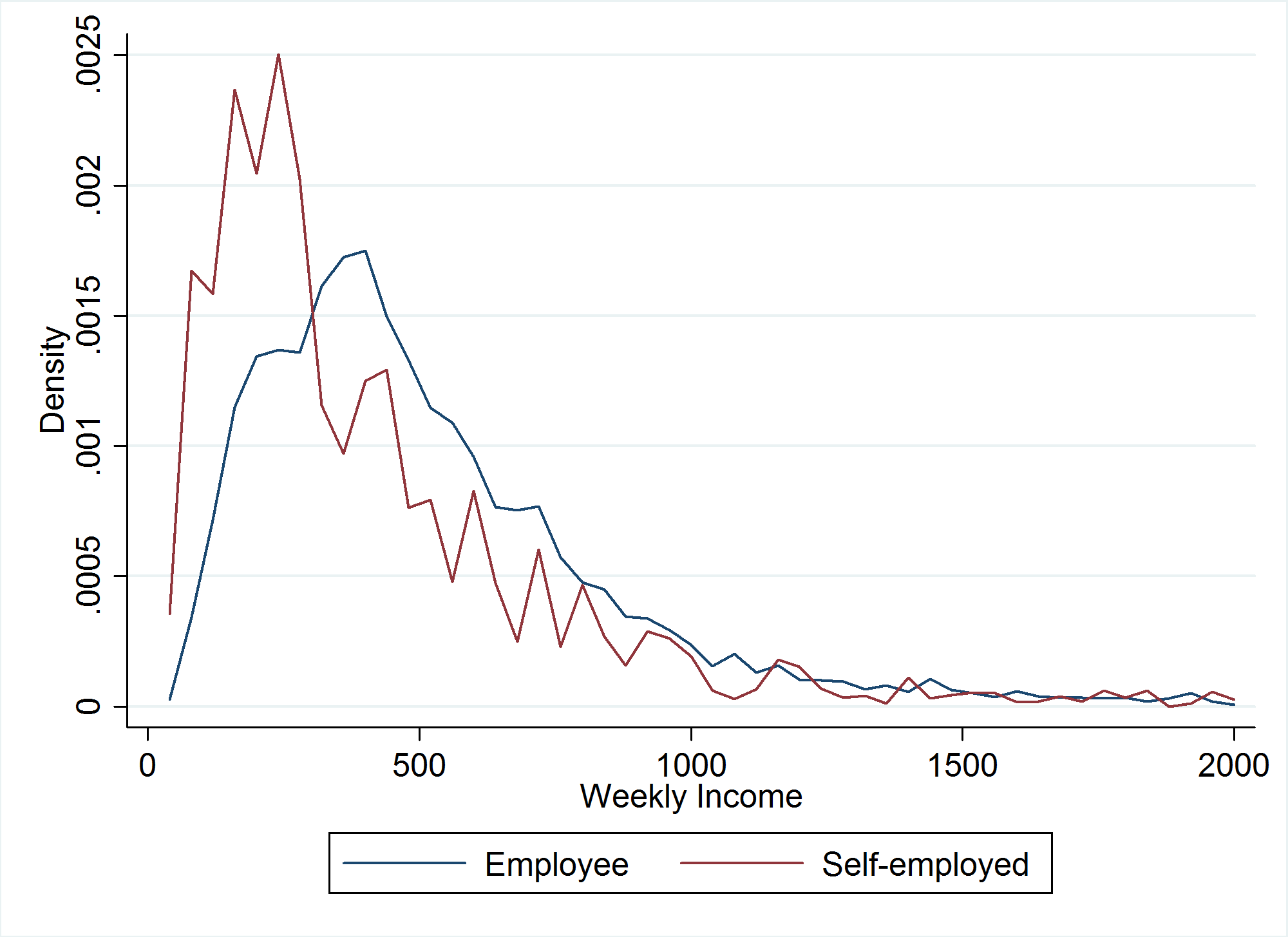

The past two decades have seen a large increase in the number of workers engaged in “atypical” work arrangements. This type of work includes employment like zero-hour contracts (ZHCs), gig work such as driving an uber or taskrabbiting, and various types of other self-employment like freelancing. In the UK, the proportion of solo self-employed (e.g. freelancers, contractors, gig and crowd workers) has risen by 25 per cent since the turn of the millennium, and since the early 1980s has doubled (see figure 1). The number of workers on ZHCs has similarly increased from 200,000 to almost a million since the year 2000. In the United States, similar trends have been identified with estimates suggesting a 20 per cent rise between 2005 and 2015 in the proportion of workers engaged in atypical work arrangements.

Figure 1. Self-employment in the UK

Source: Labour Force Survey

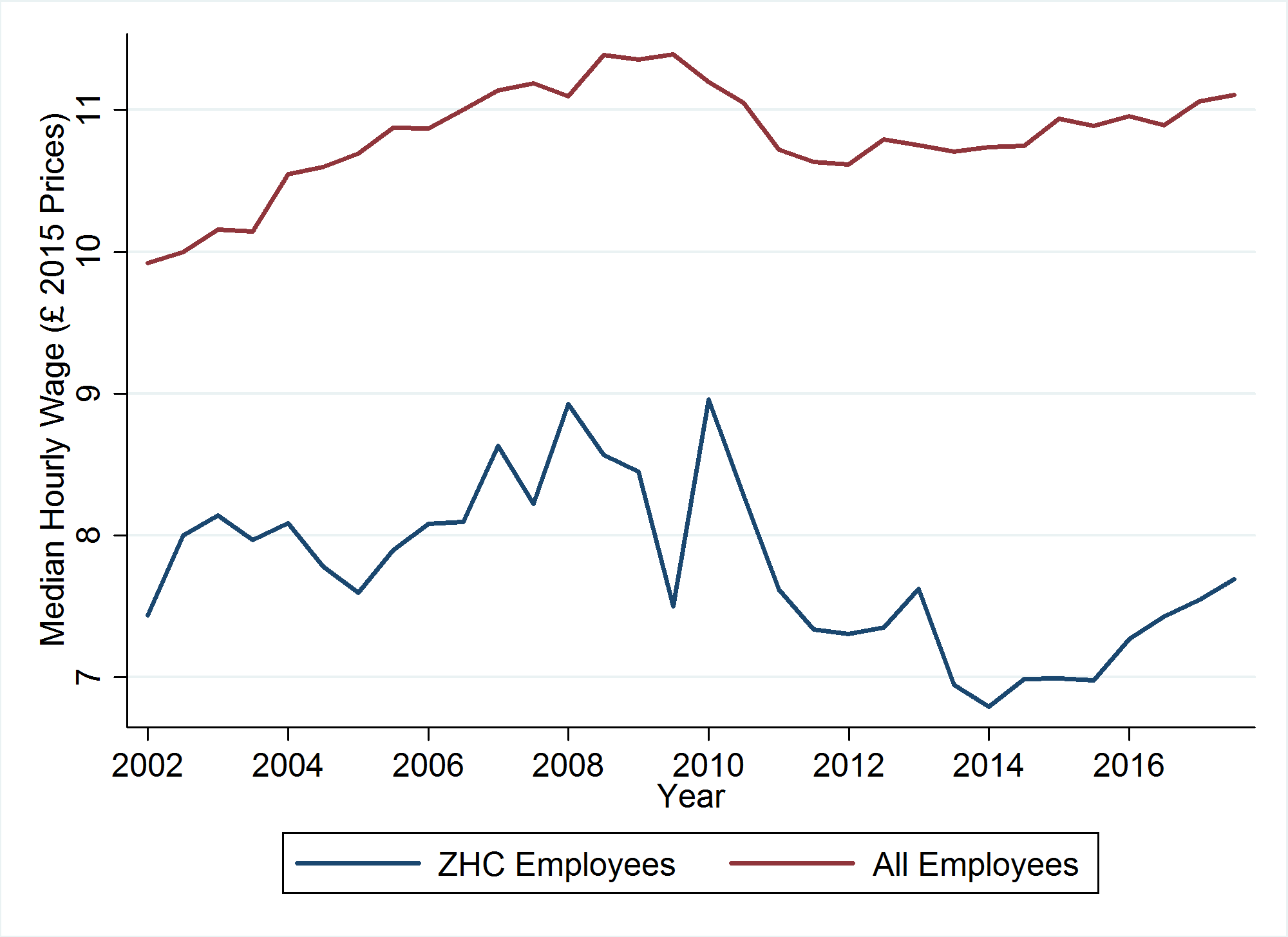

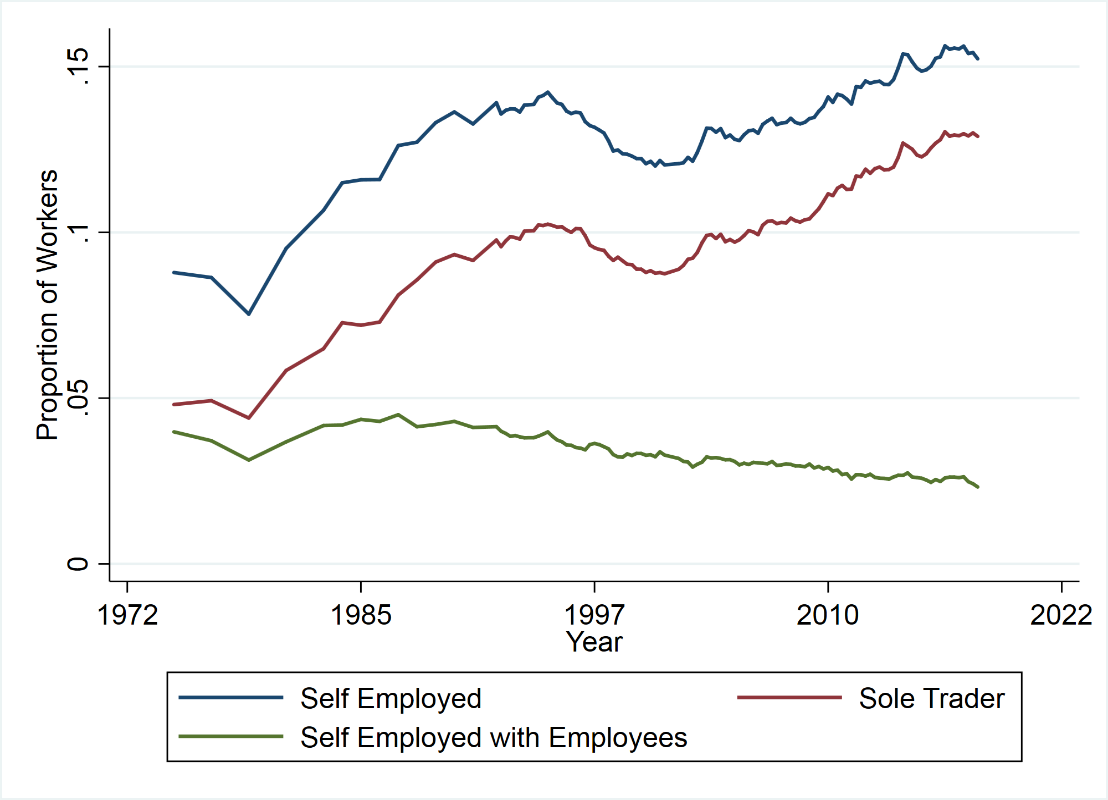

With all other things being equal, these shifts in work patterns are likely to have an impact on workers’ welfare. Income and wages for atypical workers are on average lower than traditional employees (see figures 2 and 3), and evidence from the great recession suggests that workers on ZHCs experienced a greater drop in wages and weaker recovery (see figure 3). Atypical work arrangements are also not afforded certain non-pecuniary benefits such as job security and holiday and sick pay. Conversely, they may offer other benefits such as flexibility, autonomy and a favourable tax structure. This indicates two possible mechanisms, with different implications for workers’ welfare. One where firms are demanding fewer traditional employees, thus pushing workers into more precarious working conditions with lower wages, and another where workers choose to sacrifice pay and security for more flexible and autonomous working arrangements.

Figure 2. Employee vs self-employed income in the UK

Source: Family Resource Survey

Figure 3. UK hourly wages for all employees and zero hour contracts, 2002-2018

Source: Labour Force Survey

My research suggests that worker preferences have little to do with the rise in atypical work arrangements, and that workers in both the UK and US far prefer job characteristics associated with traditional employer-employee relationships. In particular, a permanent contract is the most valued job attribute by a sizeable margin. These preferences hold even when looking at just the subgroup of atypical workers, suggesting that approximately 50 per cent of workers engaged in atypical work would prefer more traditional employment relationships. Workers aren’t in atypical jobs because they want to be – they’re in them because they don’t have other viable income options.

By using an experimental research design where respondents in a representative survey are offered fictitious job choices, with jobs described by different attributes, I am able to elicit an individual’s value of a certain job characteristic. The job characteristics that I examine are length of employment contract, entitlement to holiday and sick pay, hours and location flexibility, workplace autonomy and taxation implications. Though the list of job attributes is not exhaustive, it contains arguably the most important distinguishing factors for typical and atypical work arrangements. It is worth noting that for a more complete US setting, the job attributes would also have included health care coverage, however this was less important for the UK, so was omitted.

I find that on average, workers are willing to give up approximately 50 per cent of their hourly wage for a permanent contract over a one-month one. There are important institutional differences between the UK and US when it comes to permanent contracts. In the UK, permanent contracts offer a host of additional benefits such as unfair dismissal protection, mandatory redundancy pay and notice periods, and there is no similar legislation in the US. Despite this fact, the valuations of a permanent contract are very similar between the two countries (55.4 per cent of an hourly wage in the UK, and 44.1 per cent in the US).

Workers are also willing to pay highly for holiday pay and sick pay (28 days paid annual leave and 16 weeks paid occupational sick leave), with UK-based workers willing to give up around 35 per cent of their hourly wage for holiday and sick pay. In the US, the figure is slightly lower, but still very high at 27 per cent. US employees currently face no federal legislation on either benefits, 23 per cent of US employees receive no voluntary paid leave, and the average US employee only receives 14 paid days holiday per year. These results suggest that the majority of US workers have a strong taste for some UK style labour market policies, and may benefit greatly from such policies. However, to make a full assessment of such a policy introduction it would be necessary to understand how firms would react to the policy change.

Workers do value the characteristics associated with atypical work arrangements, though on average far less so than security. The most highly valued atypical work attribute was the ability to work from home, with both UK and US respondents willing to give up around 24 per cent of their hourly wage for such a benefit.

Surprisingly, neither respondents in the US or the UK were willing to give up any wages to be able to declare taxes as self-employed and enjoy the ability to offset certain expenses against their tax bill (in fact people wanted paying to take on this attribute). This held even for just those who were self-employed and would have extensive knowledge of the value of such a benefit. This result is suggestive that declaring taxes as self-employed is costly, potentially in terms of time or by requiring the help of a professional accountant.

In the UK, these results give credence to certain policy recommendations outlined in the government commissioned Taylor Review. Policies aimed at securing workers in precarious employment relationships rights closer to employees may give a welfare boost to these workers, depending on how firms react to these policies. Other policies aimed at offering workers more security, such as the “right to request” guaranteed hours, may also have positive welfare impacts. Such a policy would also appreciate that there is heterogeneity in preferences. Conversely, other policies recommended in the Taylor review, especially those concerning tax alignment between employees and the self-employed should be considered more carefully. Individuals appear to prefer being taxed through the PAYE system, thus forcing the self-employed to pay relatively higher tax rates than they currently face, while also having to fill tax returns may be a step away from a fairer tax system.

♣♣♣

Notes:

- This blog post is based on the author’s “Willing To Pay For Security: A discrete choice experiment to analyse labour supply preferences”, a discussion paper of LSE’s Centre for Economic Performance (CEP).

- The post gives the views of its author, not the position of LSE Business Review or the London School of Economics.

- Featured image by Neil Schofield, under a CC-BY-NC-2.0 licence

- Before commenting, please read our Comment Policy

Nikhil Datta is a researcher in the labour section of LSE’s Growth Commission. His main research areas are the share of income earned by those at the bottom of the earnings distribution, and the effects of minimum wages. He is also involved in assessing the impacts of free trade agreements, and looking into the effects of Brexit and possible policy responses.

Nikhil Datta is a researcher in the labour section of LSE’s Growth Commission. His main research areas are the share of income earned by those at the bottom of the earnings distribution, and the effects of minimum wages. He is also involved in assessing the impacts of free trade agreements, and looking into the effects of Brexit and possible policy responses.

The pandemic has exposed how fragile the system is. Within weeks big company’s like Carphone warehouse declare bankruptcy. We can all see the obvious problems with the current system like the current low interest rates blowing asset bubbles all over the globe> Life is not fair, and it will probably never be. It would be nice if the current governments got together and took on the all powerful corporations and banks to make the system just “a little” more fair and sustainable for the rest of us. I don’t think it will happen. I do not want my life to be only measured by how much money and assets I can accrue before I die, like some bad Monopoly game. Innovation , saving and hard work should be encouraged, stock buy backs , derivatives ,tax evasion, casino type speculation should be discouraged. I realise the city/UK makes a lot of money through it. The real benefits are only felt by the ultra rich.