For a few months now, all eyes in Westminster have been trained on the EU referendum. To the exclusion of almost everything else, talk has focused on what may happen when the British people make their historic choice to Remain or Leave on 23 June.

I have a very hard time dealing with the so-called ‘facts’ bandied about by both sides. There are very few facts in this debate. Neither side can say with any certainty what the UK’s relationship with the European Union will look like in five years, let alone decades.

My job in the meantime is to represent the 75,000 businesses that are part of the Accredited Chamber of Commerce Network. Our members come in all shapes and sizes, and from all sectors.

What concerns businesses that I visit all across the country – particularly those beyond the City of London’s HQ belt – is that Britain’s future relationship with the EU is just one issue among many that weighs on their minds.

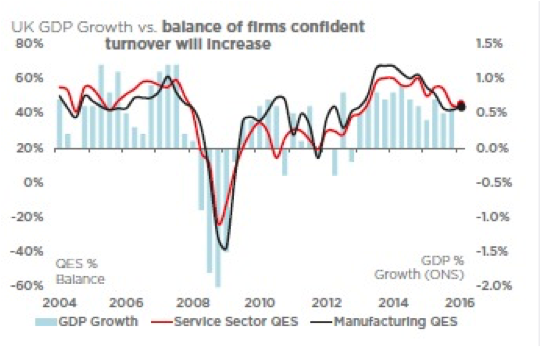

Our Quarterly Economic Survey has been a reliable bellwether for the UK economy over the years, often pointing out business trends before they are captured in the official statistics.

The most recent survey, which captured the view of over 8,500 businesses during the first quarter, suggested that companies increasingly believe the UK economy is softening.

In both the UK’s dominant services sector, and our manufacturing industry, our surveys suggest that confidence has been weakening since 2014 – long before the date of the EU referendum was announced. Business confidence in both turnover growth and profitability growth has been, and remains, disappointing.

Some of the reasons for this less confident outlook arise from global developments. We have seen that volatile asset and commodity markets have an impact on UK firms, as well as slowdowns in China and in many emerging markets. The strong dollar is a challenge as it drives up costs for many firms, and while there are signs of life in the Eurozone, growth there remains uncertain.

However it is important to be clear: not all of the UK’s growth challenges can be explained away by either global trends, or our relationship with the EU. There are some big, long-standing structural problems in the British economy which are home-grown – and have been kicked into the long grass while our politicians focus on Brussels, China, and world geopolitics.

The UK’s labour market is a source of strength for the UK economy, with the employment rate at a record high. However this has meant that companies have continued to face capacity constraints. Our survey shows that two-thirds of services firms and nearly three-quarters of manufacturing firms can’t get the people they need. Businesses I visit all across the UK routinely tell me that young people are leaving education without being ‘workplace ready’. This is not a new phenomenon. The deficiencies in our education and training system should be under the spotlight, as well as the decades of underinvestment in training by far too many businesses.

We’re also seeing a two-tier growth trend that is becoming further entrenched. The services sector remains far stronger than manufacturing. The ongoing uncertainty about the future of UK steel production demonstrates the lack of consensus around how to encourage investment in and modernization of strategic industries in the UK. Absent from all of this is any talk of a concerted plan for the future, so that we maintain crucial ‘foundation industries; to meet the needs of our manufacturing, construction, and defence sectors.

As the economy has slowly recovered over the years, governments have looked to business to shoulder more of the burden. As a result, businesses now feel weighed down by the sheer weight of up-front costs. A simple list demonstrates the issue – dividend taxes, insurance premium taxes – both up. Radical business rates reform kicked down the road. Apprenticeship levies and auto-enrolment costs coming in. And that’s before businesses even turn over a single pound. It is little wonder that businesses across the UK don’t feel like they are living in a low-tax environment. They are paying more, up-front, as a consequence of government decisions, even as the Chancellor announces Corporation Tax cuts that benefit relatively few firms.

Infrastructure upgrades are also not proceeding fast enough. We’ve heard nothing on aviation capacity since the New Year, when the government decided to delay a decision until after the Mayoral election and the EU Referendum. The slow progress of other key infrastructure projects, such as HS2 and new nuclear, fracking and renewable energy schemes, also create further cause for concern.

Many offices, business parks, and road and rail routes across Britain still lack both mobile and broadband connectivity. Across the country we see evidence that businesses are suffering from poor service standards, which has gone on for too long. Unless we see improvements on reliability, speed and coverage, UK productivity will continue to be severely affected.

Upgrades like this are wholly within our own capability. Investing to improve our physical and digital infrastructure will help support stronger business investment and export performance.

The point I’m trying to make is that many of the risks facing the UK economy stem from longstanding, well-known, and home-grown structural issues. Not every problem can be dismissed glibly with reference to global uncertainty, or reduced to an argument about whether we should be in or out of the EU.

Many businesses are far more worried about succession planning, unpredictable infrastructure, and low productivity than they are about the EU referendum. Whatever result we awaken to on June 24, these problems will remain – and far too many firms feel they are being sidelined by those in Westminster.

Our national leaders simply must demonstrate that they are paying close attention to concerns from the real economy, and that they have clear ideas to shore up business confidence. The EU referendum may be a significant political event for the entire country – but it is not the only thing that matters to business.

♣♣♣

Notes:

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Pixabay, Public Domain

- Before commenting, please read our Comment Policy

Adam Marshall is Acting Director General of the British Chambers of Commerce

Adam Marshall is Acting Director General of the British Chambers of Commerce

1 Comments