LSE’s Laura Mann and Kate Meagher discuss a recent workshop held at the Rockefeller Foundation Bellagio Centre from 26 to 30 September 2016, which addressed the challenges of digital inclusion for workers at the bottom of the pyramid.

Calls within the development community for more inclusive models of growth emphasise the need to incorporate informal workers and consumers into the benefits of global markets. Mounting unemployment and popular protest also create political pressures for more inclusive growth. The recent rise of over 90 tech hubs across Africa has stimulated rapid innovation among young African entrepreneurs to develop new kinds of business models, digital applications and organisational platforms to reconfigure markets and service provision for more effective engagement with Africa’s vast informal economy. Larger corporate actors offer partnerships, finance and infrastructure to scale solutions rapidly. Africa’s ICT innovators are gaining a measure of inclusion, but what does this form of inclusion mean for informal workers getting by at the bottom of the pyramid? Does digital inclusion improve the security and decency of their livelihoods? Does it offer the potential for social upgrading and economic restructuring? Or are these infrastructures merely squeezing the slim margins of already squeezed groups?

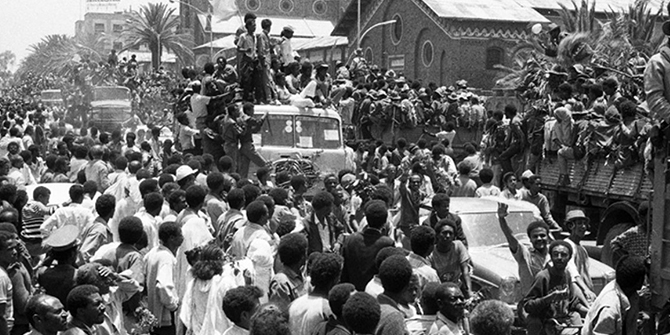

Photo Credit: Laura Mann

In September 2016, we hosted a workshop at Rockefeller Foundation Bellagio Center to address the challenges of digital inclusion for informal economy workers. We focused on four sectors: agriculture, informal urban transport, mobile money and Business Process Outsourcing (BPO). We invited a group of businesspeople, civil society representatives, worker representatives, policy-makers and academics working across the African continent, as well as from Europe and US, to discuss these ideas. In the next few weeks, we will be writing up a White Paper and a number of policy briefs to share key insights. In the meantime, here are some of the emerging themes that came out of the workshop:

1) Digital technologies do not resolve unresolved issues. In fact, they may bring those unresolved issues and contestations up to the surface and out into the open.

Many digital applications seek to reduce market inefficiencies and cut out illegal/illicit activities. Examples of such inefficiencies include agricultural traders selling counterfeit inputs or bus drivers or policeman trying to pocket fares. Geoffrey Wandera from KBS showed us an impressive diagram of all the ‘extra’ costs of public transit in Nairobi and they were certainly astronomical! However, in our discussions, it became clear that digital technologies do not bypass these groups so easily. Traders and bus drivers, policemen and intermediaries all have their own kind of power and their own influence over digital technologies. Rather than designing around these groups and their interests, developers may in fact need to socially (and politically) design applications to accommodate their interests. Nerisa Bernhardt from FairPay talked about how her company has slowly evolved its smartcard payment system to try and meet the divergent and often conflicting needs of owners, drivers, collectors, commuters and government officials. If any one of these groups does not like the technology, then it is unlikely to succeed, and so they have moved slowly but steadily forward through negotiations and adaptations.

2) ICTs may contribute to a redistribution of resources away from informal actors towards formal ICT providers.

On a related point, much anthropological and sociological research has demonstrated the redistributive element of corruption. While corruption limits the potential of capitalists to accumulate savings and to access formal finance, some of these ‘inefficiencies’ (or ‘leakages’ as they are often called) are poor peoples’ incomes. In some ways, digital payment systems serve to redistribute wealth away from informal livelihoods (which have been deemed illicit) towards formal business models. While this process is indeed part of economic growth and development, it is not necessarily inclusive and pro-poor. If we are serious about inclusion through digital technologies, we need to ask critical questions about what these technologies will do to these livelihoods and the already squeezed incomes of the poor. We also need to ask critical questions about how the costs of deploying technology are passed onto producers, consumers or commuters. Are these technologies really reducing costs or are they transforming non-digital costs into new digital costs?

3) ICTs may increase informality in some contexts and formalise work in others.

In the Business Process Outsourcing sector, commentators have described widening access to ICTs and internet as opening the door to work opportunities for African workers. Claims of ‘digital job creation’ are particularly strong in accounts of micro-work sites such as Elance and Guru. Similarly, mobile phone companies claim that their distribution networks create large numbers of jobs for workers in the informal economy. However, Debbie Freeman from Union of Informal Workers Association (UNIWA) stressed that we should not just think about quantity of jobs but quality of jobs as well. What kind of security and social upgrading opportunities exist within micro-work schemes or informal distribution chains? Freeman also reminded us that: “When we talk about inclusion we are not dealing with uniformity”. Rather African policy-makers should strive towards policy-making that takes account of the needs of different classes and those with different levels of education. The challenge is how to construct a strategic economic policy that creates skilled jobs for graduates while simultaneously creating opportunities for those at the bottom of the pyramid. Interestingly, in the transport sector, Nerisa Bernhardt commented that taxi drivers saw the new payment system as a route to formal employment and worker insurance. Informal workers do not just want to be digitally included through transactional data and market access but also included through regulation that protects their incomes, working conditions and long-term security. This is what inclusion really means to those working in informal transport!

4) ICTs confer surveillance capabilities to ICT providers. Depending on the business environment, it may strengthen or weaken the state but in all cases, it may intensify formal sector control of the informal economy.

Our workshop brought together representatives of three different models of mobile money: Nigeria’s bank-led system (heavily regulated by government), Somaliland’s completely private sector vision and Kenya’s telecom-led model (lightly regulated by the Central Bank). In the next few weeks, we will be exploring the implications of these three different set-ups for questions of commercial surveillance and access to financial information by states, but it is important to note how digital solutions make informal activities and transactions more visible and potentially more controllable to formal commercial actors. We also saw this kind of formal commercial visibility of informal actors within the other sectors too, including visibility of farmers and extension workers in agriculture, visibility of drivers and collectors in transport and workers and their social networks in the BPO sector. In making informal activities more legible to the state and formal private sector, ICTs can potentially increase the vulnerability of informal actors to more powerful interests.

5) The profit motive should not be the only determinant of ‘sustainability’. Issues of redistribution and strategic restructuring of economies should also be prioritised by regulators and domestic ICT providers.

Kate Meagher commented in the workshop: ‘Young African software developers are resources for their countries. Let’s not let venture capitalists shape their priorities.” We also heard about the weak evidence behind micro-credit as a source of poverty reduction. As many studies have shown, loans can lead to indebtedness for the very poor. There should be a place for non-profit cash payments in any poverty reduction scheme and subsidisation in the case of public goods like urban transportation, but how do you balance the needs of governments to supply cash and private payment providers wishing to make a profit from these schemes. In both cases, we discussed whether the (short term) profit motive should guide digital inclusion interventions in African countries. Instead appropriate legal and regulatory frameworks are needed to maximise the inclusive potential of ICTs (eg coordinate digital systems, protect the rights of the vulnerable, and promote non-commercial along with commercial innovations).

This article is based on the findings of the Connectivity at the Bottom of the Pyramid workshop held at the Rockefeller Foundation Bellagio Centre in September 2016. We thank the Rockefeller Foundation, LSE’s Department of International Development and the Institute of International Education (IIE) for making the workshop possible. If you have any comments or suggestions to help write our White Paper or want to know more details about the workshop, please get in touch with Laura (l.e.mann@lse.ac.uk) or Kate Meagher (k.meagher@lse.ac.uk).

Laura Mann (@balootiful) is an assistant professor in LSE’s Department of International Development. Kate Meagher is an associate professor in LSE’s Department of International Development.

The views expressed in this post are those of the authors and in no way reflect those of the Africa at LSE blog or the London School of Economics and Political Science.

4 Comments