP, but luxury goods and supplementary basic goods available outside the ration-card allotment were sold at “hard-currency collection shops”, known as “dollar shops”, at prices that included steep taxes. For Cuban consumers, the value of the dollar quickly fell against the CUP (initially, from $1 = 150 CUP in 1994 to $1 = 18 in 1996) stabilising at $1 = 24 CUP. In state enterprises, however, accounting and exchange operations functioned with an official exchange rate of $1 = 1 CUP. This was problematic because it obscured losses and surpluses from their accounts, and removed incentives to increase exports. The enterprises’ economic results appeared the same whether their produce was sold internally for CUP, or exported for hard currency, even though the monetary value to the Cuban government was significantly different.

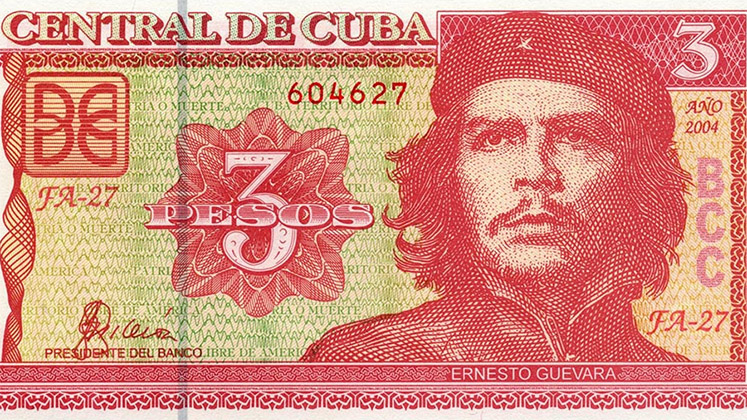

In 1994, the Cuban government introduced a new “convertible” Cuban peso (CUC) to substitute the US dollar for use in Cuba at an exchange rate of one to one. The CUC was printed and controlled by the Cuban Central Bank. Gradually, use of CUCs outstripped US dollars; then in 2004 the US dollar was removed from legal tender. “De-dollarisation” was a response to the Cuban Assets Targeting Group, set up by Bush to stop US dollar flows into and out of Cuba. The dual currency and dual exchange rates remained, however, with the CUC still pegged to the dollar, exchanged at 1 CUC to 24 CUP for Cuban consumers and 1 CUC to 1 CUP for state enterprises.

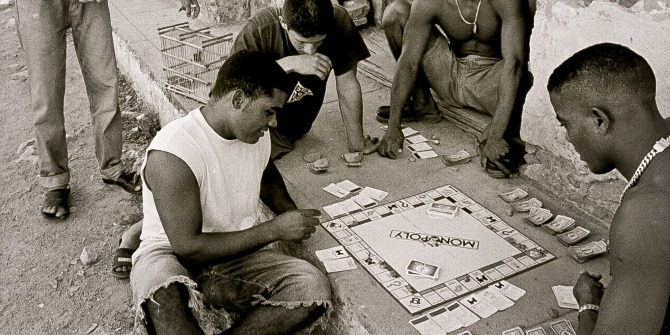

The dual currency divided the economy into two parts. Which branch any Cuban operated within depended on whether their income was exclusively from a state salary paid in CUP, or if they had access to dollars or CUC. Many Cubans had a foot in each sector. However, it also entrenched inequality and broke the link between work and remuneration. Incomes no longer reflected skill levels, nor the quantity or quality of formal work. Those with access to dollars could buy subsidised peso goods for a fraction of their market price and consume additional goods from dollar shops. Those dependent on peso incomes could not afford non-subsidised markets. State workers, including the most highly skilled, earned the lowest incomes. Many highly qualified Cubans left their professions for jobs with access to CUCs that provided them with a higher level of consumption, such as tourism, taxi driving, or joint ventures.

Eliminating the dual currency was a priority for Cubans, according to the national consultations held during Raul Castro’s mandate as president. It was a key objective in the Guidelines for Updating the Economic and Social Model approved in 2011, updated in 2016, and confirmed in the Sixth and Seventh Congresses of the Cuban Communist Party (2011 and 2016). In October 2013, the government announced that the process of reunifying the currencies was underway.

The announcement was well received. Most Cubans had come to identify income inequality with the dual monetary system, and thus assumed that monetary unification would automatically see inequalities disappear. The government’s statement, however, was clear:

Monetary and currency exchange unification is not a measure which will, in itself, resolve all of the economy’s current problems, but its implementation is indispensable to re-establishing the value of the Cuban peso and its function as money; that is to say, as a unit of account, payment, and savings.

This was necessary, the official note said, “to develop the conditions which will lead to increased efficiency, more accurate measurement of economic activity, and incentives for those sectors which produce goods and services for export, and to replace imports”. That statement was reiterated in 2020 as Day Zero approached.

Despite agreement about the urgency of unification, the process was delayed while Cuba dealt with other pressing problems, even if initial steps were taken. The one-to-one exchange rate in some Cuban enterprises was shifted to 1 CUC to 1 CUP, and later one to ten, massively devaluing the CUP, raising domestic production costs, and requiring greater state subsidies to avoid passing on the higher costs to the Cuban population. The solution ultimately lay in increasing production and raising productivity. Essentially, Day Zero is the culmination of years of preparation, the participation of hundreds of experts, and – in the final months – the training of thousands of “cadre” officials and specialists. It was also preceded by an intense public information campaign with government ministers appearing on television daily to explain the measures and address Cubans’ concerns. This continued into January 2021.

The minimum monthly wage for state employees (two thirds of total employees) has increased by 525% from 400 CUP ($17) to 2,100 CUP ($88). The new maximum, based on hours worked and excluding additional payments available, is 9,510 CUP ($396). Higher salaries will be linked to educational qualifications and other specialist criteria. The minimum age-related or disability pension was raised by 450% to $1,528. These rises cushion Cubans from inevitable prices hikes, which were anticipated at an average 160% for state-controlled prices and 300% for private businesses. It follows that the greater proportion of income a Cuban spends in the non-state sector, the more they will be impacted by the soaring prices. However, the benefits of the salary rise to individuals will be eroded if scarcity of goods leads to an inflationary spiral.

Higher salaries are structured to incentivise Cubans to improve their qualifications and skill sets. The adjustments will also push into work a large layer in society who get by without formal employment, benefiting from state provision and subsidised consumption. Already by December 2020, thousands of Cubans had applied for positions in the state sector. Yet scarcity remains high, and an inflationary spiral looms.

The “ration book” will continue to exist as a means of distributing highly subsidised food products, but subsidies for other goods in the family basket will gradually be removed as the emphasis shifts to “subsidising people”, not products, so that state support is targeted to those in need.

Nothing dramatic happened on Day Zero itself. Cubans have six months to spend or exchange their CUCs at the existing rate of one to 24 CUP. The CUP will not be the only legal tender in Cuba, however. In 2019 the government “temporarily” opened stores in freely convertible currency (MLC), including the dollar. These stores were extended in July 2020. Though widely unpopular, they are a means to provide the state with urgently needed hard currencies. These MLC stores accept bank cards only, which depends on Cubans having cash deposits in Cuban banks. The success of these stores largely depends on remittances, but these have been hit by targeted US sanctions and the global downturn.

All Cuban state enterprises now operate with an exchange rate of $1 = 24 CUP, a devaluation of 2,300% from the one-to-one rate. This is supposed to force them to increase efficiency and productivity in order to adjust. The state has committed to protecting enterprises by providing subsidies and credit for one year. However, the drive to raise productivity is bound to reduce job security and increase unemployment – difficult for a workforce accustomed to extensive protections irrespective of performance.

State enterprises have been granted greater control over management decisions: setting prices, raising salaries, distributing profits, and securing foreign exchange. State or non-state entities that export can keep 80% of revenues. Those supplying the MLC stores can keep 100%. “Monetary ordering” should benefit exporters, but importers will struggle. This should serve as an incentive to substitute imports for domestic products, fostering national production linkages, saving scarce hard currency, and increasing foreign-exchange receipts. The measures are also intended to equalise conditions for state-owned companies and non-state forms of management (self-employed workers, cooperatives, and private businesses).

For foreign investors, the monetary and exchange unification will simplify the process of negotiating, evaluating, and managing businesses in Cuba. The positive impact is blunted, however, by the fact that the US Treasury is threatening to fine foreigners that engage with Cuba. The Cuban government is struggling to combat US measures to scare off foreign investors. In December 2020, it announced that restrictions on foreign business ownership would be lifted (except in extractive industries and public services), removing the obligation for foreign investors to enter joint ventures with the Cuban state in tourism, biotechnology, and the wholesale trades. Cuba’s annual foreign investment portfolio included 503 projects for which the government seeks $12 billion as part of its national development strategy.

Speculation about monetary unification, along with goods scarcities, saw prices rise in late 2020. The government responded by raising state salaries (3 million beneficiaries), pensions (1.7 million beneficiaries), and social assistance (184,000 beneficiaries) in December 2020, earlier than planned. To counter inflation, prices on dozens of key products and services remain centrally set, but these limits have to be enforced. New, higher tariffs on electricity consumption intend to reduce state spending and promote energy saving. Some 95% of the electricity Cubans consume is produced from fossil fuels, and 48% of that is imported at high prices, which include a premium charged by suppliers to cover the risk of being sanctioned under the US blockade. Ultimately, however, the government reduced planned increases in response to complaints from the population.

Although the “monetary ordering” increases Cubans’ exposure to market mechanisms, it is not a break with Cuba’s present system. In the context of US aggression, trade dependence, economic crises, and scarcity, the government aims to adopt greater material incentives in the longrunning battle to raise production and productivity within the socialist framework. Back in November 2005, Fidel Castro talked about “the dream of everyone being able to live on their salary or on their adequate pension” without need of the ration book, which allows a “parasitic” layer in Cuban society to refuse to work while benefiting from state subsidies. From 2007, Raul Castro constantly referred to the “socialist principle” of “from each according to their ability, to each according to their work” as an aspiration in Cuba. He has repeated it in relation to the monetary ordering now underway.

Cuba delayed Day Zero, hoping to create propitious conditions for its implementation. But with the pandemic raging and a global economic recession just beginning, nothing was to be gained from further delay. The process may alarm Cubans, but as the adjustment filters through the economy, and with the state’s promise that no-one will be left behind, it could prove to be a vital step for Cuban development. But even if the new Biden administration does lift some sanctions, this year promises to be another tough one for Cuba.

Notes:

• The views expressed here are of the authors rather than the Centre or LSE

• This article was first published in New Left Review (© 2021)

• Please read our Comments Policy before commenting

Having just returned from my sixth trip to Havana, I regret not having read your terrific article beforehand. Thank you for your objectivity. Cubans are special people, and yes, I saw much hope in their hearts back in 2015. Now they’re mad at us for betraying them. The next generation has no idea what they did to deserve a life sentence in this prison. Everyone has a smartphone, and they are clued into the West. However, the hardship I saw is tempering, not crushing them. Kids no older than 7 are boxing in the park, 52 Chevys retrofitted with Toyota engines run nicely, and Cuba has some of the best culture in the world. If you do go, bring meds, hygiene products, you know, the stuff that makes life and humanity tolerable, and bring as much as you can. It will all filter to the black market and be sold in a pseudo-capitalist ether.

The finance perspective of this article is incorrect, not factual. “Cuba needs hard currency to purchase on the international market;” … This is absolutely not true. Cuba only needs cash to buy from the US. US credit is why the US Ag industry lobbies congress. Fact is, Cuba has many Canadian and European short term creditors that get paid on a fixed rate, their business is an open book and unaffected by US laws despite the rhetoric. Also, “Cuba” is not a monolith wrt cash & credit. Cuban finance is composed of Cimex, Cupet, Etecsa, Transtur, TRD, Trimagen, BFI, etc – all individual obligors that have partial control of their FX cash flows. “over half the food, fuel, medicines, and other vital resources consumed on the island are imported,” … Cuba has drastically reduced their imports, causing havoc among creditors, including a fund (paper) forced to return their cash reserves to investors as it is not needed, – imagine that! “hence the unfilled shelves and long queues.” … lack of cash in “Cuba” is absolutely not the reason for the unfilled shelves and long queues. My final comment is that due diligence is required for statements of fact … in this case, as in all other non-transparent but available info cases, just follow the money.

Henry DelForn

private investor

Well written and informative article, found as I was preparing to visit Cuba in a few days. A couple of comments: Firstly a mathematical error:

“…(wages) increased by 525% from 400 CUP ($17) to 2,100 CUP ($88)” – if the $ numbers are correct, then the ‘increase’ is 425%; i.e. it is 5.25x what it was, but the ‘increase’ is 4.25x the previous sum. This leads me to question another very surprising point, that “…pension was raised by 450 per cent to $1,528”, whereas the ‘maximum salary’ is stated as only $396! Could a pension really be nearly 4x the maximum salary? Or perhaps that sum is annual? If so, it could be clarified.

The pension amount is in pesos which share the $ symbol with the dollar.

I think the author had better talk to the poor Cubans who are still working for a miserable salary. They were promised a wage increase and would certainly welcome it but from what I see and hear they are not receiving anywhere near a 525% increase in salaries. More like 100%. If you want to talk about something that has increased 525%, well, that would be the cost of basic goods like food etc. Pork has gone from $1 a pound to $6 even more per pound. You could go to a restaurant and have a nice Cuban style meal with a beer for around the equivalent of $6 usd. Now that same meal is $25 usd. It’s just crazy what is happening there. I’ve been traveling around Cuba since 1998 but I have made a plan to spend my winter in the Dominican Republic this coming winter. Once again, the Cubans on the street will be the ones who will lose out on the tourist dollar, much like the pandemic has done to them. I am really hoping for better days ahead for these wonderful and resourceful people.

The contribution although important in terms of the embargo shaping domestic policy in Cuba does not fully cover the main question in a more complex approach: why these tough measures in such stressful and uncertain times.

The monetary ordering says more about the expectations of Biden positioning, following Obama’s open legacy, and Cuba´s interests in a closer relationship with the USA.

The article emphasises the Cuban government´s rhetoric but beyond that, it needs more analysis on cumulative results of reform implementation and especially the turndown of social assistance policies since 2008.

It is urgent to have more political visions of the economy in Cuba and worldwide, thinking in the deeper and connected relationships between power and resources appropriation.

Many thanks to bringing these discussions to British academic life environment.