The eBay Public Policy Lab has together with a team of economists at Sidley Austin LLP built up a suite of research reports uncovering how the internet, technology and online platforms expand economic opportunities also to those who have been largely left out. We have shown that small firms in advanced and emerging economies are equally capable of leveraging the way the online commerce platform reduces the cost of engaging in commerce over large distance.

We have also shown that the online commerce platform empowers entrepreneurs in country regions that are underserved by the traditional economy. Platform-enabled small retail business activity is more geographically inclusive compared to traditional entrepreneurship (e.g. in the US and France). Building on this research, we just released a study on the regional contribution to total enterprise growth in the UK and Germany.

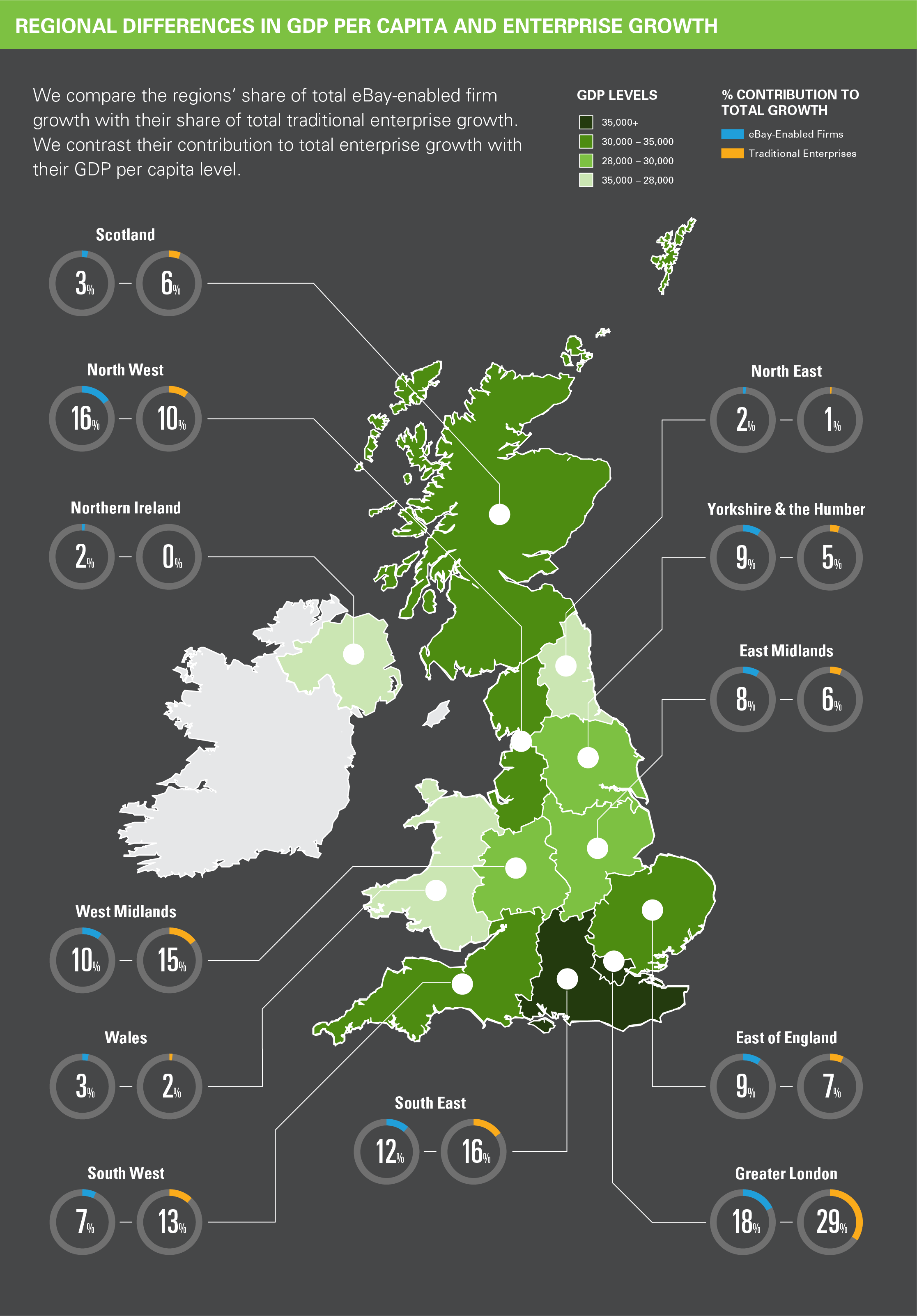

The study compares the contribution by regions to net enterprise growth in the traditional economy with the online platform-enabled economy for the UK and Germany. According to the OECD’s 2016 Regional Outlook, regional disparities have been increasing across UK regions while decreasing across German regions. Our study shows that the growth in eBay-enabled firms is more evenly spread across regions in both the UK and Germany. We also find it to be less concentrated to regions with high GDP per capita levels than traditional enterprise growth. In short, more regions and more poor regions are able to contribute to total enterprise growth in the platform-enabled economy than in the traditional economy.

A word on the methodology

We have calculated the net growth in numbers of eBay-enabled firms (i.e. firms with at least $10,000 USD in annual sales and at least 10 annual transactions on eBay) and compared this with the net growth in numbers of traditional businesses. For the UK, we calculated the growth rate between 2010 and 2015, and for Germany between 2010 and 2014. We have also calculated the geographical distribution of the total growth in numbers of eBay-enabled firms and traditional businesses across NUTS 1 regions for both countries.

The results show the percentage contribution of each region to total growth in enterprise numbers. This produces an overview of how the net enterprise growth is distributed across regions in the UK and Germany. It allows us to compare the regional contribution to the total growth in enterprise numbers in the traditional economy with the platform-enabled economy, as well as with regional GDP per capita levels.

Fuelling regional catching-up in the UK

Regional disparities across regions in the UK have been growing over the last decade. According to the OECD’s 2016 Regional Outlook, the gap in GDP per capita between regions have increased between 2008 and 2013 because poorer regions saw their income decrease whereas richer regions increased their income. For instance, Greater London is 56 per cent more productive (in terms of GDP per worker) than the country average.

Our analysis confirms the concentration of traditional economic activity to the Greater London region. In contrast, platform-enabled economic activity shows much lower dependency on London as a powerhouse and occurs also in regions where traditional economic activity is weak. Indeed, all regions were able to contribute to total eBay-enabled firm growth; even Northern Ireland, one of the regions with the lowest GDP per capita, contributed 2 per cent to total eBay-enabled firm growth but was not able to contribute at all to total traditional enterprise growth.

Although the Greater London region accounted for the largest share of total eBay-enabled firm growth (18 per cent), this share is much smaller than Greater London’s share of traditional enterprise growth (29 per cent). For example, North West England is not far behind Greater London in its capacity to contribute to enterprise growth in the platform-enabled economy (16 per cent) but significantly so in the traditional economy (10 per cent).

In addition, West Midlands and Yorkshire & the Humber, two regions with third-tier GDP per capita levels, captured a share of total eBay-enabled firm growth (11 and 9 per cent, respectively) that is at par with that of South East England (12 per cent), the region with the highest GDP per capita. This contrasts to how West Midlands and Yorkshire & the Humber were able to contribute to traditional enterprise growth (both only 5 per cent) and how they performed vis-à-vis South East England (16 per cent).

The online commerce platform appears to empower entrepreneurship in both disadvantaged and high-performing regions, enabling disadvantaged regions to perform more similar to high-performing regions in terms of entrepreneurial activity.

Figure 1. Regional differences in GDP per capita and enterprise growth (click to see larger)

Source: Sidley Austin LLP analysis of eBay data for period 2010 – 2015. GDP per capital levels for year 2013 from OECD Regional Outlook 2016 Country Notes. Traditional enterprise growth data for period 2010 to 2015 from Regional Time Series, Table 26, UK National Statistics, Business population estimates for the UK and Regions 2016.

Supporting regional catching up in Germany

Regional disparities across German regions have been declining since 2000. According to the OECD’s 2016 Regional Outlook, the gap between the 20 per cent richest and the 20 per cent poorest regions has decreased between 2008 and 2013 because the poorer regions have outperformed the richer regions.

Our analysis shows that traditional enterprise growth in Germany was clustered in the two richest southern regions of Baden-Wurtemberg and Bayern (25 and 24 per cent) as well as the capital region Berlin (24 per cent). Baden-Wurtemberg and Bayern also account for high shares of total eBay-enabled firm growth (13 and 14 per cent) but in contrast to the traditional economy, all four of the poorest regions (Sachsen-Anhalt, Thuringen, Brandenburg, and Mecklenburg-Vorpommern) capture a share of total enterprise growth in the platform-enabled economy.

Moreover, two third-tier GDP level regions, Sachsen and Rheinland-Pfalz, contribute to eBay-enabled firm growth (7 and 5 per cent respectively) at par with that of Berlin (7 per cent). In contrast, Sachsen’s contribution to traditional enterprise growth was a slim 2 per cent and Rheinland-Pfalz contributed negatively (-9 per cent).

The online commerce platform model enabled a more evenly distributed economic activity regionally than traditional economic activity also in a country displaying declining regional GDP disparities.

♣♣♣

Notes:

- This blog post is based on the authors’ paper Sexual Harassment, Workplace Authority, and the Paradox of Power, American Sociological Review, 2012

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: E-commerce, by Mediamodifier, under a CC0 licence

- When you leave a comment, you’re agreeing to our Comment Policy

Hanne Melin is Director of Global Public Policy at eBay’s Public Policy Lab for the EMEA region. The Lab explores issues that sit at the nexus of technology and commerce. Hanne is a member of the European Commission’s Strategic Policy Forum on Digital Entrepreneurship, and represents eBay in the Private Sector Consultative Group of the World Customs Organization. Before joining eBay, Hanne was an associate at the law firm Sidley Austin LLP based in Brussels, practising competition law for five years. Hanne holds a Master’s in International Business Law from King’s College London, is a guest lecturer at the law faculty of Lund University (Sweden), and a frequent speaker and writer on the topic of how the internet and technology transform trade.

Hanne Melin is Director of Global Public Policy at eBay’s Public Policy Lab for the EMEA region. The Lab explores issues that sit at the nexus of technology and commerce. Hanne is a member of the European Commission’s Strategic Policy Forum on Digital Entrepreneurship, and represents eBay in the Private Sector Consultative Group of the World Customs Organization. Before joining eBay, Hanne was an associate at the law firm Sidley Austin LLP based in Brussels, practising competition law for five years. Hanne holds a Master’s in International Business Law from King’s College London, is a guest lecturer at the law faculty of Lund University (Sweden), and a frequent speaker and writer on the topic of how the internet and technology transform trade.