The European Union’s Capital Markets Union (CMU) was created with the goal to increase the depth of investor participation and the breadth of instruments deployed in capital markets across Europe. One key direction of these reforms, from the start of the CMU development and deployment, has been the need to reduce heavy reliance of European companies on the banking sector, especially among small-to-medium-sized enterprises (SMEs).

From the start, the CMU took aim at a series of structural bottlenecks in the common currency institutions exposed by the global financial crisis, the great recession and the Eurozone sovereign debt crisis (EAFEDC) of 2008-2014. The CMU attempts to:

- Support economic growth in the EU by improving the lending and investment environment for European companies, especially SMEs;

- Rebalance investment funding channels available to European firms away from bank-issued debt, toward equity and direct debt (bonds) funding, as well as other channels for financing, including private equity, peer-to-peer lending and investments, hybrid investment instruments, angel financing and venture capital; and

- Increase private financing for large-scale state- and EU-sponsored infrastructure projects.

Reality on the ground

However, as argued in our recent paper, since launching the action plan for the Capital Markets Union in 2015, the CMU reforms have been accompanied by an increase in European SMEs reliance on bank-intermediated lending.

Our analysis shows that in recent years the CMU core pillars of broadening and deepening SMEs funding markets have been displaced by reforms more favourable to the banking sector and to the larger financial institutions, such as large pension and insurance funds. CMU efforts have also been diverted towards initiatives irrelevant to building stronger capital markets, detracting resources and attention from effective solutions.

Heavier reliance on banks and large financial institutions, paired with too strong of a focus on de-risking of the European banking sector under the European Banking Union reforms, hurts economic diversity and growth, restricts financial capital available for SMEs investment in innovation, R&D and other higher risk activities, and puts investors, taxpayers, and SMEs at a risk of systemic spillovers from the banking sector during the next economic crisis.

Specifically, based on data from a range of European and international sources, we show that in the three years since CMU development, the overall share of bank lending in non-financial corporate funding in the Euro area remained at roughly two and a half times that of their U.S. counterparts. Bank lending, as a share of total non-financial corporate debt, stood at around 20 per cent in the U.S. at the end of 2017, compared to over 75 per cent in the EU. European SMEs continue to rely on bank-issued debt as frequently in 2018 as they did in 2016, when interim CMU impact was first measured. Meanwhile, listed equity financing lost significant ground in Europe over the 2008-2017 period. Despite originally successful efforts by the EU to restart securitisation markets post-EAFEDC, volume of securitisation in the EU has fallen consistently in 2015-2017, reaching the lowest levels since 2008. SMEs share of total securitisation has fallen from a peak of 18 per cent in 2008 to just over 2 per cent in 2017.

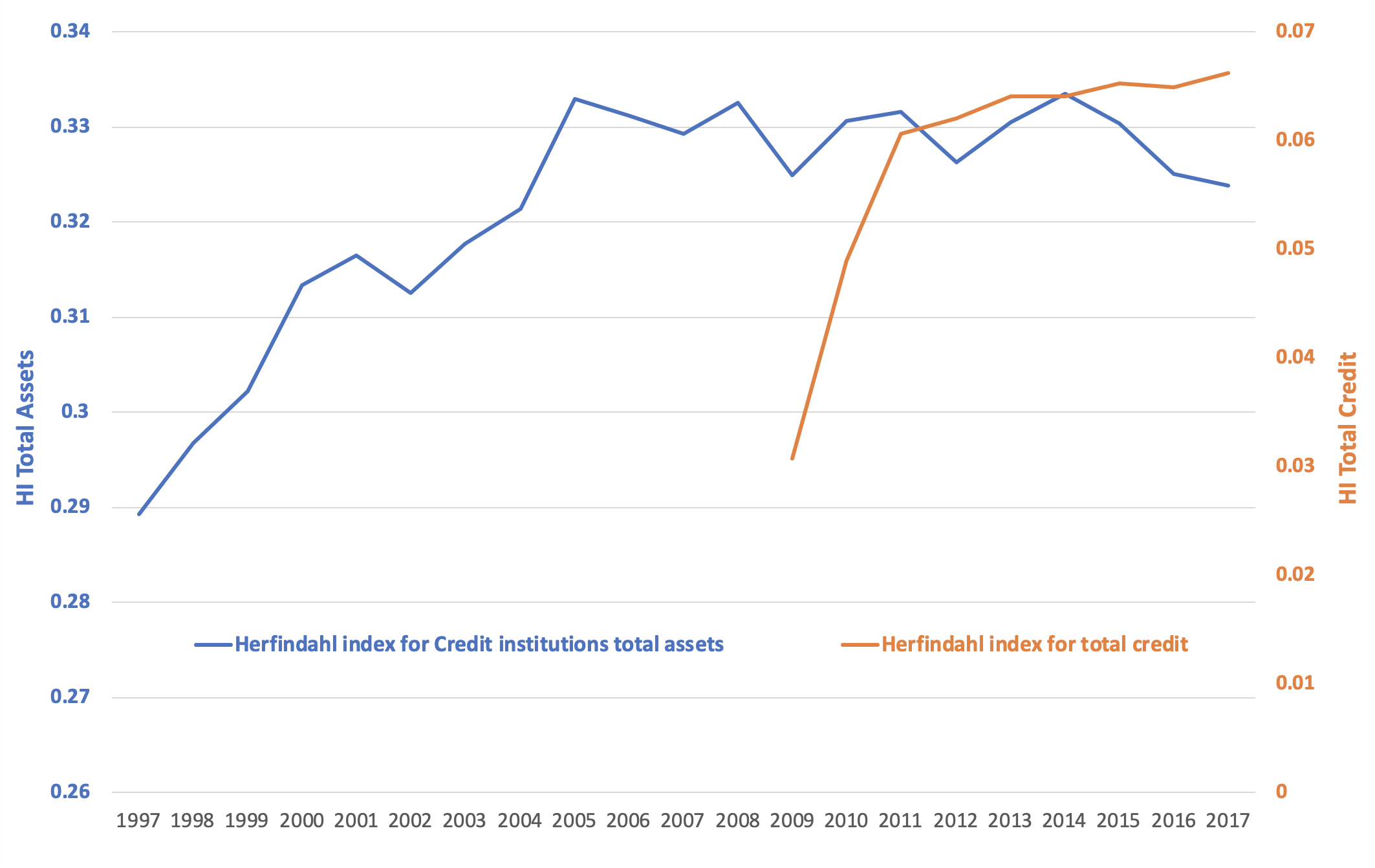

European SMEs’ dependence on bank-intermediated lending continues to pose serious structural risks to the sector that accounts for more than 70 percent of the EU’s private sector employment and a substantial proportion of job growth. Despite targeting deeper and broader capital markets, development of the CMU has been accompanied by increasing oligopolisation of the banking sector. Our data shows strong evidence of rising concentration in both overall assets and loans on the banks balance sheets (Figure 1).

Figure 1. Herfindahl indices for Euro area (EA 12) credit institutions

Source: Authors’ own calculations based on data from Eurostat and the IMF

Source: Authors’ own calculations based on data from Eurostat and the IMF

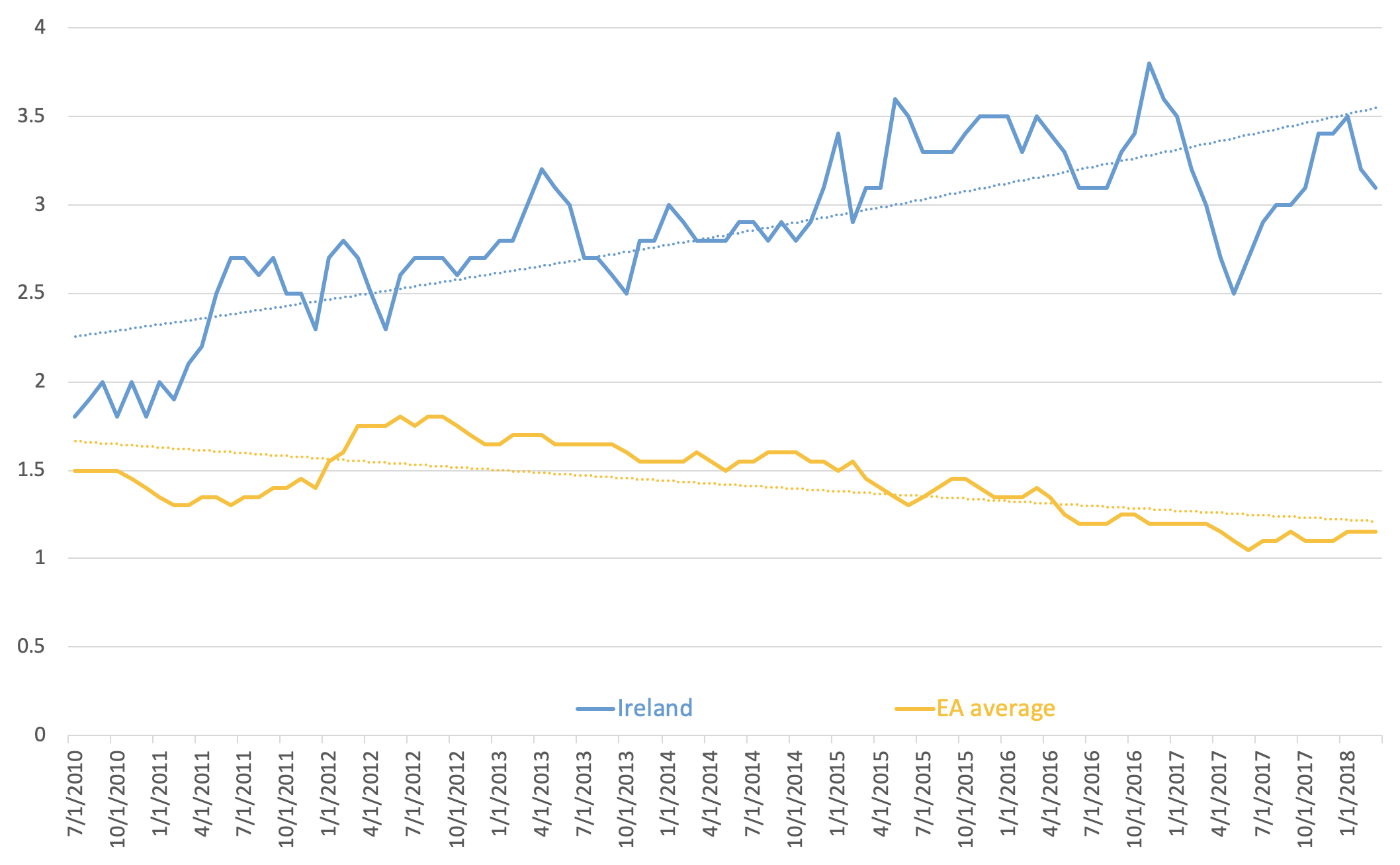

At the same time, although cost of bank finance has improved for SMEs (Figure 2), these improvements in the cost of capital for SMEs fell short of the overall drop in the interbank funding rates and ECB policy rates. In some countries, e.g. Ireland, the cost of bank finance to SMEs actually rose during the period of the post-EAFEDC recovery. In other words, Euro area SMEs did not benefit to the full extent from the quantitative easing programs deployed by Frankfurt, with the policies pass-through rates generating an uplift to the banks profits margins at the expense of the SMEs.

Figure 2. Difference between interest rates on small (<0.25 million Euro) and large (>1 million Euro) NFC loans (3 month moving average)

Source: Authors’ own calculations based on the data from the Central Bank of Ireland (Figure 29, SME Market Report 2018).

Source: Authors’ own calculations based on the data from the Central Bank of Ireland (Figure 29, SME Market Report 2018).

Incomplete reforms

Despite the European Union’s devotion to the Capital Markets Union and the multitude of regulations and initiatives enacted to support its success, the CMU is still highly incomplete, fragmented and ineffective in delivering on its core objectives to foster real economic activity within the EU. Actions taken under the CMU umbrella are in need of reconsideration or revision in order to fulfil their purported intent and to prevent mission drift.

In our paper for the GUE/NGL group, we propose refocusing of the CMU development and deployment in 2019 and onwards toward the original core objectives of the CMU, while putting renewed emphasis on the CMU as a core reform package aiming to deliver new and broader sources of funding to European SMEs. These reforms should include:

- Introducing regulatorily-controlled home-bias risk premiums for banks’ capital;

- Creating a unified system of financial information disclosures and sharing, covering the SMEs interested in accessing funding markets;

- Improving audit regulations for audit companies operating in the SMEs and large enterprises sectors;

- Increasing accountability and risk assessment capacity of the ESMA;

- Creating pan-European sovereign bond product to 1) provide added liquidity to bond markets for government bonds and 2) support the newly emerging focus of the CMU on large-scale investment projects and improved markets for occupational pensions provision;

- Deploying across the EU national-level best practices in incentivising equity and direct debt investment in SMEs, including by broadening the definition of professional investors for the purpose of increasing new sources of funding to the SMEs.

Within the current structure of the Euro area, it is not possible to fully implement the CMU at scale and with the ambition envisioned by the EU Commission. Due to the incomplete nature of the European Union, policy makers should continue to focus on redesigning the regulatory environment to help facilitate gradual strengthening of a common European market. As long as the existent markets are dominated by considerations of the home bias in investment, debt-focused financing, and lack of coherent framework on SMEs-related risk assessment and valuations, the current version of the CMU reforms will continue to shift systemic risks embedded in the banking system to other lenders and investment providers, and to SMEs, thereby undermining the economic growth potential of European SMEs.

♣♣♣

Notes:

- This blog is based on the authors’ paper “Capital Markets Union: An Action Plan of Unfinished Reforms” prepared for GUE/NGL group, European Parliament.

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image by Clay Banks on Unsplash

- Before commenting, please read our Comment Policy

Constantin Gurdgiev is professor of finance with the Middlebury Institute of International Studies at Monterey, California and an adjunct professor of finance with Trinity College Dublin in Ireland. Professor Gurdgiev works in the areas of investment markets, with specialisation on macroeconomic and geopolitical risk impacts, and heads the Middlebury Institute’s ImpactLab – an experiential learning and research program in environmental, social, and governance finance and risk impact. He advises a range of institutional and corporate clients on macroeconomic risks in European and Russian financial markets, and writes a blog on economics and finance.

Constantin Gurdgiev is professor of finance with the Middlebury Institute of International Studies at Monterey, California and an adjunct professor of finance with Trinity College Dublin in Ireland. Professor Gurdgiev works in the areas of investment markets, with specialisation on macroeconomic and geopolitical risk impacts, and heads the Middlebury Institute’s ImpactLab – an experiential learning and research program in environmental, social, and governance finance and risk impact. He advises a range of institutional and corporate clients on macroeconomic risks in European and Russian financial markets, and writes a blog on economics and finance.

Tracy Lyon is a researcher with the ImpactLab at the Middlebury Institute of International Studies at Monterey, where she is pursuing an MBA and an MA in nonproliferation and terrorism studies. In July 2019, Tracy will join BNP Paribas as an assistant vice president, Group Financial Security, US. She holds a BA in political science with a specialisation in international relations from the University of California Santa Barbara.

Tracy Lyon is a researcher with the ImpactLab at the Middlebury Institute of International Studies at Monterey, where she is pursuing an MBA and an MA in nonproliferation and terrorism studies. In July 2019, Tracy will join BNP Paribas as an assistant vice president, Group Financial Security, US. She holds a BA in political science with a specialisation in international relations from the University of California Santa Barbara.

Matt Salyer is a researcher with the ImpactLab at the Middlebury Institute of International Studies at Monterey, where he is pursuing an MBA and an MA in social enterprise management and finance. Matt previously spent 8 years working in organisational development at California state University at Monterey Bay. Matt is currently working on a project with Stanford University’s Hopkins Marine Station on developing strategies to achieve financially sustainable scaling of programs that address public health and environmental challenges across the developing world.

Matt Salyer is a researcher with the ImpactLab at the Middlebury Institute of International Studies at Monterey, where he is pursuing an MBA and an MA in social enterprise management and finance. Matt previously spent 8 years working in organisational development at California state University at Monterey Bay. Matt is currently working on a project with Stanford University’s Hopkins Marine Station on developing strategies to achieve financially sustainable scaling of programs that address public health and environmental challenges across the developing world.