Throughout the twentieth century, business elites in the United States were bound together by a dense interlock network — a network of directors connected by serving on the same corporate boards, and of boards connected by shared directors. A few dozen directors served on five or more boards, and this inner circle kept the informational pathways among corporations short. Most large companies were within three degrees of separation: a director from company A and a director from company B would be connected by a common co-director. This dense web of personal and corporate ties played a crucial role in maintaining a cohesive elite identity and a moderate political orientation in the U.S., and in diffusing corporate governance innovations.

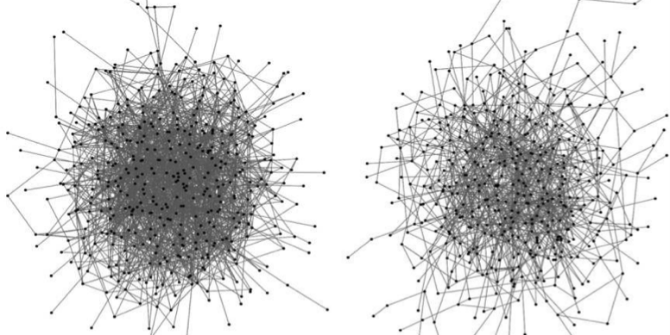

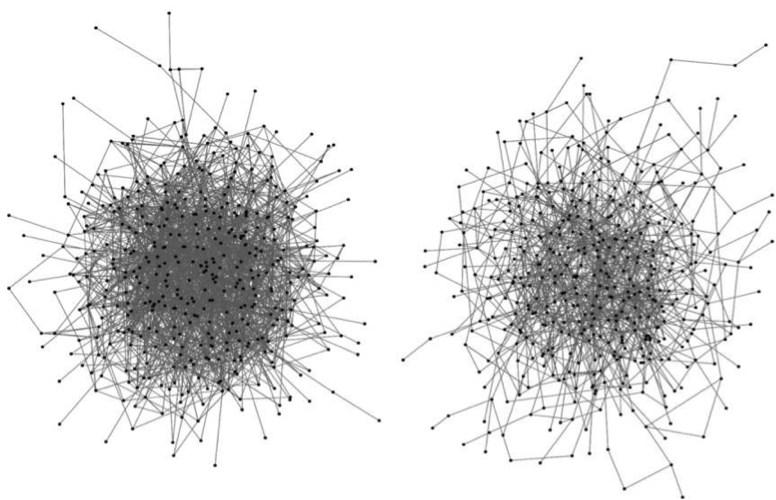

Our recent study finds that this network fell apart during the first few years of the new millennium, with important consequences for U.S. corporations and society. The inner circle of directors sitting on many boards has all but disappeared. In 2000, 61 directors served on five or more major corporate boards; by 2012, there was only one. Without a critical mass of well-connected directors, the interlock network no longer coheres (Figure 1). Each company is connected to fewer other companies, and the social reach of directors through the interlock network is curtailed.

Figure 1. S&P 500 interlock network main component, 1996 (left) and 2010 (right). Dots are companies. Two companies are connected by a line if they share a director.

Why did the inner circle disappear? The long-standing, rich-get-richer preference for well-connected directors disappeared. Throughout the twentieth century, directors serving on multiple boards were more likely to be invited onto yet more boards. Serving on many boards was a signal of high status. But after a series of corporate scandals in the early twenty-first century, culminating in the passage of the Sarbanes-Oxley act, directors serving on many boards came to be viewed with suspicion. Forbes magazine called such directors “overworked”, others called them “busy”, “overboarded”, even “greedy”, and influential advisors such as Institutional Shareholder Services called for a limit on the number of boards a director served on. When the old guard of well-connected directors retired, no others could amass the board seats to take their place, and the inner circle vanished.

This change in network density affects the shape of U.S. society. In the 1980s, Michael Useem described how the inner circle of well-connected directors maintained elite class identity. A newly appointed director assuming his first board seat could catch the eye of a member of the inner circle, who would sponsor him for additional board seats while nudging him towards appropriate corporate and political views. Once the new director became a member of the closely-connected inner circle of directors, he would in turn sponsor and tutor promising new directors. Now, however, the probability of a new director serving on a board with another who is on many boards is tiny. Moreover, even directors serving on many boards are often not closely connected to each other. The ladder that led to the inner circle of the interlock network is broken. Indeed, there is no inner circle left to join. The interlock network is no longer a crucible of elite class consciousness.

The decay in network connectivity also limits the interlock network’s role in diffusing innovations across corporate America. Examining the spread of poison pill anti-takeover provisions in the 1980s, Jerry Davis found that adoption spread through a board-to-board contagion process, much like a flu virus. Companies that shared directors with multiple companies who had already adopted poison pill provisions were highly likely to adopt the provision themselves. By 2010, the interlock network was too sparse for such processes to function. The typical company no longer has enough board links to allow for multiple exposures to previous adopters. Corporations may look less like each other now as a result.

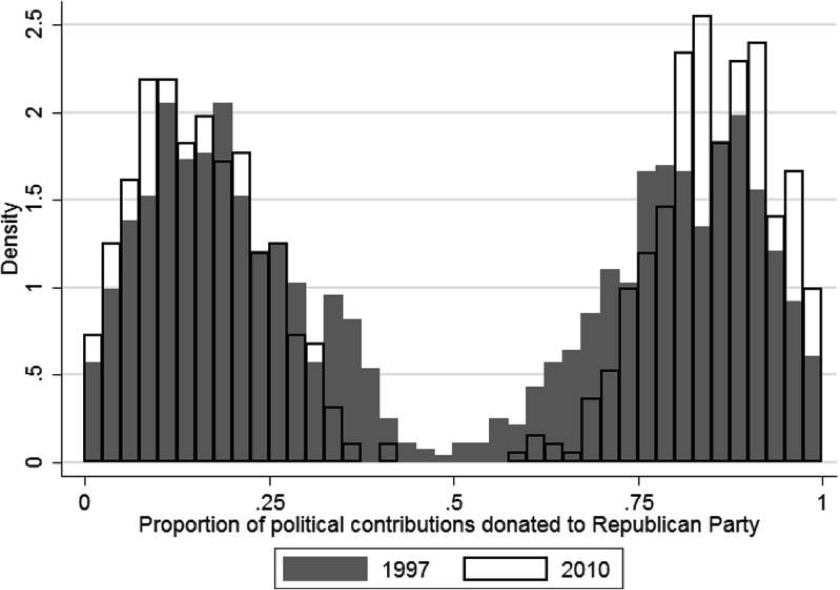

Corporate practices were not the only things diffusing across the interlock network; the network served as a substrate for diffusing political views also. Serving on the same board pulled directors closer together in their political opinions. A densely-connected single network brought directors of many differing political orientations into close and repeated contact with each other. The most-connected directors—the inner circle—came to hold moderate and pragmatic political views, close to an average of the views of the directors across the network. Mark Mizruchi and other scholars found that rather than donating to only Republicans or Democrats, directors in the inner circle often contributed funds to both sides of the aisle and supported middle-of-the-road policies designed to stabilize the status quo.

The less-connected network of today allows polarised political action by corporate elites. Directors in the interlock network are less constrained by the web of connections to their peers, and can act on their own idiosyncratic beliefs and ideologies. Figure 2 shows results of our simulation of political contributions by corporate directors. The simulation predicts that directors in 2010 would be much less likely to donate similar amounts to both Democratic and Republican political candidates compared to directors in 1997, because directors in 2010 were connected to fewer peers with dissimilar political orientations. Unfettered by ties to a broad range of peers, each corporate executive and director can deploy his considerable resources for his own company’s advantage or to push his own ideological stance.

Figure 2. Simulated distribution of number of executives by proportion of political contributions allocated to the Republican Party.

The corporate interlock network is not the only possible forum for elite interaction. Are there other networks (private equity?, nonprofit boards?, social clubs?) which now serve to unify the U.S. elite? Recent developments in U.S. society, such as the success of decidedly non-centric politicians such as Bernie Sanders and Donald Trump, suggest that no replacement has crystallized yet. Without structures binding elites to each other through dense and far-ranging ties, powerful men and women in the U.S. are free to pull society in many different directions.

For a take on how our research relates to elite political participation and the rise of Donald Trump, see Corporate America’s old boys’ club is dead – and that’s why Big Business couldn’t stop Trump

♣♣♣

Notes:

- This blog post is based on the author’s paper Who Killed the Inner Circle? The Decline of the American Corporate Interlock Network[ii], in the American Journal of Sociology 122, no. 3 (November 2016): 714–754.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Network, at Max Pixel, under a CC0 licence

- Before commenting, please read our Comment Policy.

Johan Chu is an Assistant Professor of Organizations and Strategy at the University of Chicago Booth School of Business. His research focuses on understanding large-scale change and stasis, including the durable dominance of companies, people, and ideas. Johan earned a B.S. in physics from the Korea Advanced Institute of Science and Technology (KAIST), a Ph.D. in physics from the California Institute of Technology (Caltech), and a Ph.D. in management & organizations from the University of Michigan’s Ross School of Business. In between Ph.D.s, he spent thirteen years in consulting, start-ups, and executive search. His final industry position was at the world’s largest private executive search firm, where he was the Asia-Pacific Consumer Practice leader.

Johan Chu is an Assistant Professor of Organizations and Strategy at the University of Chicago Booth School of Business. His research focuses on understanding large-scale change and stasis, including the durable dominance of companies, people, and ideas. Johan earned a B.S. in physics from the Korea Advanced Institute of Science and Technology (KAIST), a Ph.D. in physics from the California Institute of Technology (Caltech), and a Ph.D. in management & organizations from the University of Michigan’s Ross School of Business. In between Ph.D.s, he spent thirteen years in consulting, start-ups, and executive search. His final industry position was at the world’s largest private executive search firm, where he was the Asia-Pacific Consumer Practice leader.

Jerry Davis received his PhD from the Graduate School of Business at Stanford University and taught at Northwestern and Columbia before moving to the University of Michigan, where he is the Gilbert and Ruth Whitaker Professor of Business Administration and Professor of Sociology. He has published widely in management, sociology, and finance. Books include Social Movements and Organization Theory (Cambridge University Press, 2005); Organizations and Organizing (Pearson Prentice Hall, 2007); Managed by the Markets: How Finance Reshaped America (Oxford University Press, 2009); Changing your Company from the Inside Out: A Guide for Social Intrapreneurs (Harvard Business Review Press, 2015); and The Vanishing American Corporation (Berrett Koehler, 2016).