Britain has an extensive canal and navigable river network, which played a vital role in transporting goods from the Industrial Revolution through the 18th, 19th and early part of the 20th centuries. Their use for transporting freight had all but disappeared by the mid-20th century, and many had fallen into disrepair or been abandoned. Since then, the canal and waterway network has been restored and developed into a potentially valuable environmental and recreational amenity, providing the venue for an extensive range of tourism and leisure activities and a habitat for wildlife. Canals also provide transport corridors for walkers and cyclists along the towpaths formerly used by horses for drawing boats. Features of the canals are an attraction to those interested in industrial heritage and canal-side properties can have distinctive character with an outlook over green space and water.

Our recent research investigates the value of this resource to local residents in England and Wales, using house prices. Analysis of house prices is a well-established method within urban and environmental economics for establishing the value of amenities – such as good schools, transport, low crime or low pollution. This value is expressed as the monetary value of other types of consumption that people have to sacrifice in order to pay more for housing close to a desirable amenity (or away from an undesirable one). Part of our analysis looks at prices close to canals across the whole of England and Wales, and part looks specifically at the change in prices induced by the restoration of the Droitwich Canals in the West Midlands in the after 2007.

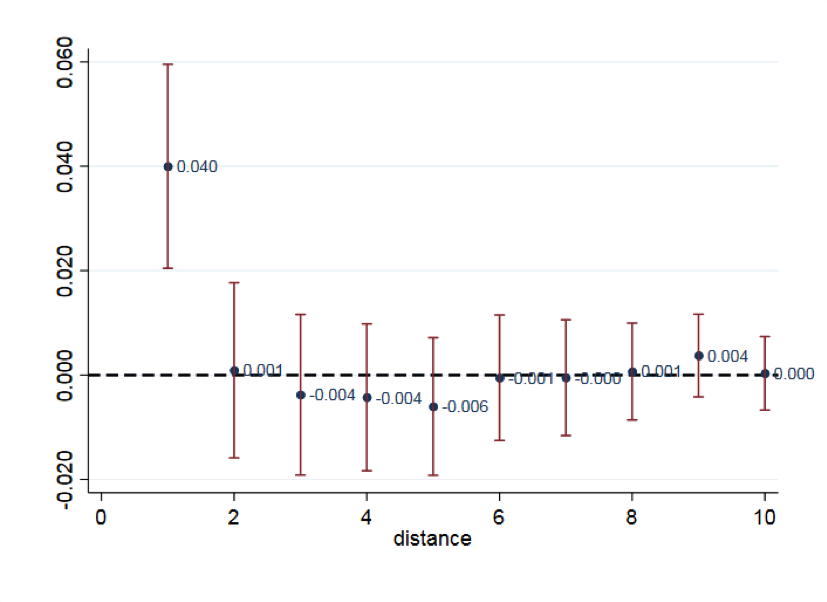

We find that there is a quite a large house price premium for living close to a canal, but this is very localised (see Figure). On average, a buyer can expect to pay around 3-4 per cent more for a property within 100 metres of a canal relative to prices elsewhere (in 2016 prices), but this premium falls to zero beyond 100m. The implication is that the price effect is driven predominantly by canal-side properties and others with a direct outlook on the canals or immediate access. There is no premium for living near a canal other than right up close to it. The premium is higher in dense urban areas, as we would expect if people are willing to pay more when green space is scarce. We also find evidence that canal-side locations have been attractive for developers, with a much higher proportion of new-build sales within 100m of canals relative to elsewhere – a 5.9 percentage point increase on an 7.8 per cent baseline.

Figure 1. Price premium for properties close to canals and waterways, 2002-2016 data

Notes: Point estimates and 95% confidence intervals from regression in prices on 100m distance-to-canal bands. Distance scale in 100m. Vertical scale is prices in log points relative to properties between 1000m and 1500m from canals and waterways (0.01 = 1%). Figure reports price differentials adjusted for local authority x year x quarter trends, housing, distances, land cover, employment and lower layer super output area fixed effects

Interestingly, the premium fell suddenly at the time of the last recession, from over 8 per cent in 2007 to 4.4 per cent in 2008. This step change suggests there was a structural shift in the demand for this environmental amenity at the time of the recession and the premium has not recovered since (up to the end of our data in 2016). A possible explanation is that demand shifted away from luxury aspects of property, including canal-side locations, as incomes fell and uncertainty about the housing market increased.

Some back-of-the-envelope calculations indicate that the environmental benefits provide an uplift to land values within 100 metres of canals in England and Wales that amounts to around £0.8-£0.9 billion in 2016.

How we did the analysis:

Although the idea of using house prices to value amenities is conceptually simple, there are challenges. The basic method is to use statistical techniques to estimate the average price difference between houses with a high level of an amenity (or dis-amenity) and similar houses with a lower level. Clearly, a key requirement is data on some variable that represents this exposure, in our setting, the indicators of distance from a property to its nearest canal. There are, however, potentially many ‘confounding factors’ which vary with distance to a canal and also affect the price directly – the physical characteristics of the housing, other amenities like distance to employment or distance to transport. Estimation methods must take account of these confounding factors so we are comparing houses on a like-for-like basis. Failure to do so might lead us to attribute differences in prices to proximity to canals, when in reality the price differences are caused by something else.

For example, if canals in urban areas are predominantly in old industrial areas, and these industrial areas have older smaller houses and industrial buildings that are less attractive to residents, it might appear that proximity to canals reduces prices when in fact it is the average size of the houses or the industrial character of the environment which reduces prices.

To avoid this type of bias, we adopt two strategies in our study. First, we use standard multiple regression techniques to estimate the association between canal proximity and housing prices, while adjusting for a rich set of structural housing characteristics and local area attributes on which we can obtain data (‘control variables). We control for a wide range of land use indicators, distance to geographical features, employment and demographic variables, and in our preferred versions of these specifications, we further control for ‘fixed effects’ at a small geographical scale – either middle layer super output areas (MSOAS) or lower layer super output areas (LSOAs) – and for differing price trends at local authority district level. This means we estimate the price effects from variation in the distance to canals, and associated variation in house prices, that occurs within these small geographical areas. Confounding factors that vary at a higher geographical level between LSOAs/MSOAs – such as access to labour markets – are eliminated.

Our second strategy focusses on a specific canal regeneration project, which restored an abandoned canal – the Droitwich Canal in the West Midlands of England. The Droitwich Canals were closed in 1939 and in the early 2000s were mostly overgrown, drained of water, non-navigable or completely destroyed. They underwent a major restoration from 2007 onwards and were re-opened in 2011. The restoration reopened them for boat navigation and recreation, improved the general environment and provided a habitat for aquatic life. In this case, we compare the price changes occurring in a ‘treatment group’ of properties close to the canal when the canal was restored, with price changes occurring at the same time in appropriate ‘control groups’.

The assumption behind this method is that prices would have evolved in the treatment group close to the Droitwich canals in much the same way as in the control group, if the Droitwich canals had not been restored. As control groups, we use places further away from the Droitwich canal, and places close to an existing neighbouring canal – the Worcester and Birmingham canal – that has remained in continuous use, and where we would not expect to say any environmental amenity-related price changes at this time. These comparisons allow us to estimate the value of the restoration and the enhanced recreational and environmental amenities it provides, in so far as this value shows up in different price changes in the treatment and control groups. This type of ‘difference-in-difference’ estimator is widely used for estimating the impact of policies on economic outcomes in the policy evaluation literature. Both methods give similar findings, with a sharp increase in prices close to canals, with larger but less precise measure effects from the analysis of the Droitwich canals restoration.

♣♣♣

Notes:

- Disclosure: the research was funded by the Canal and Rivers Trust, but carried out independently by researchers at the Centre for Economic Performance and Department of Geography and Environment.

- This blog post is based on the author’s Valuing the Environmental Benefits of Canals Using House Prices, CEP Discussion Paper No 1604, March 2019.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image by Garry Knight, under a CC BY-SA 2.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Stephen Gibbons is professor of economic geography at LSE. He is the director of the Spatial Economics Research Centre and the Urban and Spatial Programme of the Centre for Economic Performance (CEP).

Stephen Gibbons is professor of economic geography at LSE. He is the director of the Spatial Economics Research Centre and the Urban and Spatial Programme of the Centre for Economic Performance (CEP).

Cong Peng is a PhD student in economic geography at LSE, and a researcher in the project of urbanisation in developing countries.

Cong Peng is a PhD student in economic geography at LSE, and a researcher in the project of urbanisation in developing countries.

Cheng Keat Tang has a PhD in economic geography from the LSE. He is a visiting research fellow at the University of Southern California and in July 2019 will join Nanyang Technological University as an assistant professor.

Cheng Keat Tang has a PhD in economic geography from the LSE. He is a visiting research fellow at the University of Southern California and in July 2019 will join Nanyang Technological University as an assistant professor.