by Ahmed Tabaqchali

Iraq’s new prime minister, soon after being elected, wrote in an article to Iraqis that ‘when I assumed my duties, I found nothing but an almost empty treasury and an unenviable situation after 17 years of change.’

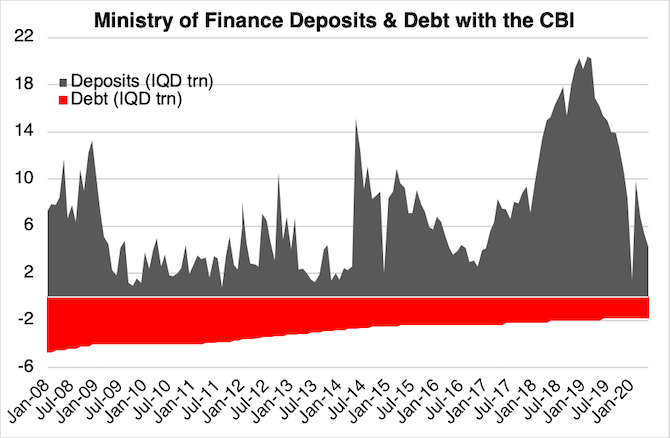

The PM was referring to the accounts he would have been introduced to upon taking office – the Ministry of Finance’s (MoF) accounts with the Central Bank of Iraq (CBI), which at the end of May had net balances of 2.4 trillion (trn) Iraqi Dinars (IQD), made up of deposits of IQD 4.2 trn and debt of IQD 1.8 trn (see Figure 1).

However, these are not the only government bank accounts, and neither are their balances the only ones, as the government isn’t fully cognisant of all of its cash balances. The existence of the other accounts were discussed in the Minister of Finance’s first TV interview as he explained that in order to meet the payment of salaries and pensions for May, trillions of dinars were identified as held in the accounts of a number of ministries and SOE’s, which were drawn upon while the government also borrowed from the TBI.

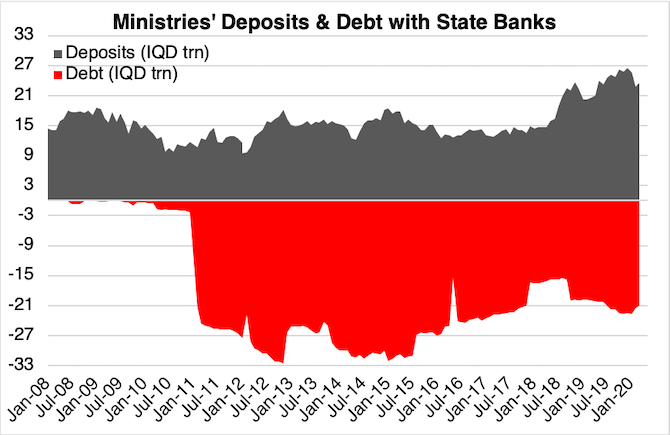

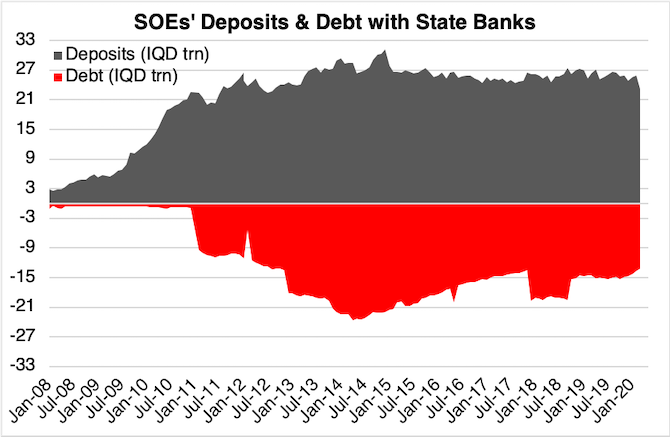

CBI data as of March show that the aggregate accounts for ministries with banks were a net of IQD 2.5 trn, made up of deposits of IQD 23.5 trn and debts of IQD 21.0 trn, while for SOEs they were a net of IQD 10.0 trn, made up of deposits of IQD 23.2 trn and debts of IQD 13.2 trn, (Figures 2 and 3 below). It’s likely that these net balances would have declined by late May, like those of the MoF’s accounts (Figures 2 and 3).

The primary reason for the incomplete picture is that Iraq lacks what is a called a Treasury Single Account (TSA): a treasury’s consolidated account, either as a single account with sub-accounts or as a series of linked accounts, through which all the government’s revenues and payments are received and made. Instead, the government accounts’ structure is that the MoF has two bank accounts at the CBI, an IQD and a USD account (Figure 1), while ministries, State-Owned Enterprises (SOEs) each of which have a single or multiple bank accounts with state owned banks, chiefly Rafidain Bank, Rasheed Bank and the Trade Bank of Iraq (TBI) (Figures 2 and 3).

Other reasons are that even though opening government accounts require the approval of the Minister of Finance or her/his authorised representatives, the MoF had no database of the number of bank accounts operational or dormant. Also, whereas the law mandates that reconciliation of all central government bank accounts be carried out regularly within set time limits, in practise these limits are regularly exceeded by ministries, and there is no reliable information about bank reconciliations for the accounts of SOEs (correct at least as of 2016–17).

The creation and operation of a Treasury Single Account (TSA) was initially mandated in the Financial Management Law (FML) 2004-Section 4(9), and its implementation was continuously discussed and agreed upon in successive engagements with both the World Bank and the IMF. Since then, however, progress never moved beyond the aspirational.

These discussions got a fresh impetus with the signing of the Stand-By Arrangement (SBA) with the IMF in 2016 following the ISIS conflict and the crash in oil revenues. The government implemented and committed to implement a number of steps towards establishing a TSA. Essentially these involved three broad steps: a full list of the government’s banks, compiled by the CBI and MoF; modernisation of the system to enable the operation of a TSA by end of 2016, by March 2017 develop plans for a phased development of a TSA; and a manual implementation of a TSA through implementing zero-cash balances, i.e. the regular sweeping of cash balances into the main account during 2017–18. These steps, as with past discussions, seem to have remained in the realms of aspiration.

Technical challenges in implementing the TSA were, and continue to be, a significant obstacle given that state banks – especially Rafidain and Rasheed Banks – are structurally weak, operate as state bureaucratic institutions, and have outdated systems. Crucially, these banks don’t have a modern core banking system, which means that their combined 300 or so branches are not connected, and each operates as a stand-alone bank. This, combined with their weak capacity, makes reconciling the government’s accounts across these branches extremely difficult. Far more daunting is the requirement for the balances in all of these accounts to be swept on a regular basis, daily or weekly, to the treasury’s main account, either manually or electronically.

As a consequence, since 2003, each ministry and SOE effectively have their own financial structure with almost full autonomy over their finances, all funded by the budget. Whether by design or a happy coincidence, this financial autonomy has enhanced the value of ministerial appointments within the Mushasasa Ta’ifia structure, and within its Wikala sub-structure for the appointments of senior civil servants. These appointments, within the Muhasasa’s super-structure, enable the control of state resources by the ethno-sectarian parties in inclusive governments, in proportion to the seats won by each in parliamentary elections.

Given this perspective, not only would the implementation of a full automated TSA, or even a manual facsimile, mean the loss of financial autonomy for each ministry and SOE – it would lead to the creation of a super-powerful MoF to control these finances, and potentially strengthen the role of the prime minister. All of which might be the real reasons behind the failure to implement a TSA.

The upshot is that the lack of a TSA effectively hampers the financial performance of the state, in-particular its cash management operations – and makes it impossible to monitor its budget execution. This is especially problematic during crises when oil revenues fall significantly below the level required for the state’s ability to meet its domestic obligations, especially the payment of salaries and pensions, forcing it into unnecessary borrowing or curtailing essential investment spending such as the provision of electricity.

While the data on these accounts are in aggregate form, without specific details, the overall patterns are revealing – especially the different behaviours of the accounts of ministries and SOEs, probably reflecting the varying autonomies enjoyed by each. During the crisis of 2014–17, the deposits of ministries declined substantially, while debt increased as the government squeezed the system to meet its obligations. In contrast, for SOEs their deposits dropped marginally and debts decreased (reflecting the drop in trade finance volumes). The government squeeze ended once the crisis was over, and the system reverted to normal as ministries’ deposits – and debts – increased significantly from mid-2018.

The need to squeeze the system is now much more pressing than it was in 2014–17, as the persistence of the COVID-19 pandemic and the emerging slow and unsynchronised rebound from the global lockdown suggests the onset of rolling crises, which will mean continued pressures on government finances. While accessing these funds would not negate the need for real financial reforms, it would provide the government enough breathing space to execute some reforms, delay the need to borrow and offset any need to cut investment spending – at minimum it would delay the onset of the worst of the inevitable painful economic adjustments should the government fail to make meaningful reforms.

Acknowledgements & Sources

The information in this report is based on publicly available information in web sites, publications, presentations, and research reports as will be seen from the hyperlinks. Specifically, data on the accounts of the MoF, government ministries and State Owned Enterprises (SOE) are taken from the Central Bank of Iraq (CBI) at here and here. Debts for Ministries & SOE’s include cash credits (regular debt) and pledged credit (debt to enable trade finance). The updated status on the Treasury Single Account (TSA) and on the accounts of government ministries and SOE’s are from the World Bank’s 2017 assessment of Iraq’s Public Financial Management. Information on the steps taken for the development of a TSA are from the IMF country reports 16/225, 16/379, 17/251, 19/248. All errors, omissions and mistakes are the author’s own.

Disclaimer: Ahmed Tabaqchali’s comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

Arizona