The dawn of 2017 seems to have pried open a can of worms in Southern Africa. In just about four months, Mozambique, not too long ago displaying strong economic growth and bullish investor sentiment, has defaulted in servicing a $60 million coupon payment for its ‘Tuna Bond’. The plunge in oil prices has sent banks in Angola clutching at the government for a bailout package. Namibia is wrestling with a surge in fiscal deficit, which stood at 9.2 per cent of GDP in 2016, and the country has since slashed the 2017/18 budget by 10.9 per cent.

The elephant in the room, however, has been South Africa’s credit rating downgrade to junk status last month, a move that has piled pressure on the rand, signalling that investors, rattled by fears of deteriorating economic conditions, could be gearing for a stampede out of one of Africa’s most attractive markets. The downgrade implies that the risk premium attached to the economy has risen. This could not have come at a time more inauspicious than now.

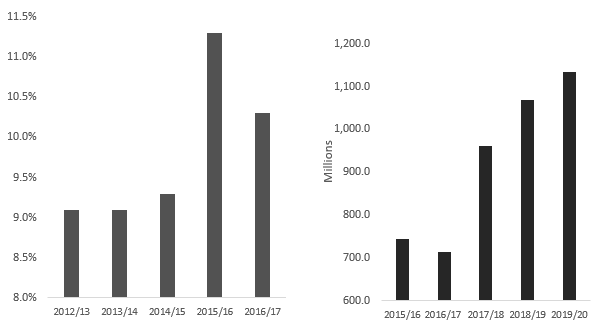

Foreign debt, as a percentage of gross national debt, has been rising over the last five years, with the government projecting a 52.3 per cent increase in greenback-denominated interest payment between 2015/16 and 2019/20 to $1.1 billion. With the rand depreciating, servicing foreign currency-denominated debt is bound to become more expensive, not to mention for an economy whose performance has been measly in the recent past, fanning fears of a rising risk of default.

Figure 1a. South Africa’s foreign debt (% of GDP) and 1b. Foreign currency commitments – interest payments ($)

Source: National Treasury South Africa

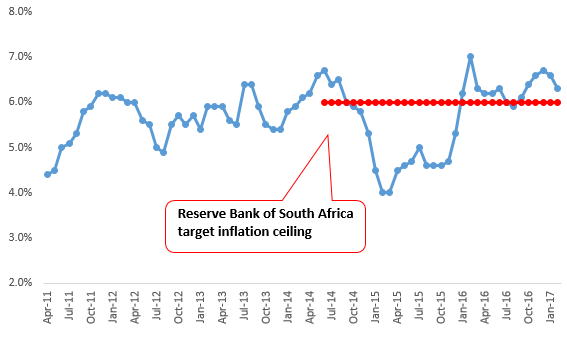

The real threat stemming from this is the looming vicious cycle in which investors, spooked by the credit rating downgrade, pull back from the market, piling more pressure on the rand, with the net effect of deteriorating the country’s foreign exchange risk further. Another key challenge the South African economy is bound to face in the coming months is the risk of a runaway inflation, which has already been trending above the target ceiling of 6 per cent over the past year. The generally contractionary budget of 2017/18 proposed (amongst other tax hikes) an increase in excise duty for alcohol and tobacco of between 6 and 10 per cent (National Treasury Budget Speech February 2017). Considering this, it is likely that inflation will be nudging further up in the months ahead.

Figure 2. South Africa’s headline inflation

Source: Bloomberg

From the wider African perspective, it certainly does not help that the developments in Southern Africa have come against the backdrop of Nigeria’s recession. For a number of investors, this twin occurrence has triggered subdued expectations for Sub-Saharan Africa as a whole. In the near-term, it might be necessary for investors to fasten seat belts tighter in light of the further turbulence that could be triggered by the following:

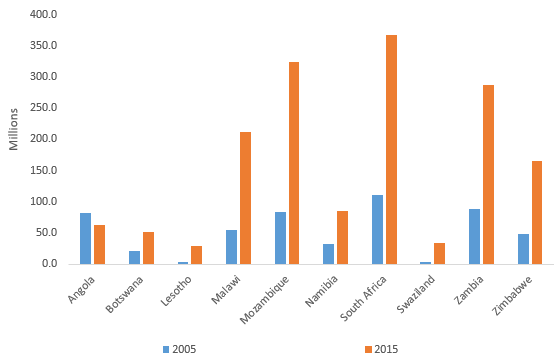

- US inward-looking policy approach – President Trump’s draft budget titled ‘A Budget Blueprint to Make America Great Again’ released mid-March 2017 proposes a 28 per cent year-on-year reduction in funding to the Department of State and the US Agency for International Development (USAID), a proposal bound to ripple through Southern Africa with implications on foreign aid receipts. Between 2005 and 2015, US foreign aid to Southern Africa tripled to $1,620.8 million, with South Africa, Mozambique and Zambia accounting for the lion’s share at 22.7 per cent, 20.0 per cent and 17.8 per cent (USAID data). This funding has been instrumental in facilitating provision of vital services in 2015. For instance, about $159.5 million was disbursed toward basic health programs in the region. A slash in the American foreign aid budget is likely to have an impact on the region, especially at a time when governments are plagued by depressed revenue mobilisation domestically.

Figure 3. US foreign aid disbursements ($)

Source: USAID Data

- Angola’s election and what it portends – Angola is set for the polls in August 2017 with President Jose Eduardo dos Santos indicating he will not seek re-election. Bearing in mind that he made a similar pledge in 2001, ahead of the 2003 election, there is no telling whether this time he will make good his pledge. What is of essence to observe, however, is that the country stands at a critical juncture for two reasons:

- In June 2016, the government shelved talks for a bailout package from the International Monetary Fund with little, if any, to indicate what alternative approach would be tapped into to mitigate adverse macroeconomic conditions stemming from the plunge in the price of oil. With crude oil accounting for 45 per cent of GDP, 95 per cent of export revenue and 80 per cent of government revenue, this remains a potential pressure point for the country, with many keen to see whether the next administration will step up the economic diversification mojo.

- Between 2000 and 2014, Angola received $21.2 billion in loans from China, accounting for about 25 per cent of all loans from China to Africa (China Africa Research Initiative). As China faces a general economic slowdown, the likelihood of tightened purse strings in terms of credit to trade partners stands as a risk to Angola. Between 2012 and 2015, China’s imports from Angola declined by 52.3 per cent to $15.9 billion in what is an indicator of both the plummet in oil prices and depressed appetite from China. Cushioning potential adverse effects from this trend is set to be a key concern for the next administration and we could see the country make good its plan to join the Southern African Development Community Free Trade Zone in the near future

It is important to observe, however, that Southern Africa, at $506.3 billion in 2015 (World Bank Data), accounts for 22.6 per cent of Africa’s GDP and 33 per cent of the continent’s foreign direct investment, at $17.9 billion in 2015 (UNCTAD Data). The region has an average GDP per capita of $2,825.7 — 43.7 per cent higher than the Sub-Saharan Africa average (GDP per capita taken at the current USD in 2015 as provided by World Development Indicators). The ongoing turbulence notwithstanding, this is a market any Africa-focused investor cannot afford to ignore.

♣♣♣

Notes:

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Johannesburg, by Lars Haefner, under the GNU Free Documentation License, or the CC BY-SA 3.0 licence, via Wikimedia Commons

- Before commenting, please read our Comment Policy.

Julians Amboko is a Senior Research Analyst with StratLink Africa Ltd, a Nairobi-based financial advisory firm focusing on emerging and frontier markets. He covers macroeconomic research and analysis for Sub-Saharan Africa, including markets such as Nigeria, Kenya, Ethiopia, Ghana, and Angola. He tweets at @AmbokoJH

Julians Amboko is a Senior Research Analyst with StratLink Africa Ltd, a Nairobi-based financial advisory firm focusing on emerging and frontier markets. He covers macroeconomic research and analysis for Sub-Saharan Africa, including markets such as Nigeria, Kenya, Ethiopia, Ghana, and Angola. He tweets at @AmbokoJH