As the COVID-19 pandemic enters its second year, requiring extensive lockdowns to contain the spread of the virus, its concrete impact on businesses is becoming clearer. The numbers are stark: 906,000 UK businesses are at serious risk of failure before April 2021. Peter Lambert and John Van Reenen look at the numbers and propose some policies to contain the damage.

Professor John Van Reenen will be speaking at the LSE online public event Going for Growth next Monday, 8 February. He will discuss how the UK and the world can get back on a path to sustainable recovery.

Almost 15% of UK businesses are at-risk of permanently closing by the start of April, according to a recent ONS Business Impacts of Coronavirus Survey (BICS). The fortnightly BICS surveyed 8,764 UK businesses between 29 December 2020 and 10 January 2021. It revealed that 3.9% of businesses have ‘no confidence’ that they will survive over the next three months, the highest fraction ever reported in the history of the survey. A further 10.8% have ‘low confidence’ of survival. Together, we define these two groups as being ‘at-risk’.

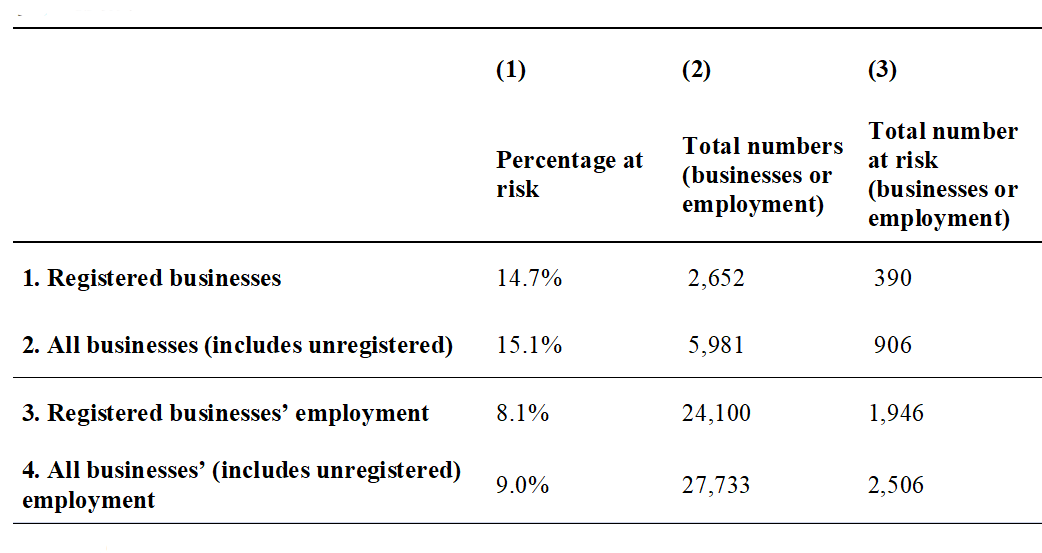

Table 1 looks at how many businesses this represents. According to the latest ONS Business Population Estimates (BPE), there were 2.65 million registered businesses in the UK at the start of 2020, with a combined employment of 24.1 million jobs. These registered businesses include all those that are VAT and/or PAYE registered, based on the Inter-Departmental Business Register (IDBR). The at-risk proportion (14.7%) of this group implies 390,000 businesses are at serious risk failure before April 2021.

There are a further 3.33 million unregistered businesses in the UK (those that are not PAYE or VAT registered). The employment this group covers includes owner/operators. If we extrapolate BICS survey responses to cover the population of all businesses (registered and unregistered), we find that 15.1% are at-risk of exit. This is likely to be an underestimate, given that the survey responses do not reflect that these unregistered businesses are smaller and therefore likely at a higher risk of closure (see also the recent Federation of Small-business report).

The second row of Table 1 multiplies this 15.1% of ‘at-risk’ population with the total number of businesses (registered and unregistered), which total 5.98 million. This calculation implies that 906,000 UK businesses will be at serious risk of failure before early April 2021.

Table 1. Number of businesses and employment at risk of closure by the end of March (all figures in thousands)

Notes: In column (1), ‘At-Risk’ is derived from businesses that replied they had ‘Low’ or ‘No Confidence’ to the question ‘How much confidence does your business have that it will survive the next three months?’ (BICS Wave 21, released January 14th, 2021). 8,764 registered businesses answered between 29th December 2020 to 10th January 2021, so this relates to whether they expected to be alive by late March and early April 2021. These responses are weighted by the ONS to be reflective of the population of registered businesses, based on the Inter-Departmental Business Register (IDBR (excluding four sector Agriculture, Public Administration and Defence; Public provision of education and health’ and Finance and Insurance’). ‘Registered businesses’ are those that are either VAT and/or PAYE registered. ‘All businesses’ also include unregistered businesses. The data for column (2) uses the latest Business Population Estimates (BPE, 2020, released Oct 8th, 2020). Employment includes salaried and non-salaried workers (e.g. owner operators). To derive our number of at-risk businesses in the first two rows we multiply the percentage at-risk in column (1) by the estimated number of businesses in column (2) to get the absolute number at risk in column (3). To derive our number of at-risk jobs in the last two rows, we multiply the employment-weighted percentage at-risk in column (1) by the employment number in column (2) to get total employment at risk in column (3). Note that the employment-weighted proportion at risk is relative to private-sector employment. The last two rows in Column (1) are lower than the first two rows because small businesses are at greater risk (see Table 2) and by definition have lower employment. See Appendix A for full details on these calculations.

The last two rows of Table 1 estimate how many jobs are in the businesses that are at risk of closure. The employment-weighted percentage at risk is lower because larger businesses are at lower risk of closure than smaller ones (see Table notes and Appendix A). We calculate that about 1.9 million jobs are at risk in registered businesses of being lost by April 2021 (8% of all registered business employment). Including unregistered businesses and their owner/operators increases this number to 2.5 million (9% of all business employment).

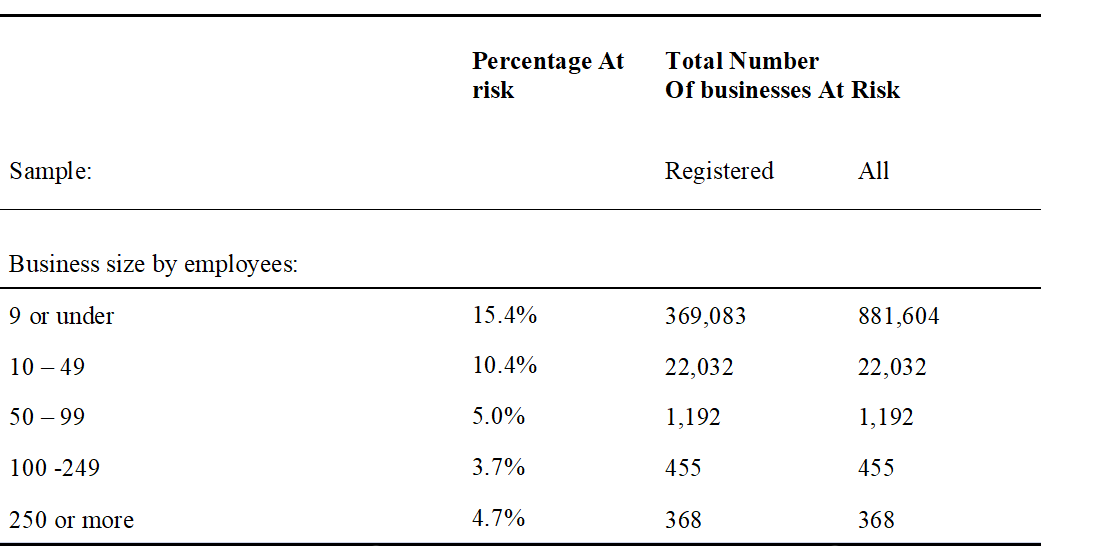

Table 2 breaks down the at-risk group by business size. It is clear that the risk of failure is much greater for smaller businesses. Micro enterprises with nine employees or less have the highest risk of failure (15.4%) whereas medium-sized enterprises (100-249 employees) had the lowest risk (4.0%). Thus, the brunt of the impact will be on the smallest enterprises that are likely to be the least prepared. This is why the at-risk proportion in Table 1 is higher for all businesses (which have a greater share of small businesses) than for registered business only.

Table 2. Businesses ‘at-risk’ by business size

Notes: See notes to Table 1 for sources and definitions. Business size is measured by number of employees who receive salary/wages, at the enterprise group level.

How do these figures compare to ‘normal’ times? In a typical year, there is a high volume of business closures (deaths) as well as a high number of new business start-ups (births). This business dynamism is a desirable feature of market economies as jobs from old businesses are replaced by new jobs, and capital is redeployed. But a large excess of deaths over births can create economic and social problems, contributing to large-scale unemployment and the scrapping of productive capital. It can also trigger more systemic financial instability.

In the first quarter of 2019, the number of UK registered business deaths was 85,520 and rose to 119,560 for 2020Q1, when the pandemic started. In both these quarters, however, new business births were greater than deaths, so on-net the economy gained registered businesses. To compare, if the entire at-risk group of 389,912 registered businesses we identified in Table 1 were to permanently close in 2021Q1, then quarterly deaths would be up 356% compared to 2019Q1, or 226% compared to 2020Q1. If realised, these numbers would be unprecedented in modern times.

Our comparisons above show that the looming wave of business closure is startling relative to both a ‘business-as-usual’ benchmark (2019Q1) as well as compared to the initial shock of the pandemic (2020Q1). Other surveys also point to an impending wave of bankruptcies of small and medium-sized enterprises (SMEs) by April 2021, with similar numbers to our own.

The policy response

While many policies can provide targeted support to specific industries such as hospitality (e.g. VAT cuts, business rates holidays and ‘Eat Out to Help Out’), our main focus will be on policies aimed at reducing the cost of finance across the entire economy through subsidised loans. More specifically, loan guarantees and debt restructuring should be used to balance the need for immediate protection with longer-term reallocation.

Loan guarantees

COVID-related business loan support schemes account for about 16% of the £430 billion in all loans outstanding to private non-financial corporations.

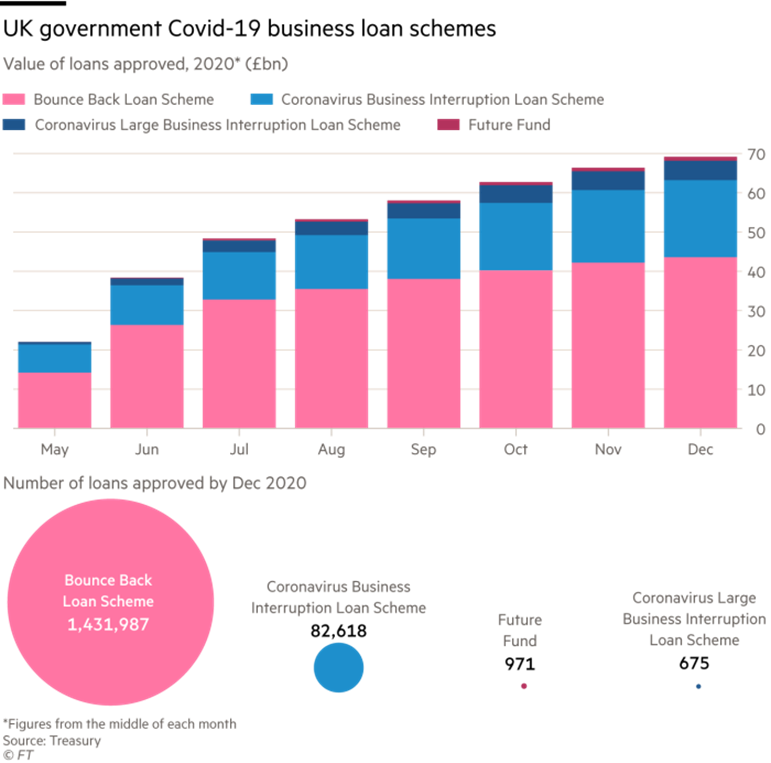

The best-known COVID-related business loan scheme is the Coronavirus Business Interruption Loan Scheme (CBILS). This provides government guarantees of 80% of a loan, as well as paying interest and fees for a year. But the Bounce Back Loan Scheme (BBLS) is even larger in cash terms and provides a more generous 100% guarantee for loans up to £50,000 with essentially zero checks on creditworthiness (with the aim of getting loans out as quickly as possible). Launched in May 2020, by mid-December 2020, the BBLS had lent £43.5 billion to about 1.4 million businesses compared to £19 billion under CBILS to just over 83,000 businesses (see Figure B1). The National Audit Office expects up to 60% of businesses to default on BBLS loans.

Figure B1. Cost of business relief schemes

The case for maintaining these partial guarantees on loans, even in the recovery phase, is strong. It is very hard to assess which businesses will survive and which will close. Banks cannot fully diversify credit risk and so, left to their own devices, will generally ask for too high a risk premium or refuse to lend altogether. Furthermore, because the lock-down has hit the capital ratios of banks, they will be more reluctant to lend even to viable businesses that may be short on liquidity.

The government can alleviate this problem by providing partial loan guarantees. This makes sense as it is best placed to diversify credit risk and to absorb the macro risk due to uncertainty. By offering partial (instead of full) guarantees, losses are shared, which mitigates the problem of bank lending to fundamentally bad creditors.

As we exit the lockdown phase, these loan guarantee programmes should be modified in at least two ways. First, the generosity of the guarantees should decrease over time. This should be gradual and tied to the state of the economy. Second, the use of state guarantees should be linked to more obligations such as restrictions on dividend payments and/or higher future corporate income taxes.

Debt restructuring

Businesses in the post-pandemic environment can be thought of as being in one of three states: (i) privately viable (the present value of their profits exceeds recovery value) and solvent (the present value of profits exceeds current debt); (ii) not viable and thus not solvent; or (iii) viable but have been made insolvent by the shock and thus need debt restructuring.

Viable businesses are covered by loan guarantees. But even with subsidies, there is still a case for intervention if the social value of the business exceeds the private value. This may happen because there is a value in the bundle of assets and relationships a business has with its employees, suppliers and customers, that is not fully priced in by the businesses’ creditors. A depressed economy with high unemployment and underutilised capital can be severely affected by a wave of bankruptcies, and this ‘scarring’ effect can be very persistent. Private creditors may end up closing too many businesses from the social point of view.

One practical set of proposals for implementing these ideas is through a UK Recovery Corporation, as proposed by CityUK. Our sense is that something like this is the clearest path forward, but there is an alternative: debt forgiveness.

Although our proposal avoids the economic damage of a sharp withdrawing of support, even the more generous provisions of equity for debt swaps will leave businesses with diluted incentives to grow, as the State shares more of the upside benefits. Hence, this may reduce the incentive to invest in order to grow. These disincentives could be mitigated with other programmes of investment support focused on key areas – for example, research and development, training and technology adoption (especially around the climate change agenda).

A more radical alternative would be to just write-off all debts. Businesses that were viable would have strong incentives to grow. Those that were not could simply sell assets and exit. The problem with forgiveness is twofold. First, the hit to the public finances would be larger. Second, if businesses suspect this will be the case, then they will be more likely to borrow excessively now. There may also be moral hazard issues for future bailouts, but given the likely one-off nature of the pandemic, this is a lesser concern.

Long-run outcomes and policy

In addition to tackling debt overhang, one can also target the longer-run growth prospects of the UK by providing support to businesses with high growth potential. There have already been a number of schemes aimed at exactly this (see Appendix B for examples like the Future Fund). We support additional, targeted assistance to businesses that not only have large growth potential themselves, but which might also provide productivity benefits to other businesses through spillovers from innovation.

As part of this more targeted support to high growth-potential businesses, support that explicitly targets start-up businesses should be extended. Existing schemes like the Seed Equity Investment Scheme should be expanded. The general principle behind this is to (i) reduce investment risk for ‘angels’; (ii) encourage start-ups and (iii) foster new investment. It is important that we make it more likely for high growth businesses to be born, not just help existing companies.

♣♣♣

Notes:

- This blog post is a shorter version of the report A major wave of UK business closures by April 2021? The scale of the problem and what can be done, Paper Number CEPCOVID-19-016, LSE Centre for Economic Performance (CEP).

- The post gives the views of its authors, not the position of LSE Business Review or the London School of Economics.

- Featured image by Marco Bianchetti on Unsplash