Our study uses administrative data to document large cyclical variations in the evolution of earnings inequality in Spain. We find that the construction sector played a key role in this evolution.

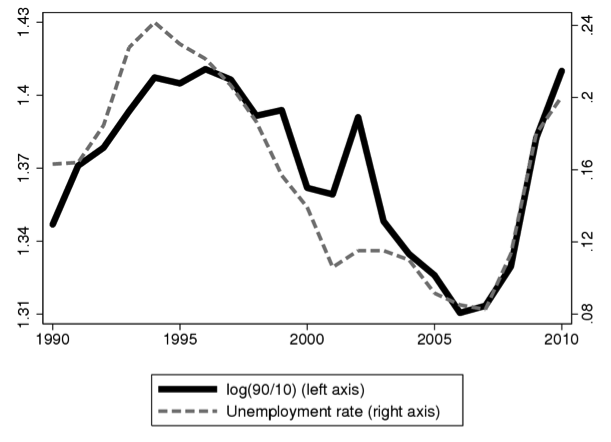

Figure 1 shows the evolution of the logarithm of the 90/10 percentile ratio of male daily earnings – a commonly used measure of inequality – between 1990 and 2010. The figure shows that inequality closely tracks the evolution of the unemployment rate during the period. Earnings inequality increased around the 1993 recession; it experienced a substantial decrease during the 1997-2007 expansion; and then there has been a sharp increase during the recent recession. In particular, during the 1997-2007 expansion, inequality decreased by 10 log points, while between 2007 and 2010, it increased by the same amount.

These fluctuations are large by international standards. By comparison, in the United States, male inequality increased by 16 log points over a longer period, between 1989 and 2005, while the increase in German earnings inequality was slightly lower.

Figure 1: Earnings inequality (males) and unemployment in Spain, 1990-2010

Source: Social security data and OECD

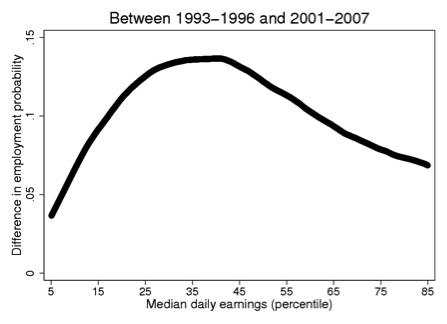

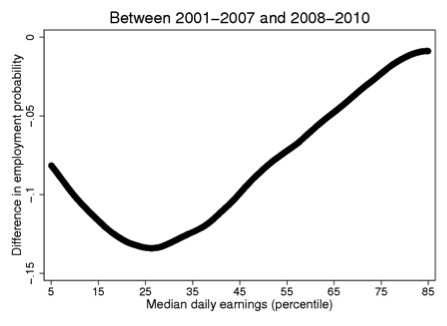

The countercyclical evolution of inequality was in large part driven by changes in the composition of employment, notably in the middle part of the distribution. Figure 2 illustrates this, by showing variations in employment probabilities across the earnings distribution, between the 1993 recession and the expansion (left graph) and between the expansion and the 2008 recession (right). The right graph in Figure 2 shows that the employment losses during the recent recession have been larger in the lower-middle part of the distribution than in the tails. The left graph shows that employment gains during the expansion were also concentrated in the lower-middle part of the distribution.

Figure 2: Employment growth as a function of daily earnings (males)

Source: Social security data. Notes: y-axis: difference in percentage of days worked by an individual relative to days present in the sample, between 1993-1996 and 2001-2007 (left), and between 2001-2007 and 2008-2010 (right). x-axis: rank of an individual in the distribution of median daily earnings during the period.

The patterns in Figure 2 are consistent with inequality falling during the expansion, as employment increased in the middle of the distribution. They are also consistent with inequality increasing in the recent recession, as a large share of lower-middle wage workers lost their jobs.

To understand the reasons for this evolution we turn to a sectoral analysis. We find that the construction sector stands out. Between 1997 and 2007, the share of construction in male employment increased from 14% to 21%. It then sharply decreased to 13% in 2010, below its 1990 level. In turn, earnings of construction workers increased during the expansion episode relative to other sectors.

To assess quantitatively the influence of sectoral factors, we decompose the evolution of inequality into changes in employment composition and changes in labour prices. We find that when accounting for sectoral differences, composition effects fully explain the evolution of the 90/10 inequality ratio between 1997 and 2010.

Overall, our evidence shows that while there has been no trend in the recent evolution of earnings inequality in Spain, countercyclical fluctuations have been substantial.

In addition our findings highlight a key role of the construction sector. The evolution of employment and earnings of construction workers is consistent with the implications of demand shocks induced by the housing market. Since those shocks were partly the consequence of policies aimed at fostering the demand for housing, our analysis suggests that such policies may have sizeable effects on aggregate labour market outcomes.

♣♣♣

Notes:

- This blog post is based on the authors’ paper The Cycle of Earnings Inequality: Evidence from Spanish Social Security Data, Economic Journal, Volume 127, Issue 603, pp. 1244–1278.

- The post gives the views of its authors, not the position of LSE Business Review, the London School of Economics, the Banco de España or the Eurosystem.

- Featured image credit: Puente Monumental de Arganzuela, by Barcex, own work, under a CC BY-SA 3.0 licence, via Wikimedia Commons

- When you leave a comment, you’re agreeing to our Comment Policy.

Stéphane Bonhomme is Professor at the University of Chicago-Department of Economics. He did his PhD at CREST and Université Paris I. His research interests include Labour economics, Microeconometrics, and econometric theory, with a special interest in latent variable modelling and panel data. Email: sbonhomme@uchicago.edu

Stéphane Bonhomme is Professor at the University of Chicago-Department of Economics. He did his PhD at CREST and Université Paris I. His research interests include Labour economics, Microeconometrics, and econometric theory, with a special interest in latent variable modelling and panel data. Email: sbonhomme@uchicago.edu

Laura Hospido is an economist at the Microeconomic Analysis Division of the Banco de España. She received her Ph.D. in Economics at CEMFI and University of Santiago de Compostela. She is also affiliated with IZA as a Reseach Fellow. Her research interests include Earnings Dynamics, Labour Supply and Mobility, Gender Economics, Financial Literacy and Survey Methodology. Email: laura.hospido@bde.es

Laura Hospido is an economist at the Microeconomic Analysis Division of the Banco de España. She received her Ph.D. in Economics at CEMFI and University of Santiago de Compostela. She is also affiliated with IZA as a Reseach Fellow. Her research interests include Earnings Dynamics, Labour Supply and Mobility, Gender Economics, Financial Literacy and Survey Methodology. Email: laura.hospido@bde.es