To calculate the damages climate change will cause in the economy, it is important to differentiate consumption from investment. Gregory Casey, Stephie Fried, and Matthew Gibson write that without that distinction, existing methods downplay the effect of climate change on capital accumulation and economic growth. Their research shows that climate change will have a significant impact on aggregate economic outcomes in developed economies and that these impacts will be closely tied to the construction sector.

Climate change will have a significant impact on macroeconomic outcomes in developed countries. As it will affect both the supply of and demand for construction, much of this impact will come through the construction sector. On the supply side, much construction work occurs outdoors, implying that worker productivity will decrease in the presence of extreme heat. On the demand side, climate change will alter the frequency and intensity of storms and increase the rate that they destroy structures, creating the need to rebuild.

In our ongoing work, we combine theory and empirics to project future impacts of climate change in the United States. Focusing on the supply of construction, we find that future changes in climate will reduce the size of the capital stock by about five and a half per cent in 2200 and reduce aggregate consumption by about one and three quarters per cent, relative to a world without climate change. We also find evidence that existing methods understate the economic impacts of climate change in the US, because they downplay the effect of climate change on capital accumulation and economic growth.

Why construction?

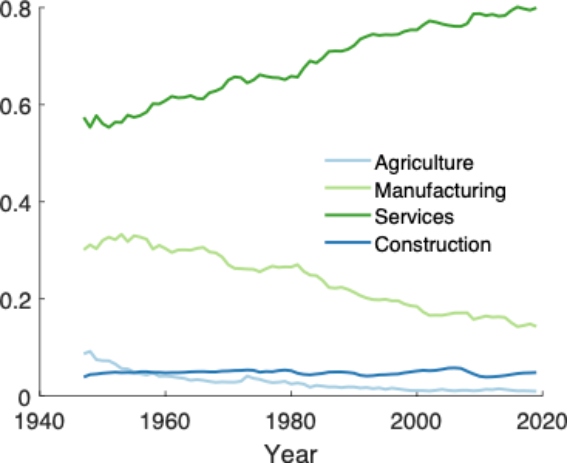

Other sectors, most notably agriculture, are also vulnerable to changes in climate. To highlight the importance of construction for aggregate economic outcomes, figure 1 shows the composition of the US economy from 1945 – 2019, dividing total production between services, manufacturing, construction, and agriculture.

Figure 1. The composition of the US economy

Note: Authors’ calculations. All data are from the Bureau of Economic Analysis.

Services and manufacturing play the largest role in the US economy and are not very sensitive to changes in climate, at least in developed economies. The share of agriculture starts low and continues to decline, implying that even large future changes in agricultural productivity will have little impact on US output. The construction share of output is around 4 per cent and relatively constant through the period. As the composition of the economy continues to evolve over time, therefore, it is construction that will determine overall vulnerability to climate change.

This does not imply, of course, the impact of climate change on US agriculture is unimportant, only that it won’t drive macroeconomic outcomes. As Schlenker and Roberts (2009) stress, the impact of climate on US agricultural productivity will affect food prices around the world, which will have a disproportionate effect on low-income individuals in the United States and in developing countries. Moreover, these impacts will have negative consequences for US workers in agriculture.

Consumption versus investment

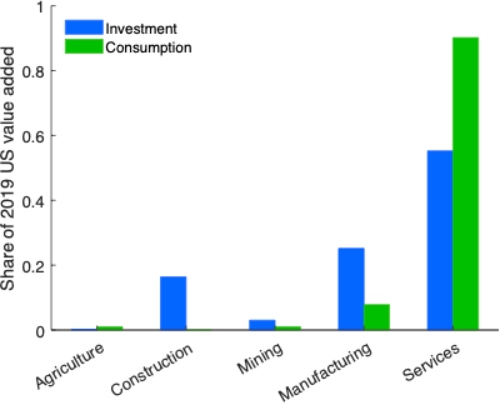

When categorising goods and services, macroeconomists almost always draw a distinction between consumption and investment. Consumption refers to spending on short-lived things, like food and dry-cleaning, that households purchase to increase their well-being. Investment refers to purchases of goods and services today that are used to produce output in the future. The capital stock is the value of accumulated investment and an important determinant of an economy’s ability to produce output. Importantly, investment includes spending on buildings by both businesses and households. Construction, therefore, contributes to investment, but not to consumption. Indeed, figure 2 shows that construction is a significant component of US investment.

Figure 2. Composition of US consumption and investment

Note: Authors’ calculations. All data are from the Bureau of Economic Analysis.

Somewhat surprisingly, the distinction between consumption and investment has been overlooked in most existing research on the macroeconomic implications of climate change. Instead, standard models assume that consumption and investment are equally affected by climate change. Since climate impacts in the US are dominated by construction, which contributes to investment, standard models are overstating consumption impacts and understating investment impacts. In other words, standard models are overstating the immediate impact of climate change on US households but understating the impact that climate change will have on the process of capital accumulation and economic growth.

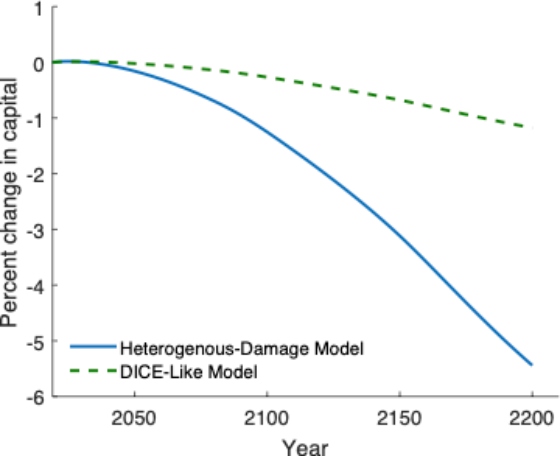

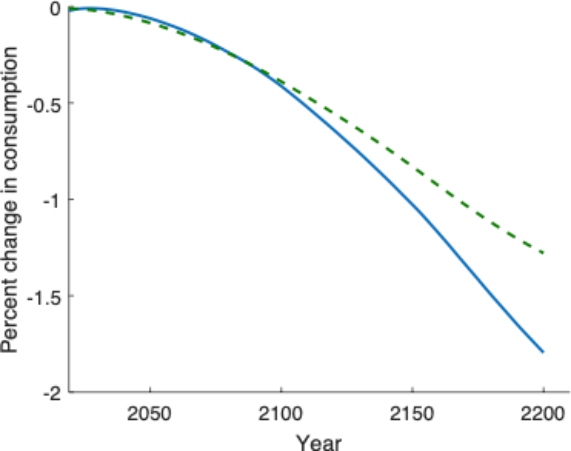

Figure 3. Aggregate consequences of climate impacts on construction

Panel (a)

Panel (b)

Note: The panels show the effects of climate change on capital (panel a) and consumption (panel b) in our model (solid blue line) and in a more standard model that ignores the distinction between consumption and investment (dashed green line).

Figure 3 shows the impact of climate in a `business-as-usual’ scenario without significant efforts to mitigate climate change. The results from our model are shown in the solid blue lines and the results from more standard approaches are shown in the dashed green lines. All results are shown relative to a world where there is no climate change after 2019. Since our model incorporates the fact that climate change will have a larger impact on investment, it leads to much greater losses in the capital stock. The dynamics of consumption are more nuanced. In the short run, standard models, which assume equal impacts to consumption and investment, overstate the impact of climate change on consumption. In the long run, however, households’ consumption depends on the size of the capital stock. Thus, our model leads to larger consumption losses in the long run.

Accounting for the distinction between consumption and investment decreases the short-term cost of climate change and increases the long-term cost. Determining the overall impact requires comparing costs that occur at different points in time. This is a normative question and a contentious issue within climate economics. When considering a measure of well-being that places equal weight on all individuals, regardless of when they are born, we find the welfare consequences of climate-induced reductions in construction productivity are 25 percent larger than standard approaches would suggest.

Conclusion

Our results suggest that climate change will have a significant impact on aggregate economic outcomes in developed economies and that these impacts will be closely tied to the construction sector. Because they ignore the distinction between consumption and investment, standard approaches to projecting the costs of climate change likely underestimate the impact of climate change on economic growth and long-run well-being in developed economies.

The authors are grateful to the Washington Center for Equitable Growth for providing funding.

Authors’ disclaimer: The views expressed herein are solely the responsibility of the authors and should not be interpreted as reflecting the views of the Federal Reserve Bank of San Francisco or the Federal Reserve System.

♣♣♣

Notes:

- This blog post is based on Understanding Climate Damages: Consumption Versus Investment, CESifo Working Paper No. 9499, presented at LSE’s Environment Week (September 2022).

- The post represents the views of its author(s), not the position of LSE Business Review or the London School of Economics.

- Featured image by C Dustin on Unsplash

- When you leave a comment, you’re agreeing to our Comment Policy.