The role of innovation in explaining economic performance has been a focus of economic research for decades, and many questions remain unanswered. One of the main challenges is how we measure innovation. Only by improving the information we have at the firm level can we say something about the links between productivity, firm performance and the implementation of new ideas. In our working paper, we contribute to this end by measuring innovation using a new firm level data set, then relating it to firm performance.

The empirical literature linking innovation and productivity in firms dates back to Griliches (1979; 1986), whose work links research and development to productivity outcomes. Yet the link between innovation and productivity is still ambiguous for what concerns small and medium enterprises (SMEs): it may further vary along age, size or sector lines. In our work, we use a novel mix of UK administrative microdata, media and website content to develop novel measures of firm innovation. This mix complements existing metrics such as patents, trademarks and self-reported innovation surveys. We match these data to a large cross-sector panel of UK SMEs and explore innovation-productivity connections with more richness and robustness than previous studies.

To do this, we exploit a cutting-edge data set developed by the data science firm Growth Intelligence (GI), which uses machine-learning routines on company website and media content to model firms’ life-cycle ‘events’ (for example, new product/service launches, mergers and acquisitions, new hiring, or joint ventures). We clean and refine these variables, using structural topic modelling to better align the reported GI data with underlying real-world activity. We also develop measures of launch quality analogous to patent citations. We then build a short panel data set matching these ‘innovative events’ to UK administrative firm level microdata, patents, trademarks and UK Innovation Survey data.

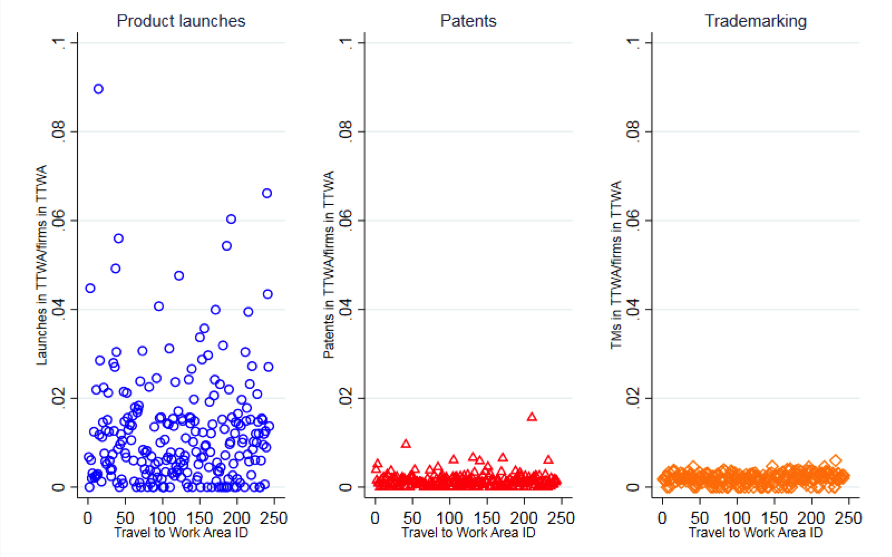

In our descriptive exercises we show that these new measures complement the existing metrics of innovation, with a more frequent coverage across sectors. Moreover, when it comes to local coverage, as reported in the figure below, launches have a far more even distribution across space than either patents or trademarks.

Figure 1. Weighted counts of launches, patents and trademarks, TTWAs, 2014-2015

Source: GI/Orbis/UKIPO 2014-2015

We then test associations between launch activity and firm productivity, controlling for past IP and for firm heterogeneity. Our results show that launch activity is associated with higher SME productivity, especially in the service sector. The results on the productivity of SMEs show that an increase of 1 standard deviation in the probability to launch (extensive margin) increases the revenue productivity by 2.7 per cent, while the increase in the number of products launched (intensive margin) increases the revenue productivity by 3.9 per cent. These results are estimated on a sample of companies with media exposure, as company media events create issues on the underlying sample selection. Interestingly, once product launches are controlled for in the model, patents do not seem to play any role, while trademarks still play a role.

We extend the analysis by looking at the manufacturing and service sectors, firm age and size. Service companies drive both the effects on the product launches and trademarks, while for manufacturing firms recent patenting is linked to lower productivity and historic patenting to higher productivity, explaining the initial cost of patenting and its long-term effects in this sector. We add a further novel angle by computing a measure of quality of launches that resembles that used for citations, by exploiting the fact that more important events are reported more times in the news. We find a strong correlation between important launches, measured by the number of mentions, and productivity, where firms that experience at least one launch have 17 per cent higher revenue productivity while each additional important launch adds 22 per cent to productivity.

We interpret these results as a clear sign that the drivers of our main results are a small set of high-profile important product and service launches. Finally, we explore the role of age and size. Young firms are defined as firms in the most recent quartile (up to nine years old) while size is defined using the OECD definition: micro, small and medium. The overall results are driven by medium-size firms while age does not seem to play a role. If anything, we find a negative effect of being a micro firm on the extensive margin and no additional effect on the intensive margin of launching.

Overall, our analysis shows that there is a need for better innovation data in order to capture mechanisms and behaviours within firms. Ignoring the fact that firms strongly select into IP activity could bring to misleading conclusions and badly informed policymakers. Finally, we believe there is scope for a large improvement on this direction, especially in terms of data. We believe that technological change plays a key role in the productivity growth, yet it is hard to capture with conventional data. We provide a fresh contribution to a well-established literature on innovation in firms, where we know that patents and surveys remain the dominant metrics, by developing new ways to view firms’ innovative activity based on web scraping and natural language processing. In fact, unusually for this field, we combine big data and large high-quality administrative data sets: an approach we think has much future potential. Cutting-edge resources will improve measurement of several economic issues, with – we hope – direct effects on the quality of policy making.

♣♣♣

Notes:

- This blog post is based on the authors’ Innovative Events, Discussion Paper No 1607 of LSE’s Centre for Economic Performance (CEP), March 2019.

- This blog post gives the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Alexas_Fotos, under a Pixabay licence

- Before commenting, please read our Comment Policy

Max Nathan is an associate professor in applied urban sciences at UCL, based at the Centre for Advanced Spatial Analysis (CASA). He is also a deputy director of the What Works Centre for Local Economic Growth and an affiliate at LSE’s CEP. His academic research focuses on the economics of cultural diversity, innovation systems and clusters, and in public policy for cities.

Max Nathan is an associate professor in applied urban sciences at UCL, based at the Centre for Advanced Spatial Analysis (CASA). He is also a deputy director of the What Works Centre for Local Economic Growth and an affiliate at LSE’s CEP. His academic research focuses on the economics of cultural diversity, innovation systems and clusters, and in public policy for cities.

Anna Cecilia Rosso is an assistant professor at the University of Milan’s department of economics, management and quantitative methods. She has a PhD in economics from UCL. Her primary research interests are economics of migration and labour economics, big data and innovation.

Anna Cecilia Rosso is an assistant professor at the University of Milan’s department of economics, management and quantitative methods. She has a PhD in economics from UCL. Her primary research interests are economics of migration and labour economics, big data and innovation.