If central banks publish the transcripts of their internal policy debates, will discussions be enhanced or inhibited? Stephen Hansen, Michael McMahon and Andrea Prat use tools from computational linguistics to analyze the positive and negative effects of transparency on deliberations of the monetary policymakers at the US Federal Reserve.

If central banks publish the transcripts of their internal policy debates, will discussions be enhanced or inhibited? Stephen Hansen, Michael McMahon and Andrea Prat use tools from computational linguistics to analyze the positive and negative effects of transparency on deliberations of the monetary policymakers at the US Federal Reserve.

The world’s major central banks display significant differences in transparency. The European Central Bank (ECB) currently publishes no direct information on its internal policy debates, and will only release minutes with a 30 year lag. The Bank of England releases minutes soon after meetings, but withholds transcripts. The US Federal Reserve (‘the Fed’) releases both minutes and transcripts of the Federal Open Market Committee (FOMC) meetings after a five-year lag.

Some of these policies have recently been revised. In December 2014, the ECB confirmed its commitment to publish regular accounts of the Governing Council’s monetary policy meetings from January 2015. Earlier that month, the Bank of England published an independent report on its transparency practices and procedures by former Fed governor Kevin Warsh, and announced that it would publish minutes simultaneously with policy decisions from August 2015 and meeting transcripts with an eight year lag. So what is the right level of transparency? Some transparency is clearly required for democratic accountability, but what are the costs and benefits of increasing the public’s information about the policymaking process?

Theory suggests that the primary channel through which transparency matters for policymakers’ behavior is ‘career concerns’ – the idea that experts wish to protect their reputation for competence. The main positive effect of transparency due to career concerns is that increased visibility provides additional incentives for committee members to work hard to identify appropriate policies.

The main negative effect (predicted by Prat, 2005) is that policymakers become conformist and begin parroting the views of their colleagues to avoid standing out which leads to a stifled and uninformative debate. When speculating on the effect of releasing Fed transcripts in 1993, Alan Greenspan, then FOMC Chairman, expressed exactly this concern to a Congressional hearing before the Committee on Banking, Finance and Urban Affairs, stating: ‘I fear in such a situation the public record would be a sterile set of bland pronouncements scarcely capturing the necessary debates which are required of monetary policymaking’.

In our research, we use the Fed’s FOMC transcript data to test for the presence of these two effects – the ‘discipline effect’ and the ‘conformity effect’ – and examine which one dominates. The first challenge, familiar to applied economists, is to disentangle causal relationships. The second, much less typical, is to quantify text data and use it to study patterns of communication.

Identifying the effect of transparency on deliberation

Since the mid1970s, FOMC meetings have been tape-recorded to assist preparation of minutes, but until late 1993, committee members believed that these tapes were recorded over and their content destroyed. Then, in response to political pressure from the Senate Banking Committee, Fed staff informed the FOMC that verbatim transcripts prepared from the tapes indeed existed. Having previously denied their existence, Chairman Greenspan and the FOMC felt compelled to agree to release all past transcripts, in addition to all future transcripts, with a five-year lag.

This creates a ‘natural experiment’ for us to analyze: prior to late 1993, FOMC members deliberated under the assumption that their debate was private, whereas afterwards they knew every spoken word would eventually be publicly observable. Importantly, this change arose not from the Fed itself in response to committee design concerns, but from external events.

Rather than examine changes before and after increased transparency, we adopt a ‘difference in differences’ approach to identify the precise effect of career concerns. In other words, we test whether any changes in deliberation in response to increased transparency are greater for committee members with more career concerns.

Theory predicts that the impact of career concerns declines with experience: as observers gather more information about policymakers, the less their behavior affects their reputation. So as a proxy for the strength of members’ career concerns, we use the number of years they have worked at the Fed. Within this framework, we attribute changes in deliberation after transparency that are relatively greater for members with less experience as being driven by career concerns.

Measuring communication

The challenge remains of how to measure deliberation and how it might have changed. For this, we draw on tools from computational linguistics and machine learning. These underlie much of the search engine and pattern recognition software used by billions of people every day. We also believe they have a bright future in the social sciences for extracting relevant metrics from large textual databases. Given the newness of these methods, it is worth taking a moment to describe how we extracted the data.

The simplest measures we use are counts of various aspects of members’ deliberation, such as how many times they speak in a given meeting or how many questions they ask. But most of the analysis draws on the Latent Dirichlet Allocation (LDA) model.

LDA is a statistical method for discovering ‘topics’ within members’ statements, where a topic is a probability distribution over words. The content of each statement is then a probability distribution over topics. Less experienced monetary policymakers refer more to data and staff briefings when their remarks will be made public.

LDA is an unsupervised machine learning algorithm, which means it uses no preassigned labels to identify topics. Researchers like us can provide documents (in our case, every statement in every meeting of Greenspan’s Chairmanship) along with a given number of topics to extract (we use a baseline of 50), and LDA returns estimates of the topics and the allocation of topics within each statement.

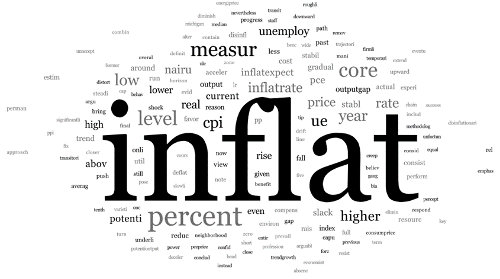

LDA is essentially a very flexible clustering algorithm, with the important feature that the same word can appear in multiple topics with different probabilities. Prior to estimation, we process the text by dropping extremely common and infrequent words, and ‘stemming’ words to bring them into a common linguistic root. ‘Preference’ and ‘prefer’, for example, both become ‘prefer’ after stemming. The estimated topics correspond closely to ones that economists would naturally imagine arise at monetary policy meetings. Figures 1 and 2 show two examples, using word clouds in which the size of a word indicates the relative likelihood of its appearing in the topic.

We label the topic represented in Figure 1 the ‘inflation topic’ since its most likely words are clearly about inflation. ‘Inflat’, the stem of various words related to inflation, is the most likely word, but words like ‘CPI’ and ‘core’ also occur with high probability. The topic in Figure 2 is one that captures words related to ‘Consumption and Investment’ demand, such as investment, inventories, income and consumption.

Figure 1: The ‘Inflation’ topic word cloud

Figure 2: The ‘Consumption and Investment’ topic word cloud

LDA yields member-meeting specific shares of time spent on each topic. From these, we can measure the amount members refer to staff briefing material and quantitative data, their topic breadth and the similarity of members’ topic coverage.

Our findings

So what does our analysis reveal? We find evidence of both the discipline and conformity effects. After transparency, more inexperienced FOMC members discuss a broader range of topics and use significantly more references to quantitative data and staff briefing material during the discussion on the economy. This indicates that they prepare more for meetings and gather additional information.

On the other hand, in the policy debate that follows the economics discussion, inexperienced members make fewer statements, ask fewer questions and speak more like Chairman Greenspan, all of which points towards conformity.

To gauge the overall effect of transparency on the informativeness of inexperienced members’ statements, we construct an ‘influence score’, which measures the extent to which a member’s speaking more about a given topic leads colleagues to speak more about it in the future. After transparency, inexperienced members become significantly more influential, suggesting they bring relatively more information to the discussion.

Overall, transparency appears to have been beneficial at the Fed by increasing information in spite of creating a more sterile debate. The challenge for central banks considering increasing transparency is to structure the deliberation process to maximize the discipline effect while minimizing the conformity effect. Quoting our conclusion, the recent Bank of England report on transparency said ‘it is this important idea that motivates some of the Review’s ultimate recommendations’.

This article originally appeared in the Winter 2014/2015 issue of CentrePiece, the magazine of the Centre for Economic Performance (CEP) at LSE and summarizes ‘Transparency and Deliberation within the FOMC: a Computational Linguistics Approach’ by Stephen Hansen, Michael McMahon and Andrea Prat, CEP Discussion Paper No. 1276.

Featured image credit – Tudor Burja (Creative Commons BY NC SA)

Please read our comments policy before commenting.

Note: This article gives the views of the author, and not the position of USApp– American Politics and Policy, nor of the London School of Economics.

Shortened URL for this post: http://bit.ly/16recKo

_________________________________

Stephen Hansen – Universitat Pompeu Fabra

Stephen Hansen – Universitat Pompeu Fabra

Stephen Hansen is at Universitat Pompeu Fabra.

Michael McMahon – University of Warwick

Michael McMahon – University of Warwick

Michael McMahon, an associate professor at the University of Warwick, is a research associate in CEP’s macroeconomics program.

_

Andrea Prat – Columbia University

Andrea Prat – Columbia University

Andrea Prat is the Richard Paul Richman Professor of Business and Professor of Economics at Columbia University. His research interests include, contracts and organization, industrial organization, microeconomics, political economy.