Many decentralised applications (dapps) are in their beginning phases in terms of technology and regulation, which for some means the future of blockchain has an uncertain look. Some investors question whether or not these dapps will be useful, and struggle as the business models have yet to be proven. Few companies have undergone a large-scale transformation to blockchain, and non-blockchain firms are nervous to invest a large amount of resources to blockchain. This attitude, however, is changing quickly.

The State of Blockchain 2017 report by Coindesk shows that more traditional companies are opening up to blockchain, realising its potential to solve business challenges. Furthermore, many firms noted blockchain technology could bring new opportunities to their company, democratising trust and promoting great inclusion of the masses. Also pointed out in the study is the massive growth of the total value of crypto-assets, many of which are ‘tokens’ for blockchain applications. In fact, the total market capitalisation of cryptocurrencies is now above $140 billion, up from $16 billion (775 per cent) at the beginning of 2017.

Ethereum, the blockchain platform for building decentralised applications, has seen even stronger growth this year. Ether (ETH), the native token of Ethereum that is used to power transactions on their blockchain, now has a market cap of $28 Billion, an increase of over 3500 per cent since January 1. What this signals is that the development of decentralised applications on the Ethereum blockchain is exploding, and we should expect even stronger growth as these applications begin to mature. However, before we make any more predictions, it’s important to note recent events that have created volatility in the space.

2017 thus far: Ethereum’s incredible growth with volatility

Unlike most other cryptocurrencies, Ethereum is backed by a wide range of startups and Fortune 500 companies like Intel, Microsoft, Santander and JP Morgan. With the introduction of the Ethereum Enterprise Alliance (EEA), a collection of these companies back in March, the Ether price rose. Ether was at this time approaching $50 and saw a continual increase. In May, during a series of initial coin offerings (ICOs) such as Cofound.it and BAT, the price of Ether went past $150 and closed around $400 mid-June. The price increase showed both Ethereum’s versatility and the global business community’s acceptance of Ethereum as one of the blockchain protocols that could potentially transform entire industries in the future.

But then the fall happened, and when investors panicked and released part of their Ether holdings, a series of orders filed at lower prices were filled, thereby reinforcing the order cycle until the order prices were modified by individuals. The fall in price could also be attributed to a surge in the supply of Ether in the market. Organisations that raised a significant amount of Ether from their respective ICOs liquidated some of their Ether to fund development and hire talent.

The Ethereum potential

A stable and growing Ether price is important to ensure that Ethereum remains attractive for developers to build projects on top of the Ethereum protocol. Ethereum is especially attractive to decentralised application developers, who see the growing Ether price as an opportunity to raise capital and develop new business ideas.

There has already been a surge in brokerages and exchanges that trade in Ether with even some traditional brokerages introducing Ether as a tradable asset to their clients. And while the volatility of Ethereum remains a reality for the foreseeable future, Ethereum has some real advantages over other crypto-assets. For one, it can act as more than just a medium of exchange. Its restrictions are based only on a person’s imagination, meaning developers can design their own cryptocurrencies to represent digital shares or assets of anything that they wish.

In fact, Ethereum has been a launchpad for a number of new tokens making up the “initial coin offering” trend. According to CoinMarketCap.com, there is approximately $6.2 billion in market value represented by over 140 crypto-assets from projects that have been launched solely on the Ethereum platform.

These initial coin offerings, which combine both crowdsourcing and investing, essentially allow investors to purchase tokens backed by cryptocurrencies. While this method of funding faces many of the same challenges as traditional crowdfunding, this surge in ICOs is driving Ethereum’s popularity and bringing it further into the mainstream.

Thoughts on the future

Public adoption of blockchain technology will allow our society to adopt even more uses for solutions like Ethereum within a wide range of industries. It’s predicted that the potential for Ethereum, and the decentralized applications built upon it, are virtually endless.

In just a few short years, Ethereum has developed a sophisticated ecosystem, and soon we will have a clearer picture of how its private currencies can coexist with government-backed currencies. There’s little doubt that Ethereum will continue to mature and all sorts of crypto-assets may be embedded in the roots of our society much sooner than we think.

♣♣♣

Notes:

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

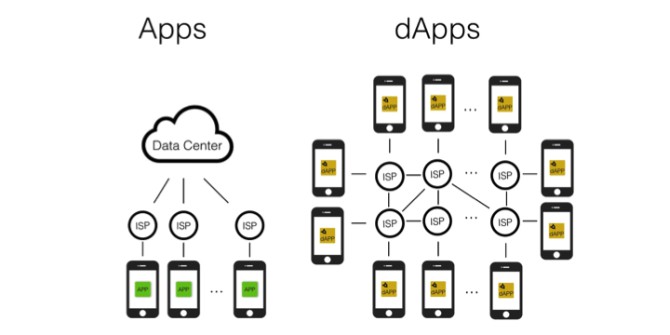

- Featured image credit: Apps vs dApps, by Classivertsen under a GFDL or CC BY-SA 3.0 licence, via Wikimedia Commons

- When you leave a comment, you’re agreeing to our Comment Policy.

TN Lee is the Head of Business Development for KyberNetwork, a decentralized exchange that allows for the instant trading and conversion of any cryptocurrency. TN has worked in the data science sector and has been involved in projects that span across FinTech, financial sector and government agencies, including the blockchain space since 2015. He has been involved with Ethereum since it first launched in 2015 and has helped and collaborated with various Singapore blockchain startups.

TN Lee is the Head of Business Development for KyberNetwork, a decentralized exchange that allows for the instant trading and conversion of any cryptocurrency. TN has worked in the data science sector and has been involved in projects that span across FinTech, financial sector and government agencies, including the blockchain space since 2015. He has been involved with Ethereum since it first launched in 2015 and has helped and collaborated with various Singapore blockchain startups.

I hear people saying that decentralized apps cannot be blocked or censored. Can your app be blocked?