Firms with direct investment in other countries create jobs at home. This is a counterintuitive fact that defies political thinking, especially in these rapidly changing times of populism and cries against global economic integration. Riccardo Crescenzi, Roberto Ganau, and Michael Storper study the number of jobs new foreign direct investment by domestic companies creates abroad, in comparison with local employment levels. They find a positive effect on domestic local employment, with a potential downside: intra-regional inequalities.

“Bring jobs back to America” has been a political mantra well beyond Donald Trump’s era. The world over, public policies for recovery from COVID-19 have cherished the idea of curbing foreign activities of domestic firms in order to boost domestic employment and wages. This represents a fundamental misconception about outward foreign direct investment. Outward FDI has in fact an overall positive effect on domestic local employment in the US. Higher returns of outward FDI are associated with high-tech manufacturing and services industries, with less developed regions benefitting the most. But there is a downside that comes with these benefits, namely inequalities.

The pandemic has boosted political scepticism on the benefits of global economic integration. Foreign activities of domestic firms have become an easy target for these criticisms in virtually all advanced economies. Decisions to invest in new activities (and create new jobs) abroad are seen by some commentators in the political arena as well as journalists as detrimental to domestic employment and earnings. To highlight one of many examples, a supposed trade-off between international expansion of a country’s firms and domestic employment levels was an explicit premise of former US President Trump’s claim to “bring jobs back to America” by reducing foreign activities of US domestic companies.

By contrast, there is a wide-ranging debate on the many complex ways that foreign direct investment (FDI) may affect domestic employment and wages, and a consensus that these effects are outcomes of the complex interplay of industry, regional, temporal and specific mechanism effects.

The evidence on what happens within firms when they invest abroad is rather mixed. Some studies have highlighted negative impacts (e.g., Brainard and Riker, 2001; Cuyvers et al., 2005; Konings and Murphy, 2006) while others have found more positive effects of outward FDI on domestic employment and the skill composition of the investing company (e.g., Lipsey et al., 2000; Castellani et al., 2008; Hijzen et al., 2011). If domestic impacts at the level of the investing company are far from clear, wider impacts on domestic local labour markets – the ones that ultimately matter for policy makers – are even less clear.

The fundamental question is: “what is the relationship between outward FDI – measured by the number of jobs directly created abroad by domestic companies in new foreign subsidiaries – and local employment levels?”

The answer goes beyond the firm level to look at the entire US economy (the largest investor in the world economy) at a detailed spatial scale (divided by economic areas—EAs) to explore the link between outward FDI and economy-wide impacts in terms of sub-national intra- and inter-regional employment disparities.

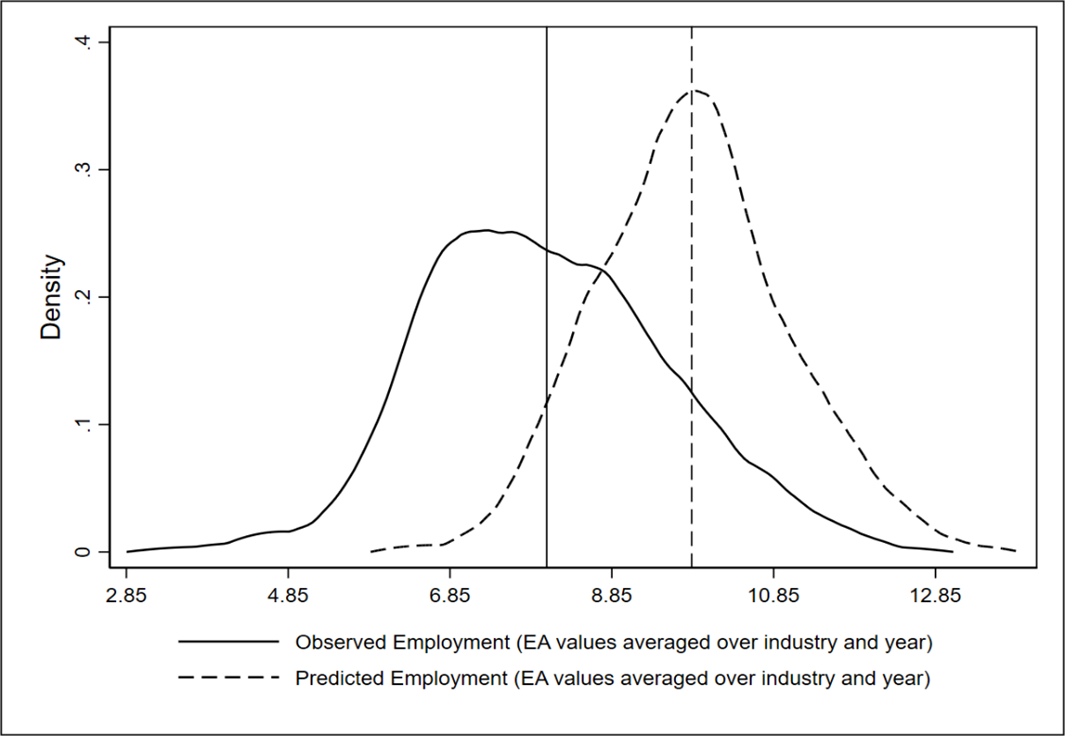

Three key findings emerge from this in-depth analysis of US local labour markets. First, there is a generally positive effect of outward FDI on domestic local employment. Indeed, as shown in Figure 1, on average, US regions would be significantly better off in terms of their local employment levels if they all maximised the local returns from the outward investment of local multinationals.

Figure 1 compares actual employment levels in US local labour markets (solid line) with “predicted” levels that we would observe —all else being equal— if each region responded to outward FDI in line with its own potential (dashed line). In other words, the chart shows what local employment levels would be if each region responded equally well to the opportunities offered by outward FDI.

All regions with actual employment levels (solid line) below predicted values (dashed line) and lower than the average (vertical solid line), are punching below their weight in terms of benefits from outward FDI and would gain more than the other economic areas from a generalised increase in outward investment conditions. Furthermore, economic areas situated on the left tail of the employment distribution would gain the most from stronger internationalisation of their local companies.

Figure 1. Kernel density estimates of observed and predicted US regional employment values

Notes: Predicted employment is calculated from a three-way Fixed Effects estimation where EA- and industry-specific employment levels are regressed on: intra-industry outward FDI in the own region; inter-industry outward FDI in the own region; intra-industry outward FDI in neighbour regions; inter-industry outward FDI in neighbour regions; EA- and industry-specific inward FDI; EA- and industry-specific wages per employee; EA-specific personal income per capita; EA-specific population density; EA-specific unemployment rate; EA-specific patent intensity; three sets of EA, industry, and year dummy variables; a set of interaction terms between industry dummies and the four variables for outward FDI. All explanatory variables are lagged one year. Observed and predicted employment values are averaged over industry and year to obtain EA-specific mean values. The vertical solid line refers to the mean value of EA-specific observed employment, while the vertical dashed line refers to the mean value of EA-specific predicted employment.

Second, compared to “leading” economic areas, less advanced ones tend, on average, to benefit more from the international expansion of their domestic companies.

| "Leading" vs "lagging" economic areas (EAs) |

|---|

| We split the sample of 179 economic areas into two groups of "lagging’" and "leading" regions through a k-means clustering approach based on a series of region-specific characteristics for local labour market conditions, personal income per capita, urbanisation, innovation capacity, and long-run population dynamics. We identify a group of 122 "lagging" economic areas and a group of 57 "leading" ones. |

Indeed, employment levels in “lagging” economic areas benefit from both intra- and inter-industry effects from outward foreign direct investment more than in “leading” EAs, where the employment effects are driven mainly by the intra-industry dimension.

Third, the industry driving the link between domestic employment and outward FDI matters a lot. High-tech manufacturing and high-tech services show the most positive effects in both “lagging” and “leading” EAs, despite these positive effects being greater in the former type of region than in the latter. In other words, in less developed regions the employment benefits from active internationalisation materialise mostly through intra- and inter-industry effects in high-tech industries.

The employment expansion of high-tech manufacturing and services in less developed regions has two closely interlinked consequences. On the bright side, it has the potential to foster structural change and upgrading through the expansion of the most dynamic sectors within the comparatively more backward sectoral profile of “lagging” regions. However, the concentration of employment benefits in high-tech sectors might foster intra-regional inequalities in so far as highly skilled workers (relatively scarcer in less developed regions) are the ones benefiting from such expansion via increased employment opportunities and higher wages.

In addition, less developed regions are also fundamentally different from “leading” economic areas when it comes to the nature of the activities (business functions) that domestic firms pursue abroad. All other things being equal, parent companies from “leading” EAs tend to realise innovation-related activities abroad more than parent companies from “lagging” areas, and the opposite occurs when considering production activities.

Thus, “lagging” economic areas tend to benefit from outward FDI in high-tech manufacturing and services industries, but these investments involve more their “traditional” and production-based business functions, as compared to investments in the same industries from “leading” EAs, where they are oriented toward innovation activities. This suggests that within global investment flows in high-tech industries, “lagging” EAs are still positioning themselves in the lower value-added sections of the chain, offshoring less sophisticated activities where cost-advantages prevail over learning opportunities.

Further differences between “leading” and “lagging” regions emerge when looking at the types of firms that invest abroad. Active internationalisation processes through “greenfield” foreign direct investment (building anew) in “lagging” EAs are much more concentrated in a small number of companies than in “leading” ones, and this seems to be the case for virtually all industries. Moreover, the top five companies from “leading” areas tend to undertake higher value-added activities abroad (e.g., innovation) than their counterparts from “lagging” ones.

It follows that positive employment returns of outward FDI in less developed regions depend on a few, very large, dominant companies. This suggests that the underlying micro-level ecosystem that leads the process of outward internationalisation in less developed regions is fundamentally different from more advanced regions. Less developed areas show a significant concentration of “global connectivity” in the hands of a limited set of large firms pursuing relatively low value-added activities abroad. This evidence sheds light on additional potential threats associated with the opportunities offered by active internationalisation in less developed regions.

A strongly concentrated market structure for investing parent companies might limit the circulation of positive spillover effects into the regional economy, explaining why less developed regions are punching below their weight when comparing expected and actual benefits from outward FDI (see Figure 1). The role of large corporations in less developed regions might also bias local policies and facilitate rent-seeking attempts when public policies try and leverage outward FDI as part of local economic development strategies.

Our analysis highlights how policies that would bluntly limit the active internationalisation of domestic companies through outward FDI could be detrimental to local employment, especially in less developed regions that still have some dynamic companies able to internationalise. However, the correct design of public policies can leverage outward FDI to the region’s advantage. Such regions tend to have a high level of concentration of their outward FDI in just a few companies. Thus, more internationalisation of these companies in less developed regions, while potentially reinforcing their overall competitiveness, might also enhance local labour market oligopoly effects, which have been shown to be associated with downward local wage pressure (Benmelech et al., 2018; Azar et al., 2019). Thus, while policy should not try to discourage firms that can potentially generate more employment in less developed regions through active internationalisation, it also needs to be attentive to these collateral effects.

We urgently need more knowledge of the on-the-ground mechanisms operating in different regions and industries, with particular focus on the market structure characterising the actors involved in the internationalisation process as well as their interaction with the genesis of public policies. The positive returns of outward FDI are counter-intuitive, especially in the public and policy arena, which is all the more reason for further research to understand the circumstances under which they occur and possible countervailing effects.

♣♣♣

Notes:

- This blog post is based on Does foreign investment hurt job creation at home? The geography of outward FDI and employment in the USA, Journal of Economic Geography (2021).

- The post expresses the views of its author(s), and do not necessarily represent those of LSE Business Review or The London School of Economics and Political Science.

- Featured image by sol on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy