One of the key issues in relation to the new German government is whether it will alter its course on European issues, in particular by relaxing the promotion of austerity policies and embracing some form of debt-mutualisation in the Eurozone. Gunnar Beck outlines eight reasons why Angela Merkel will relax her stance on austerity and debt mutualisation. He argues that regardless of whether German citizens support these policies or not, the German Chancellor will do whatever it takes to save the euro.

One of the key issues in relation to the new German government is whether it will alter its course on European issues, in particular by relaxing the promotion of austerity policies and embracing some form of debt-mutualisation in the Eurozone. Gunnar Beck outlines eight reasons why Angela Merkel will relax her stance on austerity and debt mutualisation. He argues that regardless of whether German citizens support these policies or not, the German Chancellor will do whatever it takes to save the euro.

As I predicted in the Handelsblatt, Germany’s leading financial daily, Merkel emerged as the clear victor in Germany’s recent elections. It now seems there will be another Grand Coalition with the Social Democrats. Merkel’s popularity is due in no small measure to her management of the Eurozone crisis, where so far she has been able to present herself as a tough negotiator insisting on strict assurances of tighter budgetary discipline in return for any German money. The truth is that the money is as good as gone, but Merkel has profited from the extraordinary political ineptitude of her opponents who, whenever Merkel reluctantly agreed to yet further concessions to aid the euro, decried her hesitation to say she should have given in long before.

Before the election, the SPD were calling for a German-led ‘Marshall Plan’ for the euro. The SPD performed poorly in the elections, but their party’s policy on the euro is likely to prevail. Merkel will soften her stance, and offer more solidarity in return for less and less solidity – though not because of the Social Democracts or because post-war Germans, and especially Germany’s political elite, can no longer pronounce the word ‘national interest.’ The reasons for this are many, but in one way or another all relate to Germany’s historical guilt complex, the triumph of short-term calculus over long-term evaluation, and the rise of oligarchic democracy in the West.

Eight reasons why Merkel will relent on her Eurozone policy

First, Chancellor Merkel, like any mainstream German politician, is a convinced pro-integrationist. ‘If the euro fails’, she has said again and again, ‘Europe fails.’ Those words, to the sober-minded, are devoid of logic. Yet, they signify a deep-seated and abiding commitment to EU integration and the single currency, not readily understood outside Germany.

Germany’s political establishment has been committed to ‘ever closer EU integration’ ever since West Germany became a state in 1949. The euro is part of that integration process. Any German Chancellor who would pull the plug on the euro would be subject to unprecedented foreign political and media criticism. They would go down in history as a dangerous nationalist who placed narrow self-interest over wider responsibilities, turned their back on six decades of ostensibly consensus-based integration politics, plunged Europe into a long recession, and would get no credit for burying the single currency, which never suited Europe.

Merkel could probably rely on majority popular support, but, like any other German politician, she could not withstand market turmoil, the lobbying pressure by the financial services and multi-national industrial sectors, or the unprecedented foreign and domestic political and media criticism of a kind not experienced by any German Chancellor. By contrast, even if things go badly wrong, a pro-euro German leader who dutifully continues throwing more good money after bad, would still get credit for having done ‘the right thing’, for accepting Germany’s everlasting historical responsibility, and failing not for the wrong but the right reasons, the spirit of political correctness in the guise of international solidarity.

Second, part of Germany’s ‘European’ identity since WWII is the Franco-German alliance. That alliance is in many respects an unnatural one, a mésalliance par excellence – temperamentally, economically, politically. The French ruling class, according to the political sociologist Larry Siedentop, favours EU integration as a means of furthering French interests and to contain and weaken Germany. Hans-Olaf Henkel, erstwhile president of the federation of German industry, suggested it was time for an amicable Franco-German divorce. He earned a chorus of cross-party indignation.

Third, the Eurozone crisis no longer affords any cost free options. If Germany had refused to bail out euro members at the start in accordance with the no-bail out principle of the EU Treaties, the country would have suffered a contraction of some export markets and the Bundesbank would have had to write off some of her claims on other central banks, but there would have been no question of transfer payments, and eventually a banking union with full joint liability including German bailout of Spanish and Italian banks, and then eurobonds.

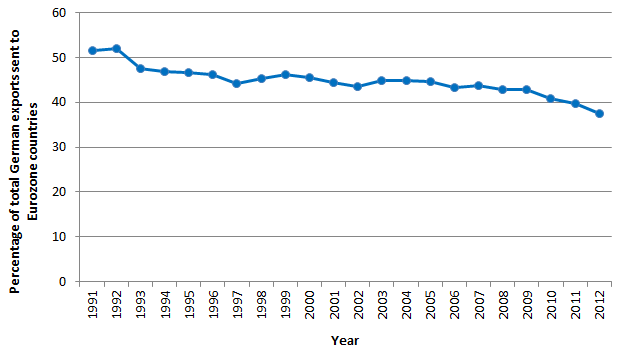

Germany, in theory, still remains free to leave the euro. In this scenario, the country would stand to lose around €600-800 billion in terms of Bundesbank claims against other Eurozone central banks, against which Germany could offset all losses from guarantees and loans. German exports to the Eurozone would also suffer, but as the Chart below shows, the Eurozone’s share of German exports has fallen from 51.6 per cent in 1991, to 45.5 per cent in 2000, and to 37.4 per cent in 2012. Contrary to official propaganda, the Eurozone is a declining market for Germany. The cost of a euro collapse would be significant but manageable, and they would be short-term rather than long-term. The problem is they would be immediate.

Chart: German exports to Eurozone countries as a percentage of total German exports (1991-2012)

Source: Statistisches Bundesamt

By contrast, if through rescue funds, haircuts, ECB bond buying, a banking union and, eventually, joint bonds, Germany finally agrees to full burden-sharing, the losses to the German taxpayer can be spread out, obfuscated and in part paid for by inflation, which shifts the costs to Europe’s savers. The cost of a bail out will amount to dozens of billions of euros a year, and the German public will over time see their savings devalued, but because it can be spread out and does not hit home immediately, it seems the softer option compared to a sudden write off and euro collapse. For Western governments, costs which are lower overall, but immediate, are almost always a less attractive proposition than much greater, but also more distant and less transparent long-term costs. Long gone is the time when long-term thinking was still possible in Western Europe.

Fourth, Merkel, who is a clever politician and not beyond a political volte face, knows that after pledging between €500 billion to €1 trillion in German guarantees and unrecoverable Bundesbank loans, a sudden policy reversal would be one U-turn too many. She would have to explain a one trillion euro mistake. Few people and politicians have the strength to admit and correct an error. And German politicians are amongst the worst at realising when the time has come to cut one’s losses.

Mrs Merkel was able to change her mind on nuclear energy because, although broadly supportive, she and her party never embraced France’s unqualified commitment to nuclear power. She cannot do the same with the euro as she committed herself early on, linked the euro rescue to the integrationist cause long ago, and has been whipping aid packages through parliament for the last two years. If Merkel pulled out now, it would be the only rational course of action, but it would also be an admission of a colossal error. For this reason alone it will not happen.

Fifth, for once the reputation of Germany’s political system is better than the reality, for democracy and the rule of law in Germany does not quite live up to its model image. Only half of Germany’s MPs have a constituency, the other half enters the Bundestag through a party list. If an MP votes against the government, they are unlikely to be offered a list place at the next election, and if they do so more often, they may face de-selection. For those who seek advancement, it is in the hands of the party leadership and available only in return for loyalty and obedience. Little wonder, then, that for the last three decades there has been no noteworthy parliamentary rebellion against a German government.

The German Constitutional Court, likewise, is only nominally independent. Its members are appointed on the recommendation of the established political parties. That may explain why the Court has consistently dismissed constitutional challenges to the government’s euro rescue policy, most recently when it held that even unlimited liability for the debts of other Eurozone countries was perfectly compatible with the German parliament’s budgetary ‘autonomy.’

Sixth, Germany, like most other Western states except perhaps Ireland, Austria, Switzerland and Iceland, suffers from an oppressive climate of political correctness. In Germany, ever closer EU integration is part of the agenda of political correctness – that package of bien pensant beliefs which is not be confused with majority opinion, but propagated by governments, the media, and right-thinking interest groups.

These facts of Germany’s political culture have nothing to do with economics, and they certainly do not suggest why Germany or indeed anyone else profits from the euro. They are bad, not good reasons to save the euro. For they sustain a political climate within the German political establishment in which it is taken for granted that, seventy years after the war, Germany still has a special responsibility. In such circumstances, it is as good as unthinkable for a Chancellor who is a committed EU integrationist, and has already committed hundreds of billions to the euro rescue, to go into reverse gear and cut her losses now. And any such bad reason is also a sufficient motivation for relaxing budgetary discipline in the Eurozone once Merkel no longer has the excuse that there is an election she has to win.

Seventh, political leaders in Western Europe now spend much more time with each other than with anyone else, except perhaps influential lobbyists. It creates an incestuous climate where politicians will do almost anything to reach agreement and politicians often seem more accountable to each other and lobbyists than to their electorates. It does not promote good government and undermines democratic accountability. In Brussels, German politicians, who so desperately want to be liked abroad, more readily sacrifice national interest to the ‘common good’ of the euro than anyone else. Their pathological fear of being seen as nationalistic will ensure that German leaders will reluctantly sanction quantitative easing, further Greek haircuts and, eventually, a relaxation of the conditions for ECB bond buying.

And if the integrationist incantations of the continual Brussels conclave will not force Merkel into full fiscal union, the unholy alliance between the world’s leading central banks, debt-ridden governments, and powerful financial institutions will. There is a consensus amongst this oligarchic triumvirate that no serious attempt be made to tame international casino capitalism. Government and banking sector debts must be ‘socialised’ and paid for not by write-offs, bonus cuts or losses by private investors, but by taxpayers and small savers.

Finally, Merkel, who has been a superb domestic political operator and judge of character, is a far less assured judge of character abroad. In June 2012 she was outwitted by Monti and Hollande, who forced her to open up the euro rescue fund to support ailing banks. A little later, she submitted to the weasel words of ECB President Draghi, who persuaded her to support his bond buying programme in defiance of the EU Treaties, as it would neither increase the money supply nor inflation, while budgetary discipline could still be enforced even once the ECB has become southern Europe’s largest creditor.

When Germany’s leading financial daily, the Handelsblatt, started serious investigations into Draghi’s covert involvement in the Goldman Sachs managed Titlos currency swaps which allowed Greece to hide billions of euros worth of debt at the time of her euro entry, and Draghi’s 1990s below-value sell-off of state Italian state assets, the editor soon received a decidedly unfriendly phone call to say this must stop at once.

With his Goldman Sachs affiliation, his background in Rome’s intrigue-ridden corridors of power, his sardonic smile, ‘cheap money’ policies and cynical contempt for the rule of law, Draghi is the very antithesis of the solidity and conservative integrity postwar Germans came to expect from a central banker. The fact that the German government is secretly in bed with ‘Draghiavelli’ – whom Bundesbank President Weidmann likened to the Devil in only thinly disguised language – symbolises, perhaps more than anything, that there remain at least two constants of German policy: bad judgement of character and political naivety.

Seventy years after WWII Germany, it appears, has not yet regained her sovereignty: i.e. the freedom to pursue her own national interests in accordance with majority opinion and subject to international law. Nor has the country become properly democratic, in as much as the government does not trust the German people to decide the very basic questions governing their economic and political future. This is well understood by perceptive observers like former British Prime Minister Tony Blair, who reportedly advises his banking clients that ‘the German government assure him they will do whatever it takes to save the euro’, even if the German people may wish otherwise. If it means relaxing budgetary discipline, a euro banking union and joint debt liability, Merkel will relent – not immediately, but over time. She will do it for all the ‘right’ reasons, but to everyone’s detriment except Goldman Sachs’ and their most faithful trustee at the helm of the ECB.

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of EUROPP – European Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/1a56VN6

_________________________________

Gunnar Beck – University of London

Gunnar Beck – University of London

Gunnar Beck is Reader in EU Law at the University of London, a practising barrister, and former adviser to the European Scrutiny Committee of the House of Commons.