A debate about whether firms with superior customer satisfaction also earn better-than-average stock returns has been persistent in the academic business and marketing literature (Fornell, Mithas, Morgeson, and Krishnan 2006). Proponents of the customer satisfaction-stock market relationship make a simple, intuitive argument that is highly relevant to both consumers and investors: Companies that do better by their customers also do better in the stock market.

Hoping to end the debate once and for all on the importance of stock prices being tied to customer satisfaction, we conducted a 15-year analysis using data from the American Customer Satisfaction Index (ACSI) and publicly traded companies in the United States. We also replicated the analysis using similar data in the United Kingdom.

Thumping the S&P 500

For the U.S. analysis, the satisfaction scores for the publicly traded companies were related to actual stock portfolio returns from a fund trading exclusively on customer satisfaction information. We combined state-of-the-art methods from finance and economics (Fama and French 2015) with customer satisfaction theory from marketing (Fornell, Mithas, and Morgeson 2009). The findings were nothing short of remarkable.

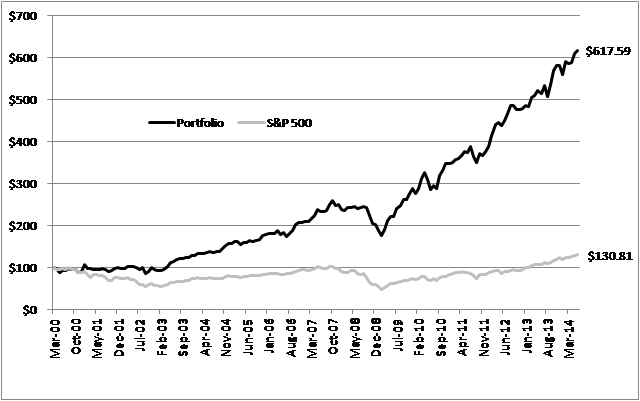

When we examine the cumulative satisfaction portfolio returns, the results show a 518 per cent growth over the 15 years, compared to only a 31 per cent increase for the S&P 500 (see Figure 1). And the consistency is uncanny; on an annual basis, the customer satisfaction portfolio outperformed the S&P 500 in 14 out of the 15 years included in the analysis.

Figure 1. Cumulative returns on $100 invested in the customer satisfaction portfolio versus the S&P 500, April 2000-June 2014

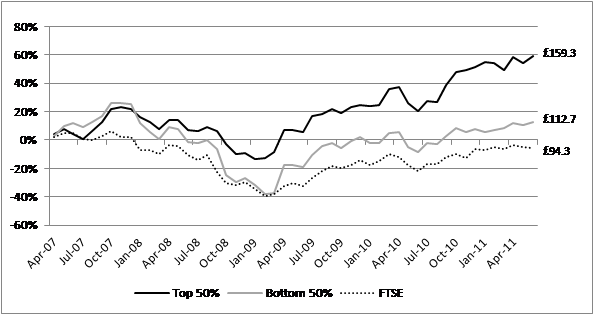

Do these results generalize across time and space? As to the question of whether the results hold in a different stock market, we extended our analysis to the United Kingdom, using similar data available in that market. As Figure 2 shows, we find highly consistent results in the UK to those in the U.S.

Figure 2. Cumulative returns on £100 invested: High NCSI Portfolio, Low NCSI Portfolio, and the FTSE 100

Note: The “High NCSI portfolio” consists of the top 50% of measured companies in customer satisfaction; the “Low NCSI portfolio” consists of the bottom 50% of measured companies in customer satisfaction.

Earnings Surprises

Going a bit deeper into the U.S. data, where we have a long 15-year period to study, we find a large, positive and significant “alpha,” indicating above-market returns outside the realm of random chance. We also find that the effect of customer satisfaction on stock price is, at least to some degree, channeled via earnings surprises. In other words, customer satisfaction allows firms to outperform what analysts (and others) believe will be the company’s near-term financial performance, with the stock market reacting once this information is made public. We also find that customer satisfaction has a significant effect on earnings as well as on earnings surprises.

As suggested by the sheer size of the abnormal stock returns solely based on trading on customer satisfaction information, the reward for having satisfied customers is much greater than is generally known. Customer satisfaction-based trading generates “excess” stock returns of about 10% per annum. Given this, why are many firms not focusing adequate attention to improving the satisfaction of their customers? That is, if the economic benefits of high customer satisfaction in terms of improved consumer utility and shareholder value seem apparent, why do many companies fail to improve customer satisfaction?

Know Your Customers

Without a doubt, many companies seem to either give short-shrift or disregard entirely the importance of customer relationship. The explanation for this is likely to be found in inadequate customer data collection and/or a general misunderstanding of just how valuable satisfied customers are to the firm.

In fact, many companies – even large, high-profile companies – don’t even know what their customers think about them and why (e.g., Hult, Morgeson, Morgan, Mithas, and Fornell 2017). Lots of data collection vehicles exist and even lots of satisfaction data exist for many companies. Yet, it is safe to say that there has not been corresponding progress in strategically developing and implementing satisfaction initiatives in many companies.

It should be recognized that customer satisfaction information is not without interpretational challenges. Consequently, it would be unrealistic to expect that equity markets would be frictionless with respect to such information. In addition to the friction associated with arbitrage costs, imperfect information, limitations on investors’ cognitive and reasoning skills, and institutional rigidities that impair market efficiency, customer satisfaction is not a part of the analysis models most investors use. But it should be!

Our argument is that we are at a point where we should re-evaluate whether it is earnings or customer satisfaction that belongs among the risk factors in asset pricing models. Empirically, they are correlated. One mitigates the effect of the other. But which one should be mitigated? What comes first, earnings or customer satisfaction? The answer is that earnings per se do not cause customer satisfaction, but there is ample evidence pointing in the other direction. What we do know is that a new exchange-traded fund (ETF) has launched that utilizes customer satisfaction data to weigh large cap companies by their satisfaction score, under the ticker ACSI.

♣♣♣

Notes:

- This blog post is based on the author’s paper Stock Returns on Customer Satisfaction Do Beat the Market: Gauging the Effect of a Marketing Intangible, in Journal of Marketing, 2016, 80(5), 92-107.

- For a podcast discussing the findings in this research, click here.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: City rush, by Christopher Burns, under a CC0 licence

- Before commenting, please read our Comment Policy.

Claes Fornell is the Donald C. Cook Distinguished Emeritus Professor at the Ross School of Business, University of Michigan. Dr. Fornell founded the American Customer Satisfaction Index (ACSI) – a monthly economic indicator of the quality of economic output. In addition to the ACSI, Dr. Fornell has founded several companies, including CFI Group, ForeSee Results, and ACSI Funds. He is the world’s leading authority on customer satisfaction, its measurement and analysis, and regularly appears in broadcast and print media.

Claes Fornell is the Donald C. Cook Distinguished Emeritus Professor at the Ross School of Business, University of Michigan. Dr. Fornell founded the American Customer Satisfaction Index (ACSI) – a monthly economic indicator of the quality of economic output. In addition to the ACSI, Dr. Fornell has founded several companies, including CFI Group, ForeSee Results, and ACSI Funds. He is the world’s leading authority on customer satisfaction, its measurement and analysis, and regularly appears in broadcast and print media.

Forrest Morgeson is Director of Research and Global CSI Manager for the American Customer Satisfaction Index (ACSI). Dr. Morgeson is responsible for managing ACSI’s academic research and statistical analysis, as well as its international licensing program and global custom research projects. He is also a faculty in the Master of Science in Marketing Research program in the Eli Broad College of Business at Michigan State University.

Forrest Morgeson is Director of Research and Global CSI Manager for the American Customer Satisfaction Index (ACSI). Dr. Morgeson is responsible for managing ACSI’s academic research and statistical analysis, as well as its international licensing program and global custom research projects. He is also a faculty in the Master of Science in Marketing Research program in the Eli Broad College of Business at Michigan State University.

Tomas Hult is Professor, Byington Endowed Chair, and Director of the International Business Center in the Eli Broad College of Business at Michigan State University. He is also Executive Director of the Academy of International Business (AIB), President of the Sheth Foundation, and serves on the U.S. District Export Council. He is an Elected Fellows of the Academy of International Business and in 2016 Dr. Hult was selected as the Academy of Marketing Science Distinguished Marketing Educator as the top marketing professor in the world.

Tomas Hult is Professor, Byington Endowed Chair, and Director of the International Business Center in the Eli Broad College of Business at Michigan State University. He is also Executive Director of the Academy of International Business (AIB), President of the Sheth Foundation, and serves on the U.S. District Export Council. He is an Elected Fellows of the Academy of International Business and in 2016 Dr. Hult was selected as the Academy of Marketing Science Distinguished Marketing Educator as the top marketing professor in the world.

How do I find the ETF?

Hi Mel: The ETF can be found at http://acsietf.com. The overall discussion about ACSI funds can be found at http://www.acsifunds.com and the ACSI methodology and information can be found at http://theacsi.org. We hope this helps.