The UK needs an electric vehicle (EV) battery recycling industry. This could strengthen the British EV supply chain and support the future development of UK-based gigafactories (large-scale battery factories) and electric vehicle production. Viet Nguyen-Tien, Robert Elliott, Gavin Harper, and Laura Lander discuss how a new clean tech industry can contribute to net-zero targets.

| #LSEUKEconomy |

|---|

Despite challenging economic conditions and ongoing supply chain concerns as a result of the COVID-19 pandemic, the global stock of electric vehicles (EVs) has tripled over the last three years, with new electric car sales in Europe alone increasing by 65% in 2021.

Trends in global EV adoption reaffirm that the transition to a low-carbon transport future could provide a significant opportunity for sustainable growth and speed up the post-COVID-19 economic recovery, especially in those countries such as the UK, where automotive manufacturing plays such a vital role in terms of value added and employment.

As batteries are the heart of electric cars, EV battery manufacturing and related activities are key to unleashing the opportunity that e-mobility could bring to the UK economy. For example, the Faraday Institution estimates that by 2040, if the UK manages to supply all of its domestic battery demand, employment in the EV battery supply chain can increase from 186,000 to 246,000 jobs. The first steps are already being taken with the first gigafactory being built in the north-east by startup company Britishvolt utilising funding from investors and government grants and showing the potential of clean tech to contribute to strong, sustainable, and equitable growth.

A recent interdisciplinary publication argues that the rise of gigafactories and the mass adoption of EVs in the UK could be further strengthened by the development of robust domestic battery recycling facilities. From the demand side, EV battery recycling is needed to ensure that spent batteries, legally classified as industrial waste, are ultimately treated in a safe and sustainable manner after their useful life in EVs and subsequent applications (thanks to refurbishment, reuse, and repurpose activities). If not handled properly, for example if they are put into unmanaged landfills, retired EV batteries could release toxic substances into water supplies. There is also a risk of catastrophic fires from poorly handled batteries. Given current government policy and growth in EV sales, it is expected that the UK will see large numbers of batteries that will need to be recycled in some way. Without exporting this potentially hazardous industrial waste, it is essential for the UK to have convenient access to local recycling facilities that can not only deal with the waste but also provide a reliable supply of inputs to feed into the EV battery production process.

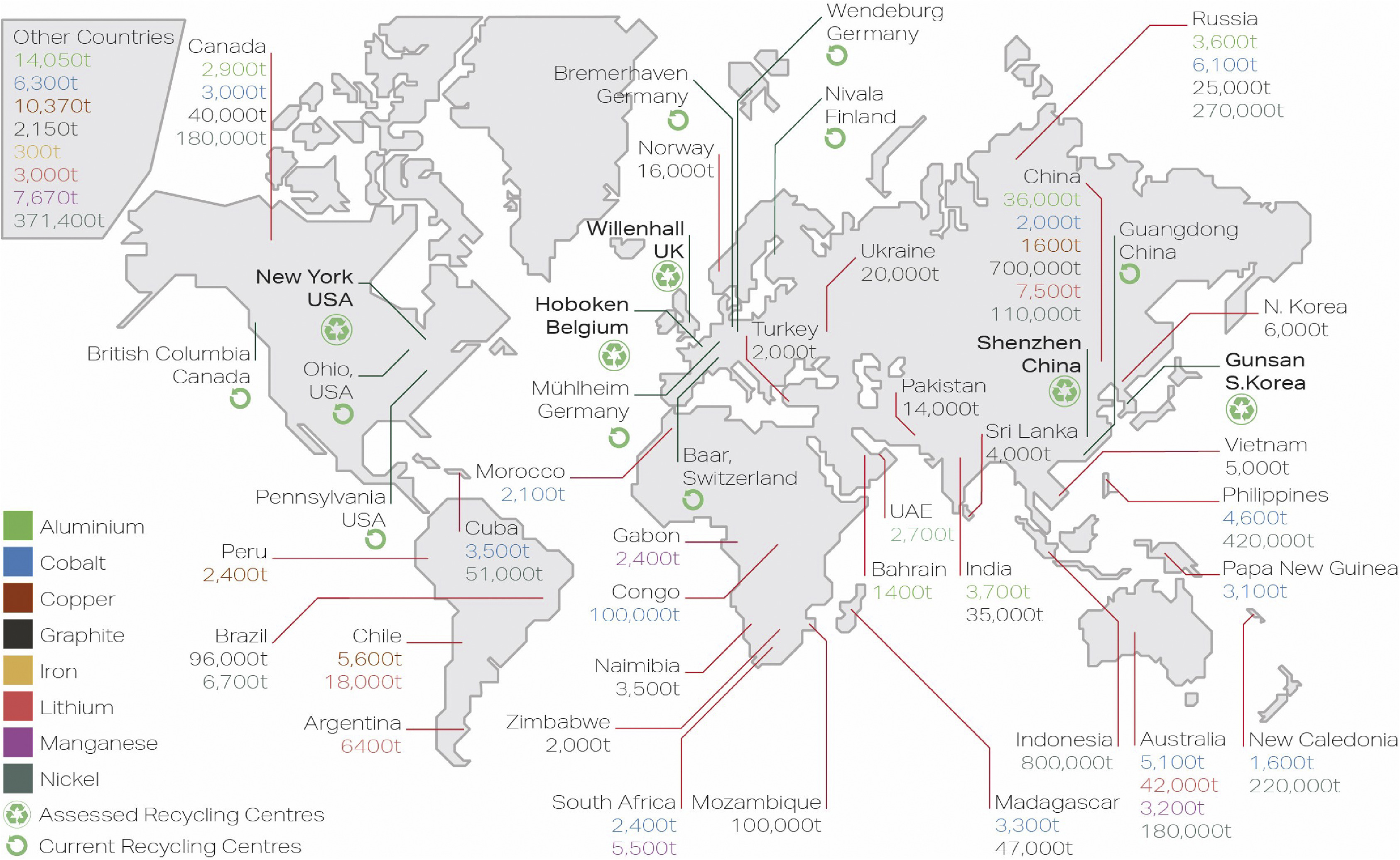

The supply of raw materials for the manufacture of EVs and their batteries is important because these inputs are susceptible to material insecurity and commodity price volatility. For example, lithium-ion batteries are currently the principal technology used to power EVs and lithium prices have approximately quintupled following the recent disruption to global supply chains. Likewise, the price of nickel, which used to be a cheaper substitute for costly and price-volatile cobalt in EV batteries, more than doubled after the beginning of the Russia-Ukraine war. Recent price volatility and geo-political instability have highlighted the importance of having greater material security for the operation of local gigafactories. One way to ensure greater operational security is to have a reliable EV-battery recycling industry that would help reduce reliance on imported raw materials. Figure 1 shows the world mine production of the main materials that are needed to build EV batteries and shows how many inputs are vulnerable to supply disruption. For example, done correctly, it is estimated that by 2040 a British recycling industry will have the potential to supply 60% of the materials required for a 20-GWh battery plant.

Figure 1. World mine production for raw materials

Source: (Lander et. al., 2021)

Developing a successful EV battery recycling industry that fuses domestically recycled materials, feeding into the manufacture of batteries, has the potential to reduce costs. It can also reduce the global extraction of raw materials, which in turn reduces global emissions and the environmental damage associated with mining. Calculations using the EverBatt model by Argonne National Laboratory (US), customised for a UK context and illustrated in Figure 2, estimate that possible reductions from recycling include 17.8–20.4% in costs, 1.8–6.1 % in energy use, 15–19.6% in water use, 13.1–13.3% in NOx emissions, 22.4–26.5% in SOx emissions, 30.1–32.7% in PM10 emissions, and 15.3–16.7% in GHGs emissions. The result would be that British EV manufactures would have reliable access to recycled inputs that may be cheaper than buying raw materials and are noticeably “cleaner” from a life-cycle perspective.

Figure 2. Economic and environmental assessment for closed-loop recycling in 2040

Source: Nguyen-Tien et. al., 2022

Despite the potential for EV battery recycling to play an important and perhaps crucial role in the UK EV manufacturing system, there remain numerous barriers to its successful development. Financial viability and the underlying economics of battery recycling are the main constraint. Given established technologies and the current stock of EVs (and vehicle life expectancy), recycling is not cost-effective at the current scale implied by the supply of used batteries. A lack of standardisation in battery configuration used for various EVs also hampers the battery dismantling process. A recycling facility would be capital intensive and require considerable investment, which at the moment has to be weighed against the risks associated with, for example: (1) the uncertainty in EV adoption rates in the UK, (2) the lifespan of batteries’ first life in EVs and subsequent cascades of reuse and repurposes, (3) the enforceability of bans on landfill, (4) the global prices of recyclable materials (such as cobalt), (5) future battery chemistries and technological advances in the lifespan and efficiency of batteries, (6) the future competitive environment in the UK and globally, (7) technological advances in recycling approaches, and (8) energy prices and wage costs, which will impact recycling plant operating costs. At the same time, the benefits to the environment and national material security may not be fully internalised in private investment decisions and hence, lack of government support may lead to underinvestment in this important but often overlooked sector.

In recent work, issues around the development of an EV battery recycling sector have been modelled using a framework called GABREAL (Geospatial Assessment of Battery Recycling Economics, Environment, and Location), which has been designed to capture many of these factors and identify where policy support may be needed. Under a set of reasonable assumptions on economic, political, and technological conditions, a single plant that would undertake all domestic UK recycling market would be profitable from 2031 without government intervention and would enjoy increasing profitability up to about £125.3 million per year by 2040. However, a market structure with multiple players (up to seven plants) across the country is possible if we adjust the assumptions on the supply of batteries and transportation costs. Figure 3 shows that the optimal solution is to have a number of larger plants located closer to major recycling demand centres (such as London and West Midlands).

Figure 3. Optimal EV battery recycling facility placement for the UK in 2040

Source: Nguyen-Tien et. al., 2022.

Given the financial risks faced by the private sector looking to invest in a recycling plant, some sort of government support may be required if the government wants to secure the environmental and security benefits associated with EV battery recycling. Financial support may be needed for the first few years of development of technologies, when the used battery supply is still below the scale required for a plant to be profitable based on current material prices, and energy and wage costs in the UK. In the longer term, non-financial incentives may be more important for the development of a nascent recycling industry. The most important non-financial incentive is likely to be a strong and credible commitment to the electrification of the transportation system and strict enforcement and regulation of the end-of-life stage of EVs.

Further ahead, the viability of the existing recycling process will be improved by further technological advancements such as pyrometallurgical recovery and hydrometallurgical metals reclamation, as well as less mature methods such as direct recycling or biological metals reclamation. The use of advanced technologies such as automated robotics, computer vision, and artificial intelligence is also expected to improve the sorting and battery dismantling processes to enable more cost-effective battery recycling. There is still much research to be done in this area. By its very nature, the research is multidisciplinary, encompassing chemists, engineers, biologists, social scientists, and economists. If the UK is to have a successful EV manufacturing sector, it will need to have a flourishing gigafactory supported by recycling facilities to deal with the possible mountain of batteries that will grow with more widespread EV adoption. The UK has the potential to lead the world in the future of e-mobility and needs not only to consider the production of the vehicle but also to ensure a reliable supply or raw materials and the costs of dealing with the industrial waste from used batteries.

Explore our dedicated hub showcasing LSE research and commentary on the state of the UK economy and its future.

♣♣♣

Notes:

- This blog post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by Argonne National Laboratory, under a CC-BY-NC-SA 2.0 licence

- When you leave a comment, you’re agreeing to our Comment Policy.

Very interesting read and so is the published paper! I have been following doctor Lander for a little while as I admire her work and the paper on economics of recycling her and her colleagues published.

I am eager to see if it would be possible to do a similar assessment but mainly based on LFP recycling whether just within Europe or UK as it is now gaining more attention by OEMs.

Again thank you for such an insightful article and referenced paper.

Dear Malene,

Thank you very much for your interest in the article and our work.

Yes, it would be absolutely possible and very interesting as you said to do a thorough assessment of LFP recycling.

The value of LFP is lower; it is therefore important to find ways to make the recycling process profitable. There might be less incentive for the industry sector to recycle LFP if there is no value to get out of it.