In most countries employers and employees both contribute to the taxes (or social security contributions) levied on labour. Employers pay taxes on top of the wage they transfer to employees and employees pay income taxes on the money they receive from employers. For many decades, economists thought that it should not matter who pays. Employers were thought to care only about total labour costs (gross wage paid plus employer taxes). Employees were thought to care only about their net wage (what’s left of the gross wage after income tax). The gross wage itself should be of interest to neither of them, so it should not matter who pays the taxes.

In contrast, politicians have often argued about which side of the labour market ought to pay taxes and contributions. Left-wing politicians thereby tend to favour levying taxes on employers while right-wing politicians tend to favour employee-side duties.

We show in a recent research article that it does matter who pays. By using a laboratory experiment to study how people actually respond to taxes on labour, we are able to show that people react differently, depending on where the taxes are paid. This directly contradicts traditional economic reasoning.

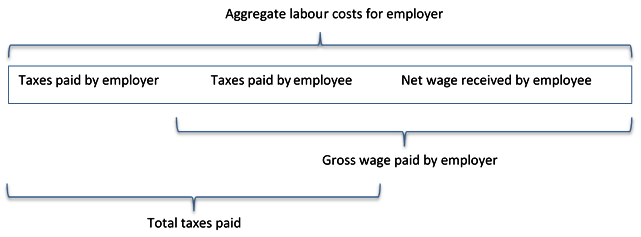

To illustrate traditional thinking, consider the following graph.

Figure 1. Wages and taxes

The employer is thought to be only interested in her own costs, which are given by the aggregate labour costs. The employee is assumed to only care about how much income she will have left to spend (given by her net income). Neither cares about how the taxes paid are split between them.

In our experiment, we organise a labour market with employers and employees. Employees supply labour to do a task for which the employer pays them. Employers make money based on the tasks successfully finished by the employees. We tax both sides, but vary the split of taxes between employer and employee, while keeping both total labour costs and net income constant. This experimental control is ideal to study the differential reactions to the taxes and to investigate the psychological mechanisms that might cause these reactions.

We are interested in three ways in which the changes in taxes might make taxpayers react. First, varying the extent to which the taxes are levied at the employer or employee side of the market might change opinions about government spending. Specifically, we measure whether it affects the level of government spending that employees prefer. Second, we measure employees’ sense of well-being to study whether the shifting of the taxes changes the way employees feel. Third, we investigate whether such shifts change employees’ willingness to work. Our results provide clear evidence that – despite what economists have always thought – it does matter who pays the taxes.

First, people prefer more public spending when employers pay the duties. Shifting all taxes from the employee to the employer makes participants in the experiment want to increase public spending by 24 to 55 per cent, depending on what the government does with the raised taxes. This suggests that employees believe that their own contribution to public spending is lower when taxes are levied on employers even if there is de facto no difference in the amount of money that ends up in their pockets.

Second, employees are less happy when they have to pay the duty rather than their employer, even when they are fully compensated by a higher gross wage. This is only observed in cases where tax proceeds are wasted by the government, which represents a case of extreme government inefficiency. Measuring well-being on a linear scale from 4 to 36, a shift of taxes from employees to employers then increases the sense of well-being in the experiment from almost 19 to almost 22. No effect on employee well-being is observed when the government efficiently uses tax proceeds to provide a public good that benefits all.

Third, we provide evidence that people are more likely to take up jobs when gross wages increase even if net wages remain unchanged. We measure this by giving employees an opportunity to pay us for a chance to do the job again. Even though we keep net income constant, they are willing to pay up to 8% more if they pay income taxes than if taxes are levied on the employer side. This suggests that people do not fully account for the taxes they have to pay when they make decisions about taking up jobs but instead base their decision partly on the (for them) economically irrelevant gross wage.

In short, it does matter who pays the taxes, because people do not seem to perfectly understand taxation. In our paper, we discuss three psychological mechanisms that help explain the results we observe.

It is not easy to draw specific policy implications from our findings. If employees’ happiness is the main goal of a tax reform, taxes should be levied on employers. If it is a policy maker’s main goal to increase the labour supply then taxes should be levied on employees. As for the level of public spending, it is ambiguous whether welfare is served better by inducing a preference for a larger or smaller public sector. What is clear is that politicians can try to use the tax liability side as a tool to induce preferences for a level of public spending closer to the one they prefer themselves. Following our results, politicians in favor of increasing public spending can create support for this view by shifting duties to the employer side while those favoring a smaller public sector would better tax the employee.

♣♣♣

Notes:

- This blog post is based on the authors’ paper The Non-equivalence of Labour Market Taxes: A Real-effort Experiment, The Economic Journal, September 2017.

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: Photo by Sidney Perry on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.

Matthias Weber works at the Center for Excellence in Finance and Economic Research (CEFER) at the Bank of Lithuania and at the Faculty of Economics at Vilnius University. His main research interests lie in the intersection of behavioral economics with macroeconomics, finance, and public economics. He holds a PhD in economics from the University of Amsterdam and has published in multiple academic journals. More information is available at www.weber-matthias.eu.

Matthias Weber works at the Center for Excellence in Finance and Economic Research (CEFER) at the Bank of Lithuania and at the Faculty of Economics at Vilnius University. His main research interests lie in the intersection of behavioral economics with macroeconomics, finance, and public economics. He holds a PhD in economics from the University of Amsterdam and has published in multiple academic journals. More information is available at www.weber-matthias.eu.

Arthur Schram (Ph.D. University of Amsterdam, 1989) is professor of Experimental Economics at the University of Amsterdam and Senior Research Fellow at the Robert Schumann Center of the European University Institute. His research interests include experimental economics, behavioral economics, and political economics. He is co-founder of the Center for Research in Experimental Economics and political Decision making (CREED). From 1998-2007 Arthur Schram was founding co-editor of Experimental Economics. He has published over 50 articles in international, peer-reviewed journals.

Arthur Schram (Ph.D. University of Amsterdam, 1989) is professor of Experimental Economics at the University of Amsterdam and Senior Research Fellow at the Robert Schumann Center of the European University Institute. His research interests include experimental economics, behavioral economics, and political economics. He is co-founder of the Center for Research in Experimental Economics and political Decision making (CREED). From 1998-2007 Arthur Schram was founding co-editor of Experimental Economics. He has published over 50 articles in international, peer-reviewed journals.

I am really confused about this article. When you talk about taxes levied on labour, do you mean only social security contributions? And is the research based only on that? In Australia, there are no “social security contributions” as you have, for example in the UK, via a National Insurance scheme to which employers and employees alike contribute. Social security funding (all social welfare) in Oz come out of general revenue to which all income earners contribute through their income tax. There is also a 2% medical/hospital levy (Medicare) on all income earners’ taxable income. I can’t see how your “taxes paid by employer” form part of your “Aggregate labour costs for employer” unless you are only including as “taxes paid by employer” social security contributions as in the UK . Or are you also including payroll tax, which is a tax levied on labour and paid by some employers? And do you include company tax as a tax levied on employers? My apologies for being a bit clueless about taxation systems apart from in Australia, but I am very interested in the research and would appreciate your clarification. Thank you.

Dear Peter,

In many countries a part of the social security contributions is paid by the employee (that is, deducted from his/her gross wage) while another part is paid by the employer (this part is thus not part of the gross wage). What share of the social security contributions is paid by employers should not matter according to traditional economic reasoning. We show, however, that it does matter (the distinction between social security contributions and taxes is not very important for our results). For the case of Australia, our findings thus suggest that one should expect different economic outcomes if the obligation to pay the contributions would be (partially or fully) shifted to employers. It does not matter whether the employer also pays other taxes or not as long as these are independent of the labor taxes / social security contributions.

Please feel free to send me an email if you have further questions.

Best regards,

Matthias