Understanding why certain jobs are better than others and what implications they have for workers’ career is clearly important. It is, however, not straightforward to identify and separate ‘good’ from ‘bad’ jobs. For example, most people would agree that, for an IT specialist, working for Google does represent a ‘good’ job in the sense that it provides a vibrant work environment and can boost a worker’s entire career, thereby substantially improving the worker’s lifetime wage income. But evaluation might get more complex and debatable when considering other occupations or workplaces.

Moreover, it is unclear whether the positive effect that a ‘good’ job has on lifetime wage income is mainly due to a static effect (i.e. a ‘wage jump’ upon taking the job) or to a dynamic effect (i.e. faster ‘wage growth’ after taking the job) and whether the benefits of a ‘good’ job, be they static or dynamic, are ‘portable’ or are lost when moving to another job. Finally, the distinction between ‘good’ and ‘bad’ jobs might not be the same for every worker, and might depend on the occupation as well as the skill and ability of the worker.

In our research, using 16 years of Portuguese data on firms, workers, and international trade, we find that the distinction between internationally active firms and domestic firms is a meaningful empirical dividing line between employers providing ‘good’ and ‘bad’ jobs to managers (as opposed to blue-collar workers). Internationally active firms provide better experience and opportunities for managers as reflected in steeper sales growth for the former (see Figure 1) and steeper wage growth for the latter (see Figure 2).

Figure 1. Growth rate of sales, domestic vs. internationally active firms

Figure 2. Experience-wage profiles in domestic vs. internationally active firms, managers and blue-collar workers

Why do managers thrive in internationally active firms? Our analysis suggests that the higher lifetime wage income for managers in internationally active firms relies on the stronger accumulation of experience that these firms allow for and on the usefulness of this experience in other firms, which translates into an almost perfect portability of the accumulated dynamic wage gains to other firms. The title of one of Eduardo de Filippo’s famous comedies effectively and drastically summarises that in life, just like in the labour market, “gli esami non finiscono mai”, that is, exams never end. Internationally active firms allow managers to accumulate and use skills that are crucial for their lifetime success. At the same time, firms grow more if employing managers with more experience and in particular more international experience.

We also find that the distinction between internationally active and domestic firms is more powerful in capturing the dynamics of managers’ wages than the distinction between large and small firms or the distinction between firms with different managerial hierarchical structures. After all, in popular rankings the best employers tend to be large multinational public companies (see here) while recent research indicates that internationally active firms provide more vibrant workplaces thanks to better management practices, managers with more diversified experience, and relationships, as buyer or sellers, with a larger and more diversified number of counterparts (Mion and Opromolla 2014; Bloom et al. 2016; Bloom et al. 2018).

Dream jobs are not the same for all workers. Managers and blue-collar workers receive higher wages in internationally active firms because of very different mechanisms. Blue collar workers are paid more because of wage jumps occurring when moving from a domestic to an internationally active firm while managers are paid more because of a higher wage growth in internationally active firms that sticks with them when, eventually, moving to a domestic firm. Moreover, the possibilities offered by internationally active firms, in terms of experience and opportunities, are better exploited by more able managers. To be more specific, our analysis indicates that experience, whether acquired in domestic or internationally active firms, is better exploited by more able managers where ability is measured by the manager-specific fixed effects in our regressions.

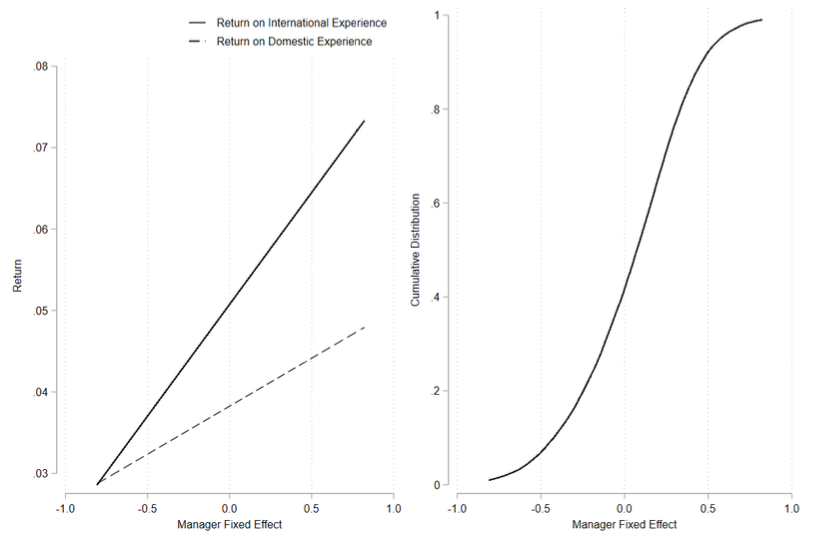

Figure 3. Returns on international and domestic experience by manager fixed effect

Indeed, Figure 3 indicates that the return on one additional year of both domestic and international experience is higher for more able managers. At the same time, Figure 3 suggests that the gap between the return on international and domestic experience grows with ability so emphasising the presence of strong complementarities among ability, experience and opportunities. This is further highlighted in Figure 4 where we show how the gap for managers stacks up, over a 10 years horizon, to a wage difference of about 10% to 17% which is quite substantial. As for blue-collar workers the gap is instead negligible.

Figure 4. Wage premium for a worker always employed by an internationally active firm with respect to an identical worker always employed by a domestic firm, by number of years of employment and percentile of ability, managers and blue-collar workers

Finally, dream jobs are not only important for individual workers or firms but also play a role at the aggregate level. Investigating the role of work experience (in particular its differential value across employers) and the determinants of life-cycle wage growth can improve our understanding of both the cross-sectional and spatial distributions of wages within a country (Song et al., 2018), of cross-country wage and income differences (Lagakos et al., 2018), and of the effects of active labour market programs aimed at enhancing the opportunities and abilities of both unemployed and less skilled workers (Dustmann and Meghir, 2005). In the case of Portugal, we find that eliminating differences in the share of international experience across regions, would substantially reduce spatial inequalities in wages by bringing down the coefficient of variation by 12.6%. At the same time our results suggest that, for more senior managers, it is more important to know how many years of international experience they have accumulated, rather than the total number of years of experience, in order to understand wage differences across managers.

As a future research avenue, we plan to better understand how experience accumulated within firms materialises and where exactly it comes from. A natural hypothesis is that workers learn from coworkers, with better coworkers being better learners, while some coworkers are more important than others for learning, and those coworkers are more frequently found in internationally active firms (Jarosch et al., 2019).

♣♣♣

Notes:

- This blog post is based on Dream Jobs, Discussion Paper No 1705 of LSE’s Centre for Economic Performance (CEP), and Centre for Economic Policy Research (CEPR) DP 15027.

- The post expresses the views of its author(s), not the position of the LSE Business Review, the London School of Economics, the Centre for Economic Policy Research, the Banco de Portugal or the Eurosystem.

- Featured image by Razvan Chisu on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Giordano Mion is a professor of international trade at the University of Sussex, an associate at the LSE Centre for Economic Performance’s trade programme. He is also affiliated with the Centre for Economic Policy Research (CEPR), the Center for Economic Studies and the Ifo Institute (CESifo) and the National Institute of Economic and Social Research (NIESR). He received a PhD in economics in 2004 from the Université Catholique de Louvain in Belgium. He is currently a member of the editorial board of the Journal of Economic Geography, and Regional Science and Urban Economics.

Giordano Mion is a professor of international trade at the University of Sussex, an associate at the LSE Centre for Economic Performance’s trade programme. He is also affiliated with the Centre for Economic Policy Research (CEPR), the Center for Economic Studies and the Ifo Institute (CESifo) and the National Institute of Economic and Social Research (NIESR). He received a PhD in economics in 2004 from the Université Catholique de Louvain in Belgium. He is currently a member of the editorial board of the Journal of Economic Geography, and Regional Science and Urban Economics.

Luca David Opromolla is a principal economist at the economics and research department of Banco de Portugal. He performs research in international trade, labour economics and banking. Opromolla is a research fellow of CEPR and CESifo, and UECE. He was a visiting professor of economics at the University of Maryland in 2014 and 2016, and his research receives support from the Fundação para a Ciência e a Tecnologia. He received his Ph.D from New York University.

Luca David Opromolla is a principal economist at the economics and research department of Banco de Portugal. He performs research in international trade, labour economics and banking. Opromolla is a research fellow of CEPR and CESifo, and UECE. He was a visiting professor of economics at the University of Maryland in 2014 and 2016, and his research receives support from the Fundação para a Ciência e a Tecnologia. He received his Ph.D from New York University.

Gianmarco Ottaviano is professor of economics holding the Achille and Giulia Boroli Chair in European Studies at Bocconi University, Italy, and an associate at LSE’s Centre for Economic Performance Trade Research Programme. His research interests include international trade, multinationals, economic integration, immigration and economic geography. He holds a PhD in economics from the Catholic University of Louvain, Belgium.

Gianmarco Ottaviano is professor of economics holding the Achille and Giulia Boroli Chair in European Studies at Bocconi University, Italy, and an associate at LSE’s Centre for Economic Performance Trade Research Programme. His research interests include international trade, multinationals, economic integration, immigration and economic geography. He holds a PhD in economics from the Catholic University of Louvain, Belgium.