Central bank research papers are a good source of information about the topics they are exploring as policies are shaped. These papers could also help us understand the thinking behind policy recommendations in the past. Tohid Atashbar analysed two decades’ worth of central bank publications to find out how they think and act.

Research is one of the main engines behind the long-run dynamics of economies and industrial innovation. This is true also about central banks; by looking at the path of their research, one can have a good sense of what topics are being explored as policies are shaped and can understand the thinking behind policy recommendations in the past. Some of the main venues to assess the research profile of central banks are the working papers and papers published by these institutions. This note asks what central banks are researching and how topics and focus have changed in recent decades.

Data and methodology

To collect the research documents published by central banks, we used the BIS’s research hub, which contains the list of central bank publications found in the Research Papers in Economics (RePEc) data base. This hub includes the research documents published by central banks during the last two decades. To scrape, collect, convert, and read the data with optical character recognition (OCR), some python modules including Beautiful Soup, Pdf Plumber, and Pytesseract (based on Google’s Tesseract-OCR Engine) are utilised. For the text analysis, the Natural Language Toolkit (NLTK) and its different modules are used.

The dataset includes 21610 research documents (papers, working papers and similar publications) from central banks (2000–October 2021) in 31 advanced economies, 13 emerging economies, the US Federal Reserve board of governors and its 12 regional members, and the Bank for International Settlements (BIS).

To have a better sense of the research trends in central banks’ research publications, different metrics, including the JEL classification of the working papers and papers, the keywords defined by the authors of the papers in the abstract, and high-density keywords in the full text of the papers were used.

The study analysed the papers in all three levels of the JEL system: 20 primary one-letter categories (A, B, …), secondary categories (A1, A2, …), and the most detailed classification (which is the preferred classification for the authors), that is, tertiary subcategories (A10, A11, …). We started from the bottom (tertiary subcategories) and aggregated the papers’ JEL codes to reach the upper level of classification.

Findings

With the cumulative share of 84 per cent of total published central bank research, central banks in the advanced economies and the federal reserve system have been the main drivers of research in this area. The database used for the study (BIS and RePEC) include a larger number of advanced economies (with more staff members relative to emerging and developing countries), which could in part explain this. Therefore, most of the monetary literature in these reference hubs focuses on issues relevant for advanced economies and, hence, among the central bank community the problems and issues more specific to these economies receive higher attention in the agenda-setting procedure of the central banking community. Given the complexities of central banking in the emerging market and developing economies (EMDEs), these results suggest the need for a more balanced view in the monetary and central banking literature towards the issues affecting these countries.

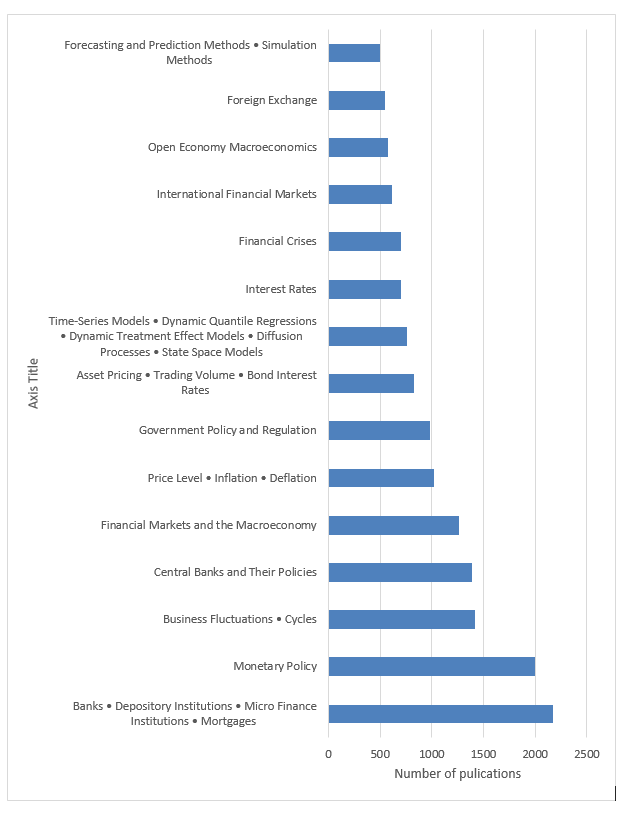

The top 15 themes of publications by the central banks, based on the third-level JEL classification codes, are shown in Figure 1. The general classification for the banks (G21: Banks • Depository Institutions • Micro Finance Institutions • Mortgages) is the top priority; monetary policy is number two; business cycles take up third place; and inflation (related to the main mandate of central banks) and price level are number six. Some other less-important themes, fiscal policy and information-related issues among them, are shown in Table 1.

Aggregation of research publications by the second-level and primary JELs is shown in Figures 2 and 3. The top topics are not unexpected and are issue-relevant for day-to-day business of the central banks: monetary policy, financial institutions, and related issues.

Figure 1. Major themes in central banks’ publications

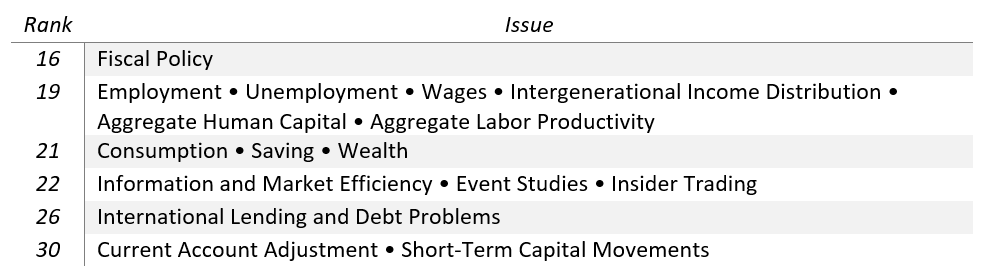

Table 1. Less frequent issues in central banks’ publications

Figure 2. Central banks’ publications by secondary JELs

Figure 3. Central banks’ publications by primary JELs

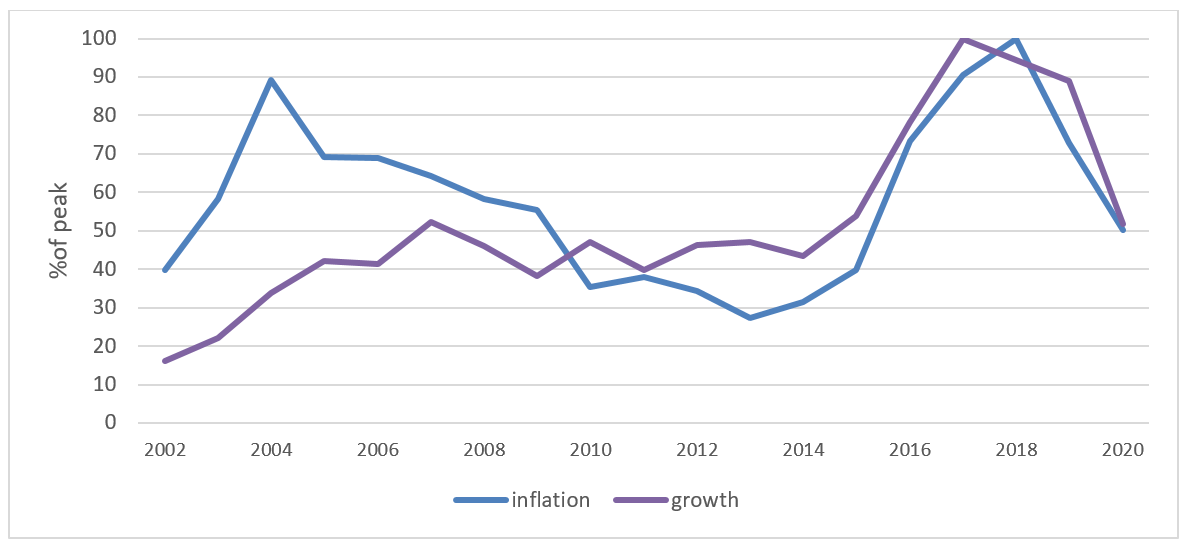

Studying the keywords in central bank publications may be an indicator of how they try to think and act. For example, the usage of the keywords “inflation” and “growth” (% of their peak) in the full text is shown in figure 4. This figure shows that the density of both inflation and growth were at their peak in 2017-2018.

Figure 4. Growth and inflation in the studies by CBs

For a better understanding of this dynamics, the ratio of the frequency of inflation to growth in the full text of central banks’ research publications (which may be a proxy for the balancing act of central banks between their two general mandates) is shown in Figure 5. This trend analysis shows that the “balancing ratio” is almost unchanged between 2010-2020 after a sharp increase in favour of growth-enhancing central banking in the first decade of the century.

Figure 5. Inflation to growth ratio in the research publications of CBs

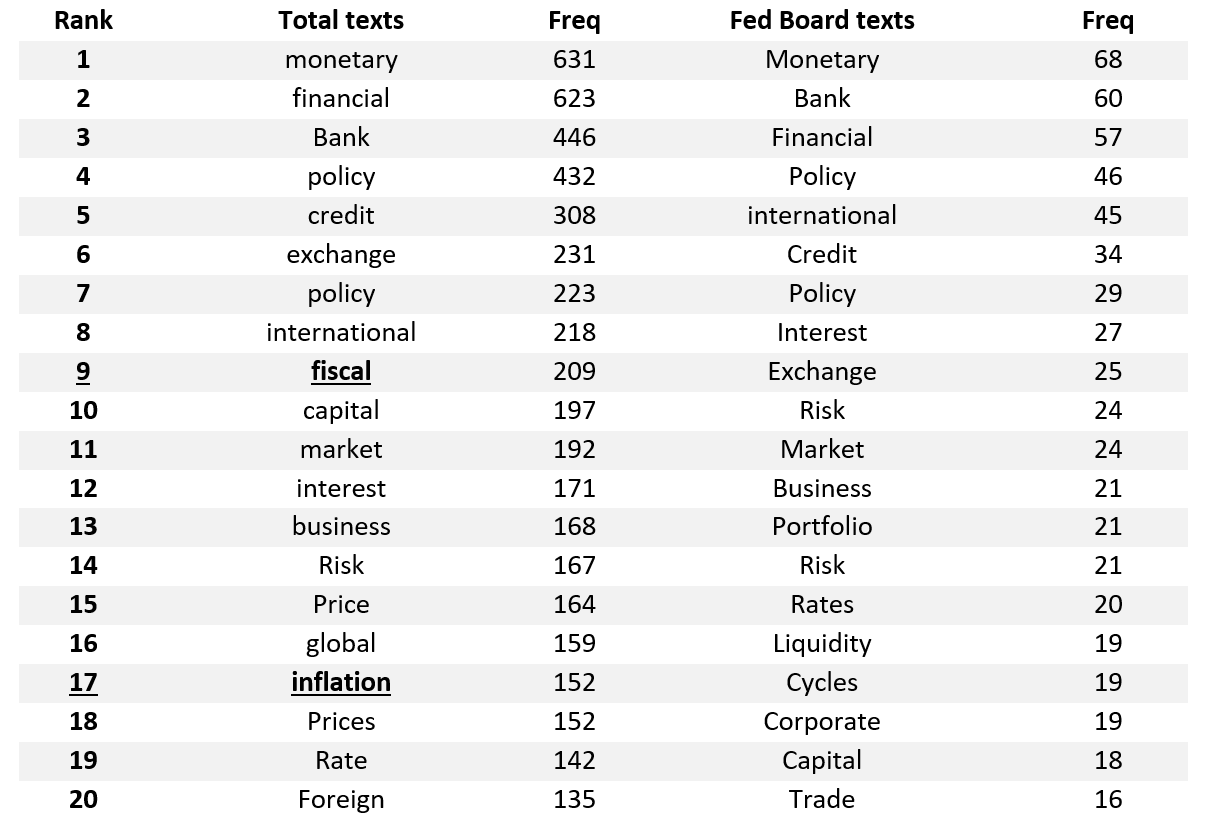

Comparative analysis of the keywords in the central banks’ papers based on the type of the institution may also provide some clues. For example, table 2 shows the top 20 frequent author-specified keywords in the publications of the central banking community versus the papers published by the Federal Reserve board (about 9 per cent of all publications). In the table, the frequency column shows the number of papers in the dataset that mention the specified keywords in the table after the abstract section of the papers. The table shows that “fiscal” and “inflation” are among the most frequent keywords in the CB community, but not in Fed board papers (most probably because inflation or the fiscal dominance of the government’s balance sheet have not been an issue for the US economy in recent decades).

Table 2. Keyword rankings in the total CBs and Fed board’s research publications

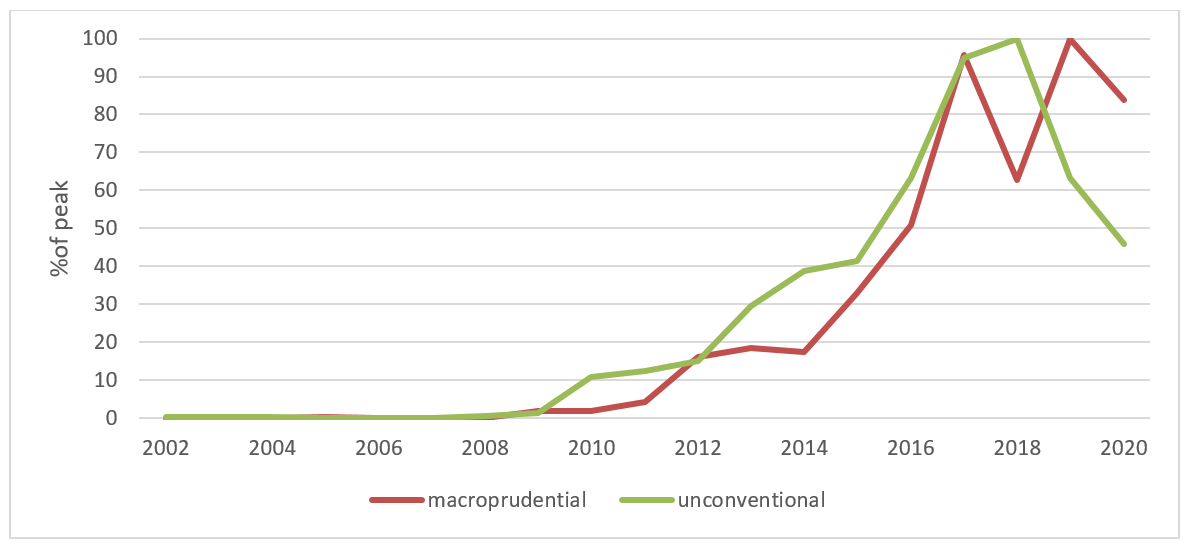

Finally, matching keyword trends with the events in the financial markets indicates some time-specific developments in the literature. For example, Figure 6 shows that some concepts like macroprudential and unconventional policies have entered the central bank literature since 2008.

Figure 6. Macroprudential and unconventional policies in the CBs publications

Conclusion

By looking at the research trends, one can review or extrapolate the future path of the central banks’ agendas. This study, based on the textual analysis of the keywords and JEL codes in central banking papers, finds that during the last three decades, while these institutions have been working mainly within their institutional mandates, time-specific events like the global financial crisis have impacted their agenda.

Author’s disclaimer: The views expressed herein are those of the author and should not be attributed to the IMF, its executive board, or its management.

♣♣♣

Notes:

- This blog post is based on ideas articulated in Green lemons: overcoming adverse selection in the green bond market, Transnational Corporations, Volume 28, Issue 3, Dec 2021, p. 35-63.

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by AbsolutVision on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy

Any hint on how could I build a dataset for a similar study on social studies?