The relationship between democracy, redistribution, and inequality has been a topic of enduring interest to the social sciences, even though the evidence is far from conclusive. In those studies, democracy refers to the rules governing the political system and its effect on inequality is usually measured at the country level. But what about the effects of democratic provisions embedded in core economic institutions, such as firms?

Examples of such provisions exist in many countries. In most European countries, for instance, employees are granted with information, consultation, and codetermination rights in relation to financial and employment-related issues. Such rights are exercised through trade unions, works councils, and joint consultative committees at the establishment level. In Nordic countries and Germany, the legislation also gives employees the possibility of being part of the boardroom, allowing them to exert some influence on strategic corporate decisions. By enfranchising employees with partial control rights and precluding shareholders (and managers) from making unilateral decisions in certain areas, such institutions moderately alter the distribution of power within firms.

But there are also firms which are fully controlled by their workforce. Worker-managed firms, also known as worker cooperatives, have existed alongside investor-controlled firms in most Western economies since the Industrial Revolution. These firms are democratic in the sense that members have equal influence on management decisions regardless of their capital contribution to the firm (“one person, one vote”). While the Mondragon Corporation, based in the Basque country, is probably the best-known example of this type of organisations, a tiny fraction of companies in most developed and developing countries adopt such form.

In a recent paper, I assess the effect of workplace democracy on pay inequality, exploring precisely the very distinct institutional setting provided by worker-managed firms. The analysis is based on matched organisation-individual administrative data from Uruguay for the period 1997-2009. One major advantage of the data set is that I can observe the entire wage distribution at each firm for any given moment in time. This makes it possible to rank the ability of workers, including quitters, according to their position in the intra-firm wage distribution.

The key findings are that:

- Workers employed in a worker-managed firm earn a small wage premium (3 per cent) compared with similar workers employed in the conventional sector.

- This positive wage gap declines significantly with increasing pay and becomes negative for top earners: low-wage workers disproportionately benefit from workplace democracy.

- The most productive members are more likely to leave the organization than other members. The separation risk of high-productivity members (those whose wages are above the median wage of the firm) is more than three times higher than that of low-productivity members. In addition, those who switch to the conventional sector experience a 7 per cent gain in their wages on leaving.

- The severity of the ‘brain drain’ is affected by the intensity of redistribution and by the opportunities offered in the conventional sector: greater internal redistribution and better labour market conditions increase the brain drain.

A simple median voter type of argument may account for the redistributive effect of workplace democracy. To the extent the median member is less productive than the average, the majority of cooperative members can gain by reducing wage differences relative to differences in productivity (Kremer, 1997).

Another possible explanation is that worker-managed firms compress the compensation structure in order to mitigate detrimental effects of pay comparisons on employee morale and job satisfaction. Previous research has shown that such costs may be particularly salient in organizations that rely heavily on team production, horizontal cooperation among workers, and in which pay secrecy policies are precluded (Cardoso, 2010; p.202-218). That is precisely the kind of organizational environment that characterizes worker-managed firms.

Existing evidence indicates that in many cases worker-managed firms perform as well as (or even better than) conventional firms. This suggests that the costs of equality associated with brain drain and potentially inferior management quality may be at least partially compensated by other labour discipline benefits, such as higher motivation of shop-floor workers, greater workplace cooperation and lower supervision costs.

Inequality is back on the scene. Concerns about the unfairness of the income and wealth distribution and its potential harmful effects on economic performance are now widespread among academics, policymakers, and the general public. From a policy perspective, this research has important implications. While tax and welfare policies usually come at the top of the policy menu to tackle inequality, less attention has been devoted to the role played by firms and workplace organization in shaping the market income distribution.

Frontier research shows that the rise in earnings inequality among workers over the last decades has been primarily a between-firm phenomenon. In other words, the wage premium associated to being employed in better firms has increased over time. However, within-firm inequality (i.e. inequality among workers employed at the same firm) has been also part of the story, explaining one-third of the increase in earning inequality in the US between 1981 and 2013. By studying the case of worker-managed firms, the most radical implementation of workplace democracy in modern economies, the paper highlights how worker participation in corporate governance may contribute to increase low-wage workers’ earnings and keep managerial rents under control.

The study also sheds light on the specific challenges faced by worker-managed firms, cooperatives, and similar organisations in terms of their compensation policies, a crucial dimension of organisational design. Even though the net effect of pay compression on performance is still not clearly understood, the research identifies one of its unintended consequences in a context in which individuals endowed with attractive exit options can ‘vote with their feet’.

♣♣♣

Notes:

- This article is based on the author’s paper Equality Under Threat by the Talented: Evidence from Worker-Managed Firms, The Economic Journal (Royal Economic Society), Volume 126, Issue 594 August 2016, Pages 1372–1403

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

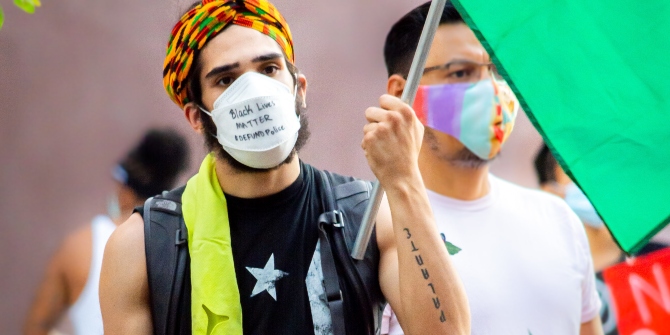

- Featured image credit: ‘Viaje a la Corporación Mondragón en el País Vasco’, by Colaborativa dot eu, under a CC-BY-2.0 licence

- Before commenting, please read our Comment Policy

Gabriel Burdin is a Marie Curie Research Fellow at the Leeds University Business School. He is also Research Fellow at the Institute for the Study of Labor (IZA) and Associate Professor at FCEA, Universidad de la Republica, Uruguay (currently on leave). He completed his PhD at the University of Siena, Italy, in 2013. His research has been published in scientific journals, including The Economic Journal, Journal of Comparative Economics, and Industrial and Labor Relations Review, and recognised through various early-stage career distinctions in his field of research, such as the Best Doctoral Dissertation in Comparative Economic Systems, awarded by the European Association of Comparative Economics (EACES). Gabriel is currently co-editor of Annals of Public and Cooperative Economics and council member of the International Association for the Economics of Participation (IAFEP).

Gabriel Burdin is a Marie Curie Research Fellow at the Leeds University Business School. He is also Research Fellow at the Institute for the Study of Labor (IZA) and Associate Professor at FCEA, Universidad de la Republica, Uruguay (currently on leave). He completed his PhD at the University of Siena, Italy, in 2013. His research has been published in scientific journals, including The Economic Journal, Journal of Comparative Economics, and Industrial and Labor Relations Review, and recognised through various early-stage career distinctions in his field of research, such as the Best Doctoral Dissertation in Comparative Economic Systems, awarded by the European Association of Comparative Economics (EACES). Gabriel is currently co-editor of Annals of Public and Cooperative Economics and council member of the International Association for the Economics of Participation (IAFEP).