There is growing concern about the increased alienation felt by many people in response to processes of globalisation, the rejection of mainstream policy positions – as evidenced by the Brexit vote – but also of the rise of far-right extremism across the world more generally. At root, these developments reflect a loss of economic control and power experienced by many over their lives, and a sense of marginalisation from political and economic elites. It is within this context, that my colleagues and I – at the University of Glasgow and Nottingham Trent University, in partnership with the New Economics Foundation and Oxfam – have constructed an international Economic Democracy Index (EDI).

Our ambition is to create a measure of the democratic health of economies that speaks to these problems of alienation and disempowerment. Which countries are doing best at engaging and including broader ‘publics’ in economic decision-making and which ones are lagging in democratic participation and empowerment? We feel that an indicator that attempts to measure the extent of democratic processes in the economy should be as important to our understanding of economic development as standard indicators such as GDP. Another objective was to explore the relationship between economic democracy and key public policy goals such as tackling inequality and poverty.

Redefining economic democracy

Conventional definitions of economic democracy – often conflated with industrial democracy – focus on collective bargaining and trade union representation or the existence of cooperative ownership. We are concerned to develop a broader definition that addresses democracy in the economy as a whole. How democratic is an economy? How well distributed is economic decision-making power and how much control and economic security do people have over their lives?

To this end, our index has been constructed from four components, which are critical to an expanded view of economic democracy: ‘workplace + employment rights’, which includes levels of employment protection and insecurity, employee participation and managerial attitudes; ‘degree of associational economic democracy’, involving levels of trade union organisation, employers’ organisation and collective ownership (such as percentages of co-ops and credit unions); ‘distribution of economic decision-making powers’, a range of measures of the concentration of economic power (strength of financial sector, geographical concentration of government fiscal powers and so on); and ‘transparency and democratic engagement in macroeconomic decision making’ (for example, the extent of different social partners in decision making, accountability and levels of corruption and central bank transparency).

Key findings: levels of economic democracy across the OECD

The index (the EDI) is compiled from data available for 32 countries in the OECD (omitting Turkey and Mexico, which had too much missing data), although our ambition is to construct a much broader global index that would include more countries from the global south.

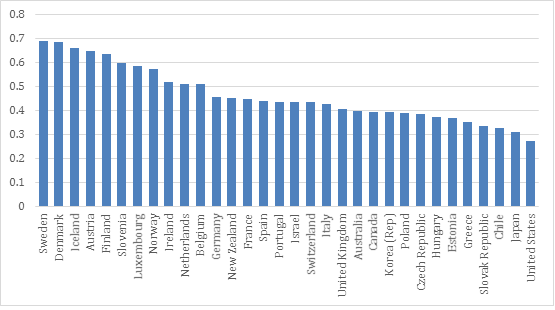

Our findings (Figure 1) will not surprise those versed in varieties of capitalism arguments: there is a stark difference between the ‘social’ model of northern European capitalism and a more market-oriented Anglo-American model. The Nordic countries are particularly highly ranked, due to greater levels of social protection, employment rights and democratic participation. The reverse is true of the more deregulated economies of the English-speaking world: the UK performs relatively poorly (20th out of 32), while the US ranks bottom. Japan also ranks near the bottom.

Figure 1. Economic Democracy Index, 2018

The best performing countries tend to be Nordic, with Sweden and Denmark clearly ahead of the rest; Iceland and Finland also feature strongly. Austria also performs well. Notably, the top ten countries all have relatively small population sizes (under twenty million), although statistical analysis suggests it is not population size per se that is responsible for this result, but particular institutional configurations and governance frameworks.

Although the picture varies across the OECD, there has been a general decline in levels of economic democracy since the financial crisis. This has been particularly pronounced in the European Union, with only France and Luxembourg experiencing an increase since 2009. This appears to be the result of austerity policies in response to the recession and crisis where governments have reduced spending and cut levels of employment protection. While justified to increase flexibility for employers, our results suggest this may increase inequality and poverty, and at the same time may also lead to deteriorations in labour productivity.

The relationship between the EDI, inequality, poverty and productivity

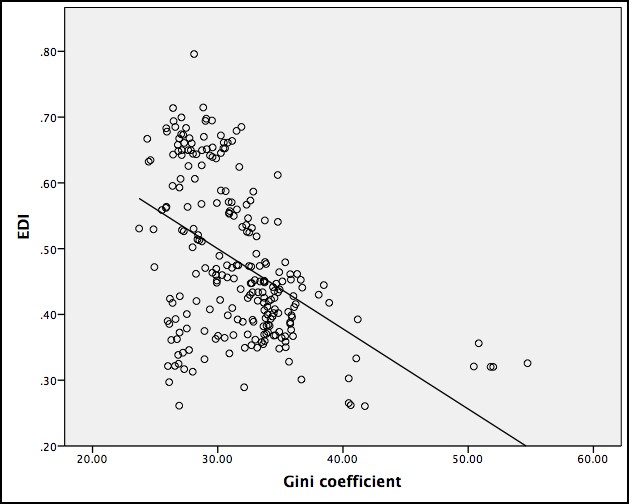

Following the construction of the index, we have used statistical analysis to explore the relationship between economic democracy, inequality and poverty. A striking finding is the strong, negative and statistically significant correlation between the EDI and poverty and inequality measures. In other words, as EDI rises, poverty rates and inequality fall (see Figure 2). Econometric analysis also suggests that there is a very strong causal relation between the EDI and inequality (as measured by the Gini coefficient). High levels of economic democracy reduce inequality.

Figure 2. EDI and Gini coefficient

We also find – contrary to many mainstream policy assumptions by global institutions such as the IMF and OECD, which have for many years advocated greater labour market flexibility and deregulation – that greater employment protection and regulation can actually enhance economic performance. In particular, it is worth noting that there is a very strong and statistically significant relationship between EDI and labour productivity. Econometric analysis also reveals that this relationship is a causal one. In other words, high levels of EDI generate higher productivity.

Policy implications

Our findings imply that countries with higher levels of economic democracy such as Norway, Denmark and Iceland have much lower levels of inequality and poverty than the US and UK. Moreover, they suggest that a combination of individual employment security, decentralised economic decision-making, and greater transparency and democratic engagement in macroeconomic decision-making enhance economic democracy and therefore may counter pressures associated with rising inequality and poverty. There is no one model or route map to higher levels of economic democracy and more inclusive governance, which can be produced by different institutional configurations. However, two common features of strong performing countries are high levels of individual employment rights – particularly the protection of income levels when people become unemployed – and strong social partnership and collective governance institutions.

These findings challenge much of the conventional policy wisdom of the 1990s onwards regarding the perceived benefits of Anglo-American style flexible labour market policies, employment and financial deregulation, and macroeconomic management, suggesting such approaches may contribute to poverty and inequality. The findings raise concern about the EU’s approach to economic management in terms of Greece’s low ranking, and the impact of the Troika’s policies on Greek national income (and hence poverty levels). Moreover, there is also a warning for France’s new president, Emmanuel Macron, who has been a recent advocate of Anglo-American style flexible labour market policies. Following such policies may increase alienation and marginalisation, fuelling the rise of the far right.

♣♣♣

Notes:

- This blog post appeared originally on Democratic Audit UK. It’s based on the work of the Democratising the Economy project, which is funded by the Economic and Social Research Council.

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image credit: TTIP protests in London, by Global Justice Now, under a CC-BY-2.0 licence.

- When you leave a comment, you’re agreeing to our Comment Policy

Andrew Cumbers is professor of regional political economy at the University of Glasgow.

Andrew Cumbers is professor of regional political economy at the University of Glasgow.

The EDI and poverty relation is very well reflected in your analysis. I would like to say that an economy by the people, for the people and to the people would bring more equal and just development. If economy is democratized than every individual will have not only an opportunity to participate in development but also get share in it. This is ECONOMIC DEMOCRACY.

,