Ownership and control of business corporations by state or government is common in Asian economies. Whether this is a better governance practice than the market-based model of developed economies remains a subject of intellectual discourse. Although studies on corporate governance question the efficiency of state ownership and control of business entities (Shleifer and Vishny, 1997), the efficiency of remuneration practices at the upper echelons of these entities is a matter of public interest.

Malaysia’s 1MDB has emerged as a popularly cited case globally in which a government-linked business corporation had allegedly failed to perform according to stakeholder expectations. As recently reported, the former prime minister was found guilty of abuse of power, criminal breach of trust and money laundering in relation to funds belonging to SRC International Sdn Bhd (an entity previously set up by 1MDB). Together with other scandals, confidence in the performance of government-linked boards of directors has worsened and questions were raised about their remuneration practices.

It has been widely acknowledged that a remuneration scheme can be abused to extract rents (inefficient or excessive pay), becoming a source of agency problem (Bebchuk and Fried, 2003). Building on the ‘inefficient pay hypothesis’ introduced in our previous study, we argue that the tendency for inefficient pay is greater if government-linked corporations are managed by self-interested agents, while monitoring by the ultimate stakeholder (the public) is lacking due to factors such as coordination or ‘capture’ problems amongst diverse stakeholder groups, inadequate disclosure and the sheer complexity of pay structures.

We contribute a critical insight by drawing from an examination of the disclosures and levels of directors’ remuneration in a sample of Malaysia’s government-linked entities (GLEs) during the 2013-2017 period. For public readership, the findings were reported in our recent book.

Our study reveals that not all GLEs have achieved satisfactory levels of disclosure for their directors’ pay because not all of them are subject to disclosure requirements. Although the top 10 constituents of the FTSE Bursa Malaysia KLCI (FBMKLCI) are significantly occupied by government-linked entities (FTSE Russell, 2018), many GLEs are not publicly listed companies, hence not regulated by stringent pay disclosure rules. For example, the remuneration of individuals that served on the boards of 1MDB, SRC and two other strategically important GLEs (Khazanah Nasional Berhad and Permodalan Nasional Berhad) were hidden from public view. In other cases where disclosure was required, salaries and bonuses of individual executive directors were disclosed, but values of long-term incentive plan (e.g., stock options), pension benefits, and other perks were largely opaque in selected cases.

In terms of stock options, we illustrated a case where profits that were cashed out from exercising the options as well as the subsequent units sold were not disclosed, and the value of options held (unexercised) during the year was also hidden. By implication, the monetary value of this pay component is unknown. Information, at best, was either not disclosed in easy-to-access format or was incomprehensible to the public at large. Inadequate disclosure means that the total fair value of the pay package for the executive director in question is hidden from public view.

Non-disclosure or inadequate disclosure of information has somewhat constrained public activism and scrutiny over directors’ pay in GLEs. To our knowledge, our research in collaboration with the Consumers Association of Penang (CAP) stands out as a visible public spirited stakeholder activism in this area so far, which requires some technical knowledge on complex remuneration components. Our proposal for rigorous pay disclosure regulation stands, even though the previous government’s plan to issue a guideline on directors’ pay by the end of last year has not materialised.

Following the change in government early this year, directors’ pay is under renewed scrutiny together with the public outcry against several appointments of Members of Parliament (MPs) to the helms of government-linked entities. Concern was raised whether such appointments were actually associated with high salaries and allowances. This issue was debated in Parliament recently. We argue that greater disclosure will enlighten the public and inspire more informed debate and activism for policy implications in the public interest.

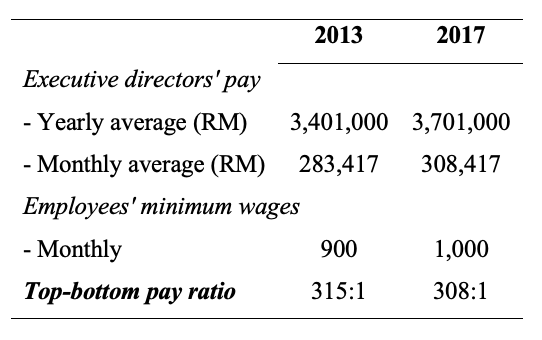

Based on a sample of limited disclosure, we find that the average individual pay disclosed for 49 GLE executive directors (including CEOs) had approximately increased from RM3.401 million in 2013 to RM3.701 million in 2017. Each executive took home an average of RM283,417 and RM308,417 monthly in 2013 and 2017, respectively. Although this figure may still be underestimated (i.e., due to inadequate or non-disclosure items), it is certainly not a ‘humble’ amount to begin with for these elites. Given a statutory minimum monthly wage, the average pay of government-linked entities’ executive directors is more than 300 times the minimum wage of employees. This is shown in Table 1.

Table 1. Top-bottom pay gap

Taking the UK as a simple comparison, the pay gap between CEOs of FTSE 100 companies and their employees was not as wide, albeit not immune from scrutiny (Chartered Institute of Personnel and Development, 2018). FTSE 100 companies are distinguishable from Malaysia’s GLEs as they operate in a more competitive market-based system where stakeholders are relatively sophisticated and facilitated by a rigorous disclosure regulation on directors’ remuneration [refer to Section 420(1) of the Companies Act 2006]. As a result, the pay gap between executive directors and employees in the UK are gradually being ‘humbled’ by market forces as well as scrutiny from civil society.

Although the complete picture of directors’ pay in GLEs remains hidden, our findings prudently reveal a wide pay gap between the top and bottom strata of society in Malaysia. In any case, rewarding a mediocre performance with an extravagant pay is a source of inefficiency, which must be curtailed in tackling the gap between rich and poor. Learning from the UK, we call for rigorous pay disclosure regulation and active monitoring of directors’ pay in Malaysia’s GLEs. In our opinion, this public interest proposal will gain support from a responsible government to achieve its Shared Prosperity Vision 2030.

In the meantime, the financial and economic implications of COVID-19 have inspired our proposal for corporate elites globally to forgo what is seen as excessive pay at the upper echelons of society. What are deemed as excessive amounts can be transferred to compensate employees who have lost jobs and suffered the coronavirus implications colossally.

♣♣♣

Notes:

- This blog post is based on the authors’ book titled ‘How Much Is Hidden? Pay for Elites in Government-Linked Entities’.

- The post expresses the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Alex Block on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Does not disclosing salary among employer considered a breach of anti-competitive act 2010 in Malaysia?